Multi-Timeframe Trend Dynamic ATR Tracking Strategy

Author: ChaoZhang, Date: 2024-12-12 16:24:49Tags: EMARSIMACDATR

Overview

This strategy is an adaptive trend following system that combines multiple technical indicators. It optimizes trading performance through multi-timeframe analysis and dynamic adjustment of stop-loss and take-profit levels. The core of the strategy uses a moving average system to identify trends, RSI and MACD to confirm trend strength, and ATR for dynamic risk management parameter adjustment.

Strategy Principles

The strategy employs a triple verification mechanism for trading: 1) Trend direction is determined by fast/slow EMA crossovers; 2) Trading signals are filtered using RSI overbought/oversold levels and MACD trend confirmation; 3) Higher timeframe EMA is incorporated for trend confirmation. For risk control, the strategy dynamically adjusts stop-loss and profit targets based on ATR, achieving adaptive position management. When market volatility increases, the system automatically expands stop-loss and profit spaces; when markets stabilize, these parameters are narrowed to improve win rates.

Strategy Advantages

- Multi-dimensional signal verification mechanism significantly improves trading accuracy

- Adaptive stop-loss and take-profit settings better accommodate different market environments

- Higher timeframe trend confirmation effectively reduces false breakout risks

- Comprehensive alert system helps capture trading opportunities and risk control timely

- Flexible trading direction settings allow strategy adaptation to different trading preferences

Strategy Risks

- Multiple verification mechanisms may miss opportunities in rapid market movements

- Dynamic stop-loss might trigger prematurely in highly volatile markets

- False signals may occur frequently in range-bound markets

- Risk of overfitting during parameter optimization

- Multi-timeframe analysis may produce conflicting signals across different timeframes

Optimization Directions

- Incorporate volume indicators as auxiliary confirmation to improve signal reliability

- Develop a quantitative trend strength scoring system to optimize entry timing

- Implement adaptive parameter optimization mechanisms to enhance strategy stability

- Add market environment classification system to apply different parameters for different markets

- Develop dynamic position management system to adjust position size based on signal strength

Summary

This is a rigorously designed trend following system that provides a comprehensive trading solution through multi-level verification mechanisms and dynamic risk management. The strategy’s core strengths lie in its adaptability and risk control capabilities, but attention must be paid to parameter optimization and market environment matching during implementation. Through continuous optimization and refinement, this strategy has the potential to maintain stable performance across different market environments.

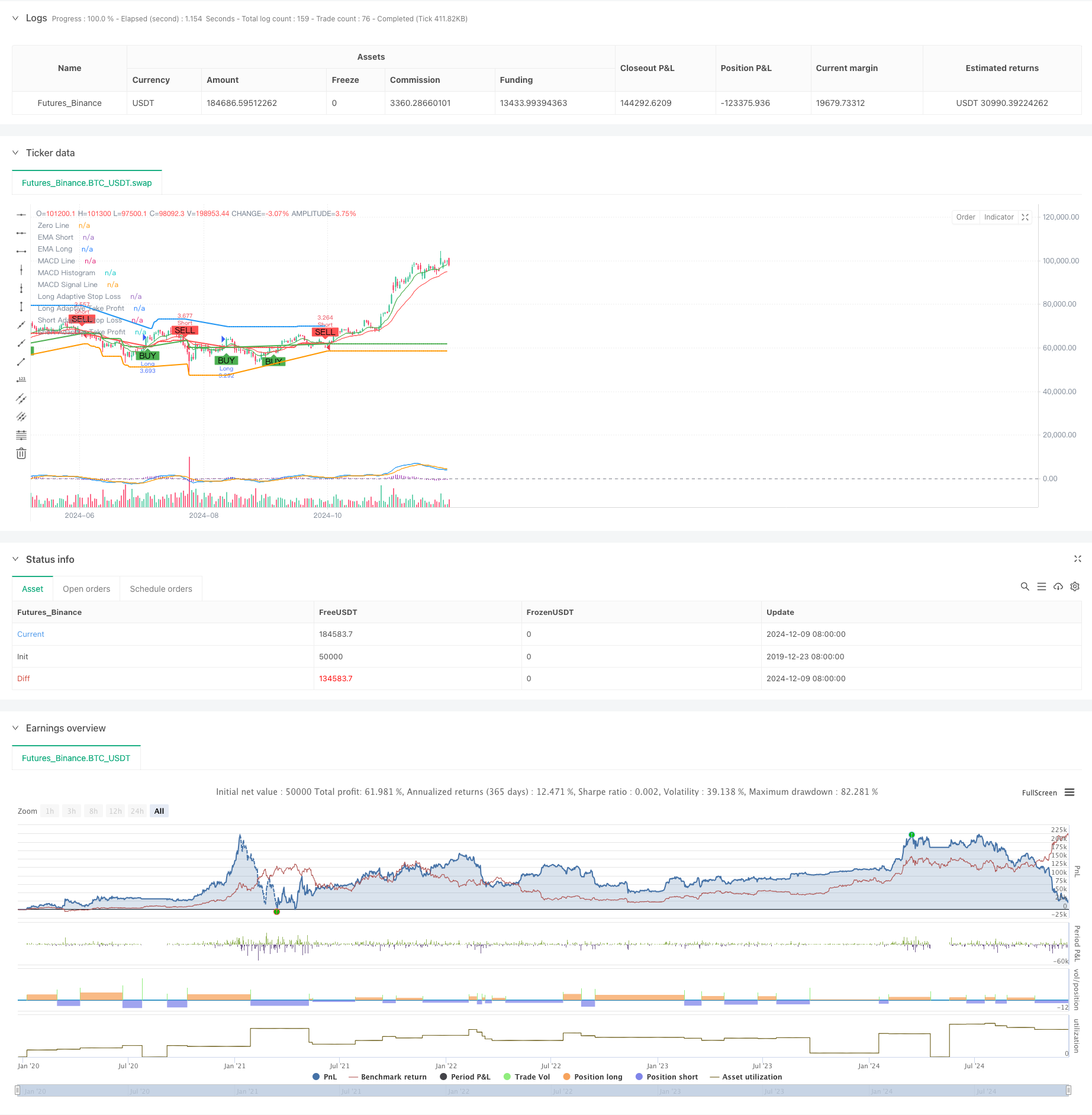

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("TrenGuard Adaptive ATR Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Parameters

emaShortPeriod = input.int(9, title="Short EMA Period", minval=1)

emaLongPeriod = input.int(21, title="Long EMA Period", minval=1)

rsiPeriod = input.int(14, title="RSI Period", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought", minval=50)

rsiOversold = input.int(30, title="RSI Oversold", minval=1)

atrPeriod = input.int(14, title="ATR Period", minval=1)

atrMultiplierSL = input.float(2.0, title="ATR Multiplier for Stop-Loss", minval=0.1)

atrMultiplierTP = input.float(2.0, title="ATR Multiplier for Take-Profit", minval=0.1)

// Multi-timeframe settings

htfEMAEnabled = input.bool(true, title="Use Higher Timeframe EMA Confirmation?", inline="htf")

htfEMATimeframe = input.timeframe("D", title="Higher Timeframe", inline="htf")

// MACD Parameters

macdShortPeriod = input.int(12, title="MACD Short Period", minval=1)

macdLongPeriod = input.int(26, title="MACD Long Period", minval=1)

macdSignalPeriod = input.int(9, title="MACD Signal Period", minval=1)

// Select trade direction

tradeDirection = input.string("Both", title="Trade Direction", options=["Both", "Long", "Short"])

// Calculating indicators

emaShort = ta.ema(close, emaShortPeriod)

emaLong = ta.ema(close, emaLongPeriod)

rsiValue = ta.rsi(close, rsiPeriod)

atrValue = ta.atr(atrPeriod)

[macdLine, macdSignalLine, _] = ta.macd(close, macdShortPeriod, macdLongPeriod, macdSignalPeriod)

// Higher timeframe EMA confirmation

htfEMALong = request.security(syminfo.tickerid, htfEMATimeframe, ta.ema(close, emaLongPeriod))

// Trading conditions

longCondition = ta.crossover(emaShort, emaLong) and rsiValue < rsiOverbought and (not htfEMAEnabled or close > htfEMALong) and macdLine > macdSignalLine

shortCondition = ta.crossunder(emaShort, emaLong) and rsiValue > rsiOversold and (not htfEMAEnabled or close < htfEMALong) and macdLine < macdSignalLine

// Initial Stop-Loss and Take-Profit levels based on ATR

var float adaptiveStopLoss = na

var float adaptiveTakeProfit = na

if (strategy.position_size > 0) // Long Position

if (longCondition) // Trend Confirmation

adaptiveStopLoss := na(adaptiveStopLoss) ? close - atrValue * atrMultiplierSL : math.max(adaptiveStopLoss, close - atrValue * atrMultiplierSL)

adaptiveTakeProfit := na(adaptiveTakeProfit) ? close + atrValue * atrMultiplierTP : math.max(adaptiveTakeProfit, close + atrValue * atrMultiplierTP)

else

adaptiveStopLoss := na(adaptiveStopLoss) ? close - atrValue * atrMultiplierSL : math.max(adaptiveStopLoss, close - atrValue * atrMultiplierSL)

adaptiveTakeProfit := na(adaptiveTakeProfit) ? close + atrValue * atrMultiplierTP : math.max(adaptiveTakeProfit, close + atrValue * atrMultiplierTP)

if (strategy.position_size < 0) // Short Position

if (shortCondition) // Trend Confirmation

adaptiveStopLoss := na(adaptiveStopLoss) ? close + atrValue * atrMultiplierSL : math.min(adaptiveStopLoss, close + atrValue * atrMultiplierSL)

adaptiveTakeProfit := na(adaptiveTakeProfit) ? close - atrValue * atrMultiplierTP : math.min(adaptiveTakeProfit, close - atrValue * atrMultiplierTP)

else

adaptiveStopLoss := na(adaptiveStopLoss) ? close + atrValue * atrMultiplierSL : math.min(adaptiveStopLoss, close + atrValue * atrMultiplierSL)

adaptiveTakeProfit := na(adaptiveTakeProfit) ? close - atrValue * atrMultiplierTP : math.min(adaptiveTakeProfit, close - atrValue * atrMultiplierTP)

// Strategy Entry

if (longCondition and (tradeDirection == "Both" or tradeDirection == "Long"))

strategy.entry("Long", strategy.long)

if (shortCondition and (tradeDirection == "Both" or tradeDirection == "Short"))

strategy.entry("Short", strategy.short)

// Strategy Exit

if (strategy.position_size > 0) // Long Position

strategy.exit("Exit Long", "Long", stop=adaptiveStopLoss, limit=adaptiveTakeProfit, when=shortCondition)

if (strategy.position_size < 0) // Short Position

strategy.exit("Exit Short", "Short", stop=adaptiveStopLoss, limit=adaptiveTakeProfit, when=longCondition)

// Plotting EMAs

plot(emaShort, title="EMA Short", color=color.green)

plot(emaLong, title="EMA Long", color=color.red)

// Plotting MACD

hline(0, "Zero Line", color=color.gray)

plot(macdLine - macdSignalLine, title="MACD Histogram", color=color.purple, style=plot.style_histogram)

plot(macdLine, title="MACD Line", color=color.blue)

plot(macdSignalLine, title="MACD Signal Line", color=color.orange)

// Plotting Buy/Sell signals with distinct colors

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Plotting Trailing Stop-Loss and Take-Profit levels with distinct colors

plot(strategy.position_size > 0 ? adaptiveStopLoss : na, title="Long Adaptive Stop Loss", color=color.red, linewidth=2, style=plot.style_line)

plot(strategy.position_size < 0 ? adaptiveStopLoss : na, title="Short Adaptive Stop Loss", color=color.green, linewidth=2, style=plot.style_line)

plot(strategy.position_size > 0 ? adaptiveTakeProfit : na, title="Long Adaptive Take Profit", color=color.blue, linewidth=2, style=plot.style_line)

plot(strategy.position_size < 0 ? adaptiveTakeProfit : na, title="Short Adaptive Take Profit", color=color.orange, linewidth=2, style=plot.style_line)

// Alert conditions for entry signals

alertcondition(longCondition and (tradeDirection == "Both" or tradeDirection == "Long"), title="Long Signal", message="Long signal triggered: BUY")

alertcondition(shortCondition and (tradeDirection == "Both" or tradeDirection == "Short"), title="Short Signal", message="Short signal triggered: SELL")

// Alert conditions for exit signals

alertcondition(strategy.position_size > 0 and shortCondition, title="Exit Long Signal", message="Exit long position: SELL")

alertcondition(strategy.position_size < 0 and longCondition, title="Exit Short Signal", message="Exit short position: BUY")

// Alert conditions for reaching take-profit levels

alertcondition(strategy.position_size > 0 and close >= adaptiveTakeProfit, title="Take Profit Long Signal", message="Take profit level reached for long position")

alertcondition(strategy.position_size < 0 and close <= adaptiveTakeProfit, title="Take Profit Short Signal", message="Take profit level reached for short position")

- Multi-Indicator High Leverage Short-Term Trading Strategy

- Multi-Indicator Comprehensive Momentum Trading Strategy

- Enhanced EMA Crossover Strategy with RSI/MACD/ATR

- MACD Valley Detector Strategy

- Multi-Timeframe Market Momentum Crossover Strategy

- Multi-Indicator Trend Following Dynamic Risk Management Strategy

- EMA/MACD/RSI Crossover Strategy

- Dual EMA Trend Momentum Trading Strategy

- Golden Momentum Capture Strategy: Multi-Timeframe Exponential Moving Average Crossover System

- Multi-EMA Trend Following Strategy with Dynamic ATR Targets

- Multi-Equilibrium Price Trend Following and Reversal Trading Strategy

- Dynamic Volatility Index (VIDYA) with ATR Trend-Following Reversal Strategy

- Multi-Indicator Adaptive Trading Strategy Based on RSI, MACD and Volume

- Price Pattern Based Double Bottom and Top Automated Trading Strategy

- Dynamic ATR Trend Following Strategy Based on Support Breakout

- Multiple Moving Average and Stochastic Oscillator Crossover Quantitative Strategy

- Adaptive Trend Following and Reversal Detection Strategy: A Quantitative Trading System Based on ZigZag and Aroon Indicators

- Multi-Indicator Synergistic Trading Strategy with Bollinger Bands, Fibonacci, MACD and RSI

- Mean Reversion Bollinger Band Dollar-Cost Averaging Investment Strategy

- Multi-dimensional Gold Friday Anomaly Strategy Analysis System

- Moving Average Crossover with RSI Trend Momentum Tracking Strategy

- Dynamic ATR-based Trailing Stop Trading Strategy

- Momentum Trend Following MACD-RSI Dual Confirmation Trading Strategy

- Dynamic Pivot Points with Golden Cross Optimization System

- Multi-Indicator Trend Following Strategy with Bollinger Bands and ATR Dynamic Stop Loss

- Dynamic Trend Following ATR Multi-Period Trading Strategy

- Multi-Indicator Trend Following Strategy with Dynamic Channel and Moving Average Trading System

- Multi-EMA Trend Following Strategy with SMMA Confirmation

- Multi-Indicator Trend Trading System with Momentum Analysis Strategy

- Trend-Following Cloud Momentum Divergence Strategy