Dynamic Dual Moving Average Breakthrough Trading System

Author: ChaoZhang, Date: 2024-12-05 16:22:32Tags: EMASMACROSS

Overview

This is an automated trading strategy system based on dual moving average crossover. The system utilizes 9-period and 21-period Exponential Moving Averages (EMA) as core indicators, generating trading signals through their crossovers. It incorporates stop-loss and take-profit management, along with a visual interface that displays trading signals and key price levels.

Strategy Principle

The strategy employs a fast EMA (9-period) and a slow EMA (21-period) to construct the trading system. Long signals are generated when the fast EMA crosses above the slow EMA, while short signals occur when the fast EMA crosses below the slow EMA. The system automatically sets stop-loss and take-profit levels based on preset percentages for each trade. Position sizing uses a percentage-based approach, defaulting to 100% of account equity.

Strategy Advantages

- Clear Signals: Uses moving average crossovers as trading signals, which are clear and easy to understand

- Risk Control: Integrated stop-loss and take-profit management system for every trade

- Visual Support: Provides trade label display featuring entry time, price, stop-loss, and take-profit levels

- Flexible Parameters: Allows adjustment of EMA periods and risk management parameters to adapt to different market conditions

- Complete Exit Mechanism: Automatically closes positions on contrary signals to avoid position offsetting

Strategy Risks

- Choppy Market Risk: May generate frequent false breakout signals in sideways markets, leading to consecutive losses

- Slippage Risk: Actual execution prices may deviate from intended levels during high volatility periods

- Position Sizing Risk: Default 100% equity allocation may expose the account to excessive risk

- Signal Lag: EMAs inherently lag price action, potentially missing optimal entry points or causing delayed exits

- Single Indicator Dependency: Reliance solely on moving average crossovers may ignore other important market information

Optimization Directions

- Add Trend Confirmation: Consider incorporating ADX or trend strength indicators to filter false signals

- Improve Money Management: Add dynamic position sizing based on market volatility

- Enhanced Stop-Loss Mechanism: Consider implementing trailing stops to better protect profits

- Market Environment Filtering: Add volatility indicators to suspend trading in unfavorable conditions

- Optimize Signal Confirmation: Consider adding volume confirmation or complementary technical indicators

Summary

This is a well-designed, logically sound moving average crossover strategy system. By combining EMA crossover signals with risk management mechanisms, the strategy can capture profits in trending markets. While inherent risks exist, the suggested optimizations can further enhance the strategy’s stability and reliability. This strategy is particularly suitable for tracking medium to long-term trends and represents a solid choice for patient traders.

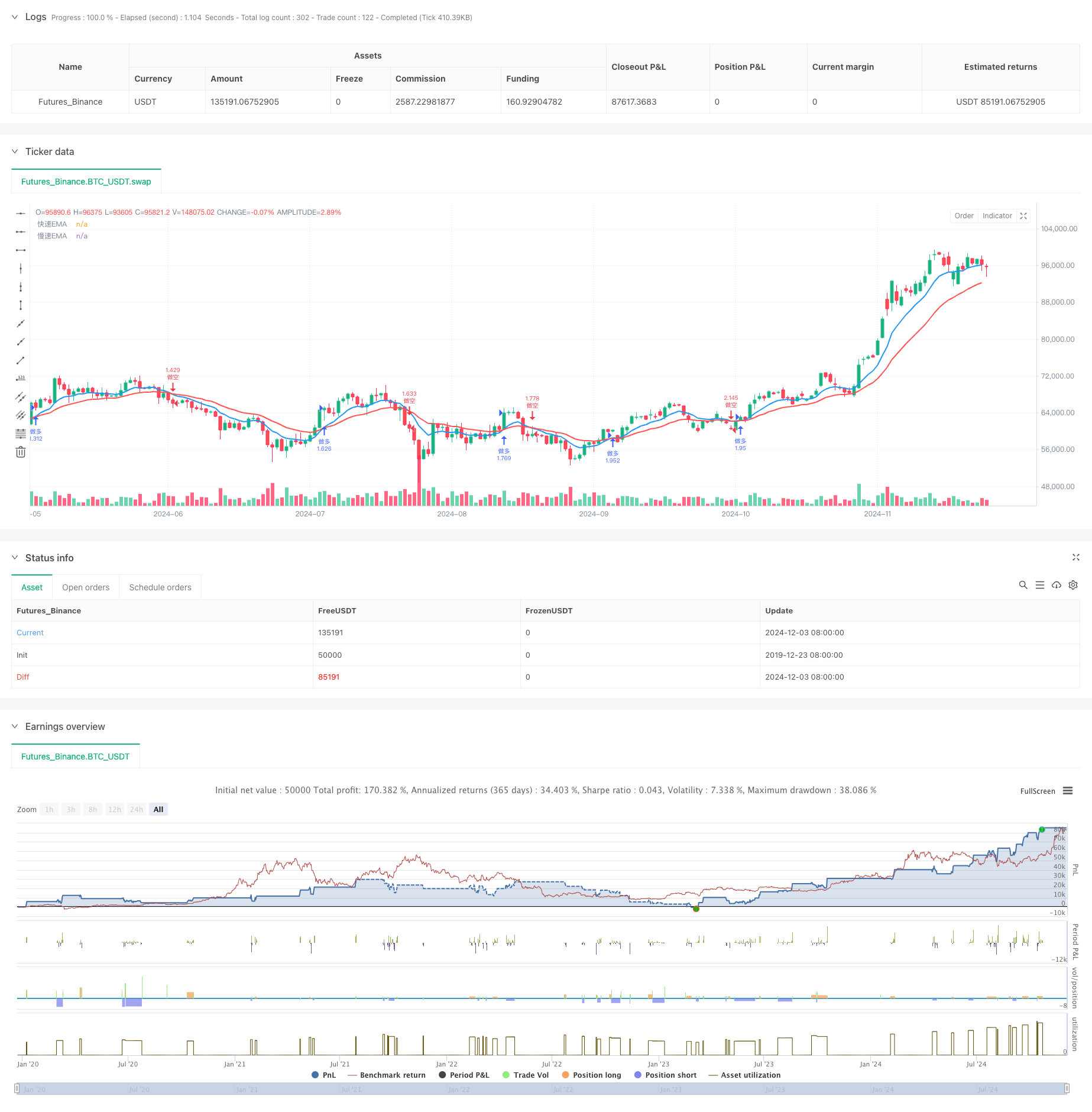

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-04 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//

// ██╗ █████╗ ██████╗ ██████╗ ██╗ ██╗ ██╗

// ██║ ██╔══██╗ ██╔═══██╗ ██╔══██╗ ██║ ██║ ██║

// ██║ ███████║ ██║ ██║ ██║ ██║ ██║ ██║ ██║

// ██║ ██╔══██║ ██║ ██║ ██║ ██║ ██║ ██║ ██║

// ███████╗ ██║ ██║ ╚██████╔╝ ██████╔╝ ╚██████╔╝ ██║

// ╚══════╝ ╚═╝ ╚═╝ ╚═════╝ ╚═════╝ ╚═════╝ ╚═╝

//

// BTC-EMA做多策略(5分钟确认版) - 作者:LAODUI

// 版本:2.0

// 最后更新:2024

// ═══════════════════════════════════════════════════════════════════════════

strategy("EMA Cross Strategy", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// 添加策略参数设置

var showLabels = input.bool(true, "显示标签", group="显示设置")

var stopLossPercent = input.float(5.0, "止损百分比", minval=0.1, maxval=20.0, step=0.1, group="风险管理")

var takeProfitPercent = input.float(10.0, "止盈百分比", step=0.1, group="风险管理")

// EMA参数设置

var emaFastLength = input.int(9, "快速EMA周期", minval=1, maxval=200, group="EMA设置")

var emaSlowLength = input.int(21, "慢速EMA周期", minval=1, maxval=200, group="EMA设置")

// 计算EMA

ema_fast = ta.ema(close, emaFastLength)

ema_slow = ta.ema(close, emaSlowLength)

// 绘制EMA线

plot(ema_fast, "快速EMA", color=color.blue, linewidth=2)

plot(ema_slow, "慢速EMA", color=color.red, linewidth=2)

// 检测交叉

crossOver = ta.crossover(ema_fast, ema_slow)

crossUnder = ta.crossunder(ema_fast, ema_slow)

// 格式化时间显示 (UTC+8)

utc8Time = time + 8 * 60 * 60 * 1000

timeStr = str.format("{0,date,MM-dd HH:mm}", utc8Time)

// 计算止损止盈价格

longStopLoss = strategy.position_avg_price * (1 - stopLossPercent / 100)

longTakeProfit = strategy.position_avg_price * (1 + takeProfitPercent / 100)

shortStopLoss = strategy.position_avg_price * (1 + stopLossPercent / 100)

shortTakeProfit = strategy.position_avg_price * (1 - takeProfitPercent / 100)

// 交易逻辑

if crossOver

if strategy.position_size < 0

strategy.close("做空")

strategy.entry("做多", strategy.long)

if showLabels

label.new(bar_index, high, text="做多入场\n" + timeStr + "\n入场价: " + str.tostring(close) + "\n止损价: " + str.tostring(longStopLoss) + "\n止盈价: " + str.tostring(longTakeProfit), color=color.green, textcolor=color.white, style=label.style_label_down, yloc=yloc.abovebar)

if crossUnder

if strategy.position_size > 0

strategy.close("做多")

strategy.entry("做空", strategy.short)

if showLabels

label.new(bar_index, low, text="做空入场\n" + timeStr + "\n入场价: " + str.tostring(close) + "\n止损价: " + str.tostring(shortStopLoss) + "\n止盈价: " + str.tostring(shortTakeProfit), color=color.red, textcolor=color.white, style=label.style_label_up, yloc=yloc.belowbar)

// 设置止损止盈

if strategy.position_size > 0 // 多仓止损止盈

strategy.exit("多仓止损止盈", "做多", stop=longStopLoss, limit=longTakeProfit)

if strategy.position_size < 0 // 空仓止损止盈

strategy.exit("空仓止损止盈", "做空", stop=shortStopLoss, limit=shortTakeProfit)

- Dynamic Dual EMA Crossover Strategy with Adaptive Profit/Loss Control

- EMA, SMA, Moving Average Crossover, Momentum Indicator

- SSL Channel

- EMA5 and EMA13 Crossover Strategy

- Indicator: WaveTrend Oscillator

- SMA Dual Moving Average Crossover Strategy

- Dynamic Take Profit and Stop Loss Trading Strategy Based on Three Consecutive Bearish Candles and Moving Averages

- Super Moving Average and Upperband Crossover Strategy

- EMA Crossover Momentum Scalping Strategy

- Multi-EMA Crossover Momentum Strategy

- Dual EMA Crossover Momentum Trend Following Strategy

- Multi-Step ATR Trading Strategy with Dynamic Profit Taking

- Dual Timeframe Dynamic Support Trading System

- Multi-Period Moving Average and RSI Momentum Cross Trend Following Strategy

- Financial Asset MFI-Based Oversold Zone Exit and Signal Averaging System

- Multi-EMA Crossover with Momentum Indicators Trading Strategy

- MACD-KDJ Combined Martingale Pyramiding Quantitative Trading Strategy

- Multi-Pattern Recognition and SR Level Trading Strategy

- G-Channel and EMA Trend Filter Trading System

- Dynamic Stop-Loss Multi-Period RSI Trend Following Strategy

- Multi-Indicator Crossover Momentum Trend Following Strategy with Optimized Take-Profit and Stop-Loss System

- Triangle Breakout with RSI Momentum Strategy

- Five EMA RSI Trend-Following Dynamic Channel Trading System

- Adaptive Weighted Trend Following Strategy (VIDYA Multi-Indicator System)

- Enhanced Dual Pivot Point Reversal Trading Strategy

- AO Multi-Layer Quantitative Trend Enhancement Strategy

- DPO-EMA Trend Crossover Quantitative Strategy Research

- EMA-MACD High-Frequency Quantitative Strategy with Smart Risk Management

- Multi-EMA Trend Momentum Trading Strategy with Risk Management System

- Historical Breakout Trend System with Moving Average Filter (HBTS)