Multi-Indicator Cross-Trend Tracking and Volume-Price Combined Adaptive Trading Strategy

Author: ChaoZhang, Date: 2024-11-27 16:58:35Tags: MACDRSIRVIEMA

Overview

This strategy is a trend-following trading system that combines multiple technical indicators, using cross signals from MACD, RSI, RVI, EMA, and volume confirmation to identify market trends, with trailing stops for risk management. The strategy operates within specific price ranges and uses multiple signal combinations to improve trading accuracy and reliability.

Strategy Principles

The strategy employs a multi-layered signal verification mechanism with several key components: First, it uses 20-period and 200-period Exponential Moving Averages (EMA) to determine overall market trends; second, it utilizes MACD indicator (12,26,9) crossovers to capture trend turning points; third, it uses Relative Strength Index (RSI) and Relative Volatility Index (RVI) to confirm overbought/oversold conditions; finally, it validates trades through volume indicators. Buy conditions require simultaneous satisfaction of: MACD golden cross, RSI below 70, RVI above 0, price above both EMAs, and minimum volume requirements. Sell conditions are the opposite. The strategy also incorporates a trailing stop mechanism to protect profits through dynamic stop-loss adjustment.

Strategy Advantages

- Multiple signal verification mechanism greatly reduces false breakout risks

- Combines trend-following and oscillating indicators for stability in various market conditions

- Volume confirmation improves trading signal reliability

- Trailing stop mechanism effectively protects accumulated profits

- Price range restrictions prevent excessive trading in extreme market conditions

- Indicator parameters can be flexibly adjusted to market conditions

- System has good scalability and adaptability

Strategy Risks

- Multiple conditions might cause missing important trading opportunities

- May generate frequent false signals in sideways markets

- Fixed price range restrictions might miss important breakout opportunities

- Over-reliance on technical indicators may ignore fundamental factors

- Trailing stops might be triggered prematurely during volatile periods

Strategy Optimization Directions

- Introduce adaptive parameter mechanisms to dynamically adjust indicator parameters based on market volatility

- Add market sentiment indicators to improve prediction of market turning points

- Develop dynamic price range judgment mechanisms for greater flexibility

- Add time period filters to avoid trading during unfavorable sessions

- Optimize stop-loss mechanism by considering volatility-based dynamic stops

- Add risk management module for more comprehensive position management

Summary

This strategy constructs a relatively complete trading system through the combination of multiple technical indicators. While it has certain limitations, the strategy has good practical value through reasonable parameter optimization and risk management. Future improvements can be made by introducing more adaptive mechanisms and risk control measures to enhance stability and profitability.

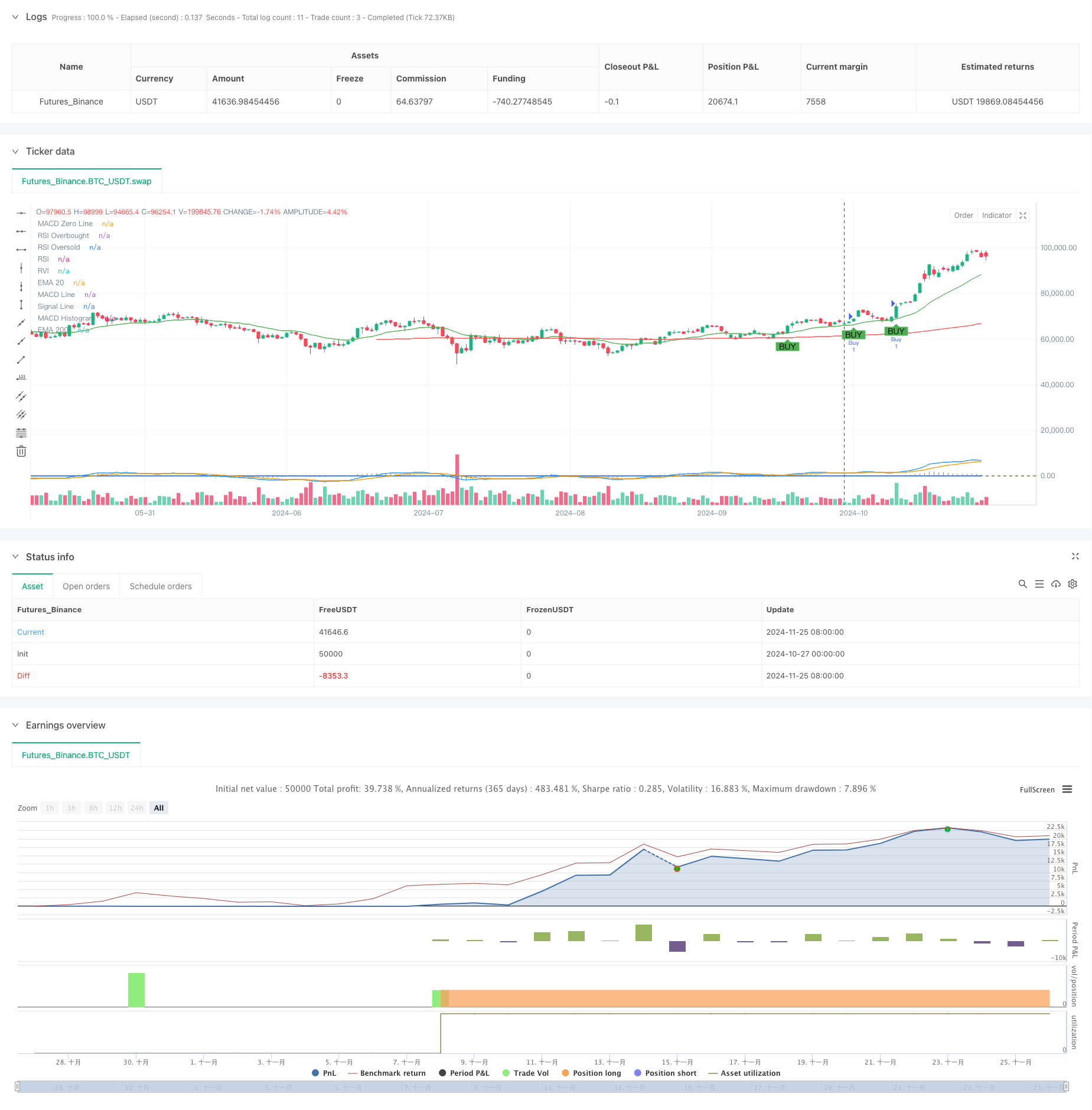

/*backtest

start: 2024-10-27 00:00:00

end: 2024-11-26 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("MACD/RSI/RVI/EMA20-200/Volume BTC Auto Trading Bot", overlay=true, margin_long=100, margin_short=100)

// Parámetros de EMA

ema20Length = input(20, title="EMA 20 Length")

ema200Length = input(200, title="EMA 200 Length")

// Parámetros de MACD

macdFastLength = input(12, title="MACD Fast Length")

macdSlowLength = input(26, title="MACD Slow Length")

macdSignalSmoothing = input(9, title="MACD Signal Smoothing")

// Parámetros de RSI y RVI

rsiLength = input(14, title="RSI Length")

rviLength = input(14, title="RVI Length")

// Volumen mínimo para operar

minVolume = input(100, title="Min Volume to Enter Trade")

// Rango de precios de BTC entre 60k y 80k

minPrice = 60000

maxPrice = 80000

// Rango de precios BTC

inPriceRange = close >= minPrice and close <= maxPrice

// Cálculo de las EMAs

ema20 = ta.ema(close, ema20Length)

ema200 = ta.ema(close, ema200Length)

plot(ema20, color=color.green, title="EMA 20")

plot(ema200, color=color.red, title="EMA 200")

// Cálculo del MACD

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalSmoothing)

macdHist = macdLine - signalLine

plot(macdLine, color=color.blue, title="MACD Line")

plot(signalLine, color=color.orange, title="Signal Line")

hline(0, "MACD Zero Line", color=color.gray)

plot(macdHist, style=plot.style_histogram, color=(macdHist >= 0 ? color.green : color.red), title="MACD Histogram")

// Cálculo del RSI

rsi = ta.rsi(close, rsiLength)

hline(70, "RSI Overbought", color=color.red)

hline(30, "RSI Oversold", color=color.green)

plot(rsi, color=color.purple, title="RSI")

// Cálculo del RVI

numerator = (close - open) + 2 * (close[1] - open[1]) + 2 * (close[2] - open[2]) + (close[3] - open[3])

denominator = (high - low) + 2 * (high[1] - low[1]) + 2 * (high[2] - low[2]) + (high[3] - low[3])

rvi = ta.sma(numerator / denominator, rviLength)

plot(rvi, color=color.blue, title="RVI")

// Volumen

volumeCondition = volume > minVolume

// Condiciones de compra

bullishCondition = ta.crossover(macdLine, signalLine) and rsi < 70 and rvi > 0 and close > ema20 and close > ema200 and inPriceRange and volumeCondition

// Condiciones de venta

bearishCondition = ta.crossunder(macdLine, signalLine) and rsi > 30 and rvi < 0 and close < ema20 and close < ema200 and inPriceRange and volumeCondition

// Configuración del trailing stop loss

trail_stop = input(true, title="Enable Trailing Stop")

trail_offset = input.float(0.5, title="Trailing Stop Offset (%)", step=0.1)

// Funciones para la gestión del Trailing Stop Loss

if (bullishCondition)

strategy.entry("Buy", strategy.long)

var float highestPrice = na

highestPrice := na(highestPrice) ? high : math.max(high, highestPrice)

strategy.exit("Trailing Stop", "Buy", stop=highestPrice * (1 - trail_offset / 100))

if (bearishCondition)

strategy.entry("Sell", strategy.short)

var float lowestPrice = na

lowestPrice := na(lowestPrice) ? low : math.min(low, lowestPrice)

strategy.exit("Trailing Stop", "Sell", stop=lowestPrice * (1 + trail_offset / 100))

plotshape(bullishCondition, title="Buy Signal", location=location.belowbar, color=color.new(color.green, 0), style=shape.labelup, text="BUY")

plotshape(bearishCondition, title="Sell Signal", location=location.abovebar, color=color.new(color.red, 0), style=shape.labeldown, text="SELL")

- Multi-Dimensional Technical Indicator Trend Following Quantitative Strategy

- EMA Dynamic Stop-Loss Trading Strategy

- EMA-MACD Composite Strategy for Trend Scalping

- Dual Trend Strategy with EMA Crossover and RSI Filter

- Multi-Indicator High-Frequency Trading Strategy: Short-Term Trading System Combining Exponential Moving Averages and Momentum Indicators

- Multi-Level Balanced Quantitative Trading Strategy

- Multi-Technical Indicator Based Trend Following and Momentum Strategy

- BONK Multi-Factor Trading Strategy

- EMA RSI MACD Dynamic Take Profit and Stop Loss Trading Strategy

- EMA, MACD, and RSI Triple Indicator Momentum Strategy

- Dual Moving Average MACD Crossover Date-Adjustable Quantitative Trading Strategy

- High-Frequency Dynamic Multi-Indicator Moving Average Crossover Strategy

- Triple Exponential Moving Average Trend Trading Strategy

- Multi-Timeframe EMA Trend Strategy with Daily High-Low Breakout System

- Advanced Flexible Multi-Period Moving Average Crossover Strategy

- T3 Moving Average Trend Following Strategy with Trailing Stop Loss

- Multi-Technical Indicator Trend Following Strategy with Ichimoku Cloud Breakout and Stop-Loss System

- Dual Standard Deviation Bollinger Bands Momentum Breakout Strategy

- Advanced Timeframe Fibonacci Retracement with High-Low Breakout Trading System

- RSI Dynamic Exit Level Momentum Trading Strategy

- Advanced Dual Moving Average Momentum Trend Following Trading System

- Dynamic Take-Profit Smart Trailing Strategy

- Multi-Timeframe Trend Following Strategy with ATR Volatility Management

- Dynamic Cost Averaging Strategy System Based on Bollinger Bands and RSI

- Multi-SMA Support Level False Breakout Strategy with ATR Stop-Loss System

- EMA Crossover Strategy with Stop Loss and Take Profit Optimization System

- VWAP-MACD-RSI Multi-Factor Quantitative Trading Strategy

- Triple Moving Average Trend Following and Momentum Integration Quantitative Trading Strategy

- Z-Score and Supertrend Based Dynamic Trading Strategy: Long-Short Switching System

- Adaptive Bollinger Breakout with Moving Average Quantitative Strategy System