Multi-Level Intelligent Dynamic Trailing Stop Strategy Based on Bollinger Bands and ATR

Author: ChaoZhang, Date: 2024-12-11 14:52:24Tags: BBATRMASMAEMASMMAWMAVWMASD

Overview

This strategy is an intelligent trading system based on Bollinger Bands and ATR indicators, incorporating multi-level profit-taking and stop-loss mechanisms. The strategy primarily enters long positions by identifying reversal signals near the lower Bollinger Band and manages risk using dynamic trailing stops. The system is designed with a 20% profit target and 12% stop-loss level, while incorporating ATR-based dynamic trailing stops to protect profits while allowing trends sufficient room to develop.

Strategy Principles

The core logic includes several key components: 1. Entry conditions: Requires a green candle following a red candle touching the lower Bollinger Band, typically indicating a potential reversal signal. 2. Moving average selection: Supports multiple types (SMA, EMA, SMMA, WMA, VWMA), with default 20-period SMA. 3. Bollinger Bands parameters: Uses 1.5 standard deviations for bandwidth, more conservative than traditional 2 standard deviations. 4. Profit-taking mechanism: Sets initial 20% profit target. 5. Stop-loss mechanism: Implements 12% fixed stop-loss to protect capital. 6. Dynamic trailing stop: - Activates ATR trailing stop after reaching profit target - Initiates ATR dynamic trailing stop after touching upper Bollinger Band - Uses ATR multiplier to dynamically adjust trailing stop distance

Strategy Advantages

- Multi-level risk control:

- Fixed stop-loss protects principal

- Dynamic trailing stop locks in profits

- Upper Bollinger Band triggered dynamic stop provides additional protection

- Flexible moving average selection allows adaptation to different market conditions

- ATR-based dynamic trailing stop automatically adjusts based on market volatility, preventing premature exits

- Entry signals combine price patterns and technical indicators, improving signal reliability

- Supports position management and transaction cost settings, closer to real trading conditions

Strategy Risks

- Rapid oscillating markets may lead to frequent trading, increasing transaction costs

- 12% fixed stop-loss might be too tight in high-volatility markets

- Bollinger Bands signals may generate false signals in trending markets

- ATR trailing stop may result in larger drawdowns during severe volatility Mitigation measures:

- Recommended use on larger timeframes (30min-1hour)

- Adjust stop-loss percentage based on specific instrument characteristics

- Consider adding trend filters to reduce false signals

- Dynamically adjust ATR multiplier for different market environments

Strategy Optimization Directions

- Entry optimization:

- Add volume confirmation mechanism

- Incorporate trend strength indicators for signal filtering

- Consider adding momentum indicators for confirmation

- Stop-loss optimization:

- Convert fixed stop-loss to ATR-based dynamic stop

- Develop adaptive stop-loss algorithm

- Dynamically adjust stop distance based on volatility

- Moving average optimization:

- Test different period combinations

- Research adaptive period methods

- Consider using price action instead of moving averages

- Position management optimization:

- Develop volatility-based position sizing system

- Implement scaled entry and exit mechanisms

- Add risk exposure control

Summary

The strategy constructs a multi-level trading system using Bollinger Bands and ATR indicators, employing dynamic management methods for entry, stop-loss, and profit-taking. Its strengths lie in its comprehensive risk control system and ability to adapt to market volatility. Through the suggested optimization directions, the strategy has significant room for improvement. It is particularly suitable for use on larger timeframes and can help investors holding quality assets optimize their entry and exit timing.

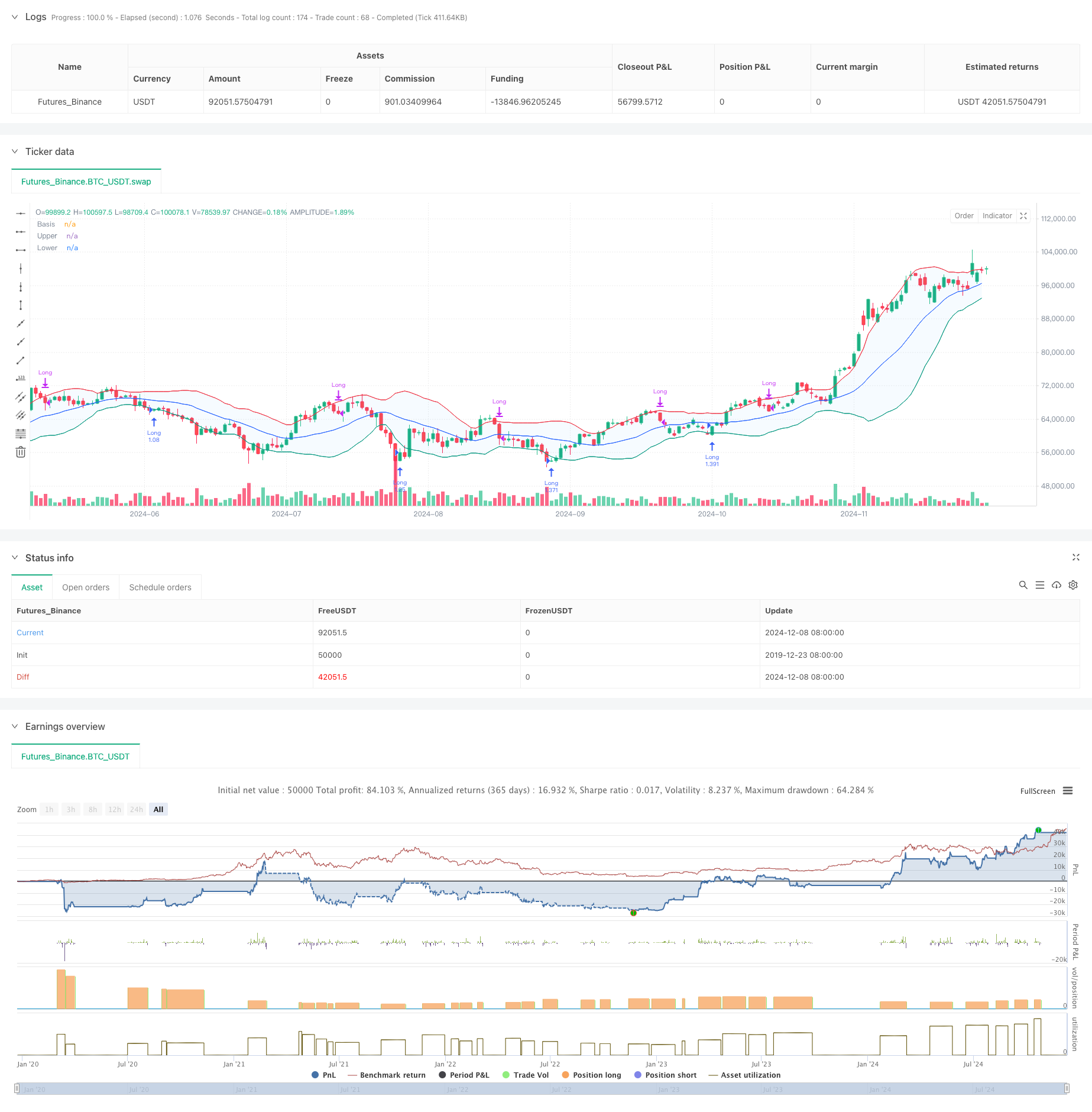

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Demo GPT - Bollinger Bands Strategy with Tightened Trailing Stops", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_value=0.1, slippage=3)

// Input settings

length = input.int(20, minval=1)

maType = input.string("SMA", "Basis MA Type", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

src = input(close, title="Source")

mult = 1.5 // Standard deviation multiplier set to 1.5

offset = input.int(0, "Offset", minval=-500, maxval=500)

atrMultiplier = input.float(1.0, title="ATR Multiplier for Trailing Stop", minval=0.1) // ATR multiplier for trailing stop

// Time range filters

start_date = input(timestamp("2018-01-01 00:00"), title="Start Date")

end_date = input(timestamp("2069-12-31 23:59"), title="End Date")

in_date_range = true

// Moving average function

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

// Calculate Bollinger Bands

basis = ma(src, length, maType)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

// ATR Calculation

atr = ta.atr(length) // Use ATR for trailing stop adjustments

// Plotting

plot(basis, "Basis", color=#2962FF, offset=offset)

p1 = plot(upper, "Upper", color=#F23645, offset=offset)

p2 = plot(lower, "Lower", color=#089981, offset=offset)

fill(p1, p2, title="Background", color=color.rgb(33, 150, 243, 95))

// Candle color detection

isGreen = close > open

isRed = close < open

// Flags for entry and exit conditions

var bool redTouchedLower = false

var float targetPrice = na

var float stopLossPrice = na

var float trailingStopPrice = na

if in_date_range

// Entry Logic: First green candle after a red candle touches the lower band

if close < lower and isRed

redTouchedLower := true

if redTouchedLower and isGreen

strategy.entry("Long", strategy.long)

targetPrice := close * 1.2 // Set the target price to 20% above the entry price

stopLossPrice := close * 0.88 // Set the stop loss to 12% below the entry price

trailingStopPrice := na // Reset trailing stop on entry

redTouchedLower := false

// Exit Logic: Trailing stop after 20% price increase

if strategy.position_size > 0 and not na(targetPrice) and close >= targetPrice

if na(trailingStopPrice)

trailingStopPrice := close - atr * atrMultiplier // Initialize trailing stop using ATR

trailingStopPrice := math.max(trailingStopPrice, close - atr * atrMultiplier) // Tighten dynamically based on ATR

// Exit if the price falls below the trailing stop after 20% increase

if strategy.position_size > 0 and not na(trailingStopPrice) and close < trailingStopPrice

strategy.close("Long", comment="Trailing Stop After 20% Increase")

targetPrice := na // Reset the target price

stopLossPrice := na // Reset the stop loss price

trailingStopPrice := na // Reset trailing stop

// Stop Loss: Exit if the price drops 12% below the entry price

if strategy.position_size > 0 and not na(stopLossPrice) and close <= stopLossPrice

strategy.close("Long", comment="Stop Loss Triggered")

targetPrice := na // Reset the target price

stopLossPrice := na // Reset the stop loss price

trailingStopPrice := na // Reset trailing stop

// Trailing Stop: Activate after touching the upper band

if strategy.position_size > 0 and close >= upper and isGreen

if na(trailingStopPrice)

trailingStopPrice := close - atr * atrMultiplier // Initialize trailing stop using ATR

trailingStopPrice := math.max(trailingStopPrice, close - atr * atrMultiplier) // Tighten dynamically based on ATR

// Exit if the price falls below the trailing stop

if strategy.position_size > 0 and not na(trailingStopPrice) and close < trailingStopPrice

strategy.close("Long", comment="Trailing Stop Triggered")

trailingStopPrice := na // Reset trailing stop

targetPrice := na // Reset the target price

stopLossPrice := na // Reset the stop loss price

- Bollinger Bands and Moving Average Crossover Strategy

- Advanced Quantitative Trading Strategy Combining RSI Divergence and Moving Averages

- Bollinger Bands Momentum Breakout Adaptive Trend Following Strategy

- Bollinger Bands Breakout Momentum Trading Strategy

- Multi-Layer Volatility Band Trading Strategy

- Adaptive Moving Average Crossover Strategy

- Multi-Moving Average Crossover Trend Following Strategy with Volatility Filter

- Multi-Period Moving Average Crossover Trend Following Strategy

- Dual Moving Average Momentum Tracking Quantitative Strategy

- Dynamic RSI Smart Timing Swing Trading Strategy

- Multi-Timeframe Smoothed Heikin Ashi Trend Following Quantitative Trading System

- Dynamic RSI Oscillator Polynomial Fitting Indicator Trend Quantitative Trading Strategy

- Daily Range Breakout Single-Direction Trading Strategy

- SMA-RSI-MACD Multi-Indicator Dynamic Limit Order Trading Strategy

- EMA/SMA Trend Following with Swing Trading Strategy Combined Volume Filter and Percentage Take-Profit/Stop-Loss System

- VWAP Standard Deviation Mean Reversion Trading Strategy

- Dynamic Price Zone Breakout Trading Strategy Based on Support and Resistance Quantitative System

- Multi-Indicator Trend Momentum Crossover Quantitative Strategy

- Advanced Dynamic Trailing Stop with Risk-Reward Targeting Strategy

- Advanced Long-Only Dynamic Trendline Breakout Strategy

- Dynamic Dual EMA Crossover Strategy with Adaptive Profit/Loss Control

- Bollinger Bands and RSI Combined Dynamic Trading Strategy

- RSI-ATR Momentum Volatility Combined Trading Strategy

- Dual EMA Trend-Following Strategy with Limit Buy Entry

- Multi-Strategy Technical Analysis Trading System

- Multi-Timeframe Combined Candlestick Pattern Recognition Trading Strategy

- Triple Bollinger Bands Touch Trend Following Quantitative Trading Strategy

- Multi-Dimensional Dynamic Breakout Trading System Based on Bollinger Bands and RSI

- RSI Mean Reversion Breakout Strategy

- Dual EMA Crossover Momentum Trend Following Strategy