Dual Momentum Oscillator Smart Timing Trading Strategy

Author: ChaoZhang, Date: 2024-12-17 14:36:46Tags: RSISMAEMAMACD

Overview

This strategy is an intelligent trading system based on dual momentum indicators: RSI and Stochastic RSI. It identifies market overbought and oversold conditions by combining signals from two momentum oscillators, capturing potential trading opportunities. The system supports period adaptation and can flexibly adjust trading cycles according to different market environments.

Strategy Principle

The core logic of the strategy is based on the following key elements: 1. Uses 14-period RSI indicator to calculate price momentum 2. Employs 14-period Stochastic RSI for secondary confirmation 3. Triggers buy signal when RSI is below 35 and Stochastic RSI is below 20 4. Triggers sell signal when RSI is above 70 and Stochastic RSI is above 80 5. Applies 3-period SMA smoothing to Stochastic RSI for signal stability 6. Supports switching between daily and weekly timeframes

Strategy Advantages

- Dual signal confirmation mechanism significantly reduces false signal interference

- Indicator parameters can be flexibly adjusted to market volatility

- SMA smoothing effectively reduces signal noise

- Supports multi-period trading to meet different investors’ needs

- Visual interface intuitively displays buy/sell signals for analysis

- Clear code structure, easy to maintain and develop further

Strategy Risks

- May generate excessive trading signals in sideways markets

- Potential signal lag during rapid trend reversals

- Improper parameter settings may lead to missed trading opportunities

- False signals may occur during high market volatility

- Requires proper stop-loss settings for risk control

Strategy Optimization Directions

- Introduce trend judgment indicators like MACD or EMA to improve signal reliability

- Add volume factors to enhance signal quality

- Implement dynamic stop-loss mechanisms to optimize risk management

- Develop adaptive parameter optimization system for strategy stability

- Consider incorporating market volatility indicators to optimize trading timing

Summary

The strategy builds a reliable trading system by combining the advantages of RSI and Stochastic RSI. The dual signal confirmation mechanism effectively reduces false signals, while flexible parameter settings provide strong adaptability. Through continuous optimization and improvement, the strategy shows promise in maintaining stable performance across various market conditions.

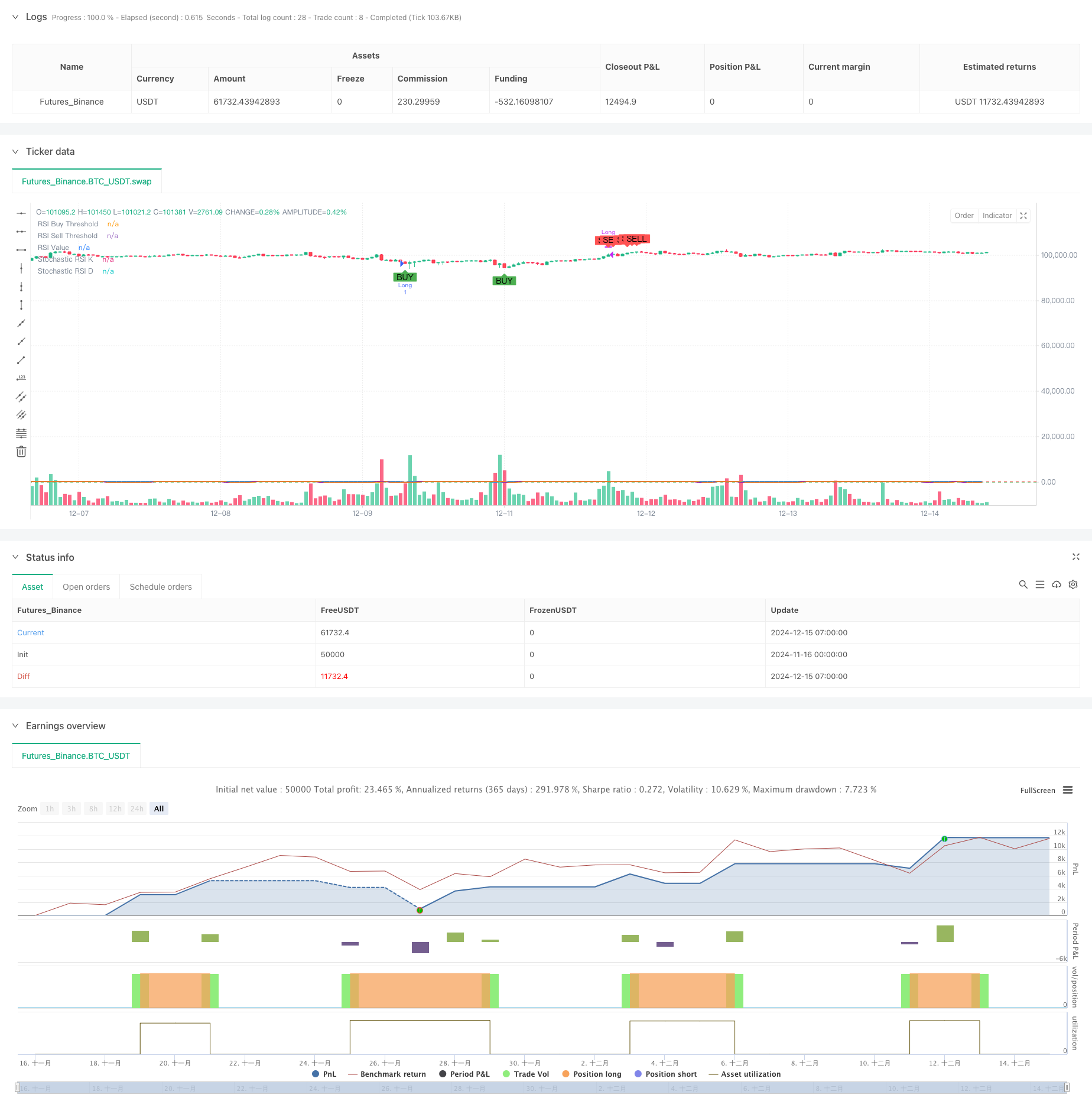

/*backtest

start: 2024-11-16 00:00:00

end: 2024-12-15 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("BTC Buy & Sell Strategy (RSI & Stoch RSI)", overlay=true)

// Input Parameters

rsi_length = input.int(14, title="RSI Length")

stoch_length = input.int(14, title="Stochastic Length")

stoch_smooth_k = input.int(3, title="Stochastic %K Smoothing")

stoch_smooth_d = input.int(3, title="Stochastic %D Smoothing")

// Threshold Inputs

rsi_buy_threshold = input.float(35, title="RSI Buy Threshold")

stoch_buy_threshold = input.float(20, title="Stochastic RSI Buy Threshold")

rsi_sell_threshold = input.float(70, title="RSI Sell Threshold")

stoch_sell_threshold = input.float(80, title="Stochastic RSI Sell Threshold")

use_weekly_data = input.bool(false, title="Use Weekly Data", tooltip="Enable to use weekly timeframe for calculations.")

// Timeframe Configuration

timeframe = use_weekly_data ? "W" : timeframe.period

// Calculate RSI and Stochastic RSI

rsi_value = request.security(syminfo.tickerid, timeframe, ta.rsi(close, rsi_length))

stoch_rsi_k_raw = request.security(syminfo.tickerid, timeframe, ta.stoch(close, high, low, stoch_length))

stoch_rsi_k = ta.sma(stoch_rsi_k_raw, stoch_smooth_k)

stoch_rsi_d = ta.sma(stoch_rsi_k, stoch_smooth_d)

// Define Buy and Sell Conditions

buy_signal = (rsi_value < rsi_buy_threshold) and (stoch_rsi_k < stoch_buy_threshold)

sell_signal = (rsi_value > rsi_sell_threshold) and (stoch_rsi_k > stoch_sell_threshold)

// Strategy Execution

if buy_signal

strategy.entry("Long", strategy.long, comment="Buy Signal")

if sell_signal

strategy.close("Long", comment="Sell Signal")

// Plot Buy and Sell Signals

plotshape(buy_signal, style=shape.labelup, location=location.belowbar, color=color.green, title="Buy Signal", size=size.small, text="BUY")

plotshape(sell_signal, style=shape.labeldown, location=location.abovebar, color=color.red, title="Sell Signal", size=size.small, text="SELL")

// Plot RSI and Stochastic RSI for Visualization

hline(rsi_buy_threshold, "RSI Buy Threshold", color=color.green)

hline(rsi_sell_threshold, "RSI Sell Threshold", color=color.red)

plot(rsi_value, color=color.blue, linewidth=2, title="RSI Value")

plot(stoch_rsi_k, color=color.purple, linewidth=2, title="Stochastic RSI K")

plot(stoch_rsi_d, color=color.orange, linewidth=1, title="Stochastic RSI D")

- Multi-Indicator Quantitative Trading Strategy - Super Indicator 7-in-1 Strategy

- Multi-Indicator Trend Following with RSI Overbought/Oversold Quantitative Trading Strategy

- Dual Moving Average Channel Trend Following Strategy

- SMA-RSI-MACD Multi-Indicator Dynamic Limit Order Trading Strategy

- Multi-Timeframe EMA Cross High-Win Rate Trend Following Strategy (Advanced)

- Quantitative Long-Short Switching Strategy Based on G-Channel and EMA

- Dynamic Dual Moving Average Crossover Quantitative Trading Strategy

- Multi-Indicator Comprehensive Trading Strategy: Perfect Combination of Momentum, Overbought/Oversold, and Volatility

- Multi-Level Dynamic MACD Trend Following Strategy with 52-Week High/Low Extension Analysis System

- Multi-Strategy Technical Analysis Trading System

- Dual Moving Average Trend Following Strategy with Risk Management

- Triple Supertrend and Bollinger Bands Multi-Indicator Trend Following Strategy

- Multi-Trendline Breakout Momentum Quantitative Strategy

- RSI Momentum and ADX Trend Strength Based Capital Management System

- Multi-Timeframe Liquidity Pivot Heatmap Strategy

- Multi-Timeframe Trend Following Strategy with ATR-Based Take Profit and Stop Loss

- Advanced Trend Following Strategy with Adaptive Trailing Stop

- Multi-Technical Indicator Trend Following Strategy with RSI Momentum Filter

- Dynamic Risk-Managed Exponential Moving Average Crossover Strategy

- Dual Exponential Moving Average and Relative Strength Index Crossover Strategy

- Advanced Quantitative Trend Capture Strategy with Dynamic Range Filter

- TradingView信号执行策略(内建Http服务版本)

- Advanced Five-Day Cross-Analysis Strategy Based on RSI and MACD Integration

- Adaptive Range Trading System Based on Dual RSI Indicators

- Dynamic Dual Supertrend Volume-Price Strategy

- Black Swan Volatility and Moving Average Crossover Momentum Tracking Strategy

- Intelligent Volatility Range Trading Strategy Combining Bollinger Bands and SuperTrend

- Multi-Indicator Synergistic Trend Following Strategy with Dynamic Stop-Loss System

- Bollinger Bands Momentum Breakout Adaptive Trend Following Strategy

- Enhanced Mean Reversion Strategy with MACD-ATR Implementation