Overview

This strategy is a trading strategy based on EMA, VWAP, and volume. The main idea is to generate opening signals when the closing price breaks through VWAP and EMA, and the trading volume is greater than the previous candle’s volume within a specific trading time. It also sets stop loss and take profit, as well as conditions for closing positions within a specific time period.

Strategy Principle

- Calculate EMA and VWAP indicators.

- Determine whether it is within the specified trading time.

- Long entry condition: closing price is greater than VWAP and EMA, volume is greater than the previous candle, and closing price is greater than opening price.

- Short entry condition: closing price is less than VWAP and EMA, volume is greater than the previous candle, and opening price is greater than closing price.

- Long exit condition: closing price falls below VWAP or EMA, reaches stop loss or take profit levels, or reaches the specified exit time.

- Short exit condition: closing price breaks above VWAP or EMA, reaches stop loss or take profit levels, or reaches the specified exit time.

Strategy Advantages

- It considers price trend (EMA), market fair value (VWAP), and trading volume simultaneously, making the opening conditions more strict, which helps to improve the strategy’s win rate.

- It sets stop loss and take profit to control risk and lock in profits.

- It limits trading time and exit time to avoid risks during non-trading hours and overnight holding.

Strategy Risks

- The strategy may not perform well in a volatile market, as frequent breakthroughs and pullbacks may lead to multiple openings and closings, increasing transaction costs and slippage.

- The stop loss level is fixed, which may be triggered prematurely when the market fluctuates violently, causing the strategy to suffer significant losses.

- The strategy does not consider actual market depth and order status, which may face issues such as slippage and opening failures in real trading.

Strategy Optimization Direction

- Consider adding more filtering conditions, such as ATR and RSI indicators, to further confirm the strength of the trend and momentum.

- Stop loss and take profit levels can be set dynamically, such as following ATR or percentage stop loss, to adapt to different market volatilities.

- Optimize parameters, such as EMA length, VWAP source, stop loss and take profit levels, etc., to improve the stability and profitability of the strategy.

- Consider adding position management, such as adjusting the opening volume according to volatility or capital ratio, to control overall risk.

Summary

By comprehensively considering price trends, market fair value, and trading volume, this strategy trades within a specific trading time. Although stop loss, take profit, and limited trading time are set, it still needs to pay attention to risks such as volatile markets and slippage in actual application. In the future, the strategy’s robustness and profitability can be improved by adding more filtering conditions, optimizing parameters, and managing positions.

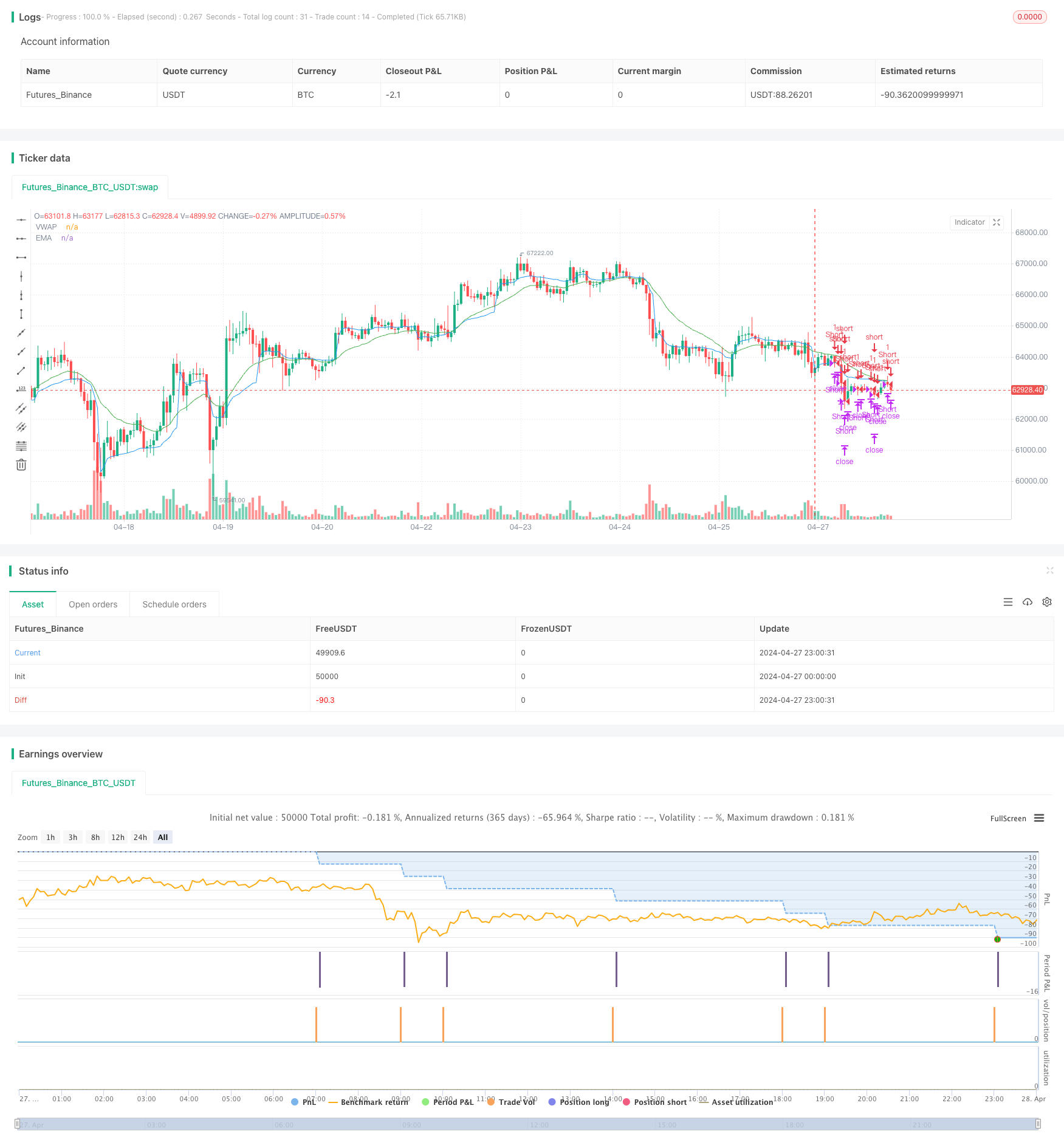

/*backtest

start: 2024-04-27 00:00:00

end: 2024-04-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA, VWAP, Volume Strategy", overlay=true, process_orders_on_close=true)

// Inputs

emaLength = input.int(21, title="EMA Length")

vwapSource = input.source(defval=hlc3, title='VWAP Source')

stopLossPoints = input.float(100, title="Stop Loss (points)")

targetPoints = input.float(200, title="Target (points)")

session = input("0950-1430", title='Only take entry during')

exit = input(defval='1515-1525', title='Exit Trade')

tradein = not na(time(timeframe.period, session))

exit_time = not na(time(timeframe.period, exit))

// Calculate indicators

ema = ta.ema(close, emaLength)

vwapValue = ta.vwap(vwapSource)

// Entry Conditions

longCondition = close > vwapValue and close > ema and volume > volume[1] and close > open and tradein

shortCondition = close < vwapValue and close < ema and volume > volume[1] and open > close and tradein

// Exit Conditions

longExitCondition = ta.crossunder(close, vwapValue) or ta.crossunder(close, ema) or close - strategy.position_avg_price >= targetPoints or close - strategy.position_avg_price <= -stopLossPoints or exit_time

shortExitCondition = ta.crossover(close, vwapValue) or ta.crossover(close, ema) or strategy.position_avg_price - close >= targetPoints or strategy.position_avg_price - close <= -stopLossPoints or exit_time

// Plotting

plot(vwapValue, color=color.blue, title="VWAP")

plot(ema, color=color.green, title="EMA")

// Strategy

if longCondition

strategy.entry("Long", strategy.long)

if shortCondition

strategy.entry("Short", strategy.short)

if longExitCondition

strategy.close('Long', immediately=true)

if shortExitCondition

strategy.close("Short", immediately=true)