Four-Period SMA Breakthrough Trading Strategy with Dynamic Profit/Loss Management System

Author: ChaoZhang, Date: 2024-11-29 16:44:42Tags: SMATPSLMA

Overview

This is a trading strategy system based on a four-period simple moving average, integrated with dynamic stop-loss and take-profit management mechanisms. The strategy captures market trend turning points by monitoring price crossovers with short-term moving averages and implements percentage-based stop-loss and take-profit levels for risk management. The core strength lies in utilizing the quick response characteristics of short-period moving averages, combined with strict money management rules to achieve stable trading results.

Strategy Principles

The strategy operates on the following core logic: First, it calculates a 4-period Simple Moving Average (SMA) as the primary indicator. When price crosses above the SMA, the system recognizes it as a bullish signal and enters a long position; when price crosses below the SMA, it identifies a bearish signal and enters a short position. Each trade is set with dynamic take-profit and stop-loss points based on the entry price, with default values of 2% for take-profit and 1% for stop-loss. This setup ensures a 2:1 reward-to-risk ratio, adhering to professional money management principles.

Strategy Advantages

- Quick Response: Using a 4-period short-term moving average enables rapid capture of market movements, suitable for short-term trading.

- Strict Risk Control: Integrated dynamic stop-loss and take-profit mechanisms provide clear exit points for each trade.

- Simple Logic: Uses classic moving average crossover method, easy to understand and execute.

- Adjustable Parameters: Profit and loss percentages can be flexibly adjusted for different market characteristics.

- Bilateral Trading: Supports both long and short operations, maximizing market opportunities.

Strategy Risks

- Consolidation Market Risk: Prone to false signals in sideways markets, leading to frequent trading.

- Slippage Risk: Due to short-period moving average usage, high trading frequency may result in significant slippage losses.

- Systemic Risk: Stop-losses may not execute timely during extreme market volatility.

- Parameter Sensitivity: Strategy performance is highly sensitive to parameter settings, requiring continuous optimization.

Strategy Optimization Directions

- Add Trend Filter: Incorporate longer-period moving averages as trend filters to reduce false signals in consolidating markets.

- Optimize Stop Levels: Dynamically adjust profit and loss ratios based on market volatility.

- Include Volume Indicators: Integrate volume as a supplementary indicator to improve entry signal reliability.

- Implement Time Filters: Add trading session filters to avoid operations during unsuitable trading periods.

Summary

This is a well-structured quantitative trading strategy with clear logic. It captures market momentum through short-term moving averages, supplemented by strict risk control mechanisms, suitable for traders seeking stable returns. While there is room for optimization, the strategy’s basic framework offers good scalability, and through continuous improvement and adjustment, it has the potential to achieve better trading results.

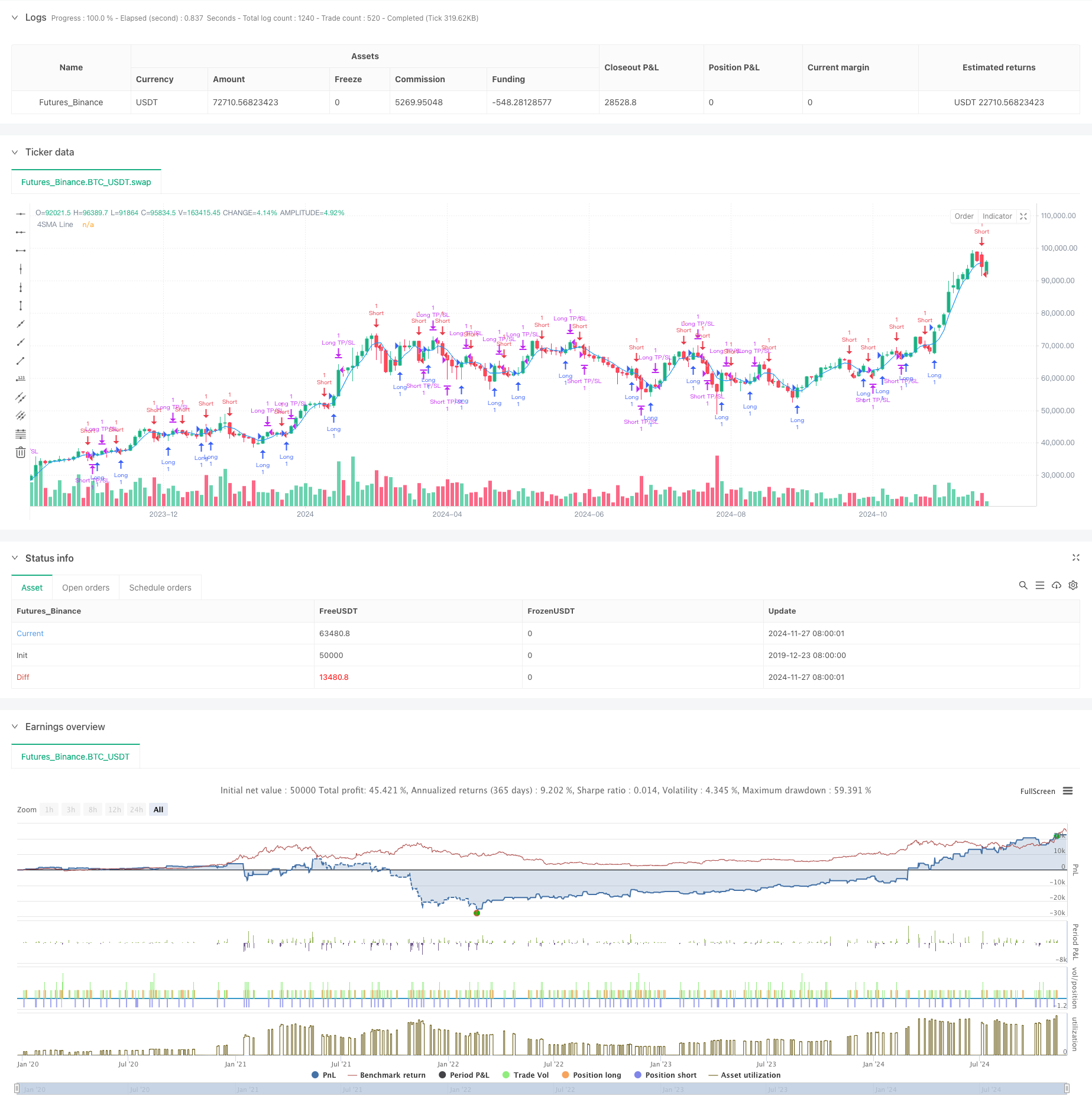

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-28 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("4SMA Strategy with Targets and Stop Loss", overlay=true)

// Input parameters for SMA

smaLength = input.int(4, title="SMA Length", minval=1)

// Input parameters for stop loss and take profit

takeProfitPercent = input.float(2.0, title="Take Profit (%)", step=0.1) // Default: 2%

stopLossPercent = input.float(1.0, title="Stop Loss (%)", step=0.1) // Default: 1%

// Calculate 4-period SMA

sma = ta.sma(close, smaLength)

// Plot SMA

plot(sma, color=color.blue, title="4SMA Line")

// Entry Conditions

longCondition = ta.crossover(close, sma) // Price crosses above SMA (bullish signal)

shortCondition = ta.crossunder(close, sma) // Price crosses below SMA (bearish signal)

// Strategy Logic

if (longCondition)

strategy.entry("Long", strategy.long) // Enter long position

if (shortCondition)

strategy.entry("Short", strategy.short) // Enter short position

// Calculate Take Profit and Stop Loss

longTakeProfit = strategy.position_avg_price * (1 + takeProfitPercent / 100) // TP for long

longStopLoss = strategy.position_avg_price * (1 - stopLossPercent / 100) // SL for long

shortTakeProfit = strategy.position_avg_price * (1 - takeProfitPercent / 100) // TP for short

shortStopLoss = strategy.position_avg_price * (1 + stopLossPercent / 100) // SL for short

// Exit for Long

if (strategy.position_size > 0) // If in a long position

strategy.exit("Long TP/SL", from_entry="Long", limit=longTakeProfit, stop=longStopLoss)

// Exit for Short

if (strategy.position_size < 0) // If in a short position

strategy.exit("Short TP/SL", from_entry="Short", limit=shortTakeProfit, stop=shortStopLoss)

- Dynamic Trailing Stop Dual Target Moving Average Crossover Strategy

- Trend Breakout Trading System with Moving Average (TBMA Strategy)

- Dynamic Moving Average Crossover Trend Following Strategy with Adaptive Risk Management

- Dual Moving Average Crossover Strategy with Adaptive Stop-Loss and Take-Profit

- Adaptive Quantitative Trading Strategy with Dual Moving Average Crossover and Take Profit/Stop Loss

- Risk-Reward Ratio Optimized Strategy Based on Moving Average Crossover

- Dual Moving Average Crossover Strategy with Dynamic Risk Management

- Moving Average Crossover with RSI Trend Momentum Tracking Strategy

- Adaptive Standard Deviation Breakout Trading Strategy: Multi-Period Optimization System Based on Dynamic Volatility

- Dual Moving Average Crossover Trend Following Strategy with Dynamic Stop-Loss and Take-Profit System

- Dual EMA Crossover with RSI Momentum Enhanced Trading Strategy

- Multi-Technical Indicator Trend Following Trading Strategy

- Multi-Exponential Moving Average Crossover Strategy with Volume-Based ATR Dynamic Stop-Loss Optimization

- Dual Chain Hybrid Momentum EMA Tracking Trading System

- Dynamic Signal Line Trend Following and Volatility Filtering Strategy

- Multi-Timeframe Bollinger Momentum Breakout Strategy with Hull Moving Average

- Multi-Step Volatility-Adjusted Dynamic SuperTrend Strategy

- Triple EMA Trend Following Quantitative Trading Strategy

- Dual Hull Moving Average Crossover Quantitative Strategy

- Statistical Deviation-Based Market Extreme Drawdown Strategy

- RSI and Bollinger Bands Cross-Regression Dual Strategy

- Multi-Wave Trend Following Price Analysis Strategy

- Smoothed Heikin-Ashi with SMA Crossover Trend Following Strategy

- Reflected EMA Trend Determination Strategy Based on Hull Moving Averages

- Dual EMA Indicator Smart Crossing Trading System with Dynamic Stop-Loss and Take-Profit Strategy

- OBV-SMA Crossover with RSI Filter Multi-Dimensional Momentum Trading Strategy

- Dynamic Volatility Trading Strategy Based on Bollinger Bands and Candlestick Patterns

- Advanced Fair Value Gap Detection Strategy with Dynamic Risk Management and Fixed Take Profit

- Dynamic RSI Oversold Rebound Trading Strategy with Stop-Loss Optimization Model

- Dynamic ATR Stop-Loss RSI Oversold Rebound Quantitative Strategy