Dynamic Support Resistance Price Action Trading System

Author: ChaoZhang, Date: 2024-12-04 15:19:00Tags: SRPA

Overview

This strategy is a trading system based on price action and dynamic support/resistance levels, executing trades near key price levels when specific candlestick patterns emerge. The system utilizes a 16-period dynamic support/resistance calculation method, combined with four classic reversal candlestick patterns - Hammer, Shooting Star, Doji, and Pin Bar to capture potential market reversals. The strategy employs fixed percentage take-profit and stop-loss levels for risk management and uses a sensitivity parameter to control entry signal strictness.

Strategy Principles

The core of the strategy lies in dynamically calculating support and resistance levels to establish price movement boundaries. When price approaches these key levels, the system looks for specific candlestick patterns as reversal signals. Entry conditions require pattern formation within 1.8% (default sensitivity) of support/resistance levels. The system implements a 35% equity management rule with 16% stop-loss and 9.5% take-profit, effectively controlling risk at around 5.6% of total equity per trade. The strategy is implemented in Pine Script with complete trade management functionality and visualization.

Strategy Advantages

- Combines two most reliable elements of technical analysis: price patterns and support/resistance, enhancing signal reliability

- Uses dynamically calculated support/resistance levels, adapting to changing market conditions

- Implements strict money management and risk control measures to prevent significant drawdowns

- Clear strategy logic with adjustable parameters, facilitating optimization for different market conditions

- Clear entry signals without subjective judgment, suitable for automated trading

Strategy Risks

- Support/resistance effectiveness may decrease in highly volatile markets

- Relatively wide stop-loss (16%) may lead to significant losses in volatile conditions

- Sensitivity parameter settings significantly impact trading frequency and accuracy

- Relying solely on price patterns may miss other important market signals

- Need to consider trading costs’ impact on strategy returns

Optimization Directions

- Introduce volume as a confirmation indicator to improve signal reliability

- Develop adaptive sensitivity parameters that adjust dynamically based on market volatility

- Optimize stop-loss settings, consider implementing trailing stops or stepped stop-loss plans

- Add trend filters to avoid reversal trades during strong trends

- Develop dynamic position sizing system adjusting trade size based on market conditions

Summary

This price action-based trading strategy provides traders with a systematic trading approach by combining dynamic support/resistance levels with classic reversal patterns. The strategy’s strengths lie in its clear logic and controllable risk, though continuous optimization based on actual trading results is necessary. Traders are advised to conduct thorough backtesting and parameter optimization before live trading, and customize the strategy based on market experience.

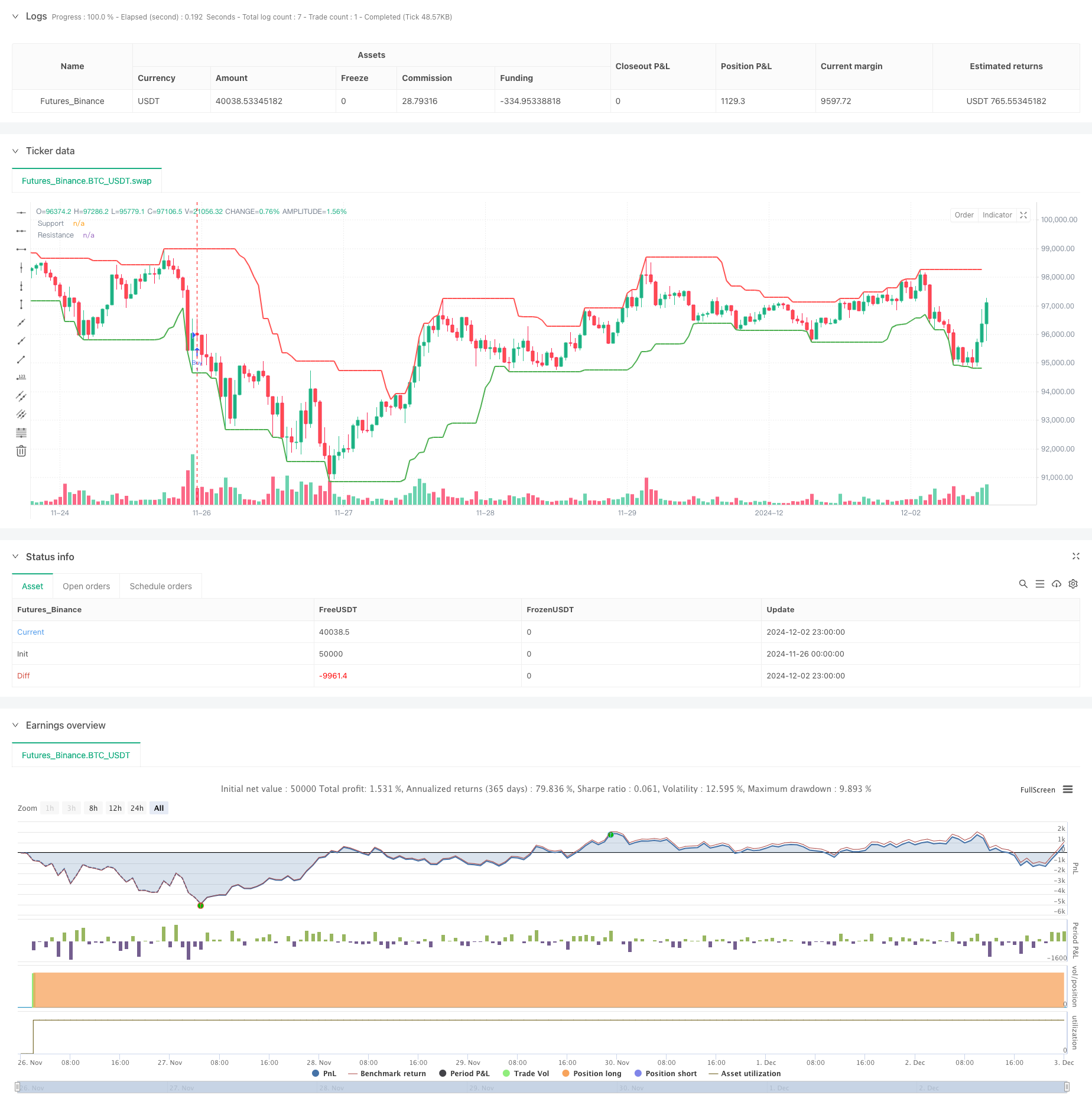

/*backtest

start: 2024-11-26 00:00:00

end: 2024-12-03 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © felipemiransan

//@version=5

strategy("Price Action Strategy", overlay=true)

// Settings

length = input.int(16, title="Support and Resistance Length")

sensitivity = input.float(0.018, title="Sensitivity")

// Stop Loss and Take Profit

stop_loss_pct = input.float(16, title="Stop Loss percentage", minval=0.1) / 100

take_profit_pct = input.float(9.5, title="Take Profit percentage", minval=0.1) / 100

// Function to identify a Hammer

isHammer() =>

body = close - open

price_range = high - low

lower_shadow = open - low

upper_shadow = high - close

body > 0 and lower_shadow > body * 2 and upper_shadow < body * 0.5 and price_range > 0

// Function to identify a Shooting Star

isShootingStar() =>

body = open - close

price_range = high - low

lower_shadow = close - low

upper_shadow = high - open

body > 0 and upper_shadow > body * 2 and lower_shadow < body * 0.5 and price_range > 0

// Function to identify a Doji

isDoji() =>

body = close - open

price_range = high - low

math.abs(body) < (price_range * 0.1) // Doji has a small body

// Function to identify a Pin Bar

isPinBar() =>

body = close - open

price_range = high - low

lower_shadow = open - low

upper_shadow = high - close

(upper_shadow > body * 2 and lower_shadow < body * 0.5) or (lower_shadow > body * 2 and upper_shadow < body * 0.5)

// Support and resistance levels

support = ta.lowest(low, length)

resistance = ta.highest(high, length)

// Entry criteria

long_condition = (isHammer() or isDoji() or isPinBar()) and close <= support * (1 + sensitivity)

short_condition = (isShootingStar() or isDoji() or isPinBar()) and close >= resistance * (1 - sensitivity)

// Function to calculate stop loss and take profit (long)

calculate_levels(position_size, avg_price, stop_loss_pct, take_profit_pct) =>

stop_loss_level = avg_price * (1 - stop_loss_pct)

take_profit_level = avg_price * (1 + take_profit_pct)

[stop_loss_level, take_profit_level]

// Function to calculate stop loss and take profit (short)

calculate_levels_short(position_size, avg_price, stop_loss_pct, take_profit_pct) =>

stop_loss_level = avg_price * (1 + stop_loss_pct)

take_profit_level = avg_price * (1 - take_profit_pct)

[stop_loss_level, take_profit_level]

// Buy entry order with label

if (long_condition and strategy.opentrades == 0)

strategy.entry("Buy", strategy.long)

pattern = isHammer() ? "Hammer" : isDoji() ? "Doji" : isPinBar() ? "Pin Bar" : ""

label.new(x=bar_index, y=low, text=pattern, color=color.green, textcolor=color.black, size=size.small)

// Sell entry order with label

if (short_condition and strategy.opentrades == 0)

strategy.entry("Sell", strategy.short)

pattern = isShootingStar() ? "Shooting Star" : isDoji() ? "Doji" : isPinBar() ? "Pin Bar" : ""

label.new(x=bar_index, y=high, text=pattern, color=color.red, textcolor=color.black, size=size.small)

// Stop Loss and Take Profit management for open positions

if (strategy.opentrades > 0)

if (strategy.position_size > 0) // Long position

avg_price_long = strategy.position_avg_price // Average price of long position

[long_stop_level, long_take_profit_level] = calculate_levels(strategy.position_size, avg_price_long, stop_loss_pct, take_profit_pct)

strategy.exit("Exit Long", from_entry="Buy", stop=long_stop_level, limit=long_take_profit_level)

if (strategy.position_size < 0) // Short position

avg_price_short = strategy.position_avg_price // Average price of short position

[short_stop_level, short_take_profit_level] = calculate_levels_short(strategy.position_size, avg_price_short, stop_loss_pct, take_profit_pct)

strategy.exit("Exit Short", from_entry="Sell", stop=short_stop_level, limit=short_take_profit_level)

// Visualization of Support and Resistance Levels

plot(support, title="Support", color=color.green, linewidth=2)

plot(resistance, title="Resistance", color=color.red, linewidth=2)

- Support-Resistance breakout

- Multi-EMA Crossover with Camarilla Support/Resistance Trend Trading System

- VWAP-ATR Dynamic Price Action Trading System

- Adaptive Channel Breakout Strategy with Dynamic Support and Resistance Trading System

- Multi-Pattern Recognition and SR Level Trading Strategy

- Open Market Exposure Dynamic Position Adjustment Quantitative Trading Strategy

- Markov Chain Probability Transition State Quantitative Trading Strategy

- Dynamic Take-Profit Stop-Loss EMA Crossover Quantitative Trading Strategy

- Multi-EMA Trend Following Trading Strategy

- RSI Dynamic Exit Level Momentum Trading Strategy

- AO Multi-Layer Quantitative Trend Enhancement Strategy

- DPO-EMA Trend Crossover Quantitative Strategy Research

- EMA-MACD High-Frequency Quantitative Strategy with Smart Risk Management

- Multi-EMA Trend Momentum Trading Strategy with Risk Management System

- Historical Breakout Trend System with Moving Average Filter (HBTS)

- Multi-RSI-EMA Momentum Hedging Strategy with Position Scaling

- Dynamic Dual EMA Crossover Quantitative Trading Strategy

- Multi-EMA Automated Trading System with Trailing Profit Lock

- High-Frequency Hybrid Technical Analysis Quantitative Strategy

- Dual EMA and Relative Strength Adaptive Trading Strategy

- Bollinger Bands High-Frequency Quantitative Strategy Combined with High-Low Breakout System

- MACD-RSI Dynamic Crossover Quantitative Trading System

- RSI and Supertrend Trend-Following Adaptive Volatility Strategy

- Dual EMA Crossover with RSI Momentum Enhanced Trading Strategy

- Multi-Technical Indicator Trend Following Trading Strategy

- Multi-Exponential Moving Average Crossover Strategy with Volume-Based ATR Dynamic Stop-Loss Optimization

- Dual Chain Hybrid Momentum EMA Tracking Trading System

- Dynamic Signal Line Trend Following and Volatility Filtering Strategy

- Multi-Timeframe Bollinger Momentum Breakout Strategy with Hull Moving Average

- Multi-Step Volatility-Adjusted Dynamic SuperTrend Strategy