Multi-EMA Crossover Momentum Trend Following Strategy

Author: ChaoZhang, Date: 2024-12-12 14:46:33Tags: EMAMA

Overview

This strategy is a trend-following system based on multiple Exponential Moving Averages (EMAs). It identifies market trends by calculating the averages of short-term and long-term EMA groups and generates trading signals at crossovers. The strategy incorporates take-profit and stop-loss mechanisms to control risk and secure profits.

Strategy Principles

The strategy employs 6 short-term EMAs (3, 5, 8, 10, 12, 15 periods) and 6 long-term EMAs (30, 35, 40, 45, 50, 60 periods). By averaging these EMAs separately, it creates smoother short-term and long-term trend indicators. Long positions are initiated when the short-term average crosses above the long-term average, while short positions are taken when the short-term average crosses below. Each trade is managed with a 10% take-profit and 5% stop-loss level.

Strategy Advantages

- Multiple EMAs reduce false signals that might occur with single moving averages, improving signal reliability

- Averaging multiple EMAs helps filter market noise and capture major trends more effectively

- Clear take-profit and stop-loss settings ensure effective risk control while securing profits

- Simple and clear strategy logic makes it easy to understand and implement

- Bilateral trading capability allows profit opportunities in both upward and downward markets

Strategy Risks

- May generate frequent false breakout signals in ranging markets, leading to consecutive losses

- Moving average systems have inherent lag, potentially missing trend beginnings or maintaining positions after trend endings

- Fixed percentage take-profit and stop-loss levels may not be suitable for all market conditions

- In highly volatile markets, positions might be stopped out before market reversals

Strategy Optimization Directions

- Incorporate volatility indicators to adjust take-profit and stop-loss levels dynamically

- Add volume confirmation indicators to improve signal reliability

- Dynamically adjust EMA parameters based on different market conditions

- Implement trend strength filters to trade only in strong trend environments

- Consider adding market sentiment indicators to optimize entry timing

Summary

This is a well-structured trend-following strategy that provides relatively reliable trading signals through the combination of multiple EMAs. While it carries some inherent lag risks, the overall performance can be further enhanced through appropriate take-profit and stop-loss settings and the suggested optimization directions. The strategy is particularly suitable for markets exhibiting clear trends.

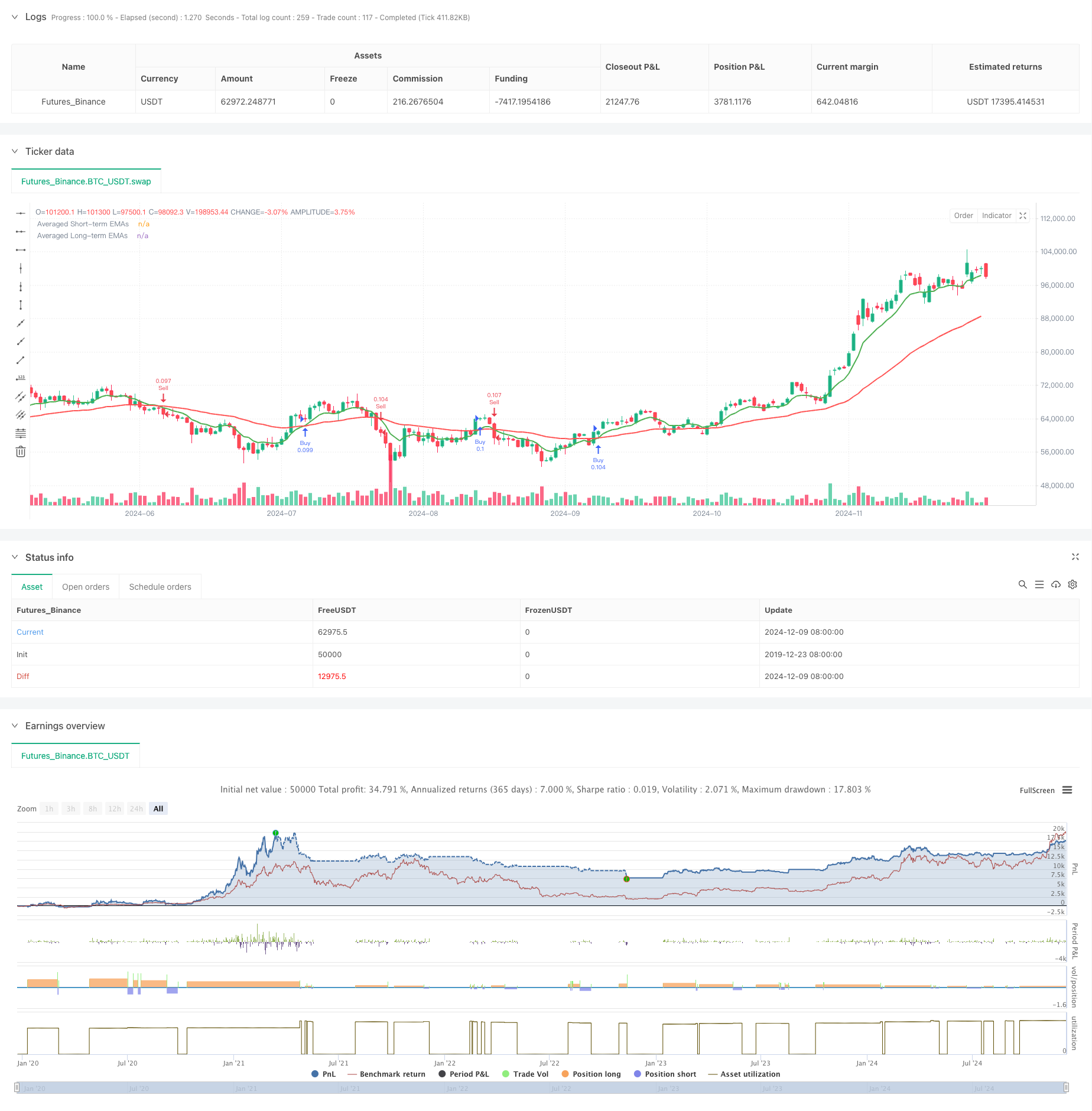

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Pavan Guppy Strategy", shorttitle="Pavan Avg", overlay=true,

default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Short-term EMAs

shortEMA1 = ta.ema(close, 3)

shortEMA2 = ta.ema(close, 5)

shortEMA3 = ta.ema(close, 8)

shortEMA4 = ta.ema(close, 10)

shortEMA5 = ta.ema(close, 12)

shortEMA6 = ta.ema(close, 15)

// Long-term EMAs

longEMA1 = ta.ema(close, 30)

longEMA2 = ta.ema(close, 35)

longEMA3 = ta.ema(close, 40)

longEMA4 = ta.ema(close, 45)

longEMA5 = ta.ema(close, 50)

longEMA6 = ta.ema(close, 60)

// Average short-term EMAs

shortAvg = (shortEMA1 + shortEMA2 + shortEMA3 + shortEMA4 + shortEMA5 + shortEMA6) / 6.0

// Average long-term EMAs

longAvg = (longEMA1 + longEMA2 + longEMA3 + longEMA4 + longEMA5 + longEMA6) / 6.0

// Plot averaged EMAs

plot(shortAvg, color=color.green, linewidth=2, title="Averaged Short-term EMAs")

plot(longAvg, color=color.red, linewidth=2, title="Averaged Long-term EMAs")

// Define the target and stop loss percentages

takeProfitPerc = 10

stopLossPerc = 5

// Generate buy signal when shortAvg crosses above longAvg

if ta.crossover(shortAvg, longAvg)

strategy.entry("Buy", strategy.long)

// Generate sell signal when shortAvg crosses below longAvg

if ta.crossunder(shortAvg, longAvg)

strategy.entry("Sell", strategy.short)

// Calculate take profit and stop loss prices for long trades

longTakeProfit = close * (1 + (takeProfitPerc / 100.0))

longStopLoss = close * (1 - (stopLossPerc / 100.0))

// Set take profit and stop loss for long positions

strategy.exit("Take Profit/Stop Loss", from_entry="Buy", limit=longTakeProfit, stop=longStopLoss)

// Calculate take profit and stop loss prices for short trades

shortTakeProfit = close * (1 - takeProfitPerc / 100.0)

shortStopLoss = close * (1 + stopLossPerc / 100.0)

// Set take profit and stop loss for short positions

strategy.exit("Take Profit/Stop Loss", from_entry="Sell", limit=shortTakeProfit, stop=shortStopLoss)

- Cross-Market Overnight Position Strategy with EMA Filter

- EMA Dual Moving Average Crossover Strategy

- EMA Momentum Trading Strategy

- Triple EMA Crossover Trading Strategy with Dynamic Stop-Loss and Take-Profit

- Multi-EMA Automated Trading System with Trailing Profit Lock

- MACD Crossover Strategy

- Triple EMA Trend Following Quantitative Trading Strategy

- Multi-Timeframe EMA Trend Strategy with Daily High-Low Breakout System

- Multi-EMA Crossover Trend Following Quantitative Trading Strategy

- Dual Chain Hybrid Momentum EMA Tracking Trading System

- Multi-EMA Trend Following Strategy with SMMA Confirmation

- Multi-Indicator Trend Trading System with Momentum Analysis Strategy

- Trend-Following Cloud Momentum Divergence Strategy

- Multi-Indicator Trend Following and Volatility Breakout Strategy

- Multi-Market Adaptive Multi-Indicator Trend Following Strategy

- Dynamic Timing and Position Management Strategy Based on Volatility

- EMA-MACD Composite Strategy for Trend Scalping

- Multi-Technical Indicator Based Trend Following and Momentum Strategy

- High-Frequency Quantitative Session Trading Strategy: Adaptive Dynamic Position Management System Based on Breakout Signals

- Enhanced Bollinger Breakout Quantitative Strategy with Momentum Filter Integration System

- Multi-Target Intelligent Volume Momentum Trading Strategy

- Multi-Period Bollinger Bands Touch Trend Reversal Quantitative Trading Strategy

- High-Frequency Breakout Trading Strategy Based on Candlestick Close Direction

- Advanced Dynamic Fibonacci Retracement Trend Quantitative Trading Strategy

- Variable Index Dynamic Average Multi-Tier Profit Trend Following Strategy

- Multi Moving Average Trading System with Momentum and Volume Confirmation Quantitative Trend Strategy

- Adaptive Trailing Drawdown Balanced Trading Strategy with Take-Profit and Stop-Loss

- Enhanced Trend Following System: Dynamic Trend Identification Based on ADX and Parabolic SAR

- Dual Timeframe Stochastic Momentum Trading Strategy

- Adaptive Bollinger Bands Dynamic Position Management Strategy