Strategi Perdagangan Kuantitatif Piramida Martingale Kombinasi MACD-KDJ

Penulis:ChaoZhang, Tanggal: 2024-12-05 16:35:26Tag:MACDKDJSMA

Gambaran umum

Strategi ini adalah sistem perdagangan Martingale berdasarkan indikator MACD dan KDJ, menggabungkan ukuran posisi piramida dan manajemen laba / kerugian dinamis. Strategi ini menentukan waktu masuk melalui crossover indikator, memanfaatkan teori Martingale untuk manajemen posisi, dan meningkatkan pengembalian melalui piramida di pasar tren.

Prinsip Strategi

Logika inti terdiri dari empat elemen utama: sinyal masuk, mekanisme penambahan posisi, manajemen laba/rugi, dan pengendalian risiko. Sinyal masuk didasarkan pada konvergensi garis MACD yang melintasi garis sinyal dan KDJs %K yang melintasi garis %D; mekanisme penambahan posisi mengadopsi teori Martingale, secara dinamis menyesuaikan ukuran posisi melalui faktor perkalian, mendukung hingga 10 posisi tambahan; mengambil keuntungan menggunakan trailing stop untuk secara dinamis menyesuaikan tingkat mengambil keuntungan; stop-loss mencakup mekanisme tetap dan trailing. Strategi ini mendukung penyesuaian yang fleksibel dari parameter indikator, parameter kontrol posisi, dan parameter kontrol risiko.

Keuntungan Strategi

- Keandalan sistem sinyal yang tinggi: Menggabungkan indikator tren MACD dan osilator KDJ untuk secara efektif menyaring sinyal palsu

- Pengelolaan posisi ilmiah: Sistem Martingale dapat mengurangi biaya kepemilikan dengan menambahkan posisi dalam kontra-trend

- Pengendalian risiko yang komprehensif: Beberapa mekanisme stop loss dan batas posisi secara efektif mengendalikan risiko

- Struktur pengembalian yang dioptimalkan: Pyramiding dapat mencapai pengembalian yang lebih baik di pasar tren

- Parameter fleksibel: Mendukung optimasi parameter strategi untuk karakteristik pasar yang berbeda

Risiko Strategi

- Risiko pasar: Penambahan posisi yang sering di berbagai pasar dapat menyebabkan kerugian yang lebih besar

- Risiko Posisi: Sistem Martingale dapat mengakibatkan ukuran posisi yang berlebihan

- Risiko likuiditas: Penempatan modal yang besar dapat menghadapi masalah likuiditas yang tidak cukup

- Risiko sistem: Optimasi parameter yang berlebihan dapat menyebabkan overfitting strategi

Arah Optimasi Strategi

- Optimasi sistem sinyal: Menggabungkan indikator volatilitas untuk menyesuaikan sensitivitas sinyal di lingkungan volatilitas tinggi

- Optimasi manajemen posisi: Desain faktor perkalian dinamis untuk penyesuaian adaptif berdasarkan kondisi pasar

- Optimasi pengendalian risiko: Tambahkan modul pengendalian penarikan untuk mengurangi posisi selama penarikan yang signifikan

- Optimasi parameter: Memperkenalkan metode pembelajaran mesin untuk penyesuaian parameter adaptif

Ringkasan

Strategi ini membangun sistem perdagangan kuantitatif yang lengkap dengan menggabungkan indikator teknis klasik dengan metode manajemen posisi canggih. Keuntungannya utama terletak pada keandalan sinyal dan kontrol risiko yang komprehensif, sambil mempertahankan kemampuan beradaptasi yang kuat melalui parameterisasi. Meskipun risiko yang melekat ada, pengoptimalan dan peningkatan terus menerus memungkinkan strategi untuk mempertahankan kinerja yang stabil di berbagai lingkungan pasar.

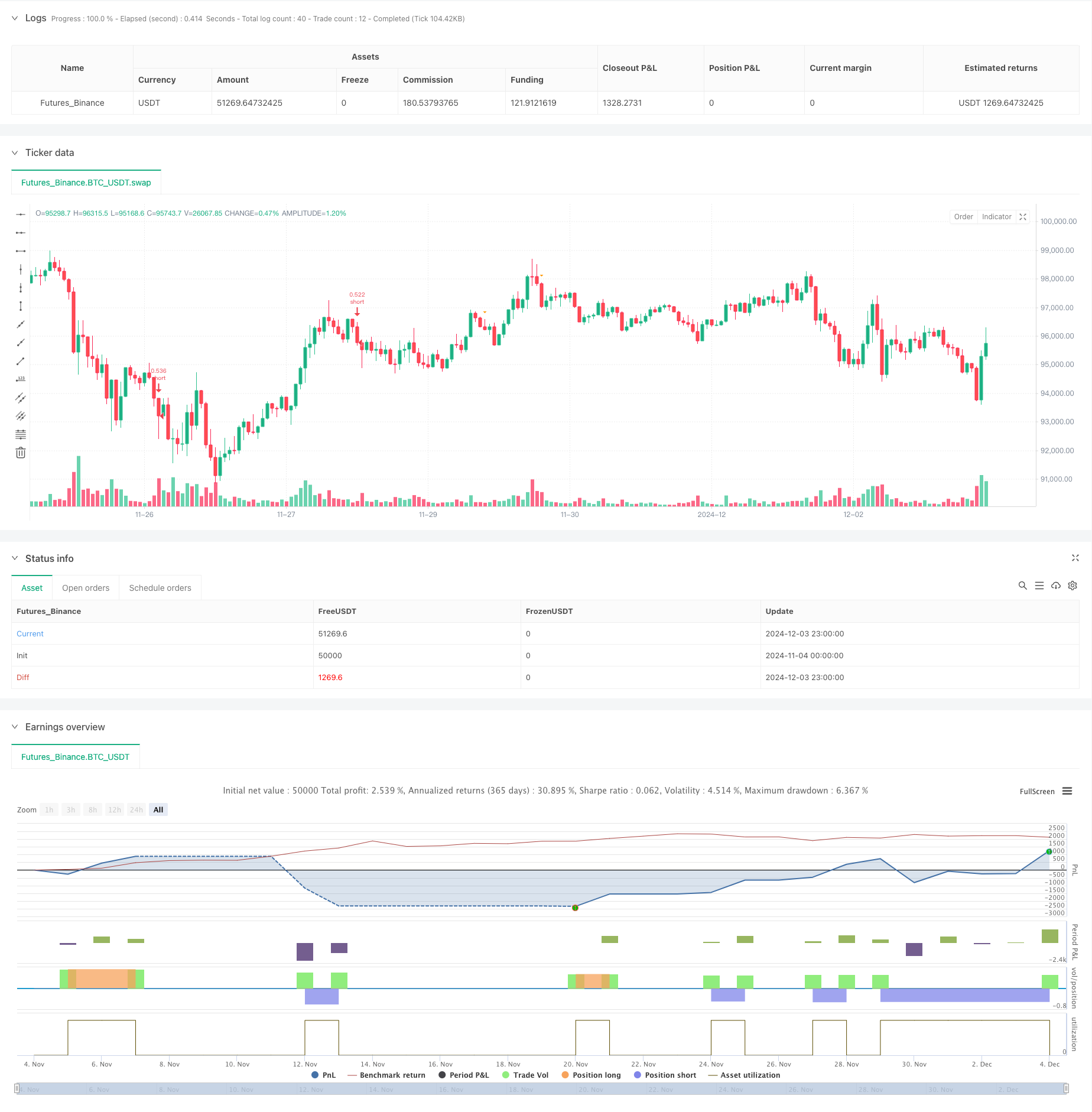

/*backtest

start: 2024-11-04 00:00:00

end: 2024-12-04 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © aaronxu567

//@version=5

strategy("MACD and KDJ Opening Conditions with Pyramiding and Exit", overlay=true) // pyramiding

// Setting

initialOrder = input.float(50000.0, title="Initial Order")

initialOrderSize = initialOrder/close

//initialOrderSize = input.float(1.0, title="Initial Order Size") // Initial Order Size

macdFastLength = input.int(9, title="MACD Fast Length") // MACD Setting

macdSlowLength = input.int(26, title="MACD Slow Length")

macdSignalSmoothing = input.int(9, title="MACD Signal Smoothing")

kdjLength = input.int(14, title="KDJ Length")

kdjSmoothK = input.int(3, title="KDJ Smooth K")

kdjSmoothD = input.int(3, title="KDJ Smooth D")

enableLong = input.bool(true, title="Enable Long Trades")

enableShort = input.bool(true, title="Enable Short Trades")

// Additions Setting

maxAdditions = input.int(5, title="Max Additions", minval=1, maxval=10) // Max Additions

addPositionPercent = input.float(1.0, title="Add Position Percent", minval=0.1, maxval=10) // Add Conditions

reboundPercent = input.float(0.5, title="Rebound Percent (%)", minval=0.1, maxval=10) // Rebound

addMultiplier = input.float(1.0, title="Add Multiplier", minval=0.1, maxval=10) //

// Stop Setting

takeProfitTrigger = input.float(2.0, title="Take Profit Trigger (%)", minval=0.1, maxval=10) //

trailingStopPercent = input.float(0.3, title="Trailing Stop (%)", minval=0.1, maxval=10) //

stopLossPercent = input.float(6.0, title="Stop Loss Percent", minval=0.1, maxval=10) //

// MACD Calculation

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalSmoothing)

// KDJ Calculation

k = ta.sma(ta.stoch(close, high, low, kdjLength), kdjSmoothK)

d = ta.sma(k, kdjSmoothD)

j = 3 * k - 2 * d

// Long Conditions

enterLongCondition = enableLong and ta.crossover(macdLine, signalLine) and ta.crossover(k, d)

// Short Conditions

enterShortCondition = enableShort and ta.crossunder(macdLine, signalLine) and ta.crossunder(k, d)

// Records

var float entryPriceLong = na

var int additionsLong = 0 // 记录多仓加仓次数

var float nextAddPriceLong = na // 多仓下次加仓触发价格

var float lowestPriceLong = na // 多头的最低价格

var bool longPending = false // 多头加仓待定标记

var float entryPriceShort = na

var int additionsShort = 0 // 记录空仓加仓次数

var float nextAddPriceShort = na // 空仓下次加仓触发价格

var float highestPriceShort = na // 空头的最高价格

var bool shortPending = false // 空头加仓待定标记

var bool plotEntryLong = false

var bool plotAddLong = false

var bool plotEntryShort = false

var bool plotAddShort = false

// Open Long

if (enterLongCondition and strategy.opentrades == 0)

strategy.entry("long", strategy.long, qty=initialOrderSize,comment = 'Long')

entryPriceLong := close

nextAddPriceLong := close * (1 - addPositionPercent / 100)

additionsLong := 0

lowestPriceLong := na

longPending := false

plotEntryLong := true

// Add Long

if (strategy.position_size > 0 and additionsLong < maxAdditions)

// Conditions Checking

if (close < nextAddPriceLong) and not longPending

lowestPriceLong := close

longPending := true

if (longPending)

// Rebound Checking

if (close > lowestPriceLong * (1 + reboundPercent / 100))

// Record Price

float addQty = initialOrderSize*math.pow(addMultiplier,additionsLong+1)

strategy.entry("long", strategy.long, qty=addQty,comment = 'Add Long')

additionsLong += 1

longPending := false

nextAddPriceLong := math.min(nextAddPriceLong, close) * (1 - addPositionPercent / 100) // Price Updates

plotAddLong := true

else

lowestPriceLong := math.min(lowestPriceLong, close)

// Open Short

if (enterShortCondition and strategy.opentrades == 0)

strategy.entry("short", strategy.short, qty=initialOrderSize,comment = 'Short')

entryPriceShort := close

nextAddPriceShort := close * (1 + addPositionPercent / 100)

additionsShort := 0

highestPriceShort := na

shortPending := false

plotEntryShort := true

// add Short

if (strategy.position_size < 0 and additionsShort < maxAdditions)

// Conditions Checking

if (close > nextAddPriceShort) and not shortPending

highestPriceShort := close

shortPending := true

if (shortPending)

// rebound Checking

if (close < highestPriceShort * (1 - reboundPercent / 100))

// Record Price

float addQty = initialOrderSize*math.pow(addMultiplier,additionsShort+1)

strategy.entry("short", strategy.short, qty=addQty,comment = "Add Short")

additionsShort += 1

shortPending := false

nextAddPriceShort := math.max(nextAddPriceShort, close) * (1 + addPositionPercent / 100) // Price Updates

plotAddShort := true

else

highestPriceShort := math.max(highestPriceShort, close)

// Take Profit or Stop Loss

if (strategy.position_size != 0)

float stopLossLevel = strategy.position_avg_price * (strategy.position_size > 0 ? (1 - stopLossPercent / 100) : (1 + stopLossPercent / 100))

float trailOffset = strategy.position_avg_price * (trailingStopPercent / 100) / syminfo.mintick

if (strategy.position_size > 0)

strategy.exit("Take Profit/Stop Loss", from_entry="long", stop=stopLossLevel, trail_price=strategy.position_avg_price * (1 + takeProfitTrigger / 100), trail_offset=trailOffset)

else

strategy.exit("Take Profit/Stop Loss", from_entry="short", stop=stopLossLevel, trail_price=strategy.position_avg_price * (1 - takeProfitTrigger / 100), trail_offset=trailOffset)

// Plot

plotshape(series=plotEntryLong, location=location.belowbar, color=color.blue, style=shape.triangleup, size=size.small, title="Long Signal")

plotshape(series=plotAddLong, location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small, title="Add Long Signal")

plotshape(series=plotEntryShort, location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small, title="Short Signal")

plotshape(series=plotAddShort, location=location.abovebar, color=color.orange, style=shape.triangledown, size=size.small, title="Add Short Signal")

// Plot Clear

plotEntryLong := false

plotAddLong := false

plotEntryShort := false

plotAddShort := false

// // table

// var infoTable = table.new(position=position.top_right,columns = 2,rows = 6,bgcolor=color.yellow,frame_color = color.white,frame_width = 1,border_width = 1,border_color = color.black)

// if barstate.isfirst

// t1="Open Price"

// t2="Avg Price"

// t3="Additions"

// t4='Next Add Price'

// t5="Take Profit"

// t6="Stop Loss"

// table.cell(infoTable, column = 0, row = 0,text=t1 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 1,text=t2 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 2,text=t3 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 3,text=t4 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 4,text=t5 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 5,text=t6 ,text_size=size.auto)

// if barstate.isconfirmed and strategy.position_size!=0

// ps=strategy.position_size

// pos_avg=strategy.position_avg_price

// opt=strategy.opentrades

// t1=str.tostring(strategy.opentrades.entry_price(0),format.mintick)

// t2=str.tostring(pos_avg,format.mintick)

// t3=str.tostring(opt>1?(opt-1):0)

// t4=str.tostring(ps>0?nextAddPriceLong:nextAddPriceShort,format.mintick)

// t5=str.tostring(pos_avg*(1+(ps>0?1:-1)*takeProfitTrigger*0.01),format.mintick)

// t6=str.tostring(pos_avg*(1+(ps>0?-1:1)*stopLossPercent*0.01),format.mintick)

// table.cell(infoTable, column = 1, row = 0,text=t1 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 1,text=t2 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 2,text=t3 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 3,text=t4 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 4,text=t5 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 5,text=t6 ,text_size=size.auto)

- Multi-SMA dan Stochastic Combined Trend Mengikuti Strategi Trading

- Nifty 50 3 Menit Pembukaan Rentang Breakout Strategi

- Elliott Wave Theory 4-9 Impulse Wave Deteksi Otomatis Strategi Perdagangan

- Starlight Moving Average Crossover Strategi

- 10SMA dan MACD Dual Trend Mengikuti Strategi Trading

- Midas Mk. II - Ultimate Crypto Swing

- Strategi Perdagangan Intraday Multi-Filter MACD dan RSI

- Sistem perdagangan konfirmasi tren MACD ganda

- Strategi Trading Tren Tren Momentum Sempadan Probabilitas Multi-Indikator

- MACD-Supertrend Tren Konfirmasi Ganda Mengikuti Strategi Perdagangan

- Strategi perdagangan pengakuan pola candlestick gabungan multi-frame

- Triple Bollinger Bands Mencapai Tren Mengikuti Strategi Perdagangan Kuantitatif

- Sistem Perdagangan Breakout Dinamis Multidimensional Berdasarkan Bollinger Bands dan RSI

- RSI Mean Reverssion Breakout Strategi

- Tren Momentum Dual EMA Crossover Mengikuti Strategi

- Strategi Trading ATR Berbagai Tahap dengan Pengambilan Keuntungan Dinamis

- Sistem Perdagangan Dukungan Dinamis Dual Timeframe

- Trend silang rata-rata bergerak multi-periode dan momentum RSI Mengikuti strategi

- Aset keuangan berbasis MFI Oversold Zone Exit and Signal Averaging System

- Multi-EMA Crossover dengan Indikator Momentum Trading Strategy

- Pengakuan Multi-Pattern dan Strategi Trading Tingkat SR

- G-Channel dan EMA Trend Filter Trading System

- Tren RSI Multi-Periode Stop-Loss Dinamis Mengikuti Strategi

- Sistem Perdagangan Penembusan Rata-rata Bergerak Dual Dinamis

- Trend Momentum Crossover Multi-Indicator Mengikuti Strategi dengan Sistem Take-Profit dan Stop-Loss yang Dioptimalkan

- Triangle Breakout dengan Strategi Momentum RSI

- Lima EMA RSI Trend-Following Dynamic Channel Trading System (Sistem Perdagangan Saluran Dinamis Berikut Tren)

- Adaptive Weighted Trend Following Strategy (Sistem Multi-Indikator Vidya)

- Strategi perdagangan pembalikan titik pivot ganda yang ditingkatkan

- Strategi Peningkatan Tren Kuantitatif Multilayer AO