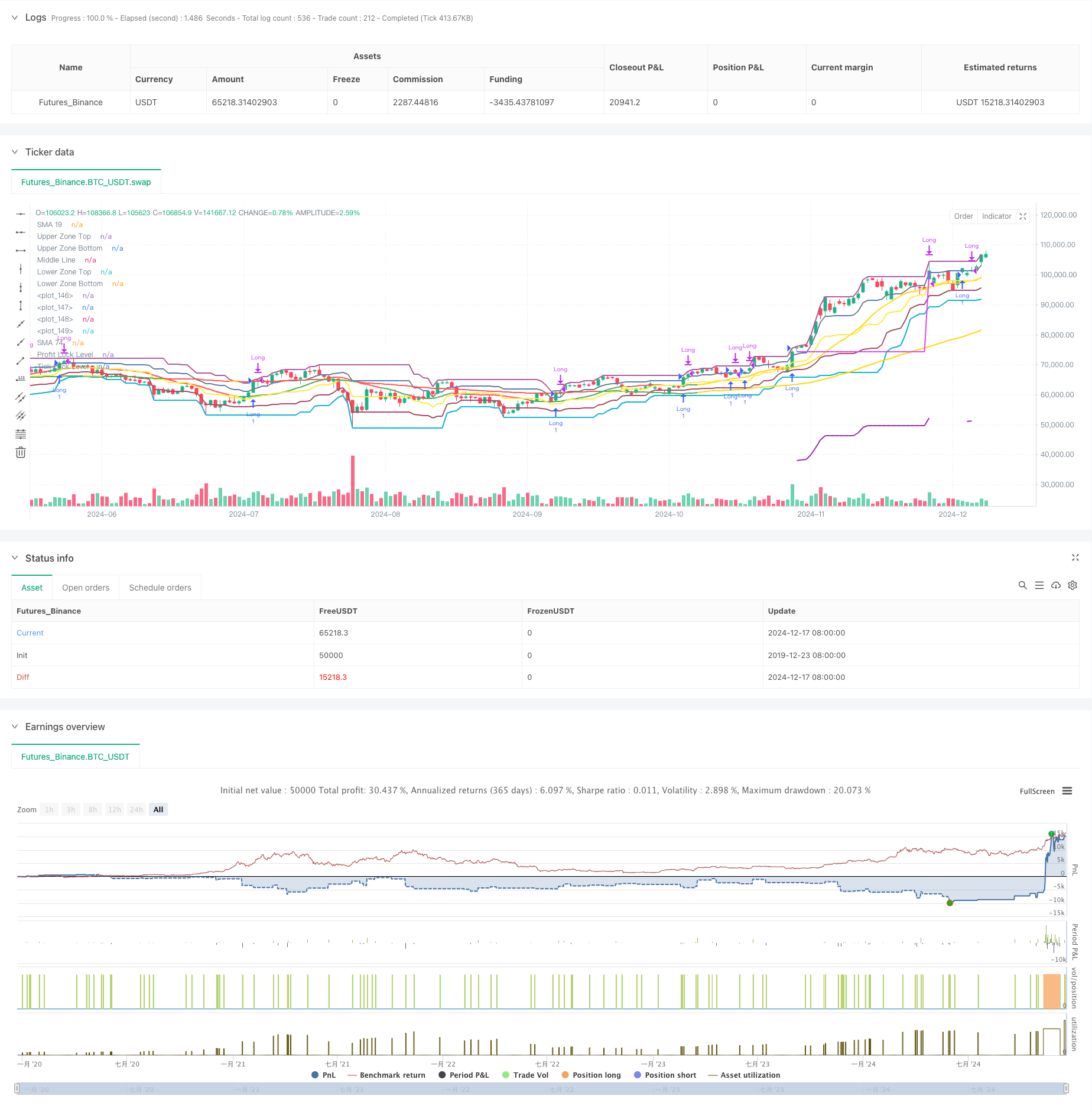

Multi-SMA Zone Breakout with Dynamic Profit Lock Quantitative Trading Strategy

Author: ChaoZhang, Date: 2024-12-20 16:28:54Tags: SMA

Overview

This is a dynamic trend-following trading strategy based on SMA indicators, combining price zones, stochastic indicators, and multiple profit protection mechanisms. The strategy monitors price movements across different zones, integrates short-term and long-term moving average crossover signals, and uses stochastic indicators to determine market conditions and trend strength for efficient trend capture. The strategy incorporates both percentage-based and fixed-point profit-taking mechanisms to effectively balance returns and risks.

Strategy Principles

The core logic includes several key components: 1. Uses 19-period and 74-period SMAs to build trend framework 2. Employs 60-period stochastic indicator to judge market conditions, categorizing SMA colors into yellow, green, red, and orange states 3. Divides price zones into 5 important levels for determining price strength 4. Entry conditions require: - SMA in green or yellow state - Price breakout above orange zone - Closing price above short-term SMA 5. Implements two profit-taking mechanisms: - Percentage-based drawdown protection from highest price - Fixed-point profit lock

Strategy Advantages

- Multiple confirmation mechanisms reduce false signals

- Dynamic zone division adapts to different market environments

- Dual profit-taking mechanisms provide better risk control

- Clear market state classification helps capture market rhythm

- Real-time trade status monitoring facilitates strategy debugging

- Combines technical indicators with price action analysis

Strategy Risks

- May generate excessive trades in ranging markets

- Fixed-point profit taking might miss larger trends

- Parameter optimization can lead to overfitting

- Potential profit loss during rapid market reversals

- Multiple confirmation conditions might miss some trading opportunities Solutions:

- Add volatility filters

- Dynamically adjust profit-taking parameters

- Enhance market environment recognition

- Optimize exit timing decisions

Strategy Optimization Directions

- Introduce volatility indicators for dynamic parameter adjustment

- Adapt profit-taking conditions based on market state

- Add volume confirmation mechanism

- Incorporate trend strength filters

- Optimize zone division method considering market characteristics

- Enhance risk management mechanisms, including:

- Daily stop loss

- Maximum drawdown control

- Position holding time limits

Summary

The strategy constructs a comprehensive trading system through the integrated use of multiple technical indicators and price action analysis methods. Its strengths lie in multiple confirmation mechanisms and flexible profit-taking systems, while attention must be paid to the impact of market environment on strategy performance. Through continuous optimization and improved risk management, the strategy shows potential for maintaining stable performance across different market conditions.

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="SMA Color Strategy",

overlay=true,

initial_capital=10000,

max_bars_back=5000,

max_labels_count=500,

max_boxes_count=500,

default_qty_type=strategy.fixed,

default_qty_value=1,

currency=currency.NONE,

process_orders_on_close=true)

// === INPUTS ===

zoneLength = input.int(20, "Price Zone Length", minval=5)

profitLockPct = input.float(50, "Profit Lock Percentage", minval=1, maxval=100, step=5) / 100

ticksToLock = input.int(12, "Ticks to Activate Lock", minval=1, tooltip="Number of ticks price must move up to activate tick-based lock")

ticksToSecure = input.int(10, "Ticks to Secure", minval=1, tooltip="Number of ticks to lock in once activated")

// Calculate tick values

tickSize = syminfo.mintick

ticksToLockPoints = ticksToLock * tickSize

ticksToSecurePoints = ticksToSecure * tickSize

// Calculate price zones

h = ta.highest(high, zoneLength)

l = ta.lowest(low, zoneLength)

priceRange = h - l

lvl5 = h

lvl4 = l + (priceRange * 0.75) // Orange line

lvl3 = l + (priceRange * 0.50) // Yellow line

lvl2 = l + (priceRange * 0.25) // Green line

lvl1 = l

// Calculate SMAs

sma19 = ta.sma(close, 19)

sma74 = ta.sma(close, 74)

// Stochastic calculation for color logic

k = ta.stoch(close, high, low, 60)

d = ta.sma(k, 10)

// SMA Color Logic with state tracking

var color currentSMAColor = color.orange

var color previousSMAColor = color.orange

var string currentColorName = "ORANGE"

var string previousColorName = "ORANGE"

smaColor = if d >= 80 or d <= 20

color.rgb(255, 215, 0)

else if d > d[1]

color.green

else if d < d[1]

color.red

else

color.orange

// Update color state and names

if smaColor != currentSMAColor

previousSMAColor := currentSMAColor

currentSMAColor := smaColor

previousColorName := currentColorName

currentColorName := if smaColor == color.rgb(255, 215, 0)

"YELLOW"

else if smaColor == color.green

"GREEN"

else if smaColor == color.red

"RED"

else

"ORANGE"

// Color logic for SMA74

sma74Color = if smaColor == color.rgb(255, 215, 0)

color.rgb(255, 215, 0)

else if sma74 < sma19

color.green

else

color.red

// === ENTRY CONDITIONS ===

smaIsGreen = smaColor == color.green

greenCandle = close > open

candleAboveOrange = close > lvl4

candleAboveSMA = close > sma19

crossedAboveOrange = ta.crossover(close, lvl4)

smaIsYellow = smaColor == color.rgb(255, 215, 0)

longCondition1 = smaIsGreen and greenCandle and candleAboveOrange and candleAboveSMA and crossedAboveOrange

longCondition2 = smaIsYellow and crossedAboveOrange and candleAboveSMA

// === PROFIT LOCK SYSTEM ===

var float entryPrice = na

var float maxPrice = na

var float profitLockLevel = na

var bool tickLockActivated = false

var float tickBasedLockLevel = na

// Reset variables on new trade entry

if (longCondition1 or longCondition2)

entryPrice := close

maxPrice := close

profitLockLevel := close * (1 - profitLockPct)

tickLockActivated := false

tickBasedLockLevel := na

// Update maximum price and profit locks when in a trade

if strategy.position_size > 0

maxPrice := math.max(maxPrice, high)

profitLockLevel := math.max(profitLockLevel, maxPrice * (1 - profitLockPct))

// Check if price has moved up enough to activate tick-based lock

if not tickLockActivated and (maxPrice - entryPrice) >= ticksToLockPoints

tickLockActivated := true

tickBasedLockLevel := entryPrice + ticksToSecurePoints

// === EXIT CONDITIONS ===

exitOnYellowLine = close < lvl3

exitOnProfitLock = low < profitLockLevel and strategy.position_size > 0

exitOnTickLock = tickLockActivated and low < tickBasedLockLevel

// === TRADE MANAGEMENT ===

if (longCondition1 or longCondition2)

strategy.entry("Long", strategy.long)

if strategy.position_size > 0

if exitOnYellowLine

strategy.close("Long", comment="Close below yellow")

if exitOnProfitLock

strategy.close("Long", comment="Profit lock triggered")

if exitOnTickLock

strategy.close("Long", comment="Tick-based lock triggered")

// Plot indicators

plot(sma19, "SMA 19", color=smaColor, linewidth=2)

plot(sma74, "SMA 74", color=sma74Color, linewidth=2)

plot(lvl5, "Upper Zone Top", color=color.red, linewidth=2)

plot(lvl4, "Upper Zone Bottom", color=color.orange, linewidth=2)

plot(lvl3, "Middle Line", color=color.yellow, linewidth=2)

plot(lvl2, "Lower Zone Top", color=color.green, linewidth=2)

plot(lvl1, "Lower Zone Bottom", color=color.blue, linewidth=2)

// Plot profit lock levels

plot(strategy.position_size > 0 ? profitLockLevel : na, "Profit Lock Level", color=color.purple, style=plot.style_linebr, linewidth=2)

plot(strategy.position_size > 0 and tickLockActivated ? tickBasedLockLevel : na, "Tick Lock Level", color=color.fuchsia, style=plot.style_linebr, linewidth=2)

// Fill zones

var p1 = plot(lvl5, display=display.none)

var p2 = plot(lvl4, display=display.none)

var p3 = plot(lvl2, display=display.none)

var p4 = plot(lvl1, display=display.none)

fill(p1, p2, color=color.new(color.red, 90))

fill(p3, p4, color=color.new(color.green, 90))

// Debug Table

if barstate.islast

var table debugTable = table.new(position.top_right, 2, 13, bgcolor=color.new(color.black, 70), frame_width=1)

table.cell(debugTable, 0, 0, "Current Color", text_color=color.white)

table.cell(debugTable, 1, 0, currentColorName, text_color=currentSMAColor)

table.cell(debugTable, 0, 1, "Previous Color", text_color=color.white)

table.cell(debugTable, 1, 1, previousColorName, text_color=previousSMAColor)

table.cell(debugTable, 0, 2, "Entry 1 (Green)", text_color=color.white)

table.cell(debugTable, 1, 2, str.tostring(longCondition1), text_color=color.white)

table.cell(debugTable, 0, 3, "Entry 2 (Yellow)", text_color=color.white)

table.cell(debugTable, 1, 3, str.tostring(longCondition2), text_color=color.white)

table.cell(debugTable, 0, 4, "Current Position", text_color=color.white)

table.cell(debugTable, 1, 4, str.tostring(strategy.position_size), text_color=color.white)

table.cell(debugTable, 0, 5, "Entry Price", text_color=color.white)

table.cell(debugTable, 1, 5, str.tostring(entryPrice), text_color=color.white)

table.cell(debugTable, 0, 6, "Max Price", text_color=color.white)

table.cell(debugTable, 1, 6, str.tostring(maxPrice), text_color=color.white)

table.cell(debugTable, 0, 7, "Profit Lock Level", text_color=color.white)

table.cell(debugTable, 1, 7, str.tostring(profitLockLevel), text_color=color.white)

table.cell(debugTable, 0, 8, "Tick Lock Active", text_color=color.white)

table.cell(debugTable, 1, 8, str.tostring(tickLockActivated), text_color=color.white)

table.cell(debugTable, 0, 9, "Tick Lock Level", text_color=color.white)

table.cell(debugTable, 1, 9, str.tostring(tickBasedLockLevel), text_color=color.white)

table.cell(debugTable, 0, 10, "Price Move (Ticks)", text_color=color.white)

table.cell(debugTable, 1, 10, str.tostring(strategy.position_size > 0 ? (maxPrice - entryPrice) / tickSize : 0), text_color=color.white)

table.cell(debugTable, 0, 11, "Locked Profit %", text_color=color.white)

table.cell(debugTable, 1, 11, str.tostring(strategy.position_size > 0 ? ((maxPrice - entryPrice) / entryPrice * 100) : 0.0) + "%", text_color=color.white)

table.cell(debugTable, 0, 12, "Exit Signals", text_color=color.white)

table.cell(debugTable, 1, 12, "Y:" + str.tostring(exitOnYellowLine) + " P:" + str.tostring(exitOnProfitLock) + " T:" + str.tostring(exitOnTickLock), text_color=color.white)

- Multi-Dimensional Trend Analysis with ATR-Based Dynamic Stop Management Strategy

- Adaptive Bollinger Bands Mean-Reversion Trading Strategy

- Advanced Multi-Indicator Trend Confirmation Trading Strategy

- Dual Moving Average-RSI Multi-Signal Trend Trading Strategy

- Adaptive Trend Following and Multi-Confirmation Trading Strategy

- Dynamic Stop-Loss Adjustment Elephant Bar Trend Following Strategy

- Dynamic RSI Quantitative Trading Strategy with Multiple Moving Average Crossover

- Multi-Dimensional KNN Algorithm with Volume-Price Candlestick Pattern Trading Strategy

- SMA-Based Intelligent Trailing Stop Strategy with Intraday Pattern Recognition

- Adaptive Multi-Strategy Dynamic Switching System: A Quantitative Trading Strategy Combining Trend Following and Range Oscillation

- Advanced Multi-Indicator Multi-Dimensional Trend Cross Quantitative Strategy

- Enhanced Mean Reversion Strategy with Bollinger Bands and RSI Integration

- Multi-Period RSI Divergence with Support/Resistance Quantitative Trading Strategy

- Adaptive Trend Following Strategy with Dynamic Drawdown Control System

- Multi-EMA Golden Cross Strategy with Tiered Take-Profit

- Multi-Technical Indicator Cross-Trend Tracking Strategy: RSI and Stochastic RSI Synergy Trading System

- Dynamic Buy Entry Strategy Combining EMA Crossing and Candle Body Penetration

- Intelligent Wave-Trend Dollar Cost Averaging Cyclical Trading Strategy

- MACD-RSI Crossover Trend Following Strategy with Bollinger Bands Optimization System

- Adaptive EMA Dynamic Position Break-out Trading Strategy

- Multi-Indicator Dynamic Trading Optimization Strategy

- Dynamic Wave-Trend Tracking Strategy

- Break of Structure with Volume Confirmation Multi-Condition Intelligent Trading Strategy

- Multi-Indicator Dynamic Stop-Loss Momentum Trend Trading Strategy

- Multi-Condition Trend Following Quantitative Trading Strategy Based on Fibonacci Retracement Levels

- Multi-Moving Average Trend Following Trading Strategy

- Multi-Filter Trend Breakthrough Smart Moving Average Trading Strategy

- Dynamic EMA Breakthrough and Reversal Strategy

- Dynamic Trend Momentum Optimization Strategy with G-Channel Indicator

- Multi-level ATH Dynamic Tracking Triple-Entry Strategy

- Adaptive VWAP Bands with Garman-Klass Volatility Dynamic Tracking Strategy