Multi-Strategy Adaptive Trend Following and Breakout Trading System

Author: ChaoZhang, Date: 2024-11-12 16:43:34Tags: EMARSIOBVATRADX

Overview

This strategy is an adaptive trading system that integrates multiple trading methods, combining trend following, range trading, and breakout trading strategies to adapt to different market conditions. The system uses technical indicators such as EMA, RSI, and OBV for market state determination, combines ADX indicator for trend strength confirmation, and implements ATR-based dynamic stop-loss for risk control. The strategy’s uniqueness lies in allowing users to freely select which trading strategies to enable and precisely control risk for each trade through money management parameters.

Strategy Principles

The strategy contains three main trading modules: 1. Trend Trading Module: Uses EMA and ADX indicators to determine trend status, confirming trends when price is above EMA and ADX is above 25, looking for long opportunities in RSI oversold zones. 2. Range Trading Module: Operates in non-trending markets, using RSI indicator for reversal trades in overbought and oversold zones. 3. Breakout Trading Module: Combines price breakouts with OBV indicator to confirm volume support, capturing breakout opportunities with high volume confirmation.

Each module employs ATR-based dynamic stop-loss and sets profit targets based on user-defined risk-reward ratios. The system uses a volume filter to ensure trades occur in adequately liquid conditions.

Strategy Advantages

- High Adaptability: Multi-strategy combination adapts to different market environments

- Comprehensive Risk Control: Uses ATR dynamic stop-loss with customizable risk-reward ratios

- High Flexibility: Users can selectively enable different strategies based on market characteristics

- Strict Trade Confirmation: Integrates multiple confirmations from price, volume, and technical indicators

- Scientific Money Management: Precise control of risk percentage for each trade

Strategy Risks

- Parameter Optimization Risk: Multiple adjustable parameters may lead to over-optimization

- Market Environment Assessment Risk: Different strategies may generate conflicting signals

- Liquidity Risk: Potential slippage in low liquidity environments

- Systematic Risk: Market events may cause stop-loss failure

Recommended risk control measures: - Conduct thorough historical data backtesting - Adopt conservative money management ratios - Regular parameter review and adjustment - Set maximum position holding time limits

Strategy Optimization Directions

Enhance Market Volatility Adaptation:

- Dynamically adjust entry conditions based on volatility

- Increase signal confirmation thresholds in high volatility environments

Improve Strategy Switching Mechanism:

- Establish market environment scoring system

- Implement dynamic strategy weight adjustment

Strengthen Money Management System:

- Introduce dynamic position sizing

- Adjust risk parameters based on historical performance

Optimize Signal Filtering:

- Add trend strength confirmation indicators

- Enhance volume analysis methods

Summary

This strategy achieves adaptive trading across different market environments through multi-strategy combination and strict risk control systems. The modular design allows flexible configuration, while comprehensive money management mechanisms ensure trading safety. Through continuous optimization and improvement, the strategy shows promise for stable performance across various market conditions. For enhanced robustness in live trading, it is recommended to adopt conservative money management approaches and regularly evaluate and adjust strategy parameters.

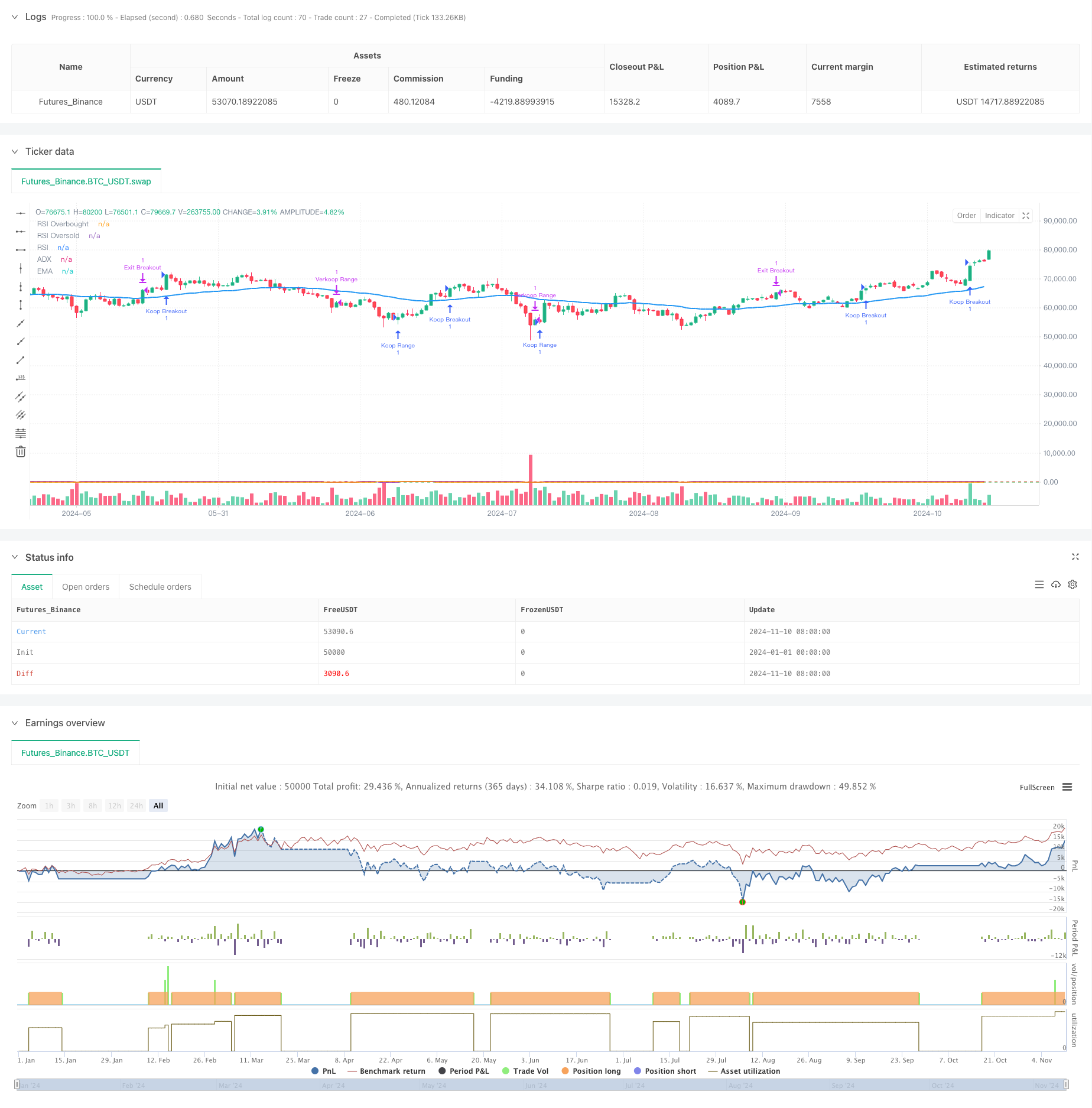

/*backtest

start: 2024-01-01 00:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ceulemans Trading Bot met ADX, Trendfilter en Selecteerbare Strategieën", overlay=true)

// Parameters voor indicatoren

emaLength = input.int(50, title="EMA Lengte")

rsiLength = input.int(14, title="RSI Lengte")

obvLength = input.int(20, title="OBV Lengte")

rsiOverbought = input.int(65, title="RSI Overbought")

rsiOversold = input.int(35, title="RSI Oversold")

atrLength = input.int(14, title="ATR Lengte")

adxLength = input.int(14, title="ADX Lengte")

adxSmoothing = input.int(14, title="ADX Smoothing") // Voeg de smoothing parameter toe

// Money Management Parameters

capitalRisk = input.float(1.0, title="Percentage van kapitaal per trade", step=0.1)

riskReward = input.float(3.0, title="Risk/Reward ratio", step=0.1)

stopLossMultiplier = input.float(1.2, title="ATR Stop-Loss Multiplier", step=0.1)

// Strategieën selecteren (aan/uit schakelaars)

useTrendTrading = input.bool(true, title="Gebruik Trend Trading")

useRangeTrading = input.bool(true, title="Gebruik Range Trading")

useBreakoutTrading = input.bool(true, title="Gebruik Breakout Trading")

// Berekening indicatoren

ema = ta.ema(close, emaLength)

rsi = ta.rsi(close, rsiLength)

obv = ta.cum(ta.change(close) * volume)

atr = ta.atr(atrLength)

[diplus, diminus, adx] = ta.dmi(adxLength, adxSmoothing) // ADX berekening met smoothing

avgVolume = ta.sma(volume, obvLength)

// Huidige marktsituatie analyseren

isTrending = close > ema and adx > 25 // Trend is sterk als ADX boven 25 is

isOversold = rsi < rsiOversold

isOverbought = rsi > rsiOverbought

isBreakout = close > ta.highest(close[1], obvLength) and obv > ta.cum(ta.change(close[obvLength]) * volume)

isRange = not isTrending and (close < ta.highest(close, obvLength) and close > ta.lowest(close, obvLength))

volumeFilter = volume > avgVolume

// Strategie logica

// 1. Trend Trading met tight stop-loss en ADX filter

if (useTrendTrading and isTrending and isOversold and volumeFilter)

strategy.entry("Koop Trend", strategy.long)

strategy.exit("Exit Trend", stop=strategy.position_avg_price - stopLossMultiplier * atr, limit=strategy.position_avg_price + riskReward * stopLossMultiplier * atr)

// 2. Range Trading

if (useRangeTrading and isRange and rsi < rsiOversold and volumeFilter)

strategy.entry("Koop Range", strategy.long)

strategy.exit("Verkoop Range", stop=strategy.position_avg_price - stopLossMultiplier * atr, limit=strategy.position_avg_price + riskReward * stopLossMultiplier * atr)

if (useRangeTrading and isRange and rsi > rsiOverbought and volumeFilter)

strategy.entry("Short Range", strategy.short)

strategy.exit("Exit Short Range", stop=strategy.position_avg_price + stopLossMultiplier * atr, limit=strategy.position_avg_price - riskReward * stopLossMultiplier * atr)

// 3. Breakout Trading met volume

if (useBreakoutTrading and isBreakout and volumeFilter)

strategy.entry("Koop Breakout", strategy.long)

strategy.exit("Exit Breakout", stop=strategy.position_avg_price - stopLossMultiplier * atr, limit=strategy.position_avg_price + riskReward * stopLossMultiplier * atr)

// Indicatoren plotten

plot(ema, title="EMA", color=color.blue, linewidth=2)

hline(rsiOverbought, "RSI Overbought", color=color.red)

hline(rsiOversold, "RSI Oversold", color=color.green)

plot(rsi, title="RSI", color=color.purple)

plot(adx, title="ADX", color=color.orange)

- Multi-Indicator Trend Following and Volatility Breakout Strategy

- Post-Open Breakout Trading Strategy with Dynamic ATR-Based Position Management

- RSI Momentum and ADX Trend Strength Based Capital Management System

- Gaussian Cross EMA Trend Retracement Strategy

- Trend-Following Variable Position Grid Strategy

- Triple EMA Trend Following Multi-Indicator Quantitative Trading Strategy

- Multi-Technical Indicator Based High-Frequency Dynamic Optimization Strategy

- Multi-Indicator Dynamic Stop-Loss Momentum Trend Trading Strategy

- Multi-Filter Trend Breakthrough Smart Moving Average Trading Strategy

- Multi-Level Multi-Period EMA Crossover Dynamic Take-Profit Optimization Strategy

- Enhanced Multi-Period Dynamic Adaptive Trend Following Trading System

- Large Volatility Breakout Dual-Direction Trading Strategy: Point-Based Threshold Entry System

- Enhanced Bollinger Mean Reversion Quantitative Strategy

- Dynamic Darvas Box Breakout with Moving Average Trend Confirmation Trading System

- Dynamic Take-Profit Stop-Loss EMA Crossover Quantitative Trading Strategy

- Multi-EMA Crossover Trend Following Strategy with Dynamic Stop-Loss and Take-Profit Optimization

- Dual Moving Average Crossover Strategy with Dynamic Risk Management

- The two platforms hedge balancing strategy

- Dual Moving Average Crossover with Dynamic Risk Management Strategy

- Multi-MA Trend Strength Capture with Momentum Profit-Taking Strategy

- Multi-Level Moving Average with Candlestick Pattern Recognition Trading System

- Multi-Timeframe EMA Trend Momentum Trading Strategy

- Intelligent Time-Based Long-Short Rotation Balanced Trading Strategy

- Advanced MACD Dynamic Trend Quantitative Trading Strategy

- Trend Breakout Trading System with Moving Average (TBMA Strategy)

- ATR-Based Multi-Trend Following Strategy with Take-Profit and Stop-Loss Optimization System

- RSI Momentum-based Smart Adaptive Trading System with Multi-level Risk Management

- Adaptive RSI Oscillator Dynamic Trading Strategy with Threshold Optimization

- RSI and AO Synergistic Trend Following Quantitative Trading Strategy

- Adaptive Trend Momentum RSI Strategy with Moving Average Filter System