SMA-RSI-MACD Multi-Indicator Dynamic Limit Order Trading Strategy

Author: ChaoZhang, Date: 2024-12-11 15:15:49Tags: SMARSIMACDEMA

Overview

This strategy is a multi-technical indicator trading system that primarily uses EMA crossover, RSI oversold conditions, and MACD golden cross for trade confirmation. It employs dynamic limit orders for entry and multiple exit mechanisms for risk management. The strategy uses 9-period and 21-period Exponential Moving Averages (EMA) as primary trend indicators, combined with Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) to filter trading signals.

Strategy Principles

The core trading logic includes the following key components: 1. Entry signals are triggered when 9-period EMA crosses above 21-period EMA 2. Entry price is set as a limit order below the 9-period EMA at a specified offset 3. Trade confirmation requires RSI below threshold and MACD golden cross 4. Exit signals include MACD death cross, fixed profit/loss points, and forced closing at market end 5. Trading time is restricted between 9:30 AM and 3:10 PM

The strategy uses limit orders for entry to achieve better entry prices and combines multiple technical indicators to improve trading accuracy.

Strategy Advantages

- Multiple signal confirmation mechanism improves trade reliability

- Limit order entries provide better execution prices

- Fixed profit/loss points facilitate risk control

- Forced closing at market end eliminates overnight risk

- Trading time restrictions avoid opening volatility

- EMA indicators provide faster trend response

- RSI and MACD combination helps filter false signals

Strategy Risks

- Multiple signal confirmation may cause missed opportunities

- Limit orders might not execute in rapid price movements

- Fixed point stops may result in larger losses during high volatility

- MACD signals may lag behind price action

- Strategy doesn’t account for changes in market volatility

- Parameter optimization may lead to overfitting

Strategy Optimization Directions

- Introduce adaptive stop-loss and take-profit points based on market volatility

- Add volume indicators as additional confirmation signals

- Consider adding trend strength filters

- Optimize limit order offset calculation using ATR

- Include market sentiment indicators to filter unfavorable conditions

- Add position sizing mechanism based on signal strength

Summary

This is a well-structured multi-indicator trading strategy that identifies trends using moving averages, filters signals with RSI and MACD, and controls risk through limit orders and multiple stop mechanisms. The strategy’s strengths lie in its signal reliability and comprehensive risk control, though it faces challenges with signal lag and parameter optimization. There is significant room for improvement through dynamic parameter adjustment and additional auxiliary indicators. It is suitable for conservative investors in trending market conditions.

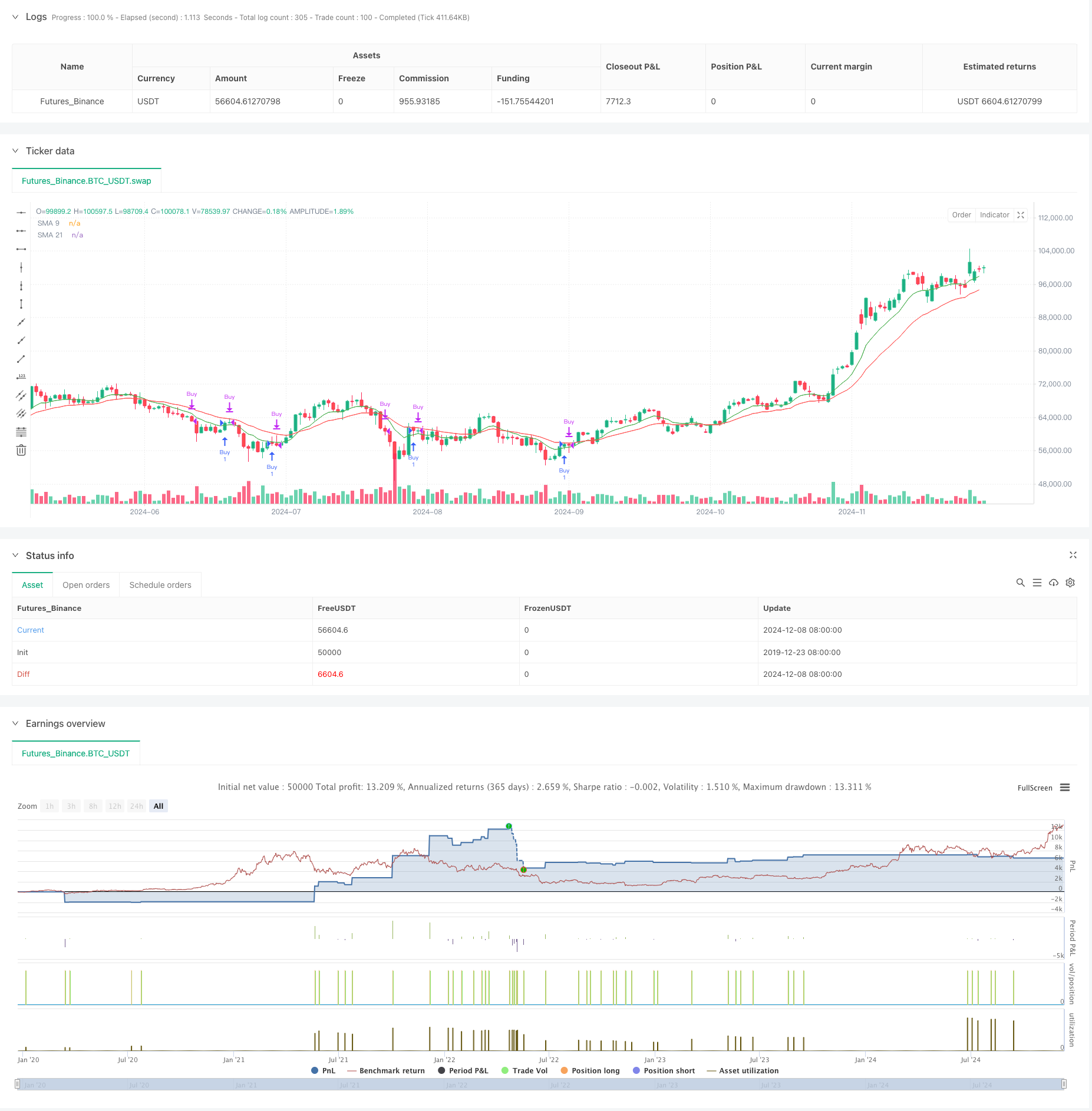

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("SMA 9 & 21 with RSI and MACD Buy Strategy", overlay=true)

// Inputs for Simple Moving Averages

sma_short = ta.ema(close, 9)

sma_long = ta.ema(close, 21)

// Plotting SMA

plot(sma_short, color=color.green, title="SMA 9")

plot(sma_long, color=color.red, title="SMA 21")

// RSI Calculation

rsi_length = input.int(14, title="RSI Length")

rsi_threshold = input.int(70, title="RSI Threshold")

rsi = ta.rsi(close, rsi_length)

// MACD Calculation

macd_fast = input.int(8, title="MACD Fast Length")

macd_slow = input.int(18, title="MACD Slow Length")

macd_signal = input.int(6, title="MACD Signal Length")

[macd_line, signal_line, _] = ta.macd(close, macd_fast, macd_slow, macd_signal)

// Inputs for Limit Order Offset

limit_offset = input.int(50, title="Limit Order Offset", minval=1) // 50 points below 9 EMA

// User input for specific date

simulationStartDate = input(timestamp("2024-12-01 00:00"), title="Simulation Start Date", group = "Simulation Dates")

simulationEndDate = input(timestamp("2024-12-30 00:00"), title="Simulation End Date", group = "Simulation Dates")

// Declare limit_price as float

var float limit_price = na

// Calculate Limit Order Price

if (sma_short[1] < sma_long[1] and sma_short > sma_long) // 9 EMA crosses above 21 EMA

limit_price := sma_short - limit_offset

// Buy Signal Condition (only on the specified date)

buy_condition = not na(limit_price) and rsi < rsi_threshold and ta.crossover(macd_line, signal_line)

// Sell Signal Condition (MACD crossover down)

sell_condition = ta.crossunder(macd_line, signal_line)

// Track Entry Price for Point-Based Exit

var float entry_price = na

if (buy_condition )

strategy.order("Buy", strategy.long, comment="Limit Order at 9 EMA - Offset", limit=limit_price)

label.new(bar_index, limit_price, "Limit Buy", style=label.style_label_up, color=color.green, textcolor=color.white)

entry_price := limit_price // Set entry price

// Exit Conditions

exit_by_macd = sell_condition

exit_by_points = not na(entry_price) and ((close >= entry_price + 12) or (close <= entry_price - 12)) // Adjust as per exit points

// Exit all positions at the end of the day

if hour == 15 and minute > 10 and strategy.position_size > 0

strategy.close_all() // Close all positions at the end of the day

strategy.cancel_all()

// Exit based on sell signal or point movement

if (exit_by_macd or exit_by_points and strategy.position_size > 0 )

strategy.close("Buy")

label.new(bar_index, close, "Close", style=label.style_label_down, color=color.red, textcolor=color.white)

- Dual Moving Average Channel Trend Following Strategy

- Multi-Indicator Quantitative Trading Strategy - Super Indicator 7-in-1 Strategy

- Dual Momentum Oscillator Smart Timing Trading Strategy

- Multi-Strategy Technical Analysis Trading System

- Quantitative Long-Short Switching Strategy Based on G-Channel and EMA

- Multi-Level Dynamic MACD Trend Following Strategy with 52-Week High/Low Extension Analysis System

- Multi-Timeframe EMA Cross High-Win Rate Trend Following Strategy (Advanced)

- Multi-Indicator Comprehensive Trading Strategy: Perfect Combination of Momentum, Overbought/Oversold, and Volatility

- Dynamic Dual Moving Average Crossover Quantitative Trading Strategy

- Multi-EMA Dynamic Trend Capture Quantitative Trading Strategy

- Adaptive Mean-Reversion Trading Strategy Based on Chande Momentum Oscillator

- MACD-Supertrend Dual Confirmation Trend Following Trading Strategy

- Multi-Period SuperTrend Dynamic Trading Strategy

- Multi-Timeframe EMA with Fibonacci Retracement and Pivot Points Trading Strategy

- Multi-Timeframe Dynamic Stop-Loss EMA-Squeeze Trading Strategy

- MACD and Linear Regression Dual Signal Intelligent Trading Strategy

- Multi-EMA Trend Following Trading Strategy

- Multi-Timeframe Smoothed Heikin Ashi Trend Following Quantitative Trading System

- Dynamic RSI Oscillator Polynomial Fitting Indicator Trend Quantitative Trading Strategy

- Daily Range Breakout Single-Direction Trading Strategy

- EMA/SMA Trend Following with Swing Trading Strategy Combined Volume Filter and Percentage Take-Profit/Stop-Loss System

- VWAP Standard Deviation Mean Reversion Trading Strategy

- Dynamic Price Zone Breakout Trading Strategy Based on Support and Resistance Quantitative System

- Multi-Indicator Trend Momentum Crossover Quantitative Strategy

- Advanced Dynamic Trailing Stop with Risk-Reward Targeting Strategy

- Advanced Long-Only Dynamic Trendline Breakout Strategy

- Multi-Level Intelligent Dynamic Trailing Stop Strategy Based on Bollinger Bands and ATR

- Dynamic Dual EMA Crossover Strategy with Adaptive Profit/Loss Control

- Bollinger Bands and RSI Combined Dynamic Trading Strategy

- RSI-ATR Momentum Volatility Combined Trading Strategy