Multi-Wave Trend Crossing Risk Management Quantitative Strategy

Author: ChaoZhang, Date: 2024-12-13 10:51:31Tags: EMASMA

Overview

This strategy is a quantitative trading system based on the WaveTrend indicator, incorporating dynamic risk management mechanisms. The strategy calculates trend strength through price fluctuations, filters signals in overbought and oversold regions, and applies risk control measures including stop-loss, take-profit, and trailing stop mechanisms.

Strategy Principles

The core of the strategy lies in calculating the WaveTrend indicator using HLC3 prices. It first computes an n1-period exponential moving average (EMA) as a baseline, then calculates price deviations from this baseline, normalizing them with a 0.015 coefficient. This results in two wave lines, wt1 and wt2, representing fast and slow lines respectively. Trading signals are generated based on these lines crossing overbought and oversold levels, combined with a multi-layered risk control system.

Strategy Advantages

- The signal system demonstrates excellent trend-following capabilities with enhanced reliability through dual overbought/oversold levels

- Comprehensive risk management system including fixed stop-loss, take-profit, and dynamic trailing stop

- Highly adjustable parameters for optimization across different market conditions

- Incorporates volatility-adaptive mechanisms for improved adaptability

- Layered signal system design effectively reduces the impact of false signals

Strategy Risks

- Frequent stop-losses may occur in highly volatile markets

- Improper parameter settings can lead to excessive trading costs

- May generate excessive false signals in ranging markets

- Requires careful calibration of stop-loss and take-profit ratios to maintain risk-reward balance

- Trailing stops might result in significant drawdowns during quick market reversals

Optimization Directions

- Incorporate volume indicators for signal confirmation to enhance trading reliability

- Optimize trailing stop parameters for better adaptation to various market conditions

- Add trend strength filters to reduce trading frequency in ranging markets

- Consider implementing dynamic stop-loss mechanisms that automatically adjust based on market volatility

- Introduce time filters to avoid entering positions during unfavorable trading periods

Summary

This strategy achieves a comprehensive quantitative trading approach by combining the WaveTrend indicator with a robust risk management system. Its core strengths lie in its adaptability and controlled risk exposure, though traders need to optimize parameters and improve the strategy based on actual market conditions. Through continuous optimization and refinement, this strategy shows promise for achieving stable returns in real trading environments.

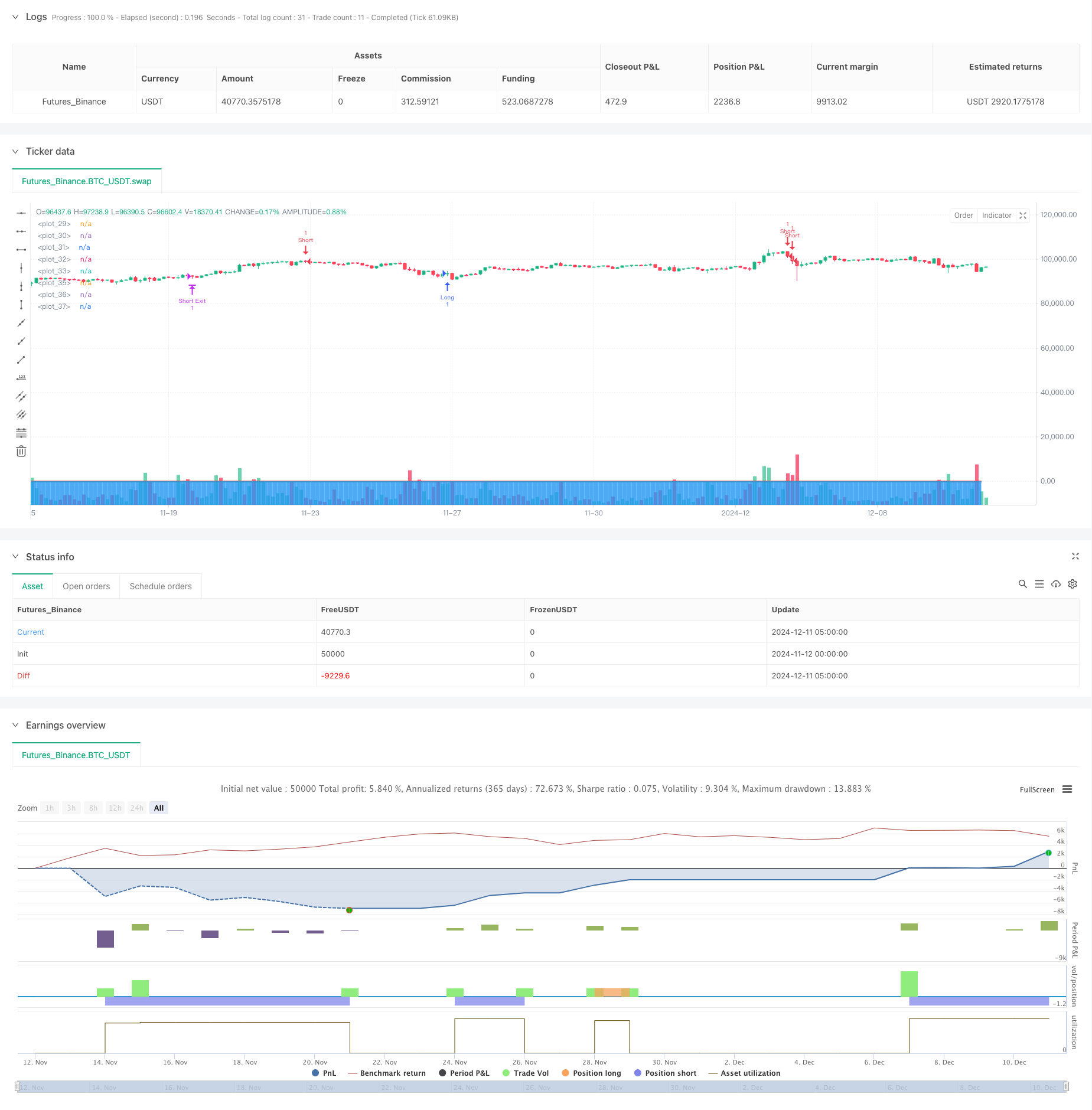

/*backtest

start: 2024-11-12 00:00:00

end: 2024-12-11 08:00:00

period: 3h

basePeriod: 3h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="WaveTrend [LazyBear] with Risk Management", shorttitle="WT_LB_RM", overlay=true)

// Input Parameters

n1 = input.int(10, "Channel Length")

n2 = input.int(21, "Average Length")

obLevel1 = input.int(60, "Over Bought Level 1")

obLevel2 = input.int(53, "Over Bought Level 2")

osLevel1 = input.int(-60, "Over Sold Level 1")

osLevel2 = input.int(-53, "Over Sold Level 2")

// Risk Management Inputs

stopLossPercent = input.float(50.0, "Stop Loss (%)", minval=0.1, maxval=100)

takeProfitPercent = input.float(5.0, "Take Profit (%)", minval=0.1, maxval=100)

trailingStopPercent = input.float(3.0, "Trailing Stop (%)", minval=0.1, maxval=100)

trailingStepPercent = input.float(2.0, "Trailing Stop Step (%)", minval=0.1, maxval=100)

// WaveTrend Calculation

ap = hlc3

esa = ta.ema(ap, n1)

d = ta.ema(math.abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ta.ema(ci, n2)

wt1 = tci

wt2 = ta.sma(wt1, 4)

// Plotting Original Indicators

plot(0, color=color.gray)

plot(obLevel1, color=color.red)

plot(osLevel1, color=color.green)

plot(obLevel2, color=color.red, style=plot.style_line)

plot(osLevel2, color=color.green, style=plot.style_line)

plot(wt1, color=color.green)

plot(wt2, color=color.red, style=plot.style_line)

plot(wt1-wt2, color=color.blue, style=plot.style_area, transp=80)

// Buy and Sell Signals with Risk Management

longCondition = ta.crossover(wt1, osLevel1) or ta.crossover(wt1, osLevel2)

shortCondition = ta.crossunder(wt1, obLevel1) or ta.crossunder(wt1, obLevel2)

// Strategy Entry with Risk Management

if (longCondition)

entryPrice = close

stopLossPrice = entryPrice * (1 - stopLossPercent/100)

takeProfitPrice = entryPrice * (1 + takeProfitPercent/100)

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", "Long",

stop=stopLossPrice,

limit=takeProfitPrice,

trail_price=close * (1 + trailingStopPercent/100),

trail_offset=close * (trailingStepPercent/100))

if (shortCondition)

entryPrice = close

stopLossPrice = entryPrice * (1 + stopLossPercent/100)

takeProfitPrice = entryPrice * (1 - takeProfitPercent/100)

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", "Short",

stop=stopLossPrice,

limit=takeProfitPrice,

trail_price=close * (1 - trailingStopPercent/100),

trail_offset=close * (trailingStepPercent/100))

- Multi-EMA Crossover Momentum Strategy

- EMA, SMA, Moving Average Crossover, Momentum Indicator

- Multi-EMA Trend Momentum Recognition and Stop-Loss Trading System

- EMA Crossover Momentum Scalping Strategy

- SMA Dual Moving Average Crossover Strategy

- Trading ABC

- Dual EMA Volume Trend Confirmation Strategy for Quantitative Trading

- EMA5 and EMA13 Crossover Strategy

- Advanced Quantitative Trend Following and Cloud Reversal Composite Trading Strategy

- Super Moving Average and Upperband Crossover Strategy

- Dynamic Dual Supertrend Volume-Price Strategy

- Black Swan Volatility and Moving Average Crossover Momentum Tracking Strategy

- Intelligent Volatility Range Trading Strategy Combining Bollinger Bands and SuperTrend

- Multi-Indicator Synergistic Trend Following Strategy with Dynamic Stop-Loss System

- Bollinger Bands Momentum Breakout Adaptive Trend Following Strategy

- Enhanced Mean Reversion Strategy with MACD-ATR Implementation

- Quantitative Trading Signal Tracking and Multi-Exit Strategy Optimization System

- Dual Moving Average and MACD Combined Trend Following Dynamic Take Profit Smart Trading System

- Triple Standard Deviation Bollinger Bands Breakout Strategy with 100-Day Moving Average Optimization

- Dynamic EMA Trend Crossover Entry Quantitative Strategy

- Dual EMA Stochastic Trend Following Trading Strategy

- Dynamic Trend Following Multi-Period Moving Average Crossover Strategy

- Dual Momentum Breakthrough Confirmation Quantitative Trading Strategy

- MACD-RSI Trend Momentum Cross Strategy with Risk Management Model

- Multi-Period EMA Crossover with RSI Momentum and ATR Volatility Based Trend Following Strategy

- Dual EMA Crossover Strategy with Smart Risk-Reward Control

- Multi-Moving Average Trend Following Strategy - Long-term Investment Signal System Based on EMA and SMA Indicators

- Historical High Breakthrough with Monthly Moving Average Filter Trend Following Strategy

- Multi-Equilibrium Price Trend Following and Reversal Trading Strategy

- Dynamic Volatility Index (VIDYA) with ATR Trend-Following Reversal Strategy