52-Week High-Low/Average Volume/Volume Breakout Strategy

Author: ChaoZhang, Date: 2024-09-26 15:47:03Tags: MASMAVOL

Overview

This strategy is a quantitative trading approach based on 52-week high-low levels, average volume, and price breakouts. It primarily focuses on situations where stock prices are near their 52-week highs, volume increases significantly, and intraday price movements are moderate. The strategy aims to identify potential buying opportunities by observing the combination of these indicators, with the goal of capturing potential upward trends in stocks.

Strategy Principles

The core principles of this strategy include:

52-Week High-Low Tracking: The strategy continuously tracks and updates the 52-week highest and lowest prices of stocks, which are often viewed as important support and resistance levels.

Price Proximity to 52-Week High: The strategy looks for stocks within 10% (adjustable) of their 52-week high, indicating potential strength.

Volume Breakout: It calculates a 50-day average volume and seeks instances where the daily volume significantly exceeds this average (default 1.5 times), potentially indicating increased market interest.

Price Change Limits: The strategy sets limits on daily price changes (3% for daily, 10% for weekly or monthly timeframes) to avoid entering during excessive volatility.

Entry Signal: A buy signal is generated when a stock simultaneously meets the conditions of being close to its 52-week high, experiencing a volume breakout, and showing moderate price movement.

Strategy Advantages

Multi-dimensional Analysis: Combines price, volume, and historical data dimensions, enhancing signal reliability.

Dynamic Adjustment: 52-week high-low points update dynamically, allowing the strategy to adapt to different market environments.

Risk Control: Limiting intraday price movement range reduces the risk of entering during extreme volatility.

Visual Aids: The strategy marks 52-week high-low points and entry signals on charts, facilitating intuitive market understanding.

Parameter Flexibility: Several key parameters can be adjusted based on different markets and personal preferences, increasing strategy adaptability.

Strategy Risks

False Breakout Risk: Relying solely on price proximity to highs and volume increase may lead to misinterpreting false breakouts as genuine.

Latency: Using 52-week data may result in slow reactions to market changes.

Overtrading: In highly volatile markets, entry signals may be triggered frequently, increasing transaction costs.

Unidirectional Operations: The strategy only focuses on long opportunities, potentially facing significant risks in declining markets.

Neglect of Fundamentals: The strategy is entirely based on technical indicators, disregarding company fundamentals and macroeconomic factors.

Strategy Optimization Directions

Introduce Trend Confirmation Indicators: Adding indicators like moving average crossovers could reduce false breakout risks.

Optimize Volume Analysis: Consider using more sophisticated volume analysis methods, such as the Relative Volume Indicator (RVI), to improve volume breakout judgment accuracy.

Implement Stop-Loss and Take-Profit Mechanisms: Set reasonable stop-loss and take-profit levels to control risks and secure profits.

Add Short-Selling Strategy: Consider incorporating short-selling operations when prices approach 52-week lows and meet other conditions, making the strategy more comprehensive.

Introduce Fundamental Screening: Combine fundamental indicators like Price-to-Earnings (P/E) ratio and market capitalization for preliminary screening of entry targets.

Conclusion

This strategy, based on 52-week high-low levels, average volume, and price breakouts, provides traders with a multi-dimensional analysis framework. By comprehensively considering price position, volume changes, and price momentum, the strategy attempts to capture potential upward opportunities. However, traders need to be aware of false breakout risks when using this strategy and should consider combining it with other technical and fundamental analysis tools to enhance decision reliability. Through continuous optimization and personalized adjustments, this strategy has the potential to become an effective trading tool.

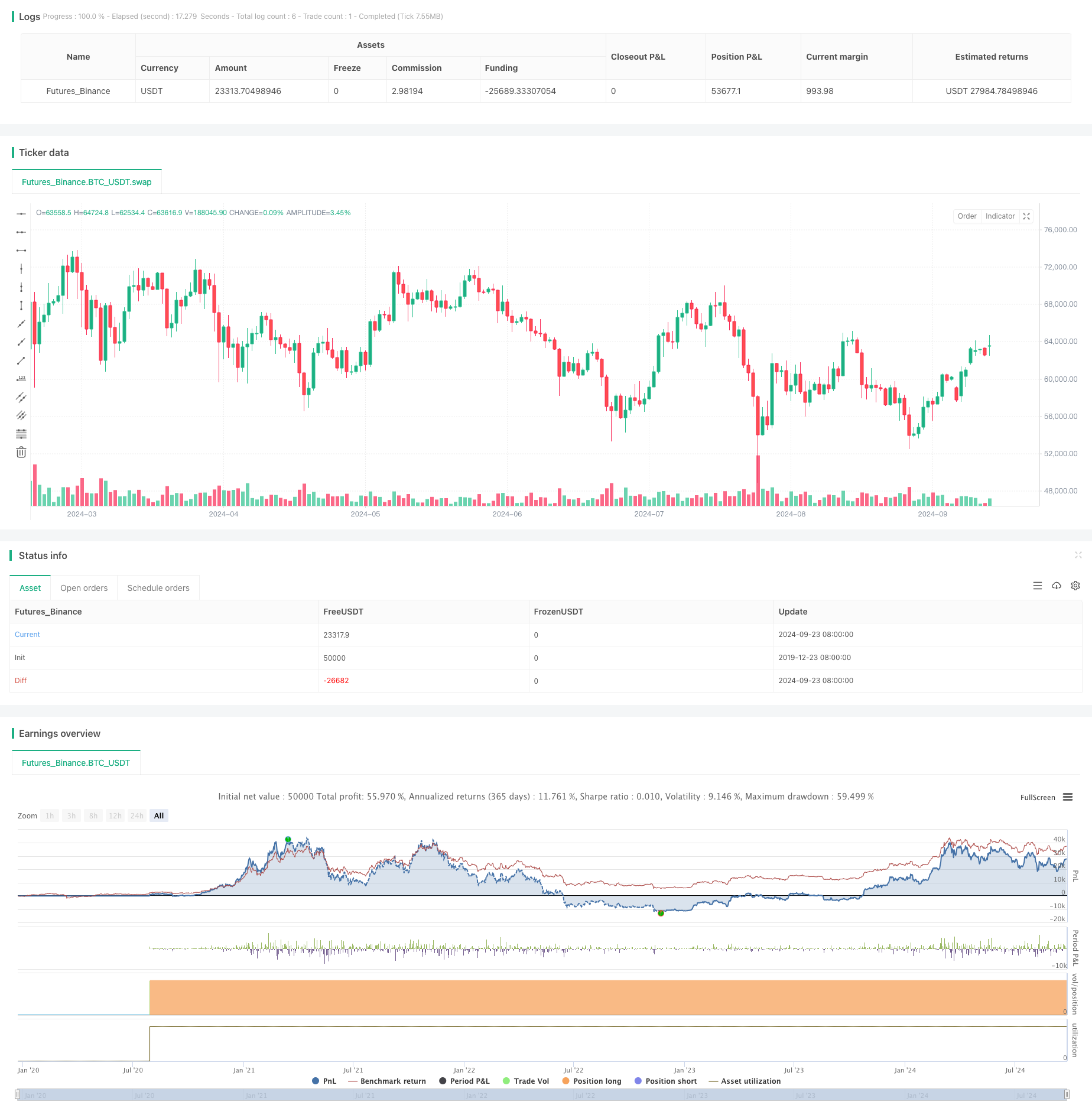

/*backtest

start: 2019-12-23 08:00:00

end: 2024-09-24 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Custom Stock Trading Strategy with 50-Day Average Volume", overlay=true)

// Define input parameters

percentFromHigh = input.int(10, title="Percentage from 52-Week High for Entry")

volumeMultiplier = input.float(1.5, title="Volume Multiplier for Exponential Rise") // Multiplier to define significant increase in volume

// Define period for average volume

averageVolumePeriod = 50 // 50-day average volume

// Calculate 52-week high and low

weeks = 52 // Number of weeks in a year

daysPerWeek = 5 // Assuming 5 trading days per week

length = weeks * daysPerWeek

// 52-week high and low calculations

highestHigh = ta.highest(close, length)

lowestLow = ta.lowest(close, length)

// // Plot horizontal lines for 52-week high and low

// var line highLine = na

// var line lowLine = na

// if (bar_index == ta.highest(bar_index, length)) // Update lines when the highest index is detected

// line.delete(highLine)

// line.delete(lowLine)

// highLine := line.new(x1=bar_index[0], y1=highestHigh, x2=bar_index + 1, y2=highestHigh, color=color.green, width=2, style=line.style_solid, extend=extend.right)

// lowLine := line.new(x1=bar_index[0], y1=lowestLow, x2=bar_index + 1, y2=lowestLow, color=color.red, width=2, style=line.style_solid, extend=extend.right)

// // Plot labels for 52-week high and low

// if (bar_index % 100 == 0) // To avoid cluttering, update labels periodically

// label.new(x=bar_index, y=highestHigh, text="52-Week High", color=color.green, textcolor=color.white, style=label.style_label_left, size=size.small)

// label.new(x=bar_index, y=lowestLow, text="52-Week Low", color=color.red, textcolor=color.white, style=label.style_label_left, size=size.small)

// Calculate percentage from 52-week high

percentFromHighValue = 100 * (highestHigh - close) / highestHigh

// Calculate 50-day average volume

avgVolume = ta.sma(volume, averageVolumePeriod)

// Exponential rise in volume condition

volumeRise = volume > avgVolume * volumeMultiplier

// Calculate the percentage change in price for the current period

dailyPriceChange = 100 * (close - open) / open

// Determine the percentage change limit based on the timeframe

priceChangeLimit = if (timeframe.isweekly or timeframe.ismonthly)

10 // 10% limit for weekly or monthly timeframes

else

3 // 3% limit for daily timeframe

// Entry condition: stock within 10% of 52-week high, exponential rise in volume, and price change <= limit

entryCondition = percentFromHighValue <= percentFromHigh and volumeRise and dailyPriceChange <= priceChangeLimit

// Strategy logic

if (entryCondition)

strategy.entry("Buy", strategy.long)

// Plot tiny triangle labels below the candle

// if (entryCondition)

// label.new(bar_index, low, style=label.style_triangleup, color=color.blue, size=size.tiny)

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- Dual-Period Moving Average with RSI Momentum and Volume Trend Following Strategy

- Multi-Technical Indicator Trend Following Trading Strategy

- Advanced Quantitative Trend Capture Strategy with Dynamic Range Filter

- Multi-Dimensional KNN Algorithm with Volume-Price Candlestick Pattern Trading Strategy

- Multi-Indicator Dynamic Volatility Trading Strategy

- SMA Dual Moving Average Trading Strategy

- MA Cross Strategy

- Dual Moving Average Crossover Adaptive Parameter Trading Strategy

- Moving Average Crossover Strategy Based on Dual Moving Averages

- Enhanced Breakout Strategy with Targets and Stop Loss Optimization

- Dual Moving Average Channel Trend Following Strategy

- Multi-Indicator Adaptive Momentum Trading Strategy

- Bollinger Bands Momentum Reversal Quantitative Strategy

- Adaptive Risk Management Strategy Based on Dual Moving Average Golden Cross

- Dual Indicator Trading Strategy Combining Trend Following and Momentum

- Adaptive Price-Crossing Moving Average Trading Strategy

- Multi-Indicator Dynamic Stop-Loss Trend Following Strategy

- Dual Coral Trend Crossover Strategy

- EMA, SMA, CCI, ATR, Perfect Order Moving Average Strategy with Trend Magic Indicator Auto-Trading System

- Multi-EMA and CCI Crossover Trend Following Strategy

- Dynamic Trend-Following EMA Crossover Strategy

- Multi-Factor Dynamic Adaptive Trend Following Strategy

- Multi-Timeframe RSI Oversold Reversal Strategy

- Intelligent Institutional Trading Structure Momentum Strategy

- Gaussian Cross EMA Trend Retracement Strategy

- EMA MACD Momentum Tracking Strategy

- Dynamic Position Management RSI Overbought Reversal Strategy

- Multi-Zone RSI Trading Strategy

- Dynamic Trend Following Strategy with Machine Learning Enhanced Risk Management