概述

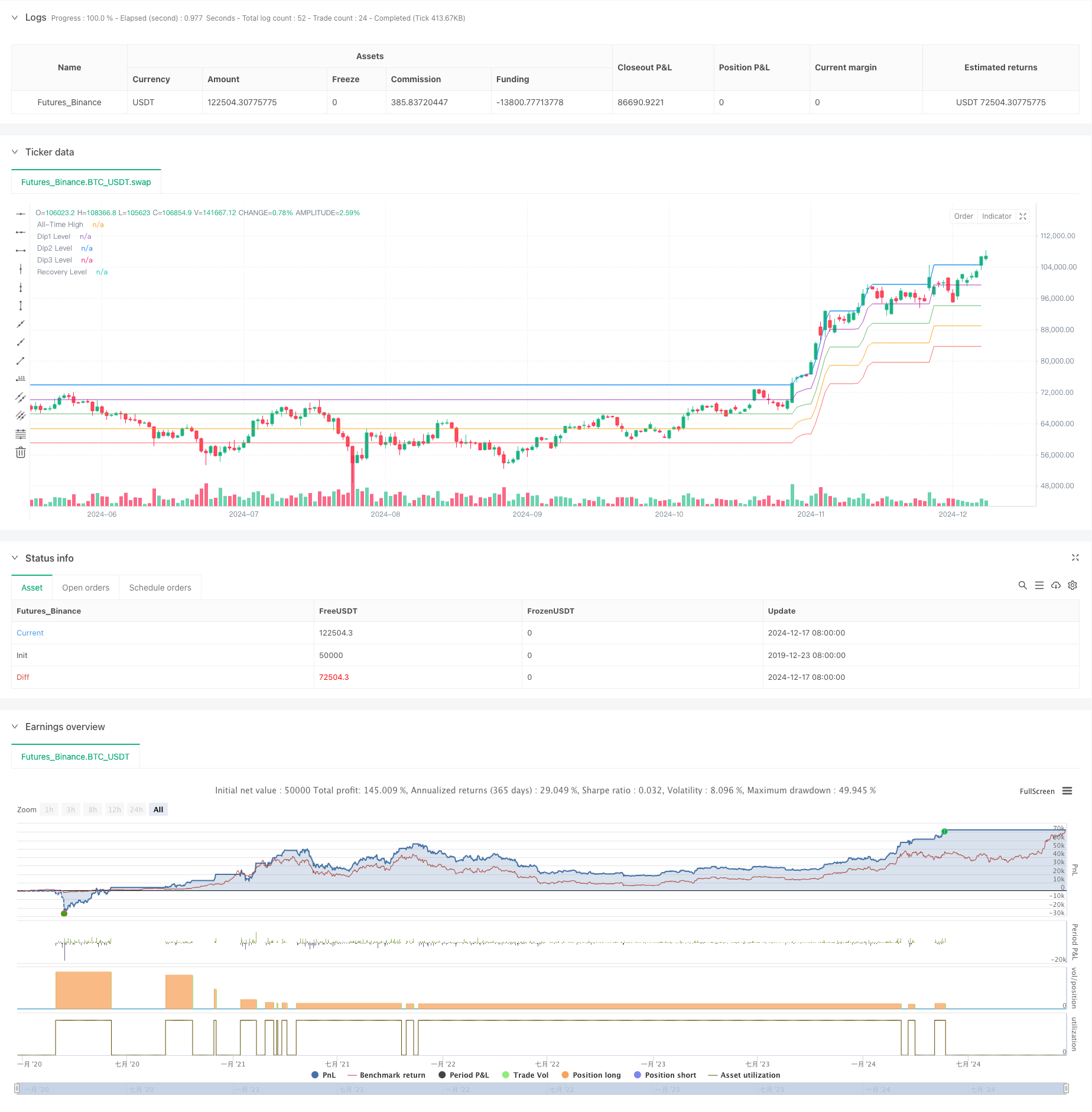

这是一个基于历史最高价(ATH)动态跟踪的多层级买入策略。策略通过监控价格从ATH的回撤幅度,在不同跌幅水平实施分批买入操作,并在价格接近ATH时全部卖出获利。该策略充分利用了市场的波动性,通过系统化的分批建仓方式来降低整体持仓成本。

策略原理

策略的核心逻辑包含以下几个关键要素: 1. 动态ATH追踪:持续更新历史最高价,并在突破新高时重置买入标记 2. 三级跌幅触发:分别在10%、15%和20%的回撤位设置买入点 3. 固定资金管理:每次买入使用相同的资金量($1000) 4. 回撤平仓机制:当价格恢复到距离ATH 5%范围内时,平掉所有持仓 策略通过这种递进式的建仓方式,在下跌过程中逐步降低平均持仓成本,并在市场反弹时通过统一平仓来锁定收益。

策略优势

- 风险分散:通过分批建仓降低了时间点选择的风险

- 成本优化:利用更大幅度的回调来降低平均持仓成本

- 趋势跟踪:动态更新ATH确保在上升趋势中持续运作

- 资金效率:固定资金分配保证了资金使用的可控性

- 自动化执行:明确的进出场条件便于系统化操作

策略风险

- 趋势反转风险:在长期下跌趋势中可能会产生连续套牢

- 资金耗尽风险:在剧烈波动市场中可能迅速消耗可用资金

- 错失机会风险:严格的买入条件可能导致错过一些良好机会

- 平仓时机风险:统一的平仓条件可能无法适应所有市场环境 建议通过设置最大回撤限制和总体仓位控制来管理这些风险。

策略优化方向

- 引入趋势过滤器:增加均线或动量指标来确认整体趋势

- 优化资金管理:根据波动率动态调整每次买入的资金量

- 改进平仓机制:增加分批平仓选项,避免单一价格平仓的风险

- 加入止损机制:设置绝对止损位来控制最大风险

- 动态参数优化:根据不同市场周期自动调整买入档位

总结

该策略通过系统化的分批建仓和统一平仓机制,很好地利用了市场的波动性。策略的成功运行依赖于市场具有足够的波动性和最终的上涨趋势。通过合理的风险控制和参数优化,策略可以在不同市场环境下保持稳定的表现。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © bsticks22

//@version=6

strategy("Long-term Bean Dip (v.1)", overlay=true)

// === Inputs ===

dip1 = input.float(10.0, "First Dip (%)", step=0.1) // 10%

dip2 = input.float(15.0, "Second Dip (%)", step=0.1) // 15%

dip3 = input.float(20.0, "Third Dip (%)", step=0.1) // 20%

recovery_threshold = input.float(5.0, "Sell when within X% of ATH", step=0.1) // 5%

buy_amount = input.float(50000.0, "Buy Amount ($)", step=100) // $1000 increments

// === Variables ===

var float all_time_high = na

var bool dip1_bought = false

var bool dip2_bought = false

var bool dip3_bought = false

// === Update All-Time High ===

if na(all_time_high)

all_time_high := high

else

// Update ATH to the previous bar's high to exclude current bar's high

all_time_high := math.max(all_time_high[1], high[1])

if high[1] > all_time_high[1]

// New ATH reached on the previous bar

dip1_bought := false

dip2_bought := false

dip3_bought := false

// === Calculate Percentage Drop from ATH ===

percent_drop = (all_time_high - close) / all_time_high * 100.0

// === Define Dip Conditions ===

buyDip1 = (percent_drop >= dip1) and not dip1_bought

buyDip2 = (percent_drop >= dip2) and not dip2_bought

buyDip3 = (percent_drop >= dip3) and not dip3_bought

// === Calculate Quantity to Buy ===

qty1 = buy_amount / close

// === Execute Buys on Dips ===

if buyDip1

strategy.entry("Dip1 Buy", strategy.long, qty=qty1)

dip1_bought := true

if buyDip2

strategy.entry("Dip2 Buy", strategy.long, qty=qty1)

dip2_bought := true

if buyDip3

strategy.entry("Dip3 Buy", strategy.long, qty=qty1)

dip3_bought := true

// === Sell Condition: Recovery to Within X% of ATH ===

sell_condition = close >= all_time_high * (1 - recovery_threshold / 100.0)

// === Execute Sell on Recovery ===

if sell_condition and strategy.position_size > 0

strategy.close_all()

// === Plotting ===

plot(all_time_high, title="All-Time High", color=color.new(color.blue, 0))

plot(all_time_high * (1 - dip1 / 100.0), title="Dip1 Level", color=color.new(color.green, 50), style=plot.style_linebr)

plot(all_time_high * (1 - dip2 / 100.0), title="Dip2 Level", color=color.new(color.orange, 50), style=plot.style_linebr)

plot(all_time_high * (1 - dip3 / 100.0), title="Dip3 Level", color=color.new(color.red, 50), style=plot.style_linebr)

plot(all_time_high * (1 - recovery_threshold / 100.0), title="Recovery Level", color=color.new(color.purple, 50), style=plot.style_linebr)

// === Plot Buy and Sell Signals ===

plotshape(buyDip1, title="Dip1 Buy", location=location.belowbar, color=color.green, style=shape.labelup, text="Buy10%")

plotshape(buyDip2, title="Dip2 Buy", location=location.belowbar, color=color.orange, style=shape.labelup, text="Buy15%")

plotshape(buyDip3, title="Dip3 Buy", location=location.belowbar, color=color.red, style=shape.labelup, text="Buy20%")

plotshape(sell_condition and strategy.position_size > 0, title="Sell", location=location.abovebar, color=color.purple, style=shape.labeldown, text="Sell")

// === Alerts ===

alertcondition(buyDip1, title="Dip1 Buy", message="Price dipped 10% from ATH, buying $1000")

alertcondition(buyDip2, title="Dip2 Buy", message="Price dipped 15% from ATH, buying $1000")

alertcondition(buyDip3, title="Dip3 Buy", message="Price dipped 20% from ATH, buying $1000")

alertcondition(sell_condition and strategy.position_size > 0, title="Sell at Recovery", message="Price recovered to within 5% of ATH, selling all")

相关推荐