Comprehensive Price Gap Short-Term Trend Capture Strategy

Author: ChaoZhang, Date: 2024-07-30 11:08:23Tags: GAPRSIATR

Overview

The Comprehensive Price Gap Short-Term Trend Capture Strategy is a short-term trading strategy based on price gaps. This strategy primarily focuses on significant downward gaps that occur at market open and initiates short-term short positions when specific conditions are met. The core idea of the strategy is to leverage market sentiment and short-term price momentum to capture potential short-term rebounds after a substantial downward gap.

Key features of the strategy include: 1. Setting a gap threshold to filter out significant downward gaps. 2. Using fixed profit targets and time limits to manage risk. 3. Implementing simple and clear entry and exit rules that are easy to understand and execute. 4. Combining concepts from technical analysis and market microstructure.

This strategy is particularly suitable for highly volatile market environments and can help traders capture potential price reversal opportunities in a short period.

Strategy Principles

The core principles of the Comprehensive Price Gap Short-Term Trend Capture Strategy are based on the following key elements:

Gap Identification: The strategy first calculates the difference between the current day’s opening price and the previous trading day’s closing price. If this difference exceeds a preset threshold (150 points in this example), it is considered a significant downward gap.

Entry Conditions: When a significant downward gap is identified and there is no current position, the strategy immediately initiates a short position at market open. This is based on the assumption that the market may be short-term oversold.

Target Setting: The strategy sets a fixed profit target (50 points in this example). Once the price rebounds to the target level, the strategy automatically closes the position for profit.

Time Limit: To avoid the risks associated with holding positions for extended periods, the strategy sets a time limit (11:00 AM in this example). If the profit target is not reached by this time, the strategy will force close the position.

Visualization: The strategy marks the occurrence of gaps and the achievement of profit targets on the chart, helping traders visually understand the strategy’s execution.

By combining these principles, the strategy aims to capture short-term price fluctuations after market open while controlling risk through clear profit targets and time limits.

Strategy Advantages

Clear Entry Signals: The strategy uses significant downward gaps as entry signals, which are clear and easy to identify and execute. Large gaps often indicate drastic changes in market sentiment, providing good opportunities for short-term trading.

Risk Management: By setting fixed profit targets and time limits, the strategy effectively controls the risk of each trade. This approach can prevent traders from making irrational decisions due to greed or fear.

Automated Execution: The strategy’s logic is simple and direct, making it very suitable for automated trading systems. This can eliminate the influence of human emotional factors and improve trading consistency and discipline.

Adaptation to Market Volatility: This strategy is particularly suitable for highly volatile market environments. In rapidly changing markets, it can quickly capture short-term reversal opportunities, potentially achieving higher returns.

Flexibility: The strategy’s parameters (such as gap threshold, target points, and closing time) can all be adjusted according to different market conditions and individual risk preferences, offering great flexibility.

Visual Support: The strategy marks key information on the chart, such as gaps and target achievements, which helps traders better understand and evaluate the strategy’s performance.

Based on Market Microstructure: The strategy utilizes price behavior and liquidity characteristics at market open, aligning with market microstructure theory and providing a certain theoretical foundation.

Quick Profit Realization: By setting relatively small profit targets, the strategy can realize profits in a short time, improving capital use efficiency.

Strategy Risks

False Breakout Risk: Not all downward gaps lead to price rebounds. In some cases, prices may continue to fall, resulting in significant losses for the strategy.

Overtrading: In highly volatile markets, the strategy may frequently trigger trading signals, leading to overtrading and increased transaction costs.

Time Risk: The fixed closing time (11:00 AM) may cause missed potential profit opportunities or force closing positions at unfavorable times.

Parameter Sensitivity: The strategy’s performance is highly dependent on parameter settings, such as gap threshold and target points. Inappropriate parameter settings may lead to poor strategy performance.

Changing Market Conditions: This strategy may perform well under certain specific market conditions but may become ineffective when market environments change.

Liquidity Risk: In markets with low liquidity, it may be difficult to execute trades at ideal prices after large gaps, increasing slippage risk.

Counter-trend Risk: The strategy is essentially a counter-trend trading approach, which may face continuous losses in strong trend markets.

Single Strategy Dependence: Over-reliance on a single strategy may expose the investment portfolio to systemic risks, especially when major market changes occur.

To address these risks, the following measures are recommended: - Combine other technical indicators (such as RSI, Bollinger Bands) to confirm trading signals. - Implement more flexible stop-loss strategies instead of relying solely on time limits. - Regularly backtest and optimize strategy parameters to adapt to changing market conditions. - Consider using this strategy as part of a larger trading system rather than using it in isolation. - Conduct thorough simulated trading and risk assessment before live trading.

Strategy Optimization Directions

Dynamic Gap Threshold: The current strategy uses a fixed gap threshold (150 points). Consider using a dynamic threshold, for example, based on the Average True Range (ATR) of the past N days to set the gap threshold. This can make the strategy better adapt to the volatility of different market cycles.

Intelligent Stop Loss: Introduce a dynamic stop-loss mechanism, such as setting stop-loss points based on market volatility or support/resistance levels, rather than relying solely on fixed time limits. This can better control risk while retaining potential profit opportunities.

Multi-timeframe Analysis: Combine trend analysis of longer timeframes, only executing short trades when the overall trend is downward. This can improve the strategy’s success rate and avoid frequent short selling in strongly bullish markets.

Quantify Market Sentiment: Introduce indicators such as trading volume and volatility to quantify market sentiment. Only execute trades when market sentiment indicators also show oversold signals, which can improve the strategy’s accuracy.

Adaptive Target Setting: The current strategy uses a fixed 50 points as the target. Consider dynamically adjusting the target based on market volatility, increasing target points during high volatility periods and decreasing them during low volatility periods.

Partial Position Closing Mechanism: Introduce a mechanism for closing positions in parts, for example, closing part of the position after reaching a certain profit level and letting the remaining position continue. This can protect profits while not missing out on big market moves.

Time Filtering: Analyze the strategy’s performance during different time periods. It may be found that the strategy works better during certain periods (such as the first 30 minutes after market open). Consider executing trades only during specific time periods.

Correlation Analysis: Study the correlation of this strategy with other assets or strategies. This can help build a more robust investment portfolio and diversify risks.

Machine Learning Optimization: Use machine learning algorithms to optimize parameter selection and trading decisions, which can improve the strategy’s adaptability and performance.

Sentiment Analysis Integration: Consider integrating market news and social media sentiment analysis, which can help predict market reactions after large gaps.

These optimization directions aim to improve the stability, adaptability, and profitability of the strategy. However, before implementing any optimizations, thorough backtesting and forward testing should be conducted to ensure that the improvements indeed bring the expected effects.

Conclusion

The Comprehensive Price Gap Short-Term Trend Capture Strategy is a short-term trading method based on price gaps, focusing on capturing potential rebound opportunities after significant downward gaps. By setting clear entry conditions, fixed profit targets, and time limits, the strategy attempts to capitalize on short-term market sentiment fluctuations while controlling risk.

The main advantages of the strategy lie in its clear trading signals, strict risk management, and ability for automated execution. It is particularly suitable for highly volatile market environments, capable of quickly capturing short-term price movements. However, the strategy also faces risks such as false breakouts, overtrading, and parameter sensitivity.

To further improve the strategy’s effectiveness, considerations can be given to introducing dynamic gap thresholds, intelligent stop-loss mechanisms, multi-timeframe analysis, and other optimization directions. These improvements can enhance the strategy’s adaptability and stability.

Overall, the Comprehensive Price Gap Short-Term Trend Capture Strategy provides traders with a unique approach to leverage short-term market fluctuations. However, like all trading strategies, it is not infallible. Successful application requires a deep understanding of market dynamics, continuous strategy optimization, and strict risk management. Traders should view this strategy as part of a broader trading system rather than relying on it in isolation. By combining other analytical methods and risk management techniques, a more robust and comprehensive trading strategy can be constructed.

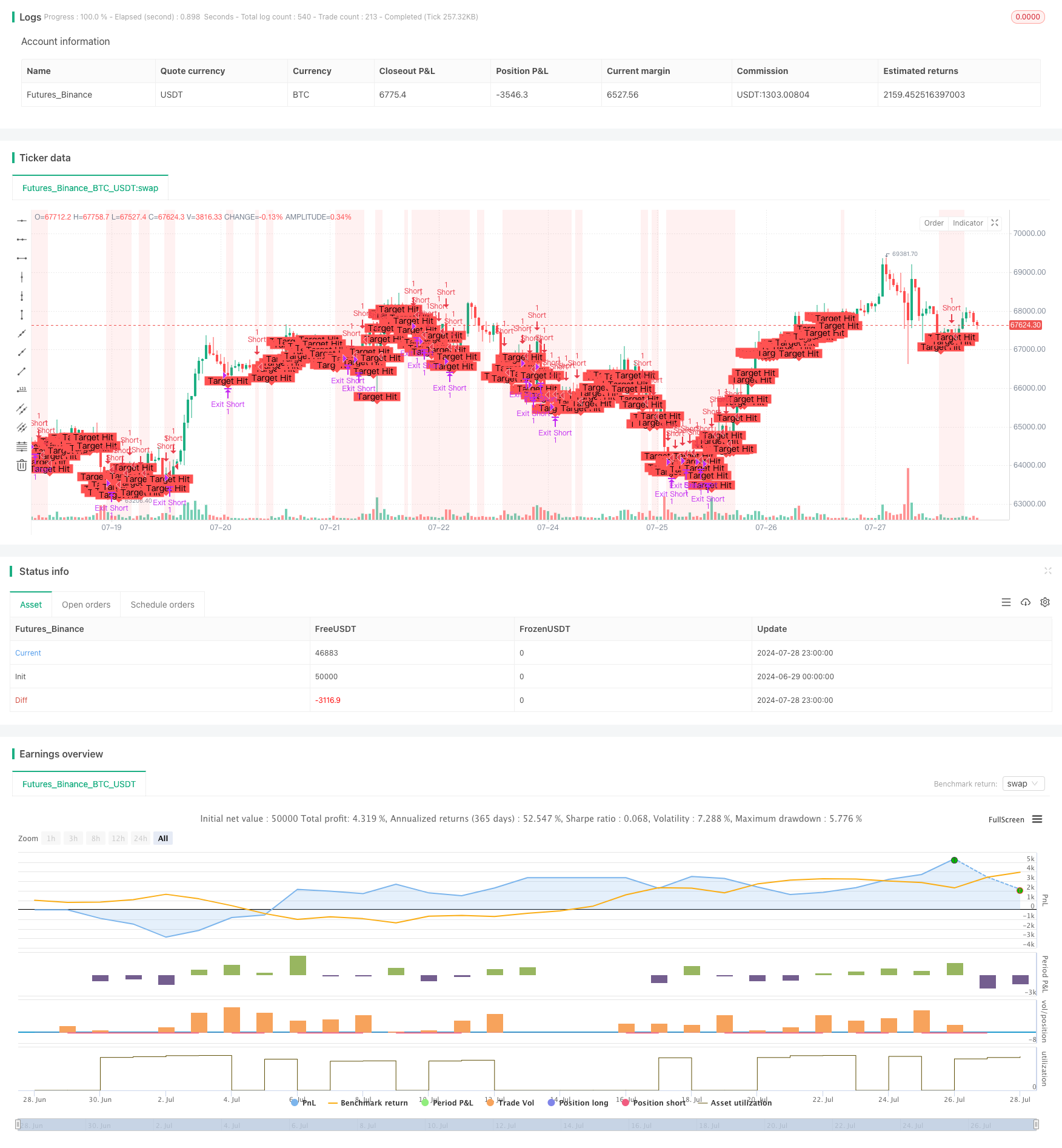

/*backtest

start: 2024-06-29 00:00:00

end: 2024-07-29 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Gap Down Short Strategy", overlay=true)

// Input parameters

targetPoints = input.int(50, title="Target Points", minval=1)

gapThreshold = input.int(150, title="Gap Threshold (in points)", minval=0)

// Calculate gap

prevClose = request.security(syminfo.tickerid, "D", close[1])

gap = open - prevClose

gapDown = gap < -gapThreshold

// Strategy logic

var float entryPrice = na

var float targetPrice = na

var bool inPosition = false

var bool targetHit = false

if (gapDown and not inPosition)

entryPrice := open

targetPrice := entryPrice - targetPoints

inPosition := true

targetHit := false

if (inPosition)

if (low <= targetPrice)

targetHit := true

inPosition := false

if (time >= timestamp(year, month, dayofmonth, 11, 0))

inPosition := false

// Plotting

bgcolor(gapDown ? color.new(color.red, 90) : na)

plotshape(series=targetHit, location=location.belowbar, color=color.red, style=shape.labeldown, text="Target Hit", size=size.small)

// Strategy results

strategy.entry("Short", strategy.short, when=gapDown and not inPosition)

if (targetHit)

strategy.exit("Exit Short", from_entry="Short", limit=targetPrice)

if (time >= timestamp(year, month, dayofmonth, 11, 0) and inPosition)

strategy.close("Short")

// Display gap information

// plotchar(gapDown, char='↓', location=location.belowbar, color=color.red, size=size.small, title="Gap Down")

// plot(gap, title="Gap", color=color.blue)

- Multi-Indicator Intelligent Pyramiding Strategy

- RSI Trend Reversal Strategy

- Dual Timeframe Supertrend with RSI Optimization System

- RSI Trend Reversal Trading Strategy with ATR Stop Loss and Trading Zone Control

- Dual Timeframe Supertrend RSI Intelligent Trading Strategy

- Turnaround Tuesday Strategy (Weekend Filter)

- RSI-ATR Momentum Volatility Combined Trading Strategy

- Multi-Level Dynamic Trend Following System

- RSI-Bollinger Bands Integration Strategy: A Dynamic Self-Adaptive Multi-Indicator Trading System

- Multi-Timeframe Quantitative Trading Strategy Based on EMA-Smoothed RSI and ATR Dynamic Stop-Loss/Take-Profit

- Adaptive Trend Following Strategy Combining AlphaTrend and KAMA with Risk Management

- Dual Indicator Cross-Confirmation Momentum Volume Quantitative Trading Strategy

- Dynamic Trend Following Strategy - Multi-Indicator Integrated Momentum Analysis System

- Multi-EMA and Supertrend Crossover Strategy

- Dynamic Mean Reversion and Momentum Strategy

- Dual EMA Dynamic Trend Capture Trading System

- Multi-Confirmation Reversal Buy Strategy

- Enhanced Dual EMA Pullback Breakout Trading Strategy

- Multi-Timeframe Exponential Moving Average Crossover Strategy

- Multi-Period Dynamic Channel Crossover Strategy

- Multi-Stochastic Oscillation and Momentum Analysis System

- Multi-Timeframe Moving Average and RSI Trend Trading Strategy

- Multi-Period Moving Average Crossover Trend Following Strategy

- Three-Week High-Low Momentum Trading Strategy

- Adaptive Moving Average Crossover Strategy

- Technical Indicator Strategy, Risk Management Strategy, Adaptive Trend Following Strategy

- Bollinger Bands Momentum Optimization Strategy

- Multi-Level Dynamic Trend Following System

- Advanced Mean Reversion Trading Strategy: Dynamic Range Breakout System Based on Standard Deviation

- EMA Crossover with Bollinger Bands Double Entry Strategy: A Quantitative Trading System Combining Trend Following and Volatility Breakout