Triangle Breakout with RSI Momentum Strategy

Author: ChaoZhang, Date: 2024-12-05 16:19:31Tags: RSI

Overview

This strategy is a quantitative trading system that combines price pattern and technical indicators. It primarily identifies triangle pattern breakouts and confirms trades using RSI momentum. The strategy uses linear regression to construct upper and lower trendlines, determining trading signals through price breakouts and RSI positions, achieving an organic combination of pattern and momentum analysis.

Strategy Principle

The core logic consists of two main components: triangle pattern recognition and RSI momentum confirmation. First, it uses linear regression to calculate recent N-period highs and lows, constructing upper and lower trendlines to form a triangle. When price breaks above the upper trendline and RSI is above 50, it triggers a buy signal; when price breaks below the lower trendline and RSI is below 50, it triggers a sell signal. The strategy features adjustable parameters for triangle length and RSI period, providing strong adaptability.

Strategy Advantages

- Clear Structure: The strategy organically combines pattern analysis and momentum analysis, improving trading reliability through double confirmation.

- Flexible Parameters: Provides adjustable triangle length and RSI period parameters, facilitating optimization for different market characteristics.

- Strong Visualization: Clearly displays trendlines and trading signals on charts, facilitating strategy monitoring and backtesting analysis.

- Controlled Risk: Uses RSI as a filter to effectively reduce risks from false breakouts.

Strategy Risks

- May generate frequent trades in choppy markets, increasing transaction costs.

- Trendline calculations based on historical data may lag in rapidly volatile markets.

- RSI indicator may generate false signals under certain market conditions.

- Strategy lacks stop-loss mechanism, potentially bearing significant losses during extreme market volatility.

Strategy Optimization Directions

- Introduce Stop-Loss Mechanism: Recommend adding fixed or trailing stop-loss for risk control.

- Optimize Entry Timing: Consider adding volume confirmation to improve breakout signal reliability.

- Enhance Signal Filtering: Can add trend filters to avoid frequent trading in ranging markets.

- Dynamic Parameter Optimization: Suggest dynamically adjusting triangle length and RSI thresholds based on market volatility.

Conclusion

The Triangle Breakout with RSI Momentum Strategy is a complete and logically clear quantitative trading system. Through the dual confirmation mechanism of pattern and momentum, it effectively improves trading signal reliability. While certain risks exist, the strategy has good practical value through reasonable parameter optimization and risk control measures. Traders are advised to conduct thorough parameter optimization and backtesting verification based on specific market characteristics before live trading.

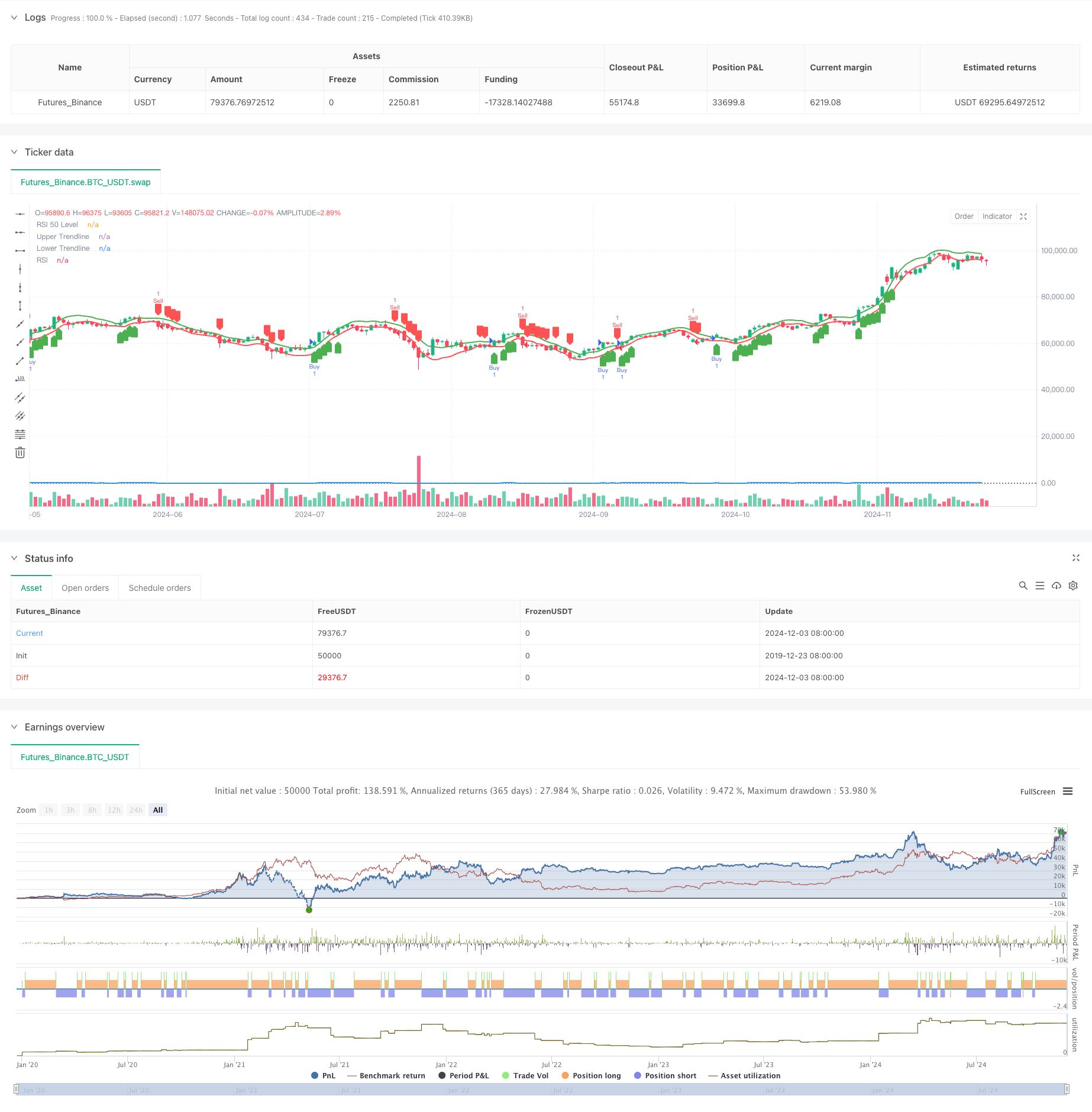

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-04 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Triangle Breakout with RSI", overlay=true)

// Input parameters

len = input.int(15, title="Triangle Length")

rsiPeriod = input.int(14, title="RSI Period")

rsiThresholdBuy = input.int(50, title="RSI Threshold for Buy")

rsiThresholdSell = input.int(50, title="RSI Threshold for Sell")

// Calculate the RSI

rsi = ta.rsi(close, rsiPeriod)

// Calculate highest high and lowest low for triangle pattern

highLevel = ta.highest(high, len)

lowLevel = ta.lowest(low, len)

// Create trendlines for the triangle

upperTrend = ta.linreg(high, len, 0)

lowerTrend = ta.linreg(low, len, 0)

// Plot the trendlines on the chart

plot(upperTrend, color=color.green, linewidth=2, title="Upper Trendline")

plot(lowerTrend, color=color.red, linewidth=2, title="Lower Trendline")

// Detect breakout conditions

breakoutUp = close > upperTrend

breakoutDown = close < lowerTrend

// Confirm breakout with RSI

buyCondition = breakoutUp and rsi > rsiThresholdBuy

sellCondition = breakoutDown and rsi < rsiThresholdSell

// Plot breakout signals with confirmation from RSI

plotshape(series=buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, size=size.small)

plotshape(series=sellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, size=size.small)

// Strategy: Buy when triangle breaks upwards and RSI is above 50; Sell when triangle breaks downwards and RSI is below 50

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.entry("Sell", strategy.short)

// Plot RSI on the bottom pane

hline(50, "RSI 50 Level", color=color.gray, linestyle=hline.style_dotted)

plot(rsi, color=color.blue, linewidth=2, title="RSI")

- Dynamic Dual-Indicator Momentum Trend Quantitative Strategy System

- Dual Moving Average-RSI Multi-Signal Trend Trading Strategy

- Dynamic EMA System Combined with RSI Momentum Indicator for Optimized Intraday Trading Strategy

- Multi-Technical Indicator Crossover Momentum Trend Following Strategy

- Dynamic Stop-Loss Adjustment Elephant Bar Trend Following Strategy

- Dual-Period RSI Trend Momentum Strategy with Pyramiding Position Management System

- Dynamic RSI Quantitative Trading Strategy with Multiple Moving Average Crossover

- Dynamic Trend RSI Indicator Crossing Strategy

- Multi-Dimensional KNN Algorithm with Volume-Price Candlestick Pattern Trading Strategy

- Adaptive Multi-Strategy Dynamic Switching System: A Quantitative Trading Strategy Combining Trend Following and Range Oscillation

- Advanced Multi-Indicator Multi-Dimensional Trend Cross Quantitative Strategy

- Dual Timeframe Dynamic Support Trading System

- Multi-Period Moving Average and RSI Momentum Cross Trend Following Strategy

- Financial Asset MFI-Based Oversold Zone Exit and Signal Averaging System

- Multi-EMA Crossover with Momentum Indicators Trading Strategy

- MACD-KDJ Combined Martingale Pyramiding Quantitative Trading Strategy

- Multi-Pattern Recognition and SR Level Trading Strategy

- G-Channel and EMA Trend Filter Trading System

- Dynamic Stop-Loss Multi-Period RSI Trend Following Strategy

- Dynamic Dual Moving Average Breakthrough Trading System

- Multi-Indicator Crossover Momentum Trend Following Strategy with Optimized Take-Profit and Stop-Loss System

- Five EMA RSI Trend-Following Dynamic Channel Trading System

- Adaptive Weighted Trend Following Strategy (VIDYA Multi-Indicator System)

- Enhanced Dual Pivot Point Reversal Trading Strategy

- AO Multi-Layer Quantitative Trend Enhancement Strategy

- DPO-EMA Trend Crossover Quantitative Strategy Research

- EMA-MACD High-Frequency Quantitative Strategy with Smart Risk Management

- Multi-EMA Trend Momentum Trading Strategy with Risk Management System

- Historical Breakout Trend System with Moving Average Filter (HBTS)

- Multi-RSI-EMA Momentum Hedging Strategy with Position Scaling

- Dynamic Dual EMA Crossover Quantitative Trading Strategy