Laguerre RSI with ADX Filtered Trading Signals Strategy

Author: ChaoZhang, Date: 2024-05-17 15:01:17Tags: RSIADX

Overview

This strategy generates buy and sell signals using the Laguerre RSI indicator and filters the signals using the ADX indicator. When the Laguerre RSI crosses above or below predefined buy and sell levels, and the ADX is above a set threshold, the strategy produces buy or sell signals. This approach of combining a fast and a slow indicator allows for timely capture of trading opportunities when the trend strength is sufficient while avoiding trading when the trend is unclear.

Strategy Principles

The Laguerre RSI is a momentum indicator used to measure the speed and strength of price changes. It is based on the Laguerre filter and is more responsive to price changes compared to the traditional RSI. The strategy generates signals by comparing the Laguerre RSI with predefined buy and sell levels.

The ADX indicator measures the strength of a price trend, with higher values indicating a stronger trend. The strategy sets an ADX threshold to enter trades only when the trend strength is sufficient and to stay on the sidelines when the trend is not clear. This helps to improve the reliability of the signals and avoid frequent trading.

The strategy uses crossovers of the Laguerre RSI to trigger buy and sell signals. It enters a long position when the indicator crosses above the buy level and a short position when it crosses below the sell level. At the same time, the ADX must be above the preset threshold to confirm the trend strength. This dual-condition design aims to capture trading opportunities in strong trends.

Strategy Advantages

- The Laguerre RSI captures price changes responsively, enabling timely generation of trading signals.

- The ADX filter ensures trading only when the trend is clear, improving the reliability of signals.

- The parameters are adjustable, allowing users to set buy and sell levels and the ADX threshold according to their preferences.

- The code is concise and efficient, easy to understand and implement.

- The strategy is applicable to various markets and time frames, offering good versatility.

Strategy Risks

- The Laguerre RSI may generate frequent false signals in choppy markets, leading to overtrading.

- The ADX filter may delay signal generation, missing some trading opportunities.

- Fixed buy and sell levels cannot adapt to dynamic changes in the market.

- The strategy does not include stop-loss, exposing it to the risk of uncontrolled single-trade losses.

- It lacks position sizing and money management, making it difficult to control overall risk.

Strategy Optimization Directions

- Introduce adaptive buy and sell levels that adjust dynamically based on the magnitude of price fluctuations. This helps adapt to different market states and reduce false signals.

- Optimize the ADX filter by setting more dynamic thresholds to start trading early in the trend. This can help capture trends earlier and increase profits.

- Incorporate stop-loss and take-profit mechanisms to control single-trade risk. Avoid excessive losses on holdings while timely locking in profits.

- Combine other auxiliary indicators, such as trading volume and volatility, to improve signal reliability.

- Introduce position sizing and money management to control overall risk exposure. Dynamically adjust the percentage of funds for each trade based on the strength of the market trend and account equity.

Summary

The Laguerre RSI with ADX filtered trading strategy is a trend-following approach. It utilizes a fast indicator to capture price changes while confirming trend strength with a slow indicator. This combination allows for timely trading when the trend is clear while staying on the sidelines when the trend is uncertain. The strategy’s advantages lie in its simplicity and wide applicability, but it also has issues such as frequent trading and insufficient risk control. Future enhancements can focus on signal optimization, risk management improvements, and position sizing to achieve more robust returns.

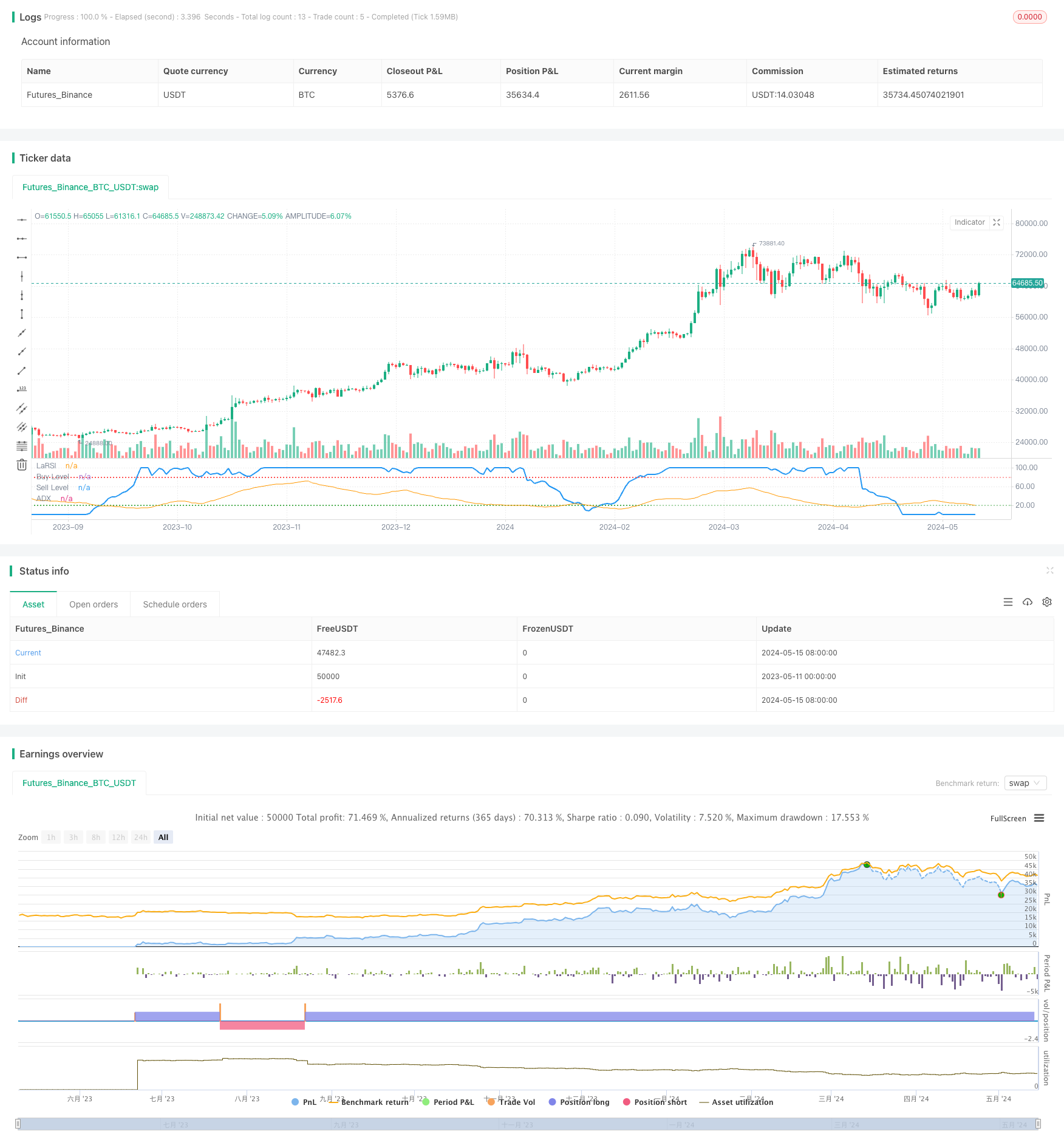

/*backtest

start: 2023-05-11 00:00:00

end: 2024-05-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Laguerre RSI with Buy/Sell Signals and ADX Filter', shorttitle='LaRSI_ADX Signals', overlay=false)

// Kullanıcı girdileri

src = input(title='Source', defval=close)

alpha = input.float(title='Alpha', minval=0, maxval=1, step=0.1, defval=0.2)

buyLevel = input(20, title='Buy Level')

sellLevel = input(80, title='Sell Level')

adxLength = input(14, title='ADX Length')

adxSmoothing = input(14, title='ADX Smoothing')

adxLevel = input(20, title='ADX Level') // adxLevel tanımlamasını ekledik

// ADX hesaplaması

[diPlus, diMinus, adx] = ta.dmi(adxLength, adxSmoothing)

// Laguerre RSI hesaplamaları

gamma = 1 - alpha

L0 = 0.0

L0 := (1 - gamma) * src + gamma * nz(L0[1])

L1 = 0.0

L1 := -gamma * L0 + nz(L0[1]) + gamma * nz(L1[1])

L2 = 0.0

L2 := -gamma * L1 + nz(L1[1]) + gamma * nz(L2[1])

L3 = 0.0

L3 := -gamma * L2 + nz(L2[1]) + gamma * nz(L3[1])

cu = (L0 > L1 ? L0 - L1 : 0) + (L1 > L2 ? L1 - L2 : 0) + (L2 > L3 ? L2 - L3 : 0)

cd = (L0 < L1 ? L1 - L0 : 0) + (L1 < L2 ? L2 - L1 : 0) + (L2 < L3 ? L3 - L2 : 0)

temp = cu + cd == 0 ? -1 : cu + cd

LaRSI = temp == -1 ? 0 : cu / temp

// Alım ve satım sinyalleri

longCondition = ta.crossover(100 * LaRSI, buyLevel) and adx > adxLevel

shortCondition = ta.crossunder(100 * LaRSI, sellLevel) and adx > adxLevel

// Strateji giriş ve çıkışları

strategy.entry('Long', strategy.long, when=longCondition)

strategy.entry('Short', strategy.short, when=shortCondition)

// Göstergeleri çizme

plot(100 * LaRSI, title='LaRSI', linewidth=2, color=color.new(color.blue, 0))

hline(buyLevel, title='Buy Level', color=color.new(color.green, 0), linestyle=hline.style_dotted)

hline(sellLevel, title='Sell Level', color=color.new(color.red, 0), linestyle=hline.style_dotted)

plot(adx, title='ADX', color=color.new(color.orange, 0))

- Multi-Indicator Intelligent Pyramiding Strategy

- Johny's BOT

- Nadaraya-Watson Envelope Multi-Confirmation Dynamic Stop-Loss Strategy

- VuManChu Cipher B + Divergences Strategy

- Multi-Technical Indicator Crossover Momentum Quantitative Trading Strategy - Integration Analysis Based on EMA, RSI and ADX

- Multi-factor Trend Following Quantitative Trading Strategy Based on RSI, ADX, and Ichimoku Cloud

- Post-Open Breakout Trading Strategy with Dynamic ATR-Based Position Management

- Multi-Strategy Adaptive Trend Following and Breakout Trading System

- Dynamic Position Sizing Short-Term Forex Trading Strategy

- Trend-Following Variable Position Grid Strategy

- Dual Moving Average Crossover Strategy

- HalfTrend Bullish and Bearish Trend Following Stop-Limit Buy Strategy

- Alligator Long-Term Trend Following Trading Strategy

- Multi-timeframe Trend Tracking Strategy Based on Impulse MACD and Dual Moving Average Crossover

- EMA5 and EMA13 Crossover Strategy

- EMA SAR Medium-to-Long-Term Trend Following Strategy

- Reverse Volatility Breakout Strategy

- Nifty 50 3-Minute Opening Range Breakout Strategy

- Dynamic Stop Loss and Take Profit Bollinger Bands Strategy

- Improved Swing High/Low Breakout Strategy with Bullish and Bearish Engulfing Patterns

- Price and Volume Breakout Buy Strategy

- K Consecutive Candles Bull Bear Strategy

- Super Moving Average and Upperband Crossover Strategy

- Multi-factor Trend Following Quantitative Trading Strategy Based on RSI, ADX, and Ichimoku Cloud

- RSI and MACD Combined Long-Short Strategy

- Ichimoku Cloud and Moving Average Strategy

- William Alligator Moving Average Trend Catcher Strategy

- Dynamic MACD and Ichimoku Cloud Trading Strategy

- MA Rejection Strategy with ADX Filter

- Bollinger Bands Strategy: Precision Trading for Maximum Gains