Trend des dynamischen Durchschnitts nach Strategie

Schriftsteller:ChaoZhang, Datum: 2024-11-12 15:05:09Tags:SMARSI- Nein.

Übersicht

Diese Strategie ist ein Trend-Nach-Handelssystem, das auf mehreren gleitenden Durchschnitten und Dynamikindikatoren basiert. Sie nutzt in erster Linie die dynamischen Beziehungen zwischen den 20-tägigen, 50-tägigen, 150-tägigen und 200-tägigen einfachen gleitenden Durchschnitten (SMA), kombiniert mit Volumen- und RSI-Indikatoren, um starke Aufwärtstrends im täglichen Zeitrahmen und Ausstiegspositionen zu erfassen, wenn die Trends schwächen. Die Strategie filtert falsche Signale effektiv und verbessert die Handelsgenauigkeit durch den koordinierten Einsatz mehrerer technischer Indikatoren.

Strategieprinzipien

Die Kernlogik umfasst folgende Schlüsselelemente:

- Moving Average System: Verwendet 20/50/150/200 Tage gleitende Durchschnitte, um ein Trendbeurteilungssystem zu erstellen, das eine bullische Ausrichtung erfordert.

- Momentum-Bestätigung: Verwendet den RSI-Indikator und seinen gleitenden Durchschnitt, um die Kursdynamik zu beurteilen, wobei RSI über 55 oder RSI SMA über 50 und steigend erforderlich ist.

- Volumenüberprüfung: Bestätigt die Signalgültigkeit durch Vergleich des 20-tägigen Volumendurchschnitts mit dem aktuellen Volumen.

- Überprüfung der Trendbeständigkeit: Prüft, ob der 50-Tage-MA mindestens 25 von 40 Handelstagen einen Aufwärtstrend aufrechterhält.

- Positionsbestätigung: Der Preis muss mindestens 20 Handelstage über dem 150-Tage-MA liegen.

Die Kaufbedingungen erfordern:

- Mehr als 4 bullische Tage in den letzten 10 Tagen mit mindestens 1 hohem Volumentag

- Der RSI-Indikator erfüllt die Dynamikbedingungen

- Das gleitende Durchschnittssystem zeigt eine bullische Ausrichtung und einen kontinuierlichen Anstieg

- Preisstabilität über 150-Tage-MA

Zu den Verkaufsbedingungen gehören:

- Preisdurchbruch unter 150-Tage-MA

- Nachfolgender Rückgang des hohen Volumens

- 50-Tage-MA unter 150-Tage-MA

- Jüngste bärische Kerzen mit erhöhter Lautstärke

Strategische Vorteile

- Kreuzvalidierung mehrerer technischer Indikatoren verringert Fehleinschätzungen

- Strenge Anforderungen an die Trendbeständigkeit filtern kurzfristige Schwankungen

- Integration der Volumenanalyse verbessert die Signalzuverlässigkeit

- Klarer Stop-Loss- und Gewinnspielraum zur effektiven Risikokontrolle

- Geeignet für die Erfassung mittelfristiger bis langfristiger Trends und zur Verringerung der Handelsfrequenz

- Klare Strategie-Logik, leicht zu verstehen und umzusetzen

Strategische Risiken

- Das gleitende Durchschnittssystem hat Verzögerungen, kann frühe Trendstadien verpassen

- Strenge Eintrittsbedingungen können einige Handelschancen verpassen

- Kann häufige falsche Signale in unruhigen Märkten erzeugen

- Verzögerung bei der Feststellung von Marktumkehrungen

- Erfordert einen größeren Kapitalbetrag, um Abzügen standzuhalten

Empfehlungen zur Risikokontrolle:

- Festlegung angemessener Stop-Loss-Positionen

- Konservatives Geldmanagement

- Erwägen Sie, Trendbestätigungsindikatoren hinzuzufügen

- Anpassung der Parameter anhand des Marktumfelds

Strategieoptimierungsrichtlinien

- Anpassungsparameter hinzufügen

- Dynamische Anpassung der MA-Perioden anhand der Marktvolatilität

- Optimierung der RSI-Schwellenwerte

- Verbesserung des Stop-Loss-Mechanismus

- Hinzufügen von Trailing Stops

- Zeitbasierte Stopps festlegen

- Einführung einer Analyse des Marktumfelds

- Hinzufügen von Trendstärkenindikatoren

- Überwachen Sie Volatilitätsindikatoren

- Optimieren Sie die Handelsgröße

- Entwurf des dynamischen Positionsmanagements

- Anpassung nach Signalstärke

Zusammenfassung

Es handelt sich um eine streng entwickelte Trend-Folge-Strategie, die durch den koordinierten Einsatz mehrerer technischer Indikatoren starke Trendchancen effektiv erfasst. Die Hauptvorteile der Strategie liegen in ihrem umfassenden Signalbestätigungsmechanismus und strengen Risikokontrollsystemen. Während es eine gewisse Verzögerung gibt, kann die Strategie durch angemessene Parameteroptimierung und Risikomanagement eine stabile Leistung im langfristigen Betrieb aufrechterhalten. Anlegern wird geraten, bei der Anwendung der Strategie im Live-Handel auf die Anpassungsfähigkeit des Marktumfelds zu achten, Positionen vernünftigerweise zu steuern und gezielte Optimierungen basierend auf den tatsächlichen Bedingungen vorzunehmen.

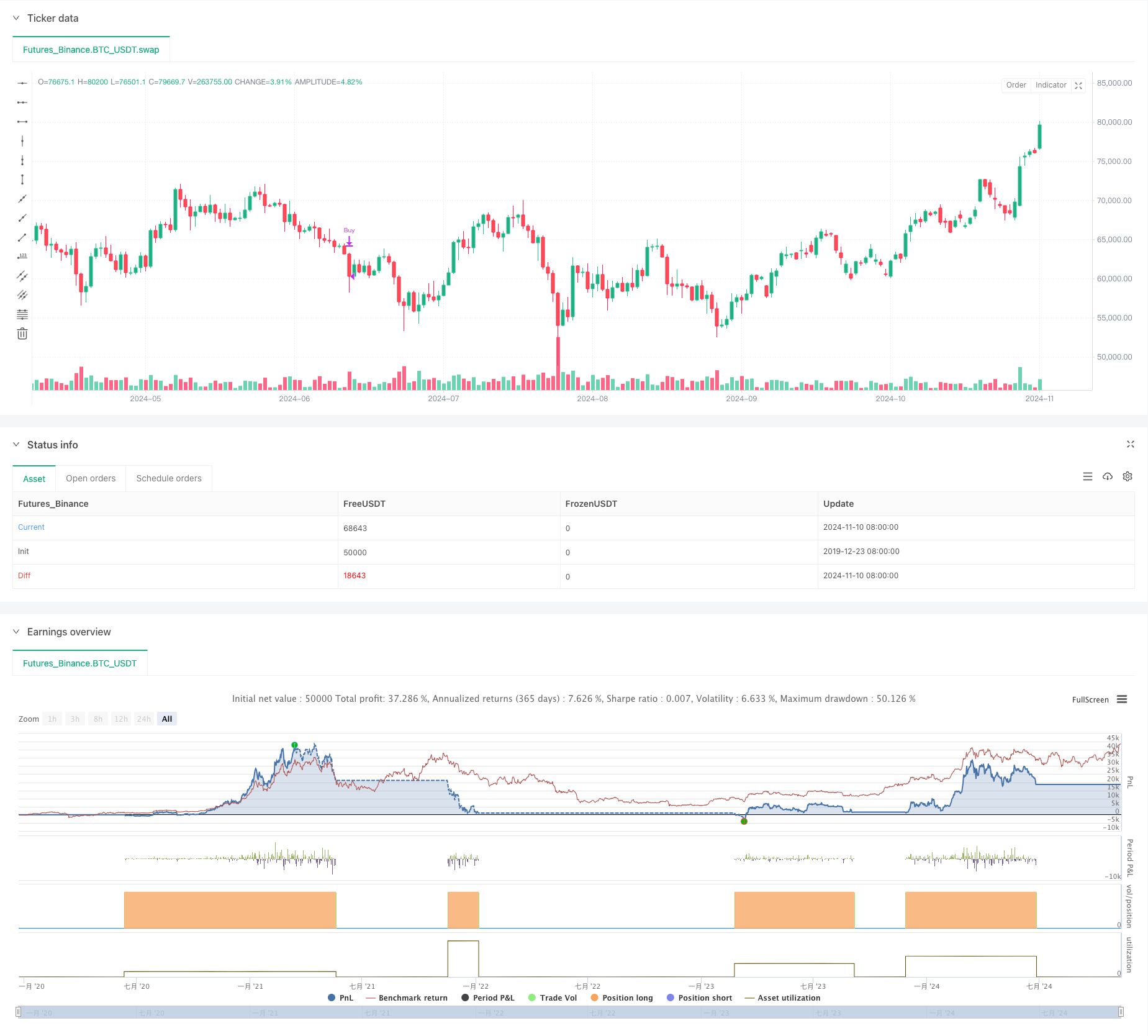

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Micho's 150 (1D Time Frame Only)", overlay=true)

// Define the length for the SMAs and RSI

sma20Length = 20

sma50Length = 50

sma150Length = 150

sma200Length = 200

volumeMaLength = 20

rsiLength = 14

rsiSmaLength = 14

smaCheckLength = 40 // Check the last month of trading days (~20 days)

requiredRisingDays = 25 // Require SMA to rise in at least 16 of the past 20 days

sma150AboveSma200CheckDays = 1 // Require SMA150 > SMA200 for the last 10 days

// Calculate the SMAs for price

sma20 = ta.sma(close, sma20Length)

sma50 = ta.sma(close, sma50Length)

sma150 = ta.sma(close, sma150Length)

sma200 = ta.sma(close, sma200Length)

// Calculate the 20-period moving average of volume

volumeMA20 = ta.sma(volume, volumeMaLength)

// Calculate the 14-period RSI

rsi = ta.rsi(close, rsiLength)

// Calculate the 14-period SMA of RSI

rsiSMA = ta.sma(rsi, rsiSmaLength)

// Check if most of the last 5 days are buyer days (close > open)

buyerDays = 0

for i = 0 to 9

if close[i] > open[i]

buyerDays := buyerDays + 1

// Check if at least 1 day has volume higher than the 20-period volume MA

highVolumeDays = 0

for i = 0 to 9

if close[i] > open[i] and volume[i] > volumeMA20

highVolumeDays := highVolumeDays + 1

// Define the new RSI condition

rsiCondition = (rsi >= 55) or (rsiSMA > 50 and rsi > rsi[1])

// Check if the 50-day SMA has been rising on at least 16 of the last 20 trading days

risingDays = 0

for i = 1 to smaCheckLength

if sma50[i] > sma50[i + 1]

risingDays := risingDays + 1

// Check if the SMA has risen on at least 16 of the last 20 days

sma50Rising = risingDays >= requiredRisingDays

// Check if the price has been above the SMA150 for the last 20 trading days

priceAboveSma150 = true

for i = 1 to smaCheckLength

if close[i] < sma150[i]

priceAboveSma150 := false

// Check if the SMA150 has been above the SMA200 for the last 10 days

sma150AboveSma200 = true

for i = 1 to sma150AboveSma200CheckDays

if sma150[i] < sma200[i]

sma150AboveSma200 := false

// Define the conditions for the 150-day and 200-day SMAs being rising

sma150Rising = sma150 > sma150[1]

sma200Rising = sma200 > sma200[1]

// Check if most of the last 5 days are seller days (close < open)

sellerDays = 0

for i = 0 to 9

if close[i] < open[i]

sellerDays := sellerDays + 1

// Check if at least 1 day has seller volume higher than the 20-period volume MA

highSellerVolumeDays = 0

for i = 0 to 9

if close[i] < open[i] and volume[i] > volumeMA20

highSellerVolumeDays := highSellerVolumeDays + 1

// Check in the last N days the price below 150

priceBelowSma150 = true

for i = 0 to 0

if close[i] > sma150[i]

priceBelowSma150 := false

// Restrict the strategy to 1D time frame

if timeframe.isdaily

// Buy condition:

// - Most of the last 5 days are buyer days (buyerDays > 2)

// - At least 1 of those days has high buyer volume (highVolumeDays >= 1)

// - RSI SMA (14-period) between 45 and 50 with RSI >= 55, or RSI SMA > 50 and RSI rising

// - 50-day SMA > 150-day SMA and 150-day SMA > 200-day SMA

// - 50-day SMA has been rising on at least 16 of the last 20 trading days

// - The price hasn't been below the 150-day SMA in the last 20 days

// - 150-day SMA has been above the 200-day SMA for the last 10 days

// - 150-day and 200-day SMAs are rising

buyCondition = (close > sma150 and buyerDays > 4 and highVolumeDays >= 1 and rsiCondition and sma50 > sma150 and sma50Rising and sma150Rising and sma200Rising and priceAboveSma150)

// Sell condition:

// - Price crossing below SMA 150

// - Seller volume (current volume > volume MA 20)

// - 150-day SMA crosses below 200-day SMA

// - Most of the last 5 days are seller days (sellerDays > 2) and at least 1 day of higher seller volume (highSellerVolumeDays >= 1)

sellCondition = (priceBelowSma150 and (sma50 < sma150 or (sellerDays >5 and highSellerVolumeDays >= 5)))

// Execute buy when all conditions are met

if (buyCondition)

strategy.entry("Buy", strategy.long)

// Execute sell when all conditions are met

if (sellCondition)

strategy.close("Buy")

- Bei der Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte

- Mehrzeitägige gleitende Durchschnitts- und RSI-Momentums-Kreuzstrategie

- Multi-Technische Indikator-Trend-Kreuzverfolgungsstrategie: RSI und Stochastisches RSI-Synergiehandelssystem

- Strategie für die Dynamik des RSI-Trendes mit doppelten gleitenden Durchschnitten

- Dynamische Unterstützungs-Widerstands-Break-out-Strategie für bewegliche Durchschnittsüberschreitungen

- Dreifach validierte RSI-Mittelumkehrung mit gleitender Durchschnittsfilterstrategie

- Mehrzeitägiger gleitender Durchschnitt und RSI-Momentum Kreuzentwicklung nach Strategie

- Adaptive Trendmomentum RSI-Strategie mit gleitendem Durchschnittsfiltersystem

- Maschinelles Lernen inspiriert Doppel gleitender Durchschnitt RSI Handelsstrategie

- Strategie zur Optimierung von Doppeldynamischen Indikatoren

- Strategie für die Dynamik des RSI mit doppeltem gleitenden Durchschnitt mit Risiko-Belohnungsoptimierungssystem

- Multi-Indicator Crossover Dynamic Strategy System: Ein quantitatives Handelsmodell auf der Grundlage von EMA, RVI und Handelssignalen

- RSI-Dynamischer Bereich Umkehrung Quantitative Strategie mit Volatilitätsoptimierungsmodell

- Bollinger-Bands-Momentumsentwicklung nach quantitativer Strategie

- Mehrjährige technische Analyse und Handelsstrategie für die Marktstimmung

- Dynamische Holding-Period-Strategie auf der Grundlage eines 123-Punkte-Umkehrmusters

- Multi-Technical Indicator Crossover Momentum Quantitative Trading Strategy - Integrationsanalyse auf der Grundlage von EMA, RSI und ADX

- Parabolische SAR-Divergenzhandelsstrategie

- Kombinierte Momentum-SMA-Crossover-Strategie mit Optimierungssystem für Marktstimmung und Widerstandsniveau

- Multiperiodische RSI-Impulsentwicklung und dreifacher EMA-Trend nach einer zusammengesetzten Strategie

- E9 Shark-32 Muster Quantitative Preis-Breakout-Strategie

- Offener Markt Exposition Dynamische Positionsanpassung Quantitative Handelsstrategie

- Der Trend der hohen Gewinnrate bedeutet eine Umkehrung der Handelsstrategie

- Strategie für die Dynamik des RSI-Trendes mit doppelten gleitenden Durchschnitten

- Trend der Umkehrung der Mehrindikatoren-Fusionsmittelwerte nach Strategie

- Handelsstrategie nach offener Ausbrechung mit dynamischer ATR-basierter Positionsverwaltung

- Integration mehrerer Indikatoren und intelligente Risikokontrolle

- Multi-Indikator-dynamische adaptive Positionsgrößenordnung mit ATR-Volatilitätsstrategie

- RSI Dynamische intelligente Stop-Loss-Handelsstrategie

- Dreifach validierte RSI-Mittelumkehrung mit gleitender Durchschnittsfilterstrategie