Statistical Deviation-Based Market Extreme Drawdown Strategy

Author: ChaoZhang, Date: 2024-11-29 16:46:33Tags: STDSMAMASD

Overview

This strategy is based on the statistical characteristics of extreme market downturns. By analyzing drawdowns statistically and using standard deviations to measure market volatility extremes, it initiates buying positions when market declines exceed normal ranges. The core idea is to capture oversold opportunities caused by market panic, identifying investment opportunities through mathematical statistical methods that arise from market irrationality.

Strategy Principle

The strategy employs a rolling time window to calculate price maximum drawdowns and their statistical characteristics. It first calculates the highest price over the past 50 periods, then computes the drawdown percentage of current closing price relative to the highest price. It then calculates the mean and standard deviation of drawdowns, setting -1 standard deviation as the trigger threshold. When market drawdown exceeds the mean minus a set multiple of standard deviations, indicating potential oversold conditions, a long position is entered. Positions are automatically closed after 35 periods. The strategy also plots drawdown curves and one, two, and three standard deviation levels for visual assessment of market oversold conditions.

Strategy Advantages

- The strategy is based on statistical principles with solid theoretical foundation. Using standard deviation to measure market volatility extremes is objective and scientific.

- Effectively captures investment opportunities during market panic periods. Entering positions during irrational market declines aligns with value investing principles.

- Fixed-period position closure avoids missing rebounds that might occur with trailing stops.

- Highly adjustable parameters allow flexibility for different market environments and trading instruments.

- Simple calculation of drawdown and standard deviation indicators makes the strategy logic clear and easy to understand and execute.

Strategy Risks

- Markets may experience continuous decline, leading to frequent losing entries. Consider setting maximum position limits.

- Fixed-period exits may miss larger upside potential. Consider adding trend-following exit methods.

- Drawdown statistical characteristics may change with market conditions. Consider regular parameter updates.

- Strategy doesn’t consider volume and other market information. Consider cross-validation with multiple indicators.

- Standard deviation may become unreliable in highly volatile markets. Consider implementing risk control measures.

Optimization Directions

- Incorporate volume indicators to confirm market panic levels.

- Add trend indicators to avoid frequent entries in downtrends.

- Optimize exit mechanism with dynamic holding period adjustments based on market performance.

- Add stop-loss settings to control single-trade risk.

- Consider using adaptive parameters to improve strategy adaptation to market changes.

Summary

This strategy captures market oversold opportunities through statistical methods, with strong theoretical foundation and practical value. The strategy logic is simple and clear with adjustable parameters, suitable as a base strategy for expansion and optimization. Strategy stability and profitability can be further enhanced by adding technical indicators and risk control measures. In live trading, carefully set parameters considering market conditions and trading instrument characteristics, while maintaining proper risk control.

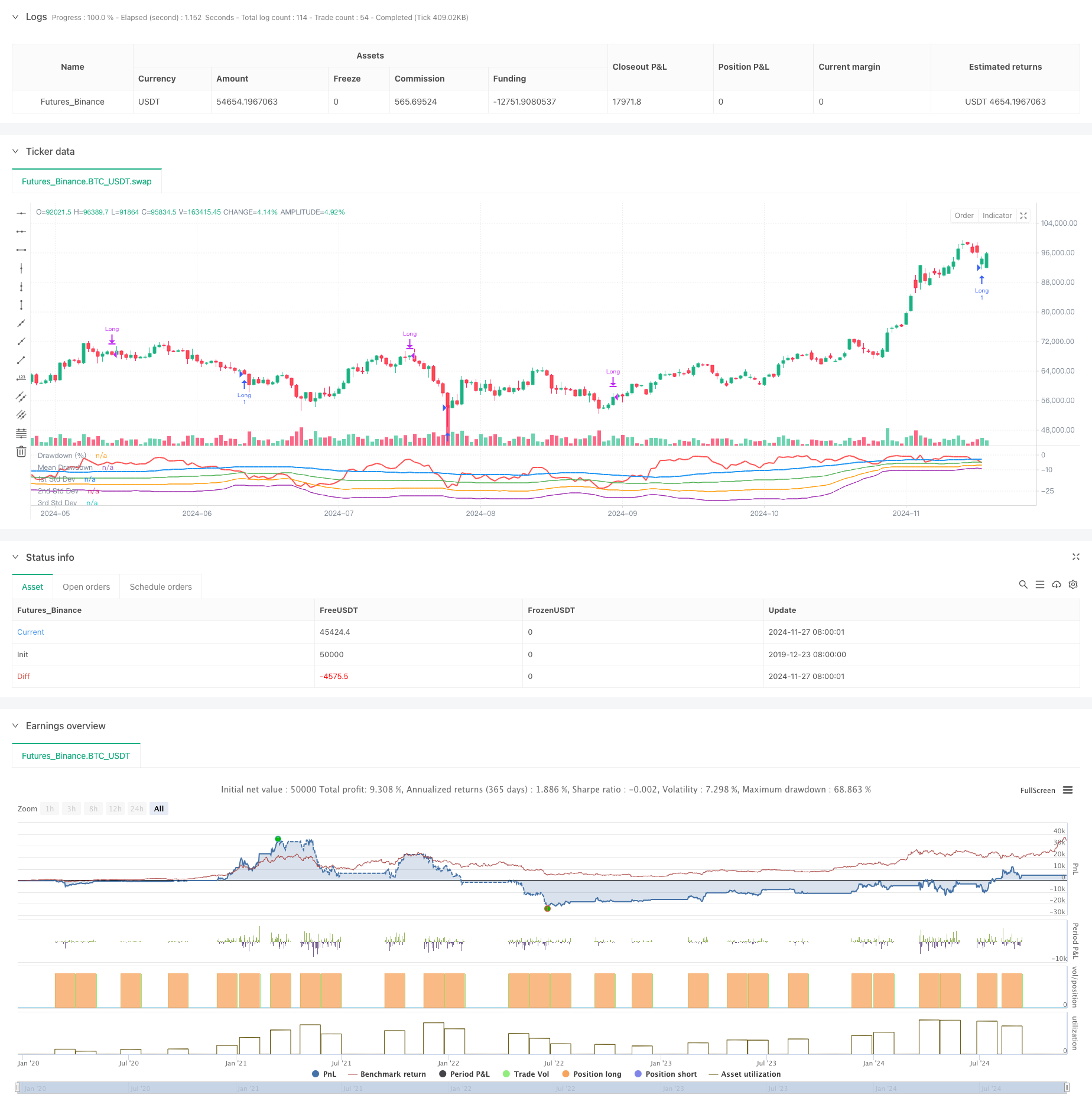

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-28 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Buy When There's Blood in the Streets Strategy", overlay=false, shorttitle="BloodInTheStreets")

//This strategy identifies opportunities to buy during extreme market drawdowns based on standard deviation thresholds.

//It calculates the maximum drawdown over a user-defined lookback period, identifies extreme deviations from the mean,

//and triggers long entries when specific conditions are met. The position is exited after a defined number of bars.

// User Inputs

lookbackPeriod = input.int(50, title="Lookback Period", minval=1, tooltip="Period to calculate the highest high for drawdown")

stdDevLength = input.int(50, title="Standard Deviation Length", minval=1, tooltip="Length of the period to calculate standard deviation")

stdDevThreshold = input.float(-1.0, title="Standard Deviation Threshold", tooltip="Trigger level for long entry based on deviations")

exitBars = input.int(35, title="Exit After (Bars)", minval=1, tooltip="Number of bars after which to exit the trade")

// Drawdown Calculation

peakHigh = ta.highest(high, lookbackPeriod)

drawdown = ((close - peakHigh) / peakHigh) * 100

// Standard Deviation Calculation

drawdownStdDev = ta.stdev(drawdown, stdDevLength)

meanDrawdown = ta.sma(drawdown, stdDevLength)

// Define Standard Deviation Levels

stdDev1 = meanDrawdown - drawdownStdDev

stdDev2 = meanDrawdown - 2 * drawdownStdDev

stdDev3 = meanDrawdown - 3 * drawdownStdDev

// Plot Drawdown and Levels

plot(drawdown, color=color.red, linewidth=2, title="Drawdown (%)")

plot(meanDrawdown, color=color.blue, linewidth=2, title="Mean Drawdown")

plot(stdDev1, color=color.green, linewidth=1, title="1st Std Dev")

plot(stdDev2, color=color.orange, linewidth=1, title="2nd Std Dev")

plot(stdDev3, color=color.purple, linewidth=1, title="3rd Std Dev")

// Entry Condition

var float entryBar = na

goLong = drawdown <= meanDrawdown + stdDevThreshold * drawdownStdDev

if (goLong and strategy.position_size == 0)

strategy.entry("Long", strategy.long)

entryBar := bar_index

// Exit Condition

if (strategy.position_size > 0 and not na(entryBar) and bar_index - entryBar >= exitBars)

strategy.close("Long")

- Triple Standard Deviation Momentum Reversal Trading Strategy

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- Triple Standard Deviation Bollinger Bands Breakout Strategy with 100-Day Moving Average Optimization

- Enhanced Dynamic Bollinger Bands Trading Strategy

- Enhanced Mean Reversion Strategy with Bollinger Bands and RSI Integration

- Adaptive Standard Deviation Breakout Trading Strategy: Multi-Period Optimization System Based on Dynamic Volatility

- Dynamic Reversal Point Strategy Based on Bollinger Bands and Fractal Breakouts

- Cross-boundary Dynamic Range Quantitative Trading Strategy Based on Bollinger Bands

- Multi-Level Intelligent Dynamic Trailing Stop Strategy Based on Bollinger Bands and ATR

- Moving Average Crossover Strategy Based on Dual Moving Averages

- RSI and Supertrend Trend-Following Adaptive Volatility Strategy

- Dual EMA Crossover with RSI Momentum Enhanced Trading Strategy

- Multi-Technical Indicator Trend Following Trading Strategy

- Multi-Exponential Moving Average Crossover Strategy with Volume-Based ATR Dynamic Stop-Loss Optimization

- Dual Chain Hybrid Momentum EMA Tracking Trading System

- Dynamic Signal Line Trend Following and Volatility Filtering Strategy

- Multi-Timeframe Bollinger Momentum Breakout Strategy with Hull Moving Average

- Multi-Step Volatility-Adjusted Dynamic SuperTrend Strategy

- Triple EMA Trend Following Quantitative Trading Strategy

- Dual Hull Moving Average Crossover Quantitative Strategy

- Four-Period SMA Breakthrough Trading Strategy with Dynamic Profit/Loss Management System

- RSI and Bollinger Bands Cross-Regression Dual Strategy

- Multi-Wave Trend Following Price Analysis Strategy

- Smoothed Heikin-Ashi with SMA Crossover Trend Following Strategy

- Reflected EMA Trend Determination Strategy Based on Hull Moving Averages

- Dual EMA Indicator Smart Crossing Trading System with Dynamic Stop-Loss and Take-Profit Strategy

- OBV-SMA Crossover with RSI Filter Multi-Dimensional Momentum Trading Strategy

- Dynamic Volatility Trading Strategy Based on Bollinger Bands and Candlestick Patterns

- Advanced Fair Value Gap Detection Strategy with Dynamic Risk Management and Fixed Take Profit

- Dynamic RSI Oversold Rebound Trading Strategy with Stop-Loss Optimization Model