VWAP and RSI Dynamic Bollinger Bands Take Profit and Stop Loss Strategy

Author: ChaoZhang, Date: 2024-06-14 15:18:39Tags: VWAPRSIBBATR

Overview

This strategy combines three technical indicators: VWAP (Volume Weighted Average Price), RSI (Relative Strength Index), and Bollinger Bands, to implement a simple and easy-to-use quantitative trading strategy with dynamic take profit and stop loss. The main idea of the strategy is to use the VWAP indicator to determine the price trend over a past period, while using the RSI and Bollinger Bands indicators to determine whether the price is in the overbought or oversold range, thus determining the trading signal. Once a trading signal is determined, the strategy calculates dynamic take profit and stop loss levels based on the ATR (Average True Range) indicator to control risk and lock in profits.

Strategy Principle

- Calculate the values of the VWAP, RSI, and Bollinger Bands technical indicators.

- Determine whether the price trend is upward, downward, or sideways by judging the relationship between the closing price and VWAP over the past 15 candles.

- If the price is below the lower Bollinger Band, RSI is less than 45, and the VWAP signal shows a downward trend, a long signal is generated; if the price is above the upper Bollinger Band, RSI is greater than 55, and the VWAP signal shows an upward trend, a short signal is generated.

- Once a trading signal is determined, the strategy calculates the take profit and stop loss levels based on the ATR indicator, with a take profit to stop loss ratio of 1.5:1.

- If a long position is held, when the RSI is greater than or equal to 90, the strategy closes the long position; if a short position is held, when the RSI is less than or equal to 10, the strategy closes the short position.

Strategy Advantages

- By combining multiple technical indicators, the reliability of trading signals is improved.

- The use of dynamic take profit and stop loss can effectively control risk and lock in profits.

- The code structure is clear and easy to understand and optimize.

- Applicable to various market environments, including trending and sideways markets.

Strategy Risks

- In times of high market volatility, frequent trading may lead to high transaction costs.

- If the market experiences unexpected events or irrational behavior, the strategy may generate incorrect trading signals.

- The parameter settings of the strategy may need to be adjusted according to different market environments to ensure the effectiveness of the strategy.

Strategy Optimization Directions

- Try adjusting the parameter settings of VWAP, RSI, and Bollinger Bands to adapt to different market environments and trading instruments.

- Introduce other technical indicators, such as MACD, KDJ, etc., to further improve the reliability of trading signals.

- Optimize the calculation method of take profit and stop loss, such as using trailing stop loss or profit protection stop loss, to better control risk and lock in profits.

- Combine fundamental analysis, such as economic data and policy changes, to improve the overall performance of the strategy.

Summary

This strategy combines three technical indicators: VWAP, RSI, and Bollinger Bands, to implement a simple and easy-to-use quantitative trading strategy. The strategy uses dynamic take profit and stop loss to effectively control risk and lock in profits. Although the strategy has some potential risks, with reasonable parameter settings and continuous optimization, it is believed that the strategy can achieve good results in actual trading.

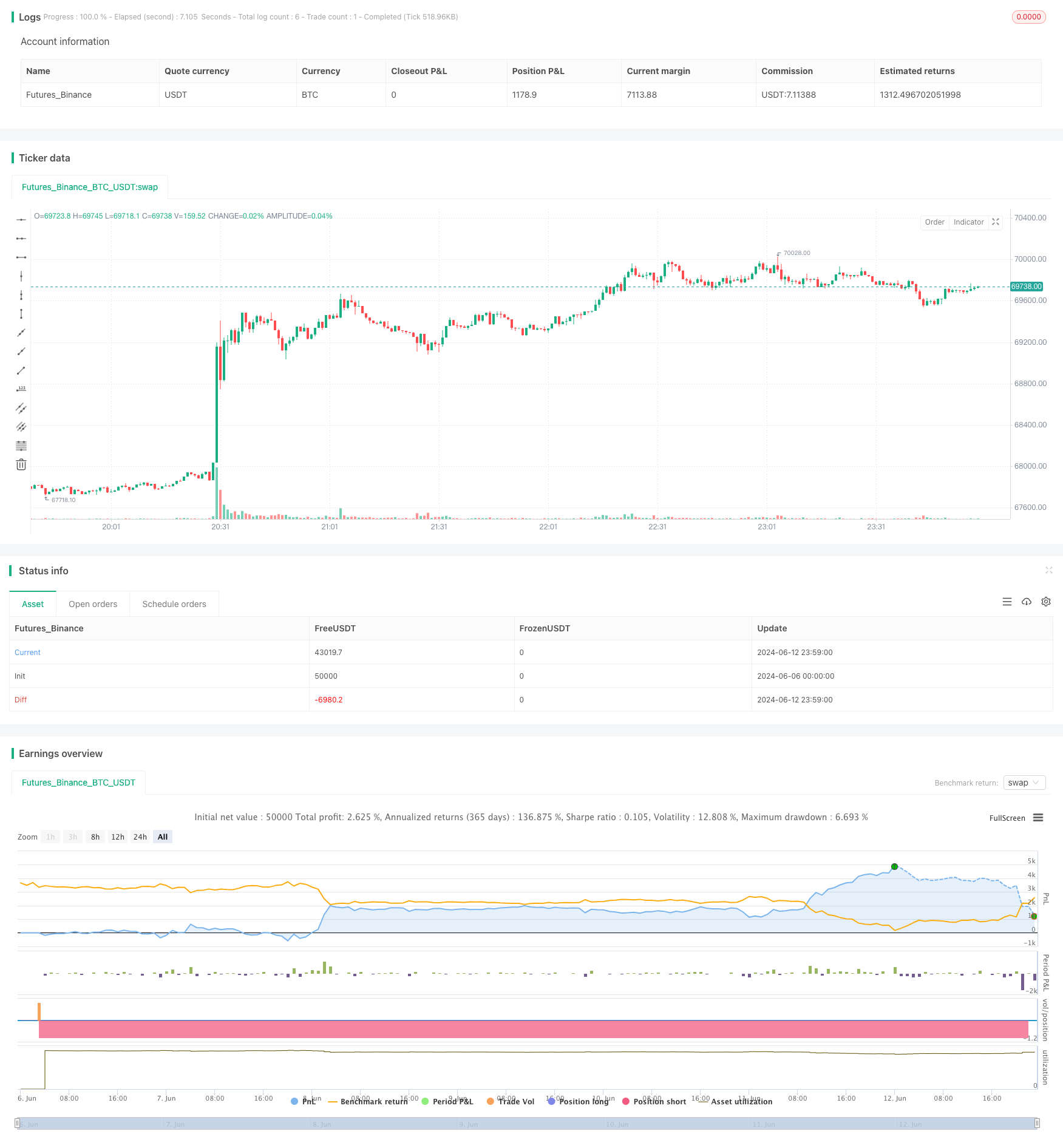

/*backtest

start: 2024-06-06 00:00:00

end: 2024-06-13 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("VWAP and RSI Strategy", overlay=true)

// VWAP calculation

vwap = ta.vwap(close)

// RSI calculation

rsi_length = 16

rsi = ta.rsi(close, rsi_length)

// Bollinger Bands calculation

bb_length = 14

bb_std = 2.0

[bb_middle, bb_upper, bb_lower] = ta.bb(close, bb_length, bb_std)

// Variables for VWAP signal calculation

backcandles = 15

float vwapsignal = na

// Function to check if last 15 candles are above or below VWAP

calc_vwapsignal(backcandles) =>

upt = true

dnt = true

for i = 0 to backcandles - 1

if close[i] < vwap[i]

upt := false

if close[i] > vwap[i]

dnt := false

if upt and dnt

3

else if upt

2

else if dnt

1

else

0

// Calculate VWAP signal for each bar

vwapsignal := calc_vwapsignal(backcandles)

// Calculate total signal

totalsignal = 0

if vwapsignal == 2 and close <= bb_lower and rsi < 45

totalsignal := 2

else if vwapsignal == 1 and close >= bb_upper and rsi > 55

totalsignal := 1

// Define strategy entry and exit conditions

slatr = 1.2 * ta.atr(7)

TPSLRatio = 1.5

if (totalsignal == 2 and strategy.opentrades == 0)

strategy.entry("Long", strategy.long, stop=close - slatr, limit=close + slatr * TPSLRatio)

if (totalsignal == 1 and strategy.opentrades == 0)

strategy.entry("Short", strategy.short, stop=close + slatr, limit=close - slatr * TPSLRatio)

// Additional exit conditions based on RSI

if (strategy.opentrades > 0)

if (strategy.position_size > 0 and rsi >= 90)

strategy.close("Long")

if (strategy.position_size < 0 and rsi <= 10)

strategy.close("Short")

- Big Red Candle Breakout Buy Strategy

- Multi-Indicator Composite Trend Following Strategy

- RSI-Bollinger Bands Integration Strategy: A Dynamic Self-Adaptive Multi-Indicator Trading System

- Multi-Indicator Intelligent Pyramiding Strategy

- Mean Reversion Strategy with Bollinger Bands, RSI and ATR-Based Dynamic Stop-Loss System

- High-Precision RSI and Bollinger Bands Breakout Strategy with Optimized Risk-Reward Ratio

- Dynamic Mean Reversion and Momentum Strategy

- Reverse Volatility Breakout Strategy

- AI-Optimized Adaptive Stop-Loss Trading System with Multiple Technical Indicator Integration

- Intelligent Time-Based Long-Short Rotation Balanced Trading Strategy

- EMA Trend Filter Strategy

- Moving Average Crossover Strategy

- Intraday Breakout Strategy Based on 3-Minute Candle High Low Points

- Advanced Entry Strategy based on Moving Average, Support/Resistance, and Volume

- EMA RSI MACD Dynamic Take Profit and Stop Loss Trading Strategy

- G-Trend EMA ATR Intelligent Trading Strategy

- Trend Following Strategy Based on 200-Day Moving Average and Stochastic Oscillator

- RSI Trend Strategy

- EMA Crossover Momentum Scalping Strategy

- BB Breakout Strategy

- Chande-Kroll Stop Dynamic ATR Trend Following Strategy

- This strategy generates trading signals based on the Chaikin Money Flow (CMF)

- Trend Filtered Pin Bar Reversal Strategy

- Quantitative Trading Strategy Based on Reversal Patterns at Support and Resistance Levels

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- TSI Crossover Strategy

- EMA Dual Moving Average Crossover Strategy

- Williams %R Dynamic TP/SL Adjustment Strategy

- RSI Dynamic Drawdown Stop-Loss Strategy

- VWAP Trading Strategy with Volume Anomaly Detection