Estrategia de seguimiento de tendencias dinámicas ATR de varios marcos de tiempo

El autor:¿ Qué pasa?, Fecha: 2024-12-12 16:24:49Las etiquetas:El EMAIndicador de riesgoEl MACDEl ATR

Resumen general

Esta estrategia es un sistema de seguimiento de tendencias adaptativo que combina múltiples indicadores técnicos. Optimiza el rendimiento comercial a través del análisis de marcos de tiempo múltiples y el ajuste dinámico de los niveles de stop-loss y take-profit. El núcleo de la estrategia utiliza un sistema de promedio móvil para identificar tendencias, RSI y MACD para confirmar la fuerza de la tendencia y ATR para el ajuste dinámico de parámetros de gestión de riesgos.

Principios de estrategia

La estrategia emplea un mecanismo de triple verificación para la negociación: 1) la dirección de la tendencia se determina por cruces rápidos / lentos de la EMA; 2) las señales de negociación se filtran utilizando los niveles de sobrecompra / sobreventa de RSI y la confirmación de tendencia MACD; 3) se incorpora una EMA de marco de tiempo más alto para la confirmación de la tendencia. Para el control de riesgos, la estrategia ajusta dinámicamente los objetivos de stop-loss y ganancias basados en ATR, logrando una gestión de posiciones adaptativa. Cuando aumenta la volatilidad del mercado, el sistema expande automáticamente los espacios de stop-loss y ganancias; cuando los mercados se estabilizan, estos parámetros se reducen para mejorar las tasas de ganancia.

Ventajas estratégicas

- Mecanismo de verificación de señales multidimensional mejora significativamente la precisión de las operaciones

- Los ajustes de stop-loss y take-profit adaptados se adaptan mejor a los diferentes entornos de mercado

- La confirmación de tendencias a un plazo más largo reduce efectivamente los riesgos de ruptura falsa

- Un sistema de alerta integral ayuda a captar las oportunidades comerciales y controlar el riesgo a tiempo

- La configuración flexible de la dirección de negociación permite la adaptación de la estrategia a las diferentes preferencias comerciales

Riesgos estratégicos

- Los mecanismos de verificación múltiples pueden perder oportunidades en movimientos rápidos del mercado

- Las operaciones de suspensión de pérdidas dinámicas podrían activarse prematuramente en mercados altamente volátiles

- Las señales falsas pueden ocurrir con frecuencia en los mercados de rango

- Riesgo de sobreajuste durante la optimización de parámetros

- El análisis de marcos de tiempo múltiples puede producir señales contradictorias en diferentes marcos de tiempo

Direcciones de optimización

- Incorporar indicadores de volumen como confirmación auxiliar para mejorar la fiabilidad de la señal

- Desarrollar un sistema cuantitativo de puntuación de la fuerza de la tendencia para optimizar el momento de entrada

- Implementar mecanismos de optimización de parámetros adaptativos para mejorar la estabilidad de la estrategia

- Añadir un sistema de clasificación del entorno de mercado para aplicar diferentes parámetros para diferentes mercados

- Desarrollar un sistema dinámico de gestión de la posición para ajustar el tamaño de la posición en función de la intensidad de la señal

Resumen de las actividades

Este es un sistema rigurosamente diseñado que proporciona una solución comercial integral a través de mecanismos de verificación de múltiples niveles y gestión de riesgos dinámica. Las fortalezas centrales de la estrategia se encuentran en su adaptabilidad y capacidades de control de riesgos, pero se debe prestar atención a la optimización de parámetros y la coincidencia del entorno de mercado durante la implementación. A través de la optimización y el refinamiento continuos, esta estrategia tiene el potencial de mantener un rendimiento estable en diferentes entornos de mercado.

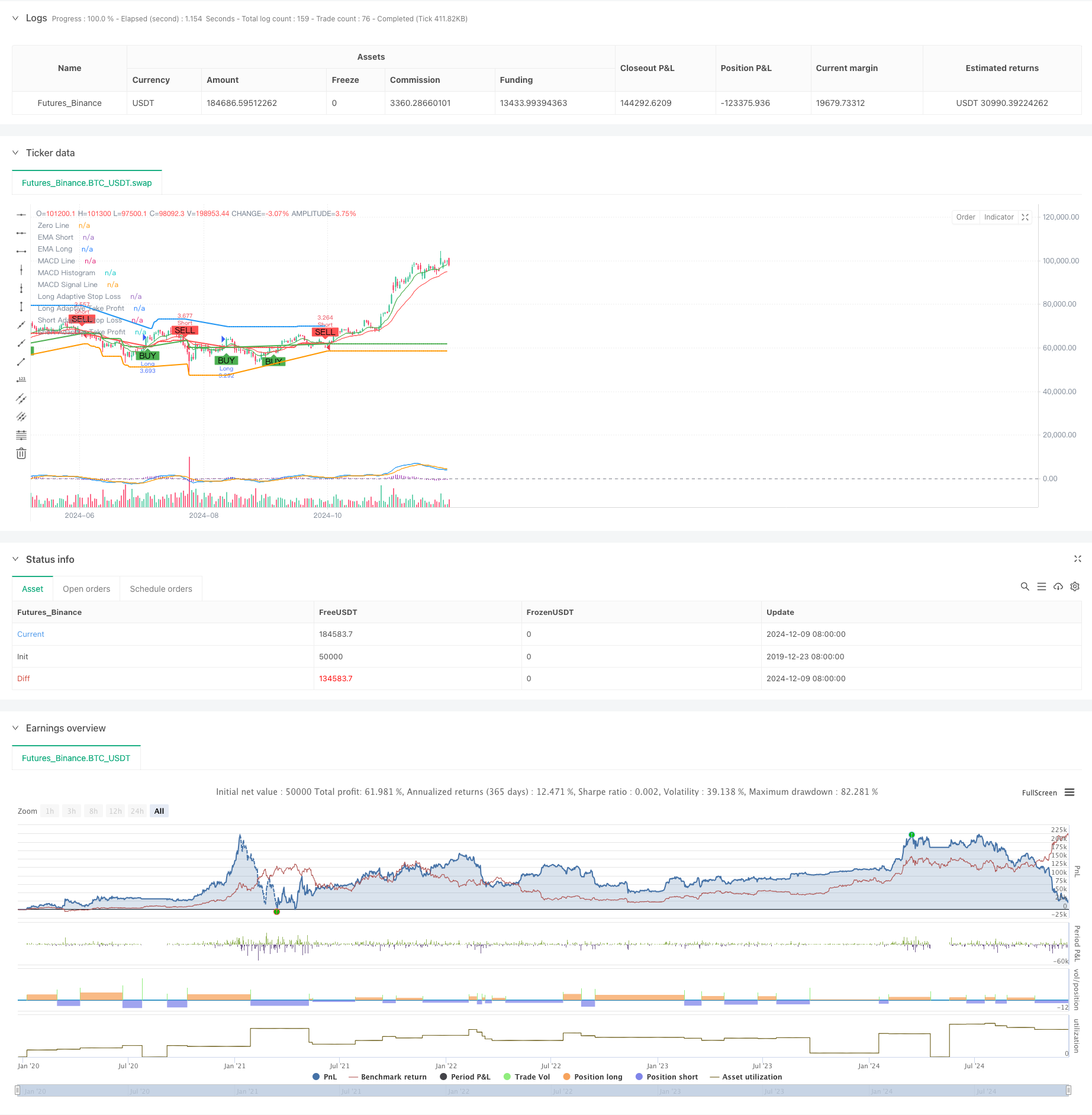

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("TrenGuard Adaptive ATR Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Parameters

emaShortPeriod = input.int(9, title="Short EMA Period", minval=1)

emaLongPeriod = input.int(21, title="Long EMA Period", minval=1)

rsiPeriod = input.int(14, title="RSI Period", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought", minval=50)

rsiOversold = input.int(30, title="RSI Oversold", minval=1)

atrPeriod = input.int(14, title="ATR Period", minval=1)

atrMultiplierSL = input.float(2.0, title="ATR Multiplier for Stop-Loss", minval=0.1)

atrMultiplierTP = input.float(2.0, title="ATR Multiplier for Take-Profit", minval=0.1)

// Multi-timeframe settings

htfEMAEnabled = input.bool(true, title="Use Higher Timeframe EMA Confirmation?", inline="htf")

htfEMATimeframe = input.timeframe("D", title="Higher Timeframe", inline="htf")

// MACD Parameters

macdShortPeriod = input.int(12, title="MACD Short Period", minval=1)

macdLongPeriod = input.int(26, title="MACD Long Period", minval=1)

macdSignalPeriod = input.int(9, title="MACD Signal Period", minval=1)

// Select trade direction

tradeDirection = input.string("Both", title="Trade Direction", options=["Both", "Long", "Short"])

// Calculating indicators

emaShort = ta.ema(close, emaShortPeriod)

emaLong = ta.ema(close, emaLongPeriod)

rsiValue = ta.rsi(close, rsiPeriod)

atrValue = ta.atr(atrPeriod)

[macdLine, macdSignalLine, _] = ta.macd(close, macdShortPeriod, macdLongPeriod, macdSignalPeriod)

// Higher timeframe EMA confirmation

htfEMALong = request.security(syminfo.tickerid, htfEMATimeframe, ta.ema(close, emaLongPeriod))

// Trading conditions

longCondition = ta.crossover(emaShort, emaLong) and rsiValue < rsiOverbought and (not htfEMAEnabled or close > htfEMALong) and macdLine > macdSignalLine

shortCondition = ta.crossunder(emaShort, emaLong) and rsiValue > rsiOversold and (not htfEMAEnabled or close < htfEMALong) and macdLine < macdSignalLine

// Initial Stop-Loss and Take-Profit levels based on ATR

var float adaptiveStopLoss = na

var float adaptiveTakeProfit = na

if (strategy.position_size > 0) // Long Position

if (longCondition) // Trend Confirmation

adaptiveStopLoss := na(adaptiveStopLoss) ? close - atrValue * atrMultiplierSL : math.max(adaptiveStopLoss, close - atrValue * atrMultiplierSL)

adaptiveTakeProfit := na(adaptiveTakeProfit) ? close + atrValue * atrMultiplierTP : math.max(adaptiveTakeProfit, close + atrValue * atrMultiplierTP)

else

adaptiveStopLoss := na(adaptiveStopLoss) ? close - atrValue * atrMultiplierSL : math.max(adaptiveStopLoss, close - atrValue * atrMultiplierSL)

adaptiveTakeProfit := na(adaptiveTakeProfit) ? close + atrValue * atrMultiplierTP : math.max(adaptiveTakeProfit, close + atrValue * atrMultiplierTP)

if (strategy.position_size < 0) // Short Position

if (shortCondition) // Trend Confirmation

adaptiveStopLoss := na(adaptiveStopLoss) ? close + atrValue * atrMultiplierSL : math.min(adaptiveStopLoss, close + atrValue * atrMultiplierSL)

adaptiveTakeProfit := na(adaptiveTakeProfit) ? close - atrValue * atrMultiplierTP : math.min(adaptiveTakeProfit, close - atrValue * atrMultiplierTP)

else

adaptiveStopLoss := na(adaptiveStopLoss) ? close + atrValue * atrMultiplierSL : math.min(adaptiveStopLoss, close + atrValue * atrMultiplierSL)

adaptiveTakeProfit := na(adaptiveTakeProfit) ? close - atrValue * atrMultiplierTP : math.min(adaptiveTakeProfit, close - atrValue * atrMultiplierTP)

// Strategy Entry

if (longCondition and (tradeDirection == "Both" or tradeDirection == "Long"))

strategy.entry("Long", strategy.long)

if (shortCondition and (tradeDirection == "Both" or tradeDirection == "Short"))

strategy.entry("Short", strategy.short)

// Strategy Exit

if (strategy.position_size > 0) // Long Position

strategy.exit("Exit Long", "Long", stop=adaptiveStopLoss, limit=adaptiveTakeProfit, when=shortCondition)

if (strategy.position_size < 0) // Short Position

strategy.exit("Exit Short", "Short", stop=adaptiveStopLoss, limit=adaptiveTakeProfit, when=longCondition)

// Plotting EMAs

plot(emaShort, title="EMA Short", color=color.green)

plot(emaLong, title="EMA Long", color=color.red)

// Plotting MACD

hline(0, "Zero Line", color=color.gray)

plot(macdLine - macdSignalLine, title="MACD Histogram", color=color.purple, style=plot.style_histogram)

plot(macdLine, title="MACD Line", color=color.blue)

plot(macdSignalLine, title="MACD Signal Line", color=color.orange)

// Plotting Buy/Sell signals with distinct colors

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Plotting Trailing Stop-Loss and Take-Profit levels with distinct colors

plot(strategy.position_size > 0 ? adaptiveStopLoss : na, title="Long Adaptive Stop Loss", color=color.red, linewidth=2, style=plot.style_line)

plot(strategy.position_size < 0 ? adaptiveStopLoss : na, title="Short Adaptive Stop Loss", color=color.green, linewidth=2, style=plot.style_line)

plot(strategy.position_size > 0 ? adaptiveTakeProfit : na, title="Long Adaptive Take Profit", color=color.blue, linewidth=2, style=plot.style_line)

plot(strategy.position_size < 0 ? adaptiveTakeProfit : na, title="Short Adaptive Take Profit", color=color.orange, linewidth=2, style=plot.style_line)

// Alert conditions for entry signals

alertcondition(longCondition and (tradeDirection == "Both" or tradeDirection == "Long"), title="Long Signal", message="Long signal triggered: BUY")

alertcondition(shortCondition and (tradeDirection == "Both" or tradeDirection == "Short"), title="Short Signal", message="Short signal triggered: SELL")

// Alert conditions for exit signals

alertcondition(strategy.position_size > 0 and shortCondition, title="Exit Long Signal", message="Exit long position: SELL")

alertcondition(strategy.position_size < 0 and longCondition, title="Exit Short Signal", message="Exit short position: BUY")

// Alert conditions for reaching take-profit levels

alertcondition(strategy.position_size > 0 and close >= adaptiveTakeProfit, title="Take Profit Long Signal", message="Take profit level reached for long position")

alertcondition(strategy.position_size < 0 and close <= adaptiveTakeProfit, title="Take Profit Short Signal", message="Take profit level reached for short position")

- Estrategia de negociación a corto plazo de alto apalancamiento de múltiples indicadores

- Estrategia de negociación de impulso integral de múltiples indicadores

- Estrategia reforzada de cruce de la EMA con el RSI/MACD/ATR

- Estrategia del detector de valle MACD

- Estrategia de cruce del impulso del mercado en varios plazos

- Tendencia de múltiples indicadores tras una estrategia dinámica de gestión del riesgo

- Estrategia de intercambio entre la EMA/MACD/RSI

- Estrategia de negociación con doble tendencia de la EMA

- Estrategia de captura de impulso de oro: Sistema de cruce de media móvil exponencial de varios marcos de tiempo

- Tendencia multi-EMA siguiendo una estrategia con objetivos ATR dinámicos

- Estrategia de negociación de seguimiento de la tendencia de precios de equilibrio múltiple y inversión

- Indice de volatilidad dinámica (VIDYA) con estrategia de reversión de tendencia ATR

- Estrategia de negociación adaptativa de múltiples indicadores basada en el RSI, el MACD y el volumen

- Estrategia de negociación automatizada basada en patrones de precios de doble fondo y superior

- Tendencia dinámica de ATR siguiendo una estrategia basada en la ruptura de soporte

- Estrategia cuantitativa de cruce de media móvil múltiple y oscilador estocástico

- Estrategia adaptativa de seguimiento de tendencias y detección de reversión: un sistema de negociación cuantitativo basado en los indicadores ZigZag y Aroon

- Estrategia de negociación sinérgica de múltiples indicadores con bandas de Bollinger, Fibonacci, MACD y RSI

- Estrategia de inversión de media reversión de la banda de Bollinger en dólar-costo promedio

- Sistema de análisis de estrategias de anomalías del viernes de oro multidimensional

- La media móvil se cruza con la estrategia de seguimiento del impulso de la tendencia del RSI

- Estrategia dinámica de negociación de suspensión de operaciones de seguimiento basada en ATR

- Tendencia de impulso tras la estrategia de negociación de doble confirmación MACD-RSI

- Puntos dinámicos de giro con sistema de optimización de la Cruz de Oro

- Tendencia de múltiples indicadores siguiendo la estrategia con bandas de Bollinger y ATR stop loss dinámico

- Tendencia dinámica tras la estrategia de negociación multiperíodo de ATR

- Tendencia de múltiples indicadores siguiendo una estrategia con canal dinámico y sistema de negociación de media móvil

- Tendencia de seguimiento de la estrategia multi-EMA con confirmación de SMMA

- Sistema de negociación de tendencias de múltiples indicadores con estrategia de análisis de impulso

- Estrategia de divergencia de impulso de la nube de seguimiento de tendencias