VWAP-MACD-RSI Multi-Factor Quantitative Trading Strategy

Author: ChaoZhang, Date: 2024-11-27 16:11:00Tags: VWAPMACDRSITPSL

Overview

This is a quantitative trading strategy based on three technical indicators: VWAP, MACD, and RSI. The strategy identifies trading opportunities by combining signals from Volume Weighted Average Price (VWAP), Moving Average Convergence Divergence (MACD), and Relative Strength Index (RSI). It incorporates percentage-based take-profit and stop-loss mechanisms for risk management and uses strategy position sizing to optimize capital utilization.

Strategy Principles

The core logic is based on the comprehensive analysis of three main indicators:

- VWAP serves as the primary trend reference line, with price crossovers indicating potential trend changes

- MACD histogram confirms trend strength and direction, with positive values indicating uptrends and negative values indicating downtrends

- RSI identifies overbought or oversold market conditions to avoid entering at extreme levels

Buy conditions require:

- Price crosses above VWAP

- Positive MACD histogram

- RSI below overbought level

Sell conditions require:

- Price crosses below VWAP

- Negative MACD histogram

- RSI above oversold level

Strategy Advantages

- Multiple technical indicators cross-validation improves signal reliability

- VWAP incorporates volume factor for enhanced market depth analysis

- RSI filters extreme market conditions, reducing false breakout risks

- Percentage-based take-profit and stop-loss adapt to different price ranges

- Position sizing based on account equity enables dynamic position management

- Clear strategy logic, easy to understand and maintain

Strategy Risks

- Choppy markets may generate frequent trades, increasing transaction costs

- Multiple indicators might lead to delayed signals, affecting entry timing

- Fixed percentage take-profit and stop-loss may not suit all market conditions

- Lack of volatility consideration could increase risk during high volatility periods

- Absence of trend strength filtering may generate excessive signals in weak trends

Strategy Optimization Directions

- Introduce ATR for dynamic adjustment of take-profit and stop-loss levels

- Add trend strength filters to reduce false signals in choppy markets

- Optimize VWAP period settings, consider multiple VWAP periods combination

- Implement volume confirmation mechanism to improve breakout signal reliability

- Consider adding time filters to avoid trading during low liquidity periods

- Implement dynamic position sizing mechanism based on market conditions

Summary

This strategy constructs a relatively complete trading system by combining three classic technical indicators: VWAP, MACD, and RSI. The design emphasizes signal reliability and risk management through multiple indicator cross-validation to improve trading quality. While there are aspects that need optimization, the overall framework is sound and offers good scalability. Traders are advised to validate the strategy through backtesting across different market conditions and optimize parameters according to specific requirements before live implementation.

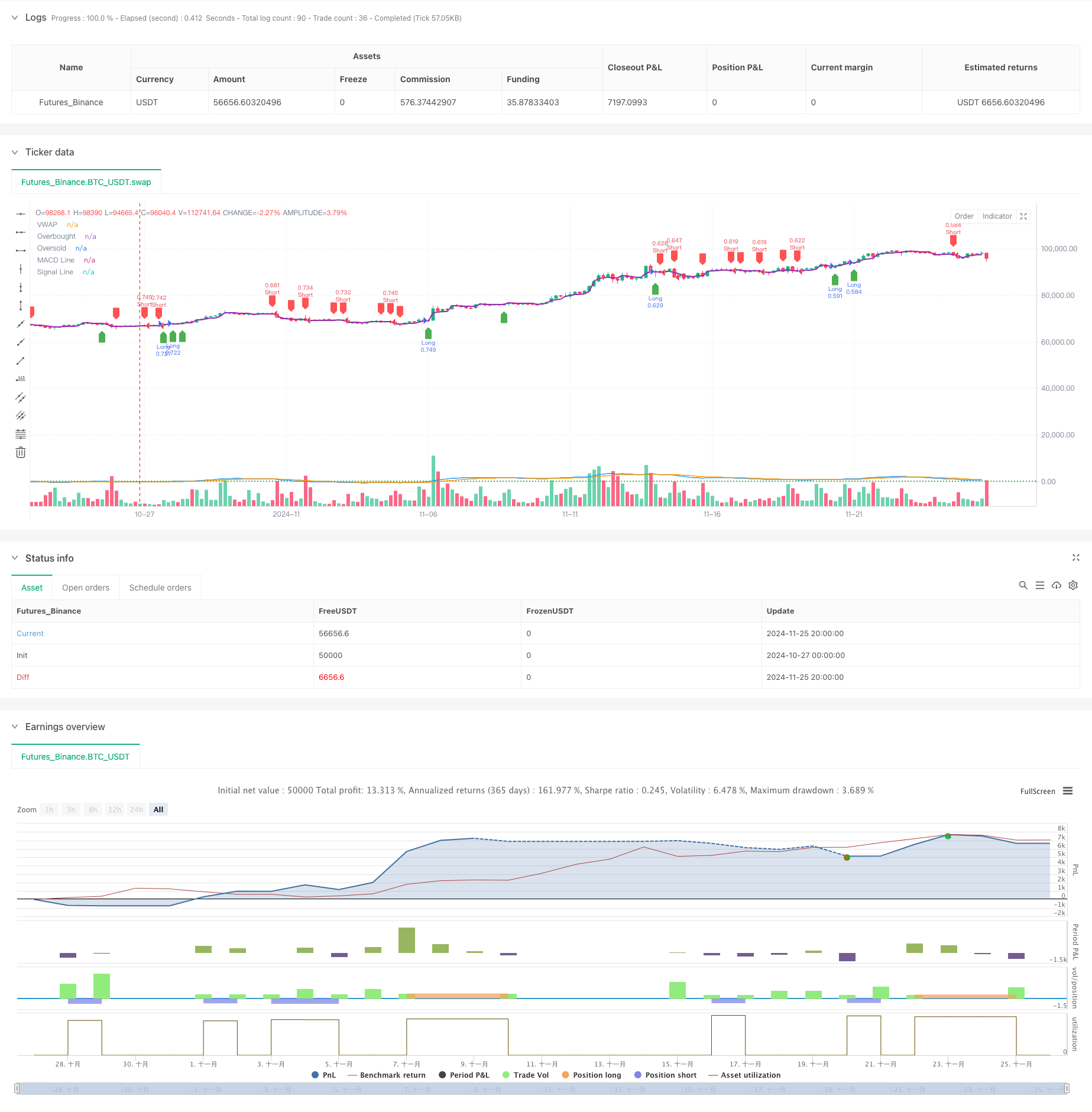

/*backtest

start: 2024-10-27 00:00:00

end: 2024-11-26 00:00:00

period: 4h

basePeriod: 4h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("pbs", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Input for take-profit and stop-loss

takeProfitPercent = input.float(0.5, title="Take Profit (%)", step=0.1) / 100

stopLossPercent = input.float(0.25, title="Stop Loss (%)", step=0.1) / 100

macdFastLength = input.int(12, title="MACD Fast Length")

macdSlowLength = input.int(26, title="MACD Slow Length")

macdSignalLength = input.int(9, title="MACD Signal Length")

rsiLength = input.int(14, title="RSI Length")

rsiOverbought = input.int(70, title="RSI Overbought Level", step=1)

rsiOversold = input.int(30, title="RSI Oversold Level", step=1)

vwap = ta.vwap(close)

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalLength)

macdHistogram = macdLine - signalLine

rsi = ta.rsi(close, rsiLength)

plot(vwap, color=color.purple, linewidth=2, title="VWAP")

hline(rsiOverbought, "Overbought", color=color.red, linestyle=hline.style_dotted)

hline(rsiOversold, "Oversold", color=color.green, linestyle=hline.style_dotted)

plot(macdLine, color=color.blue, title="MACD Line")

plot(signalLine, color=color.orange, title="Signal Line")

// Buy Condition

longCondition = ta.crossover(close, vwap) and macdHistogram > 0 and rsi < rsiOverbought

// Sell Condition

shortCondition = ta.crossunder(close, vwap) and macdHistogram < 0 and rsi > rsiOversold

// Execute trades based on conditions

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit/Stop Loss", "Long", limit=close * (1 + takeProfitPercent), stop=close * (1 - stopLossPercent))

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit/Stop Loss", "Short", limit=close * (1 - takeProfitPercent), stop=close * (1 + stopLossPercent))

// Plot Buy/Sell Signals

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal")

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal")

- Multi-EMA Crossover with Momentum Indicators Trading Strategy

- Enhanced Multi-Indicator Trend Reversal Intelligence Strategy

- Multi-Indicator Crossover Momentum Trading Strategy with Optimized Take Profit and Stop Loss System

- Multi-Technical Indicator Trend Following Trading Strategy

- Multi-Indicator Trend Following Options Trading EMA Cross Strategy

- Multi-Timeframe Trend Following Trading System with ATR and MACD Integration

- Multi-dimensional Gold Friday Anomaly Strategy Analysis System

- Volume-based Dynamic DCA Strategy

- RSI Low Point Reversal Strategy

- RSI-based Trading Strategy with Percentage-based Take Profit and Stop Loss

- Dual Standard Deviation Bollinger Bands Momentum Breakout Strategy

- Advanced Timeframe Fibonacci Retracement with High-Low Breakout Trading System

- RSI Dynamic Exit Level Momentum Trading Strategy

- Multi-Indicator Cross-Trend Tracking and Volume-Price Combined Adaptive Trading Strategy

- Advanced Dual Moving Average Momentum Trend Following Trading System

- Dynamic Take-Profit Smart Trailing Strategy

- Multi-Timeframe Trend Following Strategy with ATR Volatility Management

- Dynamic Cost Averaging Strategy System Based on Bollinger Bands and RSI

- Multi-SMA Support Level False Breakout Strategy with ATR Stop-Loss System

- EMA Crossover Strategy with Stop Loss and Take Profit Optimization System

- Triple Moving Average Trend Following and Momentum Integration Quantitative Trading Strategy

- Z-Score and Supertrend Based Dynamic Trading Strategy: Long-Short Switching System

- Adaptive Bollinger Breakout with Moving Average Quantitative Strategy System

- AI-Optimized Adaptive Stop-Loss Trading System with Multiple Technical Indicator Integration

- Multi-Period Moving Average Crossover with Volume Analysis System

- Dual Moving Average Momentum Tracking Quantitative Strategy

- Dual Moving Average Crossover Strategy with Adaptive Stop-Loss and Take-Profit

- Adaptive Trend Following Strategy Based on Momentum Oscillator

- PVT-EMA Trend Crossover Volume-Price Strategy

- MACD-EMA Multi-Period Dynamic Crossover Quantitative Trading System