Estrategia de parada de seguimiento inteligente basada en SMA con reconocimiento de patrones intradiarios

El autor:¿ Qué pasa?, Fecha: 2025-01-17 16:04:09Las etiquetas:La SMASe trata de la MA18El ATR

Resumen general

Esta es una estrategia basada en el promedio móvil simple de 18 días (SMA18), que combina el reconocimiento de patrones intradiarios y mecanismos inteligentes de parada de seguimiento. La estrategia observa principalmente la relación de precios con SMA18, junto con posiciones altas y bajas intradiarias, para ejecutar entradas largas en momentos óptimos. Emplea un enfoque flexible de stop-loss, que ofrece puntos fijos de stop-loss y una opción de parada de seguimiento de dos días.

Principios de estrategia

La lógica central incluye varios elementos clave: Condiciones de entrada basadas en la posición de precios en relación con la media móvil de 18 días, con opciones para entradas de ruptura o por encima de la línea Análisis de los patrones de velas intradiarios, centrándose particularmente en los patrones de Inside Bar para mejorar la precisión de la entrada 3. Comercio selectivo basado en las características del día de la semana 4. Fijación del precio de entrada mediante órdenes límite con un pequeño desplazamiento al alza de los mínimos para mejorar la probabilidad de llenado Mecanismos de doble stop-loss: paradas fijas basadas en el precio de entrada o paradas de seguimiento basadas en mínimos de dos días

Ventajas estratégicas

- Combina indicadores técnicos y patrones de precios para señales de entrada más fiables

- Mecanismo de selección flexible de los plazos de negociación para la optimización específica del mercado

- Sistema inteligente de stop-loss que protege las ganancias y permite un movimiento adecuado de los precios

- Parámetros muy ajustables para diferentes entornos de mercado

- Reducción efectiva de la señal falsa mediante el filtrado de patrones de la barra interna

Riesgos estratégicos

- Las paradas fijas pueden provocar salidas anticipadas en mercados volátiles

- Las paradas de seguimiento podrían bloquear ganancias mínimas durante las inversiones rápidas

- Las barras internas frecuentes durante la consolidación pueden conducir a un exceso de negociación Medidas de mitigación:

- Ajuste dinámico del stop-loss basado en la volatilidad del mercado

- Adición de indicadores de confirmación de tendencia

- Aplicación de objetivos mínimos de utilidad para filtrar operaciones de baja calidad

Direcciones de optimización

- Incorporar indicadores de volatilidad (como ATR) para el ajuste dinámico de pérdidas de parada

- Añadir dimensión de análisis de volumen para mejorar la fiabilidad de la señal

- Desarrollar algoritmos de selección de fechas más inteligentes basados en el rendimiento histórico

- Implementar filtros de fuerza de tendencia para evitar el comercio en tendencias débiles

- Mejorar los algoritmos de reconocimiento de la barra interior para una mejor identificación de patrones

Resumen de las actividades

Esta estrategia construye un sistema de negociación integral mediante la combinación de múltiples dimensiones analíticas. Sus principales fortalezas se encuentran en la flexibilidad de los parámetros y los mecanismos inteligentes de stop-loss, lo que permite la adaptación a diversos entornos de mercado. A través de la optimización y mejora continua, la estrategia muestra promesa para mantener un rendimiento estable en diferentes condiciones de mercado.

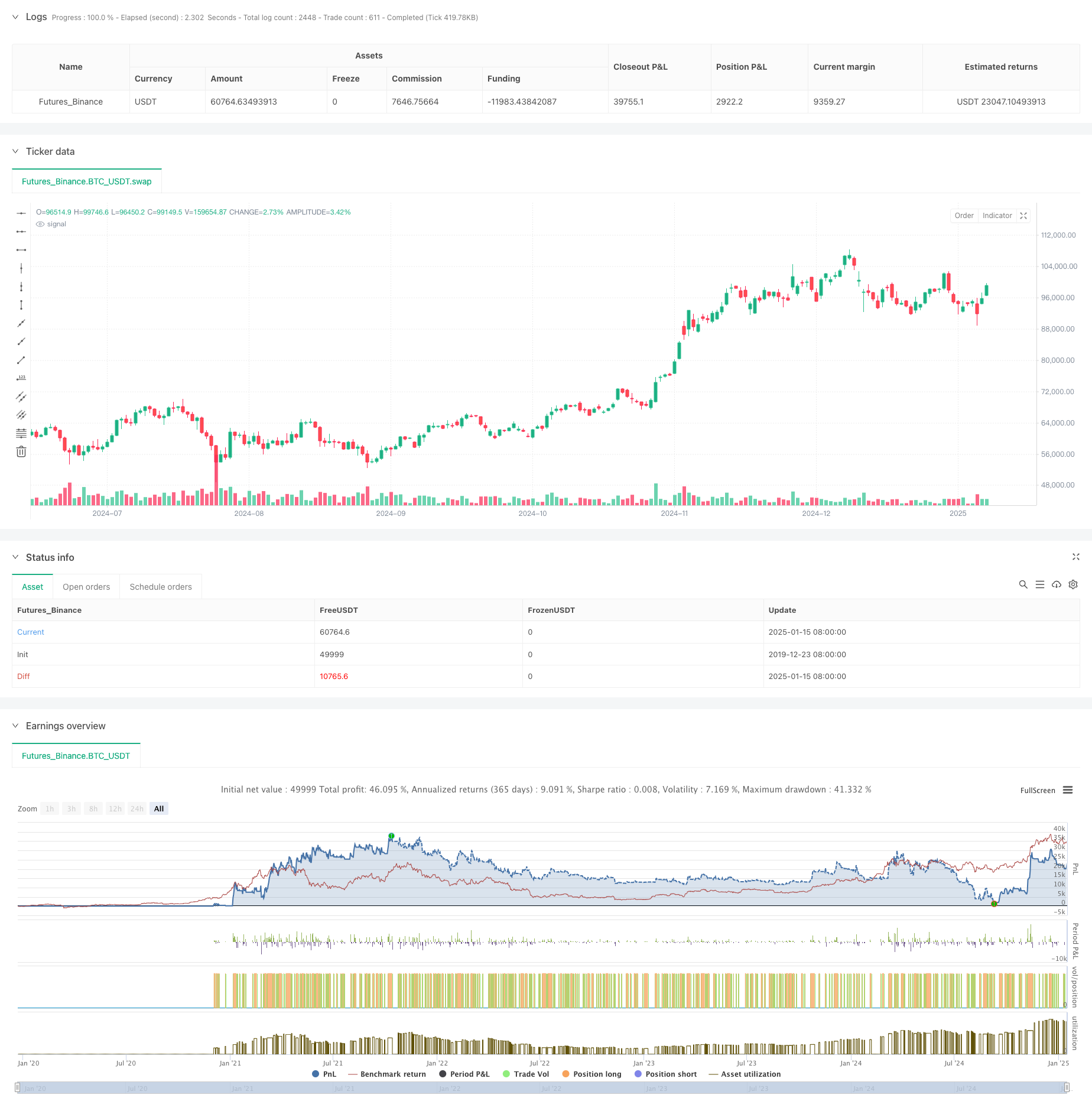

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-16 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © zweiprozent

strategy('Buy Low over 18 SMA Strategy', overlay=true, default_qty_value=1)

xing = input(false, title='crossing 18 sma?')

sib = input(false, title='trade inside Bars?')

shortinside = input(false, title='trade inside range bars?')

offset = input(title='offset', defval=0.001)

belowlow = input(title='stop below low minus', defval=0.001)

alsobelow = input(false, title='Trade only above 18 sma?')

tradeabove = input(false, title='Trade with stop above order?')

trailingtwo = input(false, title='exit with two days low trailing?')

insideBar() => //and high <= high[1] and low >= low[1] ? 1 : 0

open <= close[1] and close >= open[1] and close <= close[1] or open >= close[1] and open <= open[1] and close <= open[1] and close >= close[1] ? 1 : 0

inside() =>

high <= high[1] and low >= low[1] ? 1 : 0

enterIndex = 0.0

enterIndex := enterIndex[1]

inPosition = not na(strategy.position_size) and strategy.position_size > 0

if inPosition and na(enterIndex)

enterIndex := bar_index

enterIndex

//if strategy.position_size <= 0

// strategy.exit("Long", stop=low[0]-stop_loss,comment="stop loss")

//if not na(enterIndex) and bar_index - enterIndex + 0 >= 0

// strategy.exit("Long", stop=low[0]-belowlow,comment="exit")

// enterIndex := na

T_Low = request.security(syminfo.tickerid, 'D', low[0])

D_High = request.security(syminfo.tickerid, 'D', high[1])

D_Low = request.security(syminfo.tickerid, 'D', low[1])

D_Close = request.security(syminfo.tickerid, 'D', close[1])

D_Open = request.security(syminfo.tickerid, 'D', open[1])

W_High2 = request.security(syminfo.tickerid, 'W', high[1])

W_High = request.security(syminfo.tickerid, 'W', high[0])

W_Low = request.security(syminfo.tickerid, 'W', low[0])

W_Low2 = request.security(syminfo.tickerid, 'W', low[1])

W_Close = request.security(syminfo.tickerid, 'W', close[1])

W_Open = request.security(syminfo.tickerid, 'W', open[1])

//longStopPrice = strategy.position_avg_price * (1 - stopl)

// Go Long - if prev day low is broken and stop loss prev day low

entryprice = ta.sma(close, 18)

//(high[0]<=high[1]or close[0]<open[0]) and low[0]>vwma(close,30) and time>timestamp(2020,12,0,0,0)

showMon = input(true, title='trade tuesdays?')

showTue = input(true, title='trade wednesdayy?')

showWed = input(true, title='trade thursday?')

showThu = input(true, title='trade friday?')

showFri = input(true, title='trade saturday?')

showSat = input(true, title='trade sunday?')

showSun = input(true, title='trade monday?')

isMon() =>

dayofweek(time('D')) == dayofweek.monday and showMon

isTue() =>

dayofweek(time('D')) == dayofweek.tuesday and showTue

isWed() =>

dayofweek(time('D')) == dayofweek.wednesday and showWed

isThu() =>

dayofweek(time('D')) == dayofweek.thursday and showThu

isFri() =>

dayofweek(time('D')) == dayofweek.friday and showFri

isSat() =>

dayofweek(time('D')) == dayofweek.saturday and showSat

isSun() =>

dayofweek(time('D')) == dayofweek.sunday and showSun

clprior = close[0]

entryline = ta.sma(close, 18)[1]

//(isMon() or isTue()or isTue()or isWed()

noathigh = high < high[1] or high[2] < high[3] or high[1] < high[2] or low[1] < ta.sma(close, 18)[0] and close > ta.sma(close, 18)[0]

if noathigh and time > timestamp(2020, 12, 0, 0, 0) and (alsobelow == false or high >= ta.sma(close, 18)[0]) and (isMon() or isTue() or isWed() or isThu() or isFri() or isSat() or isSun()) and (high >= high[1] or sib or low <= low[1]) //((sib == false and inside()==true) or inside()==false) and (insideBar()==true or shortinside==false)

if tradeabove == false

strategy.entry('Long', strategy.long, limit=low + offset * syminfo.mintick, comment='long')

if tradeabove == true and (xing == false or clprior < entryline) // and high<high[1]

strategy.entry('Long', strategy.long, stop=high + offset * syminfo.mintick, comment='long')

//if time>timestamp(2020,12,0,0,0) and isSat()

// strategy.entry("Long", strategy.long, limit=0, comment="long")

//strategy.exit("Long", stop=low-400*syminfo.mintick)

//strategy.exit("Long", stop=strategy.position_avg_price-10*syminfo.mintick,comment="exit")

//strategy.exit("Long", stop=low[1]-belowlow*syminfo.mintick, comment="stop")

if strategy.position_avg_price > 0 and trailingtwo == false and close > strategy.position_avg_price

strategy.exit('Long', stop=strategy.position_avg_price, comment='stop')

if strategy.position_avg_price > 0 and trailingtwo == false and (low > strategy.position_avg_price or close < strategy.position_avg_price)

strategy.exit('Long', stop=low[0] - belowlow * syminfo.mintick, comment='stop')

if strategy.position_avg_price > 0 and trailingtwo

strategy.exit('Long', stop=ta.lowest(low, 2)[0] - belowlow * syminfo.mintick, comment='stop')

- Supertrend+4 en movimiento

- Estrategia de ruptura falsa de nivel de soporte multi-SMA con sistema de stop-loss ATR

- La tendencia alfa

- Concepto SuperTendencia Doble

- Estrategia de escape promedio de ATR

- Indicador de línea de seguimiento

- Estrategia de negociación de volatilidad escalable durante el día

- Tendencia de la línea de señal dinámica siguiendo una estrategia que combina ATR y volumen

- Estrategia cuantitativa de impulso de ruptura de tendencia de múltiples líneas

- Estrategia de inversión de la media móvil doble con control de riesgos

- Sistema EMA dinámico combinado con el indicador de impulso del RSI para una estrategia de negociación intradiaria optimizada

- Indicador multi-técnico Tendencia de impulso cruzado siguiendo la estrategia

- Ajuste dinámico de stop-loss Tendencia de la barra de elefante Siguiendo la estrategia

- Estrategia de impulso de tendencia del RSI de dos períodos con sistema de gestión de posiciones piramidal

- Estrategia de negociación de marcos de tiempo múltiples que combina patrones armónicos y Williams % R

- Tendencia de la EMA con estrategia de operaciones de ruptura de números redondos

- Estrategia de negociación cuantitativa RSI dinámica con cruce de medias móviles múltiples

- Estrategia de cruce del indicador RSI de tendencia dinámica

- Algorismo KNN multidimensional con estrategia de negociación de patrones de candelabro de volumen-precio

- Tendencia doble de cruce de la siguiente estrategia: EMA y MACD Sistema de negociación sinérgico

- Sistema de conmutación dinámica adaptativo de múltiples estrategias: una estrategia de negociación cuantitativa que combina el seguimiento de tendencias y la oscilación de rango

- Estrategia cuantitativa avanzada de tendencias multidimensionales de múltiples indicadores

- Sistema de negociación cuantitativa de regresión multifactorial y franja de precios dinámica

- Estrategia de negociación de detección de tendencias dinámicas y gestión de riesgos de múltiples indicadores

- Tendencia de cruce dinámico de media móvil multiglazada siguiendo una estrategia con múltiples confirmaciones

- Estrategia de stop-loss dinámica avanzada basada en velas grandes y divergencia del RSI

- Estrategia de cruce de la media móvil de impulso ponderada por liquidez

- Estrategia de negociación cuantitativa de inversión de tendencia sinérgica de múltiples indicadores

- Estrategia del canal de Keltner de soporte dinámico multicanal

- Aprendizaje automático estrategia de trading cuantitativa