Dynamic Stop-Loss Moving Average Crossover Strategy

Author: ChaoZhang, Date: 2024-09-26 14:47:09Tags: EMAMARR

Overview

The Dynamic Stop-Loss Moving Average Crossover Strategy is a quantitative trading method based on technical analysis, primarily utilizing the crossover of short-term and long-term moving averages to identify market trends and execute trades. This strategy combines several key elements, including moving average crossovers, dynamic stop-loss, and fixed risk-reward ratios, aiming to capture market trends while effectively controlling risk.

The core idea of the strategy is to determine market trend changes by observing the relative position changes between short-term Exponential Moving Average (EMA) and long-term EMA. When the short-term EMA crosses above the long-term EMA, it is considered a buy signal; conversely, when the short-term EMA crosses below the long-term EMA, it is seen as a sell signal. To enhance the strategy’s reliability and profitability, it also incorporates a dynamic stop-loss mechanism and fixed risk-reward ratio settings.

Strategy Principles

Moving Average Crossover:

- Uses 9-period and 21-period Exponential Moving Averages (EMA)

- Generates a buy signal when the 9-period EMA crosses above the 21-period EMA

- Generates a sell signal when the 9-period EMA crosses below the 21-period EMA

Entry Logic:

- Enters the market immediately upon confirmation of the moving average crossover

- For long positions, enters at the current market price

- For short positions, enters at the current market price

Stop-Loss Setting:

- Utilizes a dynamic stop-loss mechanism

- For long positions, sets the stop-loss at the lowest point of the last 5 periods

- For short positions, sets the stop-loss at the highest point of the last 5 periods

Profit Target:

- Adopts a fixed risk-reward ratio (RR) of 1:3

- For long positions, profit target = entry price + (entry price - stop-loss price) * 3

- For short positions, profit target = entry price - (stop-loss price - entry price) * 3

Position Management:

- Closes any existing opposite position when a new trading signal appears

- Opens a new position for each trade

Trailing Stop:

- Introduces a trailing stop mechanism to lock in profits and adapt to market fluctuations

- The offset of the trailing stop can be adjusted through input parameters

Strategy Advantages

Trend Following Capability: By using moving average crossovers, the strategy can effectively capture changes in market trends, allowing traders to trade in line with major trends. This approach helps traders avoid frequent trading in sideways or choppy markets, thereby reducing unnecessary losses.

Risk Control: The strategy employs a dynamic stop-loss mechanism, setting the stop-loss point at recent volatility extremes. This method adjusts the stop-loss position according to actual market fluctuations, effectively controlling risk while avoiding premature exit due to market noise.

Profit Maximization: By setting a 1:3 risk-reward ratio, the strategy sets a high profit target for each trade while controlling risk. This method ensures that even with a lower win rate, overall profitability can be achieved given enough trades.

High Adaptability: The strategy uses relatively universal technical indicators and trading principles, making it applicable to different markets and time frames. Traders can optimize the strategy according to their trading style and target market by adjusting the periods of moving averages and other parameters.

Automation Potential: The strategy’s logic is clear and well-defined, making it easy to implement programmatically and offering strong automation potential. This not only eliminates interference from human emotions but also enables 24⁄7 market monitoring and trade execution.

Trailing Stop Mechanism: The introduced trailing stop mechanism allows the strategy to lock in more profits when the market continues to move in a favorable direction, while timely stopping losses when the market reverses. This greatly enhances the strategy’s profitability and risk management level.

Strategy Risks

False Breakout Risk: In choppy markets, moving averages may cross frequently, generating many false signals. This could lead to a series of small losses, eroding account capital. Solution: Consider introducing additional filtering conditions, such as trend strength indicators or volume confirmation, to reduce the impact of false signals.

Lag Risk: Moving averages are inherently lagging indicators and may give signals when the trend is already nearing its end, leading to late entries or missing most of the move. Solution: Try using shorter-period moving averages or combining with other leading indicators to optimize entry timing.

Large Gap Risk: In the event of major news or black swan events, the market may experience large gaps, causing stop-losses to fail and resulting in unexpected losses. Solution: It is recommended to set maximum loss limits and consider using derivatives such as options to hedge tail risks.

Overtrading Risk: Under certain market conditions, the strategy may generate too many trading signals, increasing transaction costs and potentially leading to overtrading. Solution: Set trading interval limits or add signal confirmation mechanisms to reduce trading frequency.

Parameter Sensitivity Risk: The strategy’s performance may be very sensitive to the chosen moving average periods and other parameters. Small changes in parameters may lead to significant differences in backtesting results. Solution: It is recommended to conduct extensive parameter optimization and robustness testing to find parameter combinations that perform stably under different market conditions.

Market Environment Change Risk: The strategy may perform well in trending markets but may underperform in range-bound or high-volatility environments. Solution: Consider introducing a market environment identification mechanism to adopt different trading strategies or parameter settings in different market states.

Strategy Optimization Directions

Incorporate Volume Analysis: Integrating volume indicators into the strategy can help confirm the validity of price movements. For example, requiring volume to increase simultaneously with moving average crossovers can filter out some potential false breakouts. This is because real trend changes are usually accompanied by significant increases in trading volume.

Add Trend Strength Filtering: Introduce trend strength indicators such as ADX (Average Directional Index) and only execute trades when the trend is strong enough. This can help avoid overtrading in sideways or weak trend markets, improving the overall win rate of the strategy.

Optimize Stop-Loss Method: Consider using ATR (Average True Range) to set dynamic stop-losses, which can better adapt to actual market volatility. ATR provides an objective measure based on market volatility, making stop-loss settings more flexible and effective.

Implement Time Filtering: Analyze market characteristics during different time periods and execute the strategy during optimal trading hours. This is because financial markets may exhibit different characteristics, such as volatility and liquidity differences, at different times.

Incorporate Fundamental Factors: On the basis of pure technical analysis, consider introducing some fundamental factors, such as economic data releases or central bank policy changes. This can help the strategy make more informed decisions before and after major events.

Implement Dynamic Parameter Adjustment: Develop a mechanism that can dynamically adjust strategy parameters based on recent market conditions. This can be achieved through machine learning algorithms, allowing the strategy to better adapt to constantly changing market environments.

Add Multi-Timeframe Analysis: In addition to the current timeframe, include analysis of longer-term timeframes. For example, add consideration of weekly trends in a daily system. This ensures that the trading direction aligns with larger market trends.

Optimize Position Management: Implement more complex position management strategies, such as dynamically adjusting trade size based on account profit/loss status, market volatility, or signal strength. This can help maximize potential returns while keeping risks under control.

Summary

The Dynamic Stop-Loss Moving Average Crossover Strategy is a quantitative trading system that combines multiple mature technical analysis concepts. It captures market trends through moving average crossovers, manages risk and returns using dynamic stop-losses and fixed risk-reward ratios, and introduces a trailing stop mechanism to adapt to market fluctuations. This strategy design aims to effectively control risk and maximize potential returns while capturing market trends.

The main advantages of the strategy lie in its trend-following capability, strict risk control, clear profit target setting, and strong adaptability and automation potential. However, it also faces potential risks such as false breakouts, lag, and large gaps. To address these challenges and further enhance strategy performance, we have proposed multiple optimization directions, including incorporating volume analysis, adding trend strength filtering, optimizing stop-loss methods, implementing time filtering, incorporating fundamental factors, implementing dynamic parameter adjustment, adding multi-timeframe analysis, and optimizing position management.

Overall, this strategy provides traders with a systematic, quantifiable trading method with the potential to achieve stable performance under various market conditions. However, like all trading strategies, it is not infallible. When using this strategy, traders need to fully understand its principles, recognize potential risks, and make necessary adjustments and optimizations based on their risk tolerance and investment objectives. Through continuous backtesting, live trading verification, and ongoing improvements, this strategy has the potential to become a powerful tool in traders’ toolkits, helping to achieve long-term stable trading returns.

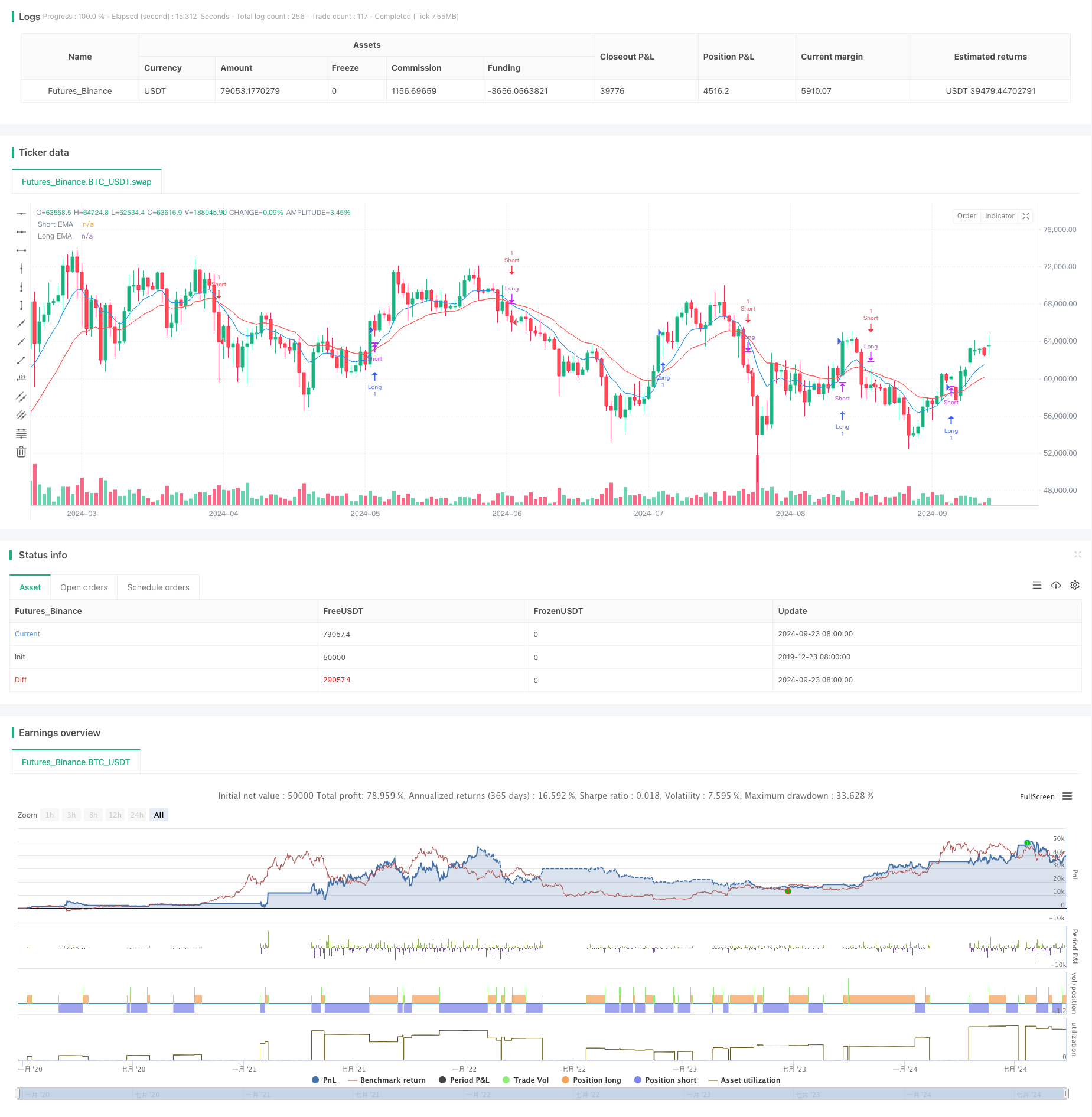

/*backtest

start: 2019-12-23 08:00:00

end: 2024-09-24 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("RAMZY CRYPTO-KING", overlay=true)

// Input for moving averages

shortMA = input(9, title="Short EMA Period")

longMA = input(21, title="Long EMA Period")

trailOffset = input(0, title="Trailing Drawdown Offset")

// Calculate moving averages

shortEMA = ta.ema(close, shortMA)

longEMA = ta.ema(close, longMA)

// Plot moving averages

plot(shortEMA, color=color.blue, title="Short EMA")

plot(longEMA, color=color.red, title="Long EMA")

// Identify recent swing high and low

swingHigh = ta.highest(high, 5)

swingLow = ta.lowest(low, 5)

// Buy condition: EMA crossover

longCondition = ta.crossover(shortEMA, longEMA)

if (longCondition)

strategy.close("Short") // Close any existing short position

stopLoss = swingLow // At swing low

takeProfit = close + (3 * (close - stopLoss)) // 1:3 RR

strategy.entry("Long", strategy.long)

strategy.exit("TP/SL", "Long", limit=takeProfit, stop=stopLoss, trail_offset=trailOffset)

// Sell condition: EMA crossover

shortCondition = ta.crossunder(shortEMA, longEMA)

if (shortCondition)

strategy.close("Long") // Close any existing long position

stopLoss = swingHigh // At swing high

takeProfit = close - (3 * (stopLoss - close)) // 1:3 RR

strategy.entry("Short", strategy.short)

strategy.exit("TP/SL", "Short", limit=takeProfit, stop=stopLoss, trail_offset=trailOffset)

// Debugging Labels

if (longCondition)

label.new(bar_index, high, "Buy", style=label.style_label_down, color=color.green, textcolor=color.white)

if (shortCondition)

label.new(bar_index, low, "Sell", style=label.style_label_up, color=color.red, textcolor=color.white)

- Dual EMA Stochastic Oscillator System: A Quantitative Trading Model Combining Trend Following and Momentum

- 5EMA Trend Following Strategy with Dynamic Stop-Loss and Take-Profit

- Triple EMA Crossover Trading Strategy with Dynamic Stop-Loss and Take-Profit

- Multi-Timeframe EMA Trend Strategy with Daily High-Low Breakout System

- EMA Momentum Trading Strategy

- Dual Chain Hybrid Momentum EMA Tracking Trading System

- Triple EMA Trend Following Quantitative Trading Strategy

- Cross-Market Overnight Position Strategy with EMA Filter

- Multi-EMA Crossover Momentum Trend Following Strategy

- Improved Swing High/Low Breakout Strategy with Bullish and Bearish Engulfing Patterns

- Multi-Factor Dynamic Adaptive Trend Following Strategy

- Multi-Timeframe RSI Oversold Reversal Strategy

- Intelligent Institutional Trading Structure Momentum Strategy

- Gaussian Cross EMA Trend Retracement Strategy

- EMA MACD Momentum Tracking Strategy

- Dynamic Position Management RSI Overbought Reversal Strategy

- Multi-Zone RSI Trading Strategy

- Dynamic Trend Following Strategy with Machine Learning Enhanced Risk Management

- Crossover Moving Average with Smoothed Candlestick Momentum Strategy

- Dual Moving Average Crossover Strategy with Daily Profit Target

- MACD-ATR-EMA Multi-Indicator Dynamic Trend Following Strategy

- RSI Momentum Divergence Breakout Strategy

- Multi-Indicator Synergy Long-Term Trading Strategy

- Golden Momentum Capture Strategy: Multi-Timeframe Exponential Moving Average Crossover System

- Triple Supertrend Crossover Strategy

- Advanced Multi-Timeframe Ichimoku Cloud Trading Strategy with Dynamic Multidimensional Analysis

- Dual Moving Average Momentum Trading Strategy: Time-Optimized Trend Following System

- Enhanced EMA/WMA Crossover Strategy with Comprehensive Exit Conditions

- Supertrend and EMA Crossover Quantitative Trading Strategy

- EMA, SMA, Moving Average Crossover, Momentum Indicator