Reflected EMA Trend Determination Strategy Based on Hull Moving Averages

Author: ChaoZhang, Date: 2024-11-29 16:35:43Tags: HMAEMAWMA

Overview

This strategy utilizes the reflective properties of Hull Moving Averages (HMA) to determine market trends. The core of the strategy involves calculating the difference between short-term and long-term Hull Moving Averages and using this reflected difference to predict price movements. Through adjustable percentage parameters, the strategy can adapt to different trading timeframes, providing more accurate trend determination signals.

Strategy Principles

The strategy employs two Hull Moving Averages with periods of 36 and 44 as base indicators. It calculates the absolute difference between these two moving averages and applies reflection calculations based on the current trend direction to obtain the reflection value. The strategy also incorporates Weighted Moving Average (WMA) to calculate delta values, using crossovers between delta and reflection values to identify trend turning points. During trend determination, the strategy uses an adjustable correction factor to control trend reversal sensitivity. Trading signals are generated when prices break through preset trend limitation lines.

Strategy Advantages

- Uses Hull Moving Averages to reduce the lag typically associated with traditional moving averages

- Incorporates reflection values for more accurate detection of trend turning points

- Features adjustable correction factors for enhanced adaptability

- Improves signal reliability through absolute difference calculations

- Integrates risk control mechanisms including dynamic trend line adjustments

- Includes visualization components for intuitive market state assessment

Strategy Risks

- May generate frequent false signals in ranging markets

- Improper parameter settings can lead to delayed signals or excessive sensitivity

- Trend limitation lines may not adjust quickly enough in volatile markets

- Strategy relies on historical data calculations, potentially limiting response to sudden market events

Strategy Optimization Directions

- Introduce volatility indicators for dynamic correction factor adjustment

- Implement market state recognition mechanisms for parameter adaptation

- Develop self-adaptive parameter optimization systems

- Add volume analysis modules to enhance signal reliability

- Improve risk control mechanisms with stop-loss and money management features

Summary

This strategy innovatively combines Hull Moving Averages with reflection value concepts to create a responsive and adaptive trend following system. Its core strength lies in accurately capturing trend turning points while maintaining adaptability through adjustable parameters. While inherent risks exist, continuous optimization and refinement make this strategy a potentially stable and reliable trading tool.

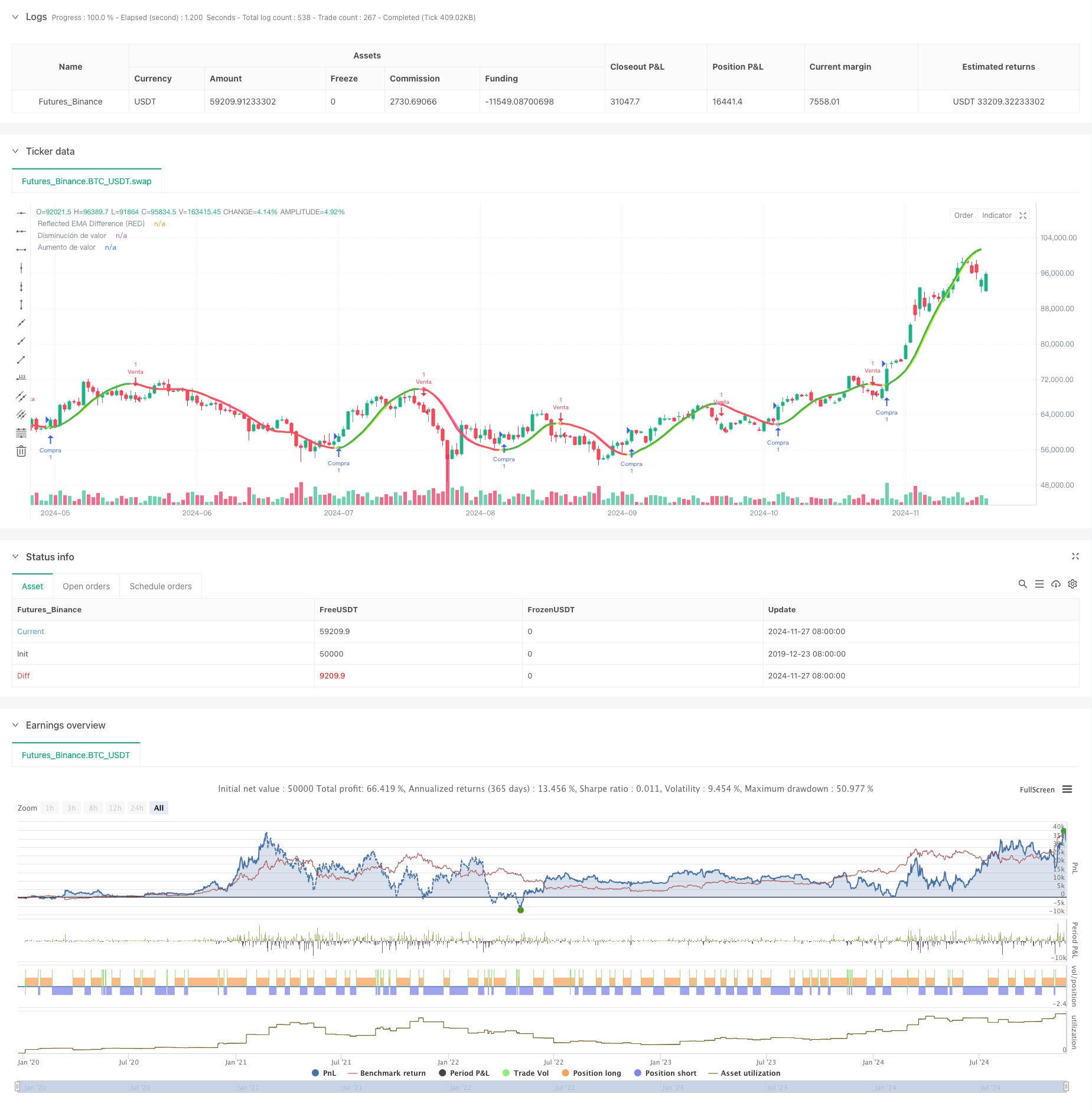

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-28 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Reflected EMA Difference (RED)", shorttitle="RED [by MarcosPna]", overlay=true) //mv30

// Análisis de Riesgo

// Risk Analysis

media_delta = ta.wma(2 * ta.wma(close, 8 / 2) - ta.wma(close, 8), math.floor(math.sqrt(8)))

// Calcular EMAs

// Calculate EMAs

ema_corta_delta = ta.hma(close, 36)

ema_larga_delta = ta.hma(close, 44)

// Calcular la diferencia entre las EMAs

// Calculate the difference between EMAs

diferencia_delta_ema = math.abs(ema_corta_delta - ema_larga_delta)

// Calcular el valor reflejado basado en la posición de la EMA corta

// Compute the reflected value based on the position of the short EMA

valor_reflejado_delta = ema_corta_delta + (ema_corta_delta > ema_larga_delta ? diferencia_delta_ema : -diferencia_delta_ema)

// Suavizar el valor reflejado

// Smooth the reflected value

periodo_suavizado_delta = input.int(2, title="Periodo extendido")

ema_suavizada_delta = ta.hma(valor_reflejado_delta, periodo_suavizado_delta)

// Ploteo de las EMAs y la línea reflejada

// Plot EMAs and the reflected line

plot(valor_reflejado_delta, title="Reflected EMA Difference (RED)", color=valor_reflejado_delta > ema_suavizada_delta ? color.rgb(253, 25, 238, 30) : color.rgb(183, 255, 30), linewidth=2, style=plot.style_line)

// Parámetros ajustables para la reversión de tendencia

// Adjustable parameters for trend reversal

factor_correccion_delta = input.float(title='Porcentaje de cambio', minval=0, maxval=100, step=0.1, defval=0.04)

tasa_correccion_delta = factor_correccion_delta * 0.01

// Variables para la reversión de tendencia

// Variables for trend reversal

var int direccion_delta_tendencia = 0

var float precio_maximo_delta = na

var float precio_minimo_delta = na

var float limite_tendencia_delta = na

// Inicializar precio máximo y mínimo con el primer valor de la EMA suavizada reflejada

// Initialize peak and trough prices with the first value of the smoothed reflected EMA

if na(precio_maximo_delta)

precio_maximo_delta := ema_suavizada_delta

if na(precio_minimo_delta)

precio_minimo_delta := ema_suavizada_delta

// Lógica de reversión de tendencia con la EMA suavizada reflejada

// Trend reversal logic with the smoothed reflected EMA

if direccion_delta_tendencia >= 0

if ema_suavizada_delta > precio_maximo_delta

precio_maximo_delta := ema_suavizada_delta

limite_tendencia_delta := precio_maximo_delta - (precio_maximo_delta * tasa_correccion_delta)

if ema_suavizada_delta <= limite_tendencia_delta

direccion_delta_tendencia := -1

precio_minimo_delta := ema_suavizada_delta

strategy.entry("Venta", strategy.short)

else

if ema_suavizada_delta < precio_minimo_delta

precio_minimo_delta := ema_suavizada_delta

limite_tendencia_delta := precio_minimo_delta + (precio_minimo_delta * tasa_correccion_delta)

if ema_suavizada_delta >= limite_tendencia_delta

direccion_delta_tendencia := 1

precio_maximo_delta := ema_suavizada_delta

strategy.entry("Compra", strategy.long)

// Ploteo y señales

// Plotting and signals

indice_delta_ascendente = plot(direccion_delta_tendencia == 1 ? limite_tendencia_delta : na, title="Aumento de valor", style=plot.style_linebr, linewidth=3, color=color.new(color.green, 0))

senal_compra_delta = direccion_delta_tendencia == 1 and direccion_delta_tendencia[1] == -1

plotshape(senal_compra_delta ? limite_tendencia_delta : na, title="Estilo señal alcista", location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

indice_delta_descendente = plot(direccion_delta_tendencia == 1 ? na : limite_tendencia_delta, title="Disminución de valor", style=plot.style_linebr, linewidth=3, color=color.new(color.red, 0))

senal_venta_delta = direccion_delta_tendencia == -1 and direccion_delta_tendencia[1] == 1

plotshape(senal_venta_delta ? limite_tendencia_delta : na, title="Estilo señal bajista", location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

// Variables para manejo de cajas

// Variables for box management

var box caja_tendencia_delta = na

// Condición: Cruce de HullMA hacia abajo

// Condition: HullMA crosses below reflected EMA value

cruce_bajista_delta = ta.crossunder(media_delta, valor_reflejado_delta)

// Condición: Cruce de HullMA hacia arriba

// Condition: HullMA crosses above reflected EMA value

cruce_alcista_delta = ta.crossover(media_delta, valor_reflejado_delta)

// Dibujar caja cuando HullMA cruza hacia abajo el valor reflejado de EMA

// Draw a box when HullMA crosses below the reflected EMA value

// if (cruce_bajista_delta) and direccion_delta_tendencia == 1

// caja_tendencia_delta := box.new(left=bar_index, top=high, right=bar_index, bottom=low, text = "Critical Areas", text_color = color.white, border_width=2, border_color=color.rgb(254, 213, 31), bgcolor=color.new(color.red, 90))

// Cerrar caja cuando HullMA cruza hacia arriba el valor reflejado de EMA

// Close the box when HullMA crosses above the reflected EMA value

// if (cruce_alcista_delta and not na(caja_tendencia_delta))

// box.set_right(caja_tendencia_delta, bar_index)

// caja_tendencia_delta := na // Remove the reference to create a new box at the next cross down

- RedK Momentum Bars

- Hull Suite Strategy

- Advanced Flexible Multi-Period Moving Average Crossover Strategy

- Optimized Multi-Timeframe HMA Quantitative Trading Strategy with Dynamic Stop-Loss

- Momentum-based ZigZag

- RSI and MA Combination Strategy

- VWMA-ADX Momentum and Trend-Based Bitcoin Long Strategy

- Williams %R - Smoothed

- Hull Moving Average Swing Trader

- Low Scanner strategy crypto

- Dynamic Signal Line Trend Following and Volatility Filtering Strategy

- Multi-Timeframe Bollinger Momentum Breakout Strategy with Hull Moving Average

- Multi-Step Volatility-Adjusted Dynamic SuperTrend Strategy

- Triple EMA Trend Following Quantitative Trading Strategy

- Dual Hull Moving Average Crossover Quantitative Strategy

- Statistical Deviation-Based Market Extreme Drawdown Strategy

- Four-Period SMA Breakthrough Trading Strategy with Dynamic Profit/Loss Management System

- RSI and Bollinger Bands Cross-Regression Dual Strategy

- Multi-Wave Trend Following Price Analysis Strategy

- Smoothed Heikin-Ashi with SMA Crossover Trend Following Strategy

- Dual EMA Indicator Smart Crossing Trading System with Dynamic Stop-Loss and Take-Profit Strategy

- OBV-SMA Crossover with RSI Filter Multi-Dimensional Momentum Trading Strategy

- Dynamic Volatility Trading Strategy Based on Bollinger Bands and Candlestick Patterns

- Advanced Fair Value Gap Detection Strategy with Dynamic Risk Management and Fixed Take Profit

- Dynamic RSI Oversold Rebound Trading Strategy with Stop-Loss Optimization Model

- Dynamic ATR Stop-Loss RSI Oversold Rebound Quantitative Strategy

- Advanced Dual EMA Strategy with ATR Volatility Filter System

- Dual EMA Dynamic Zone Trend Following Strategy

- Multi-MA Crossover with RSI Dynamic Trailing Stop Loss Quantitative Trading Strategy

- Dual EMA Trend Momentum Trading Strategy