基于OBV与MA交叉信号的趋势跟踪策略

Author: ChaoZhang, Date: 2024-04-29 13:48:58Tags: OBVMASMA

概述

本策略名为”OBVious MA Strategy 基于OBV与MA交叉信号的趋势跟踪策略”,核心是使用OBV(On Balance Volume)指标与移动平均线的交叉来产生交易信号。OBV可以提供领先的趋势信号,本策略利用OBV突破移动平均线作为进场和出场条件,以捕捉趋势。同时使用独立的进场MA和出场MA,可以更灵活地控制持仓时间。该策略虽然是一个简单的演示,但展现了如何有效利用OBV进行量价分析。

策略原理

- 计算OBV指标值:若当前收盘价高于前一根K线,则OBV加上当前成交量,否则减去成交量。

- 计算OBV的四条移动平均线:长周期做多进场MA、长周期做多出场MA、短周期做空进场MA和短周期做空出场MA。

- 产生交易信号:

- 当OBV上穿长周期做多进场MA且方向过滤器不为做空时,开多仓

- 当OBV下穿长周期做多出场MA时,平多仓

- 当OBV下穿短周期做空进场MA且方向过滤器不为做多时,开空仓

- 当OBV上穿短周期做空出场MA时,平空仓

- 交易管理:若有反向信号产生,会先平掉原有仓位再开新仓位。

策略优势

- 充分利用OBV领先的趋势信号,在趋势初期就能及时建仓。

- 将进场和出场MA分离,可以独立优化进出场时机。

- 代码逻辑简单清晰,易于理解和改进。

- 引入方向过滤,可避免频繁交易,降低成本。

策略风险

- 缺乏其他确认指标,可能产生假信号。建议结合其他指标使用。

- 缺乏止损和仓位管理,面临单笔亏损放大的风险。可以加入合理的止损和资金管理措施。

- 参数选择不当会影响策略表现。需要根据不同市场特点和周期进行参数优化。

策略优化方向

- 可以尝试引入趋势过滤,如MA方向、ATR等,以改善信号质量。

- 可以在OBV上使用不同类型的MA,如EMA、WMA等,捕捉不同速度的趋势。

- 可以优化仓位管理,如采用加减仓策略,在趋势强度提升时加仓,降低时减仓。

- 可以结合其他量价指标,如MVA、PVT等,构建联合信号来提高胜率。

总结

本策略展示了一种基于OBV与MA交叉的简单趋势跟踪方法。优点是逻辑清晰,能够及时捕捉趋势,通过分离进出场MA可以灵活控制持仓。但缺点是缺乏风险控制措施以及信号确认手段。后续可以从趋势过滤、参数优化、仓位管理、联合信号等方面进行改进,以期获得更稳健的策略表现。本策略更适合作为一个向导信号,配合其他策略来使用。

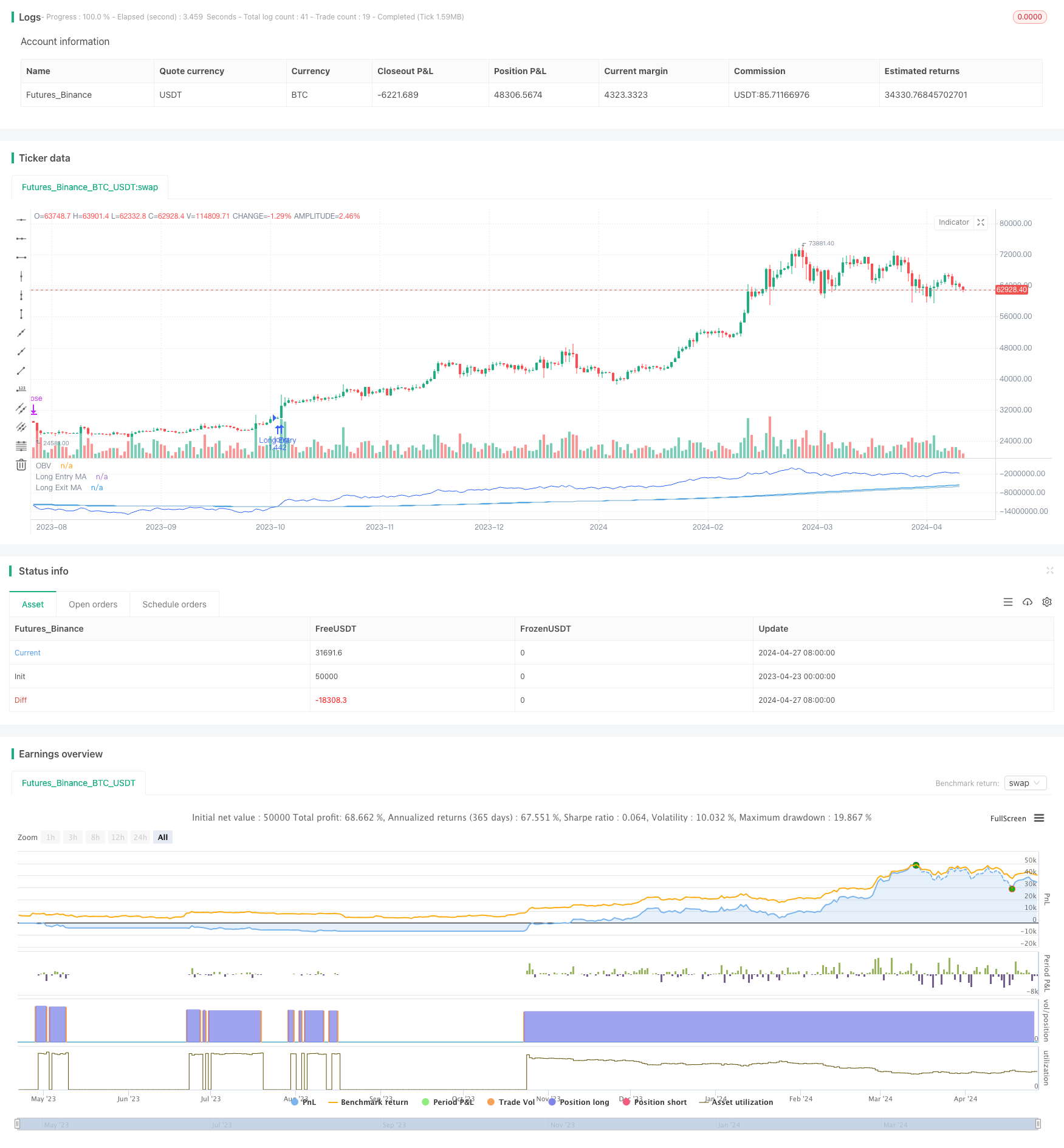

/*backtest

start: 2023-04-23 00:00:00

end: 2024-04-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ThousandX_Trader

//@version=5

strategy(title="OBVious MA Strategy [1000X]", overlay=false,

initial_capital=10000, margin_long=0.1, margin_short=0.1,

default_qty_type=strategy.percent_of_equity, default_qty_value=100,

slippage=1, commission_type=strategy.commission.percent, commission_value=0.1)

// Direction Input ///

tradeDirection = input.string("long", title="Direction", options=["long", "short"], group = "Direction Filter")

///////////////////////////////////////

// 1000X OBV MA INDICATOR //

///////////////////////////////////////

// OBV Trend Length Inputs //

long_entry_length = input(190, title="Long Entry MA Length", group = "Moving Average Settings")

long_exit_length = input(202, title="Long Exit MA Length", group = "Moving Average Settings")

short_entry_length = input(395, title="Short MA Entry Length", group = "Moving Average Settings")

short_exit_length = input(300, title="Short Exit MA Length", group = "Moving Average Settings")

// OBV Calculation

obv = ta.cum(ta.change(close) >= 0 ? volume : -volume)

// Calculate OBV Moving Averages

obv_ma_long_entry = ta.sma(obv, long_entry_length)

obv_ma_long_exit = ta.sma(obv, long_exit_length)

obv_ma_short_entry = ta.sma(obv, short_entry_length)

obv_ma_short_exit = ta.sma(obv, short_exit_length)

///////////////////////////////////////

// STRATEGY RULES //

///////////////////////////////////////

longCondition = ta.crossover(obv, obv_ma_long_entry) and tradeDirection != "short" and strategy.position_size <= 0

longExitCondition = ta.crossunder(obv, obv_ma_long_exit)

shortCondition = ta.crossunder(obv, obv_ma_short_entry) and tradeDirection != "long" and strategy.position_size >= 0

shortExitCondition = ta.crossover(obv, obv_ma_short_exit)

///////////////////////////////////////

// ORDER EXECUTION //

///////////////////////////////////////

// Close opposite trades before entering new ones

if (longCondition and strategy.position_size < 0)

strategy.close("Short Entry")

if (shortCondition and strategy.position_size > 0)

strategy.close("Long Entry")

// Enter new trades

if (longCondition)

strategy.entry("Long Entry", strategy.long)

if (shortCondition)

strategy.entry("Short Entry", strategy.short)

// Exit conditions

if (longExitCondition)

strategy.close("Long Entry")

if (shortExitCondition)

strategy.close("Short Entry")

///////////////////////////////////////

// PLOTTING //

///////////////////////////////////////

// Plot OBV line with specified color

plot(obv, title="OBV", color=color.new(#2962FF, 0), linewidth=1)

// Conditionally plot Long MAs with specified colors based on Direction Filter

plot(tradeDirection == "long" ? obv_ma_long_entry : na, title="Long Entry MA", color=color.new(color.rgb(2, 130, 228), 0), linewidth=1)

plot(tradeDirection == "long" ? obv_ma_long_exit : na, title="Long Exit MA", color=color.new(color.rgb(106, 168, 209), 0), linewidth=1)

// Conditionally plot Short MAs with specified colors based on Direction Filter

plot(tradeDirection == "short" ? obv_ma_short_entry : na, title="Short Entry MA", color=color.new(color.rgb(163, 2, 227), 0), linewidth=1)

plot(tradeDirection == "short" ? obv_ma_short_exit : na, title="Short Exit MA", color=color.new(color.rgb(192, 119, 205), 0), linewidth=1)

相关内容

- 均线,简单移动平均线,均线斜率,追踪止损,重新进场

- 波林带结合伍迪CCI多重指标过滤交易信号策略

- 双均线动量交易策略:基于时间优化的趋势跟踪系统

- 双均线交叉自适应参数择时交易策略

- 基于多均线的趋势交易策略

- 移动平均线交叉策略

- 移动平均交叉策略

- SMA双均线交易策略

- 基于双均线交叉的移动平均线策略

- 趋势捕捉策略

更多内容

- MA99接触与动态止损策略

- Donchian突破交易策略

- Ichimoku Leading Span B 突破策略

- 基于EMA交叉的风险管理型多头策略

- MACD与RSI结合的长线交易策略

- DCA双均线海龟交易策略

- VWAP交易策略

- 多重指标组合策略(CCI,DMI,MACD,ADX)

- RSI2策略之日内反转胜率回测

- 赫斯特未来分界线策略

- GBS高低点确认策略

- 多指标趋势追踪策略

- 挤压回测变形金刚v2.0

- 斐波那契趋势反转策略

- HTF 锯齿形路径策略

- 基于WaveTrend指标的趋势追踪策略

- CCI、DMI和MACD混合多空策略

- AlphaTradingBot 交易策略

- 维加斯超级趋势增强策略

- 基于修正Hull移动平均与一目均衡的量化交易策略