Stratégie de négociation quantitative de pyramide combinée MACD-KDJ

Auteur:ChaoZhang est là., Date: 2024-12-05 16h35 et 26hLes étiquettes:Le MACDLe KDJSMA

Résumé

Cette stratégie est un système de trading Martingale basé sur les indicateurs MACD et KDJ, combinant le dimensionnement des positions pyramidales et la gestion dynamique des profits / pertes. La stratégie détermine le moment d'entrée par le biais de croisements d'indicateurs, utilise la théorie de Martingale pour la gestion des positions et améliore les rendements par pyramidalité sur les marchés tendance.

Principes de stratégie

La logique de base se compose de quatre éléments clés: signaux d'entrée, mécanisme d'ajout de position, gestion de profit/perte et contrôle des risques. Les signaux d'entrée sont basés sur la convergence de la ligne MACD traversant la ligne de signal et de la ligne %D de KDJ

Les avantages de la stratégie

- Haute fiabilité du système de signal: Combine l'indicateur de tendance MACD et l'oscillateur KDJ pour filtrer efficacement les faux signaux

- Gestion scientifique des positions: le système Martingale peut réduire les coûts de détention en ajoutant des positions dans des contratrends

- Contrôle complet du risque: plusieurs mécanismes de stop-loss et limites de position contrôlent efficacement le risque

- Structure de rendement optimisée: la pyramide peut obtenir de meilleurs rendements sur les marchés tendance

- Paramètres flexibles: permet d'optimiser les paramètres de stratégie pour différentes caractéristiques du marché

Risques stratégiques

- Risque de marché: les ajouts fréquents de positions sur différents marchés peuvent entraîner des pertes accrues

- Risque de position: le système Martingale peut entraîner une taille excessive des positions

- Risque de liquidité: un déploiement important de capitaux peut être confronté à des problèmes de liquidité insuffisants

- Risque du système: une optimisation excessive des paramètres peut entraîner une suradaptation de la stratégie

Directions d'optimisation de la stratégie

- Optimisation du système de signal: intégrer des indicateurs de volatilité pour ajuster la sensibilité du signal dans des environnements à forte volatilité

- Optimisation de la gestion des positions: conception de facteurs multiplicateurs dynamiques pour un ajustement adaptatif basé sur les conditions du marché

- Optimisation de la maîtrise des risques: ajout d'un module de maîtrise du prélèvement pour réduire les positions lors de prélèvements importants

- Optimisation des paramètres: Introduction de méthodes d'apprentissage automatique pour le réglage adaptatif des paramètres

Résumé

La stratégie construit un système de trading quantitatif complet en combinant des indicateurs techniques classiques avec des méthodes de gestion de position avancées. Ses principaux avantages résident dans la fiabilité du signal et le contrôle complet des risques, tout en maintenant une forte adaptabilité grâce à la paramétrisation. Bien que des risques inhérents existent, l'optimisation et l'amélioration continues permettent à la stratégie de maintenir une performance stable dans différents environnements de marché.

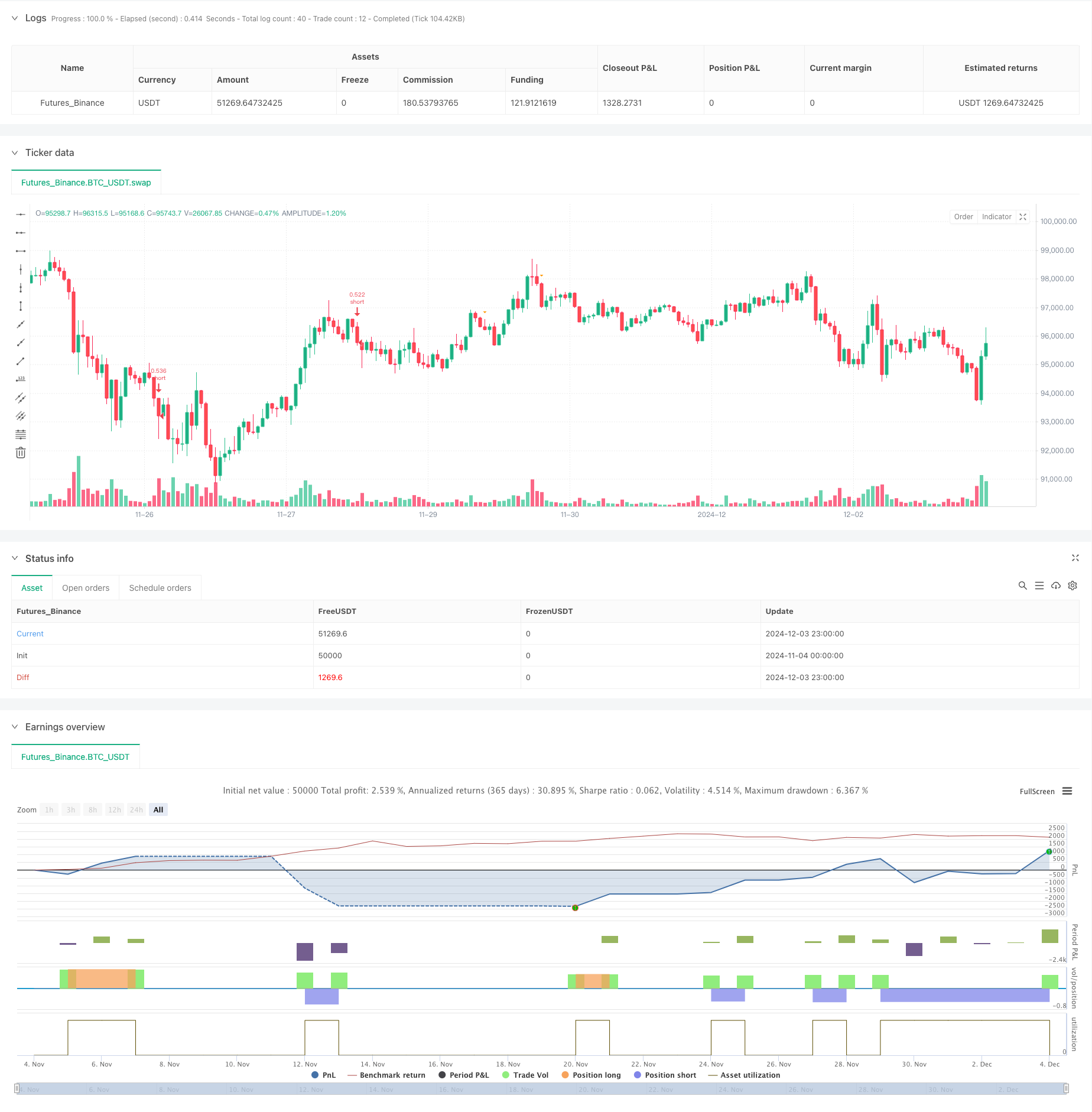

/*backtest

start: 2024-11-04 00:00:00

end: 2024-12-04 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © aaronxu567

//@version=5

strategy("MACD and KDJ Opening Conditions with Pyramiding and Exit", overlay=true) // pyramiding

// Setting

initialOrder = input.float(50000.0, title="Initial Order")

initialOrderSize = initialOrder/close

//initialOrderSize = input.float(1.0, title="Initial Order Size") // Initial Order Size

macdFastLength = input.int(9, title="MACD Fast Length") // MACD Setting

macdSlowLength = input.int(26, title="MACD Slow Length")

macdSignalSmoothing = input.int(9, title="MACD Signal Smoothing")

kdjLength = input.int(14, title="KDJ Length")

kdjSmoothK = input.int(3, title="KDJ Smooth K")

kdjSmoothD = input.int(3, title="KDJ Smooth D")

enableLong = input.bool(true, title="Enable Long Trades")

enableShort = input.bool(true, title="Enable Short Trades")

// Additions Setting

maxAdditions = input.int(5, title="Max Additions", minval=1, maxval=10) // Max Additions

addPositionPercent = input.float(1.0, title="Add Position Percent", minval=0.1, maxval=10) // Add Conditions

reboundPercent = input.float(0.5, title="Rebound Percent (%)", minval=0.1, maxval=10) // Rebound

addMultiplier = input.float(1.0, title="Add Multiplier", minval=0.1, maxval=10) //

// Stop Setting

takeProfitTrigger = input.float(2.0, title="Take Profit Trigger (%)", minval=0.1, maxval=10) //

trailingStopPercent = input.float(0.3, title="Trailing Stop (%)", minval=0.1, maxval=10) //

stopLossPercent = input.float(6.0, title="Stop Loss Percent", minval=0.1, maxval=10) //

// MACD Calculation

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalSmoothing)

// KDJ Calculation

k = ta.sma(ta.stoch(close, high, low, kdjLength), kdjSmoothK)

d = ta.sma(k, kdjSmoothD)

j = 3 * k - 2 * d

// Long Conditions

enterLongCondition = enableLong and ta.crossover(macdLine, signalLine) and ta.crossover(k, d)

// Short Conditions

enterShortCondition = enableShort and ta.crossunder(macdLine, signalLine) and ta.crossunder(k, d)

// Records

var float entryPriceLong = na

var int additionsLong = 0 // 记录多仓加仓次数

var float nextAddPriceLong = na // 多仓下次加仓触发价格

var float lowestPriceLong = na // 多头的最低价格

var bool longPending = false // 多头加仓待定标记

var float entryPriceShort = na

var int additionsShort = 0 // 记录空仓加仓次数

var float nextAddPriceShort = na // 空仓下次加仓触发价格

var float highestPriceShort = na // 空头的最高价格

var bool shortPending = false // 空头加仓待定标记

var bool plotEntryLong = false

var bool plotAddLong = false

var bool plotEntryShort = false

var bool plotAddShort = false

// Open Long

if (enterLongCondition and strategy.opentrades == 0)

strategy.entry("long", strategy.long, qty=initialOrderSize,comment = 'Long')

entryPriceLong := close

nextAddPriceLong := close * (1 - addPositionPercent / 100)

additionsLong := 0

lowestPriceLong := na

longPending := false

plotEntryLong := true

// Add Long

if (strategy.position_size > 0 and additionsLong < maxAdditions)

// Conditions Checking

if (close < nextAddPriceLong) and not longPending

lowestPriceLong := close

longPending := true

if (longPending)

// Rebound Checking

if (close > lowestPriceLong * (1 + reboundPercent / 100))

// Record Price

float addQty = initialOrderSize*math.pow(addMultiplier,additionsLong+1)

strategy.entry("long", strategy.long, qty=addQty,comment = 'Add Long')

additionsLong += 1

longPending := false

nextAddPriceLong := math.min(nextAddPriceLong, close) * (1 - addPositionPercent / 100) // Price Updates

plotAddLong := true

else

lowestPriceLong := math.min(lowestPriceLong, close)

// Open Short

if (enterShortCondition and strategy.opentrades == 0)

strategy.entry("short", strategy.short, qty=initialOrderSize,comment = 'Short')

entryPriceShort := close

nextAddPriceShort := close * (1 + addPositionPercent / 100)

additionsShort := 0

highestPriceShort := na

shortPending := false

plotEntryShort := true

// add Short

if (strategy.position_size < 0 and additionsShort < maxAdditions)

// Conditions Checking

if (close > nextAddPriceShort) and not shortPending

highestPriceShort := close

shortPending := true

if (shortPending)

// rebound Checking

if (close < highestPriceShort * (1 - reboundPercent / 100))

// Record Price

float addQty = initialOrderSize*math.pow(addMultiplier,additionsShort+1)

strategy.entry("short", strategy.short, qty=addQty,comment = "Add Short")

additionsShort += 1

shortPending := false

nextAddPriceShort := math.max(nextAddPriceShort, close) * (1 + addPositionPercent / 100) // Price Updates

plotAddShort := true

else

highestPriceShort := math.max(highestPriceShort, close)

// Take Profit or Stop Loss

if (strategy.position_size != 0)

float stopLossLevel = strategy.position_avg_price * (strategy.position_size > 0 ? (1 - stopLossPercent / 100) : (1 + stopLossPercent / 100))

float trailOffset = strategy.position_avg_price * (trailingStopPercent / 100) / syminfo.mintick

if (strategy.position_size > 0)

strategy.exit("Take Profit/Stop Loss", from_entry="long", stop=stopLossLevel, trail_price=strategy.position_avg_price * (1 + takeProfitTrigger / 100), trail_offset=trailOffset)

else

strategy.exit("Take Profit/Stop Loss", from_entry="short", stop=stopLossLevel, trail_price=strategy.position_avg_price * (1 - takeProfitTrigger / 100), trail_offset=trailOffset)

// Plot

plotshape(series=plotEntryLong, location=location.belowbar, color=color.blue, style=shape.triangleup, size=size.small, title="Long Signal")

plotshape(series=plotAddLong, location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small, title="Add Long Signal")

plotshape(series=plotEntryShort, location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small, title="Short Signal")

plotshape(series=plotAddShort, location=location.abovebar, color=color.orange, style=shape.triangledown, size=size.small, title="Add Short Signal")

// Plot Clear

plotEntryLong := false

plotAddLong := false

plotEntryShort := false

plotAddShort := false

// // table

// var infoTable = table.new(position=position.top_right,columns = 2,rows = 6,bgcolor=color.yellow,frame_color = color.white,frame_width = 1,border_width = 1,border_color = color.black)

// if barstate.isfirst

// t1="Open Price"

// t2="Avg Price"

// t3="Additions"

// t4='Next Add Price'

// t5="Take Profit"

// t6="Stop Loss"

// table.cell(infoTable, column = 0, row = 0,text=t1 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 1,text=t2 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 2,text=t3 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 3,text=t4 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 4,text=t5 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 5,text=t6 ,text_size=size.auto)

// if barstate.isconfirmed and strategy.position_size!=0

// ps=strategy.position_size

// pos_avg=strategy.position_avg_price

// opt=strategy.opentrades

// t1=str.tostring(strategy.opentrades.entry_price(0),format.mintick)

// t2=str.tostring(pos_avg,format.mintick)

// t3=str.tostring(opt>1?(opt-1):0)

// t4=str.tostring(ps>0?nextAddPriceLong:nextAddPriceShort,format.mintick)

// t5=str.tostring(pos_avg*(1+(ps>0?1:-1)*takeProfitTrigger*0.01),format.mintick)

// t6=str.tostring(pos_avg*(1+(ps>0?-1:1)*stopLossPercent*0.01),format.mintick)

// table.cell(infoTable, column = 1, row = 0,text=t1 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 1,text=t2 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 2,text=t3 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 3,text=t4 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 4,text=t5 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 5,text=t6 ,text_size=size.auto)

- Tendance combinée multi-SMA et stochastique suivant une stratégie de négociation

- Nifty 50 stratégie de rupture de la fourchette d' ouverture de 3 minutes

- Théorie des ondes d'Elliott 4-9 Détection automatique des ondes d'impulsion Stratégie de trading

- Stratégie de croisement des moyennes mobiles de la lumière des étoiles

- 10Tendance double SMA et MACD à la suite d'une stratégie de négociation

- Midas Mk. II - Le dernier Crypto Swing

- Stratégie de négociation intraday multi-filtre MACD et RSI

- Système de négociation de confirmation de tendance MACD double

- Stratégie de négociation de tendance à l'évolution de la tendance à l'évolution de la tendance

- La tendance à la confirmation double du MACD-Supertrend suite à la stratégie de négociation

- Stratégie de négociation combinée de reconnaissance de modèle de chandelier sur plusieurs délais

- Les bandes de Bollinger triplées touchent la tendance suite à une stratégie de négociation quantitative

- Système de négociation de rupture dynamique multidimensionnelle basé sur les bandes de Bollinger et le RSI

- Résultats de l'évaluation de la valeur ajoutée

- Tendance de dynamique du double EMA à la suite de la stratégie

- Stratégie de négociation ATR en plusieurs étapes avec prise de bénéfices dynamique

- Système de négociation à support dynamique à double échéancier

- La tendance croisée de la moyenne mobile à plusieurs périodes et du momentum RSI suivant la stratégie

- Système de moyenne de sortie et de signaux de zone de survente d'actifs financiers basé sur les IFM

- Stratégie de négociation multi-EMA croisée avec indicateurs de dynamique

- La stratégie de négociation au niveau des SR

- Système de négociation des filtres de tendance G-Channel et EMA

- La valeur de l'indicateur de volatilité est la valeur de l'indicateur de volatilité de l'indicateur de volatilité de l'indicateur de volatilité.

- Système de négociation dynamique de moyenne mobile à double percée

- Tendance de dynamique croisée multi-indicateur Suivre une stratégie avec système optimisé de prise de profit et de stop-loss

- Triangle Breakout avec la stratégie de dynamique RSI

- Système de négociation dynamique de cinq canaux EMA RSI suivant la tendance

- L'évolution pondérée adaptative en fonction de la stratégie (système multi-indicateur Vidya)

- Stratégie de négociation améliorée de l'inversion à double pivot

- Stratégie de renforcement quantitatif des tendances multi-couches de l'AO