Strategi Stop Trailing Dynamic Multi-Level yang cerdas berdasarkan Bollinger Bands dan ATR

Penulis:ChaoZhang, Tanggal: 2024-12-11 14:52:24Tag:BBATRMASMAEMASMMAWMAVWMASD

Gambaran umum

Strategi ini adalah sistem perdagangan cerdas berdasarkan Bollinger Bands dan indikator ATR, menggabungkan mekanisme pengambilan keuntungan dan stop-loss multi-level. Strategi ini terutama memasuki posisi panjang dengan mengidentifikasi sinyal pembalikan di dekat Bollinger Band bawah dan mengelola risiko menggunakan stop trailing dinamis. Sistem ini dirancang dengan target keuntungan 20% dan tingkat stop-loss 12%, sementara menggabungkan stop trailing dinamis berbasis ATR untuk melindungi keuntungan sambil memungkinkan tren ruang yang cukup untuk berkembang.

Prinsip Strategi

Logika inti mencakup beberapa komponen utama: 1. Ketentuan masuk: Membutuhkan lilin hijau mengikuti lilin merah yang menyentuh Bollinger Band bagian bawah, biasanya menunjukkan sinyal pembalikan potensial. 2. Pemilihan rata-rata bergerak: Mendukung beberapa jenis (SMA, EMA, SMMA, WMA, VWMA), dengan SMA 20 periode default. Parameter Bollinger Bands: Menggunakan 1,5 standar deviasi untuk bandwidth, lebih konservatif daripada standar deviasi 2 tradisional. Mekanisme pengambilan keuntungan: Menetapkan target keuntungan awal 20%. 5. Mekanisme Stop-Loss: Mengimplementasikan stop-loss tetap 12% untuk melindungi modal. 6. hentikan pengangkut dinamis: - Mengaktifkan ATR trailing stop setelah mencapai target keuntungan - Memulai ATR berhenti dinamika setelah menyentuh atas Bollinger Band - Menggunakan ATR multiplier untuk secara dinamis menyesuaikan jarak penghentian belakang

Keuntungan Strategi

- Pengendalian risiko multi-level:

- Stop loss tetap melindungi pokok

- Kekuatan stop trailing yang dinamis dalam keuntungan

- Stop dinamis yang dipicu oleh Bollinger Band atas memberikan perlindungan tambahan

- Pilihan rata-rata bergerak yang fleksibel memungkinkan penyesuaian dengan kondisi pasar yang berbeda

- Stop trailing dinamis berbasis ATR disesuaikan secara otomatis berdasarkan volatilitas pasar, mencegah keluar dini

- Sinyal masuk menggabungkan pola harga dan indikator teknis, meningkatkan keandalan sinyal

- Mendukung pengelolaan posisi dan pengaturan biaya transaksi, lebih dekat dengan kondisi perdagangan nyata

Risiko Strategi

- Pasar yang berosilasi cepat dapat menyebabkan perdagangan yang sering, meningkatkan biaya transaksi

- Stop loss tetap 12% mungkin terlalu ketat di pasar dengan volatilitas tinggi

- Sinyal Bollinger Bands dapat menghasilkan sinyal palsu di pasar tren

- ATR trailing stop dapat mengakibatkan penarikan yang lebih besar selama volatilitas yang parah Langkah-langkah mitigasi:

- Rekomendasi penggunaan pada jangka waktu yang lebih panjang (30 menit-1 jam)

- Mengatur persentase stop loss berdasarkan karakteristik instrumen tertentu

- Pertimbangkan untuk menambahkan filter tren untuk mengurangi sinyal palsu

- Sesuaikan secara dinamis pengganda ATR untuk lingkungan pasar yang berbeda

Arah Optimasi Strategi

- Optimasi entri:

- Tambahkan mekanisme konfirmasi volume

- Masukkan indikator kekuatan tren untuk penyaringan sinyal

- Pertimbangkan untuk menambahkan indikator momentum untuk konfirmasi

- Optimasi stop-loss:

- Konversi stop loss tetap ke stop stop dinamis berbasis ATR

- Mengembangkan algoritma stop-loss adaptif

- Mengatur jarak berhenti secara dinamis berdasarkan volatilitas

- Optimasi rata-rata bergerak:

- Uji kombinasi periode yang berbeda

- Metode Periode Adaptif Penelitian

- Pertimbangkan untuk menggunakan price action daripada moving average

- Optimasi manajemen posisi:

- Mengembangkan sistem ukuran posisi berbasis volatilitas

- Mengimplementasikan mekanisme masuk dan keluar skala

- Tambahkan kontrol eksposur risiko

Ringkasan

Strategi ini membangun sistem perdagangan multi-level menggunakan Bollinger Bands dan indikator ATR, menggunakan metode manajemen dinamis untuk masuk, stop-loss, dan profit-taking. Kekuatannya terletak pada sistem kontrol risiko yang komprehensif dan kemampuan untuk beradaptasi dengan volatilitas pasar. Melalui arah optimasi yang disarankan, strategi ini memiliki ruang yang signifikan untuk perbaikan.

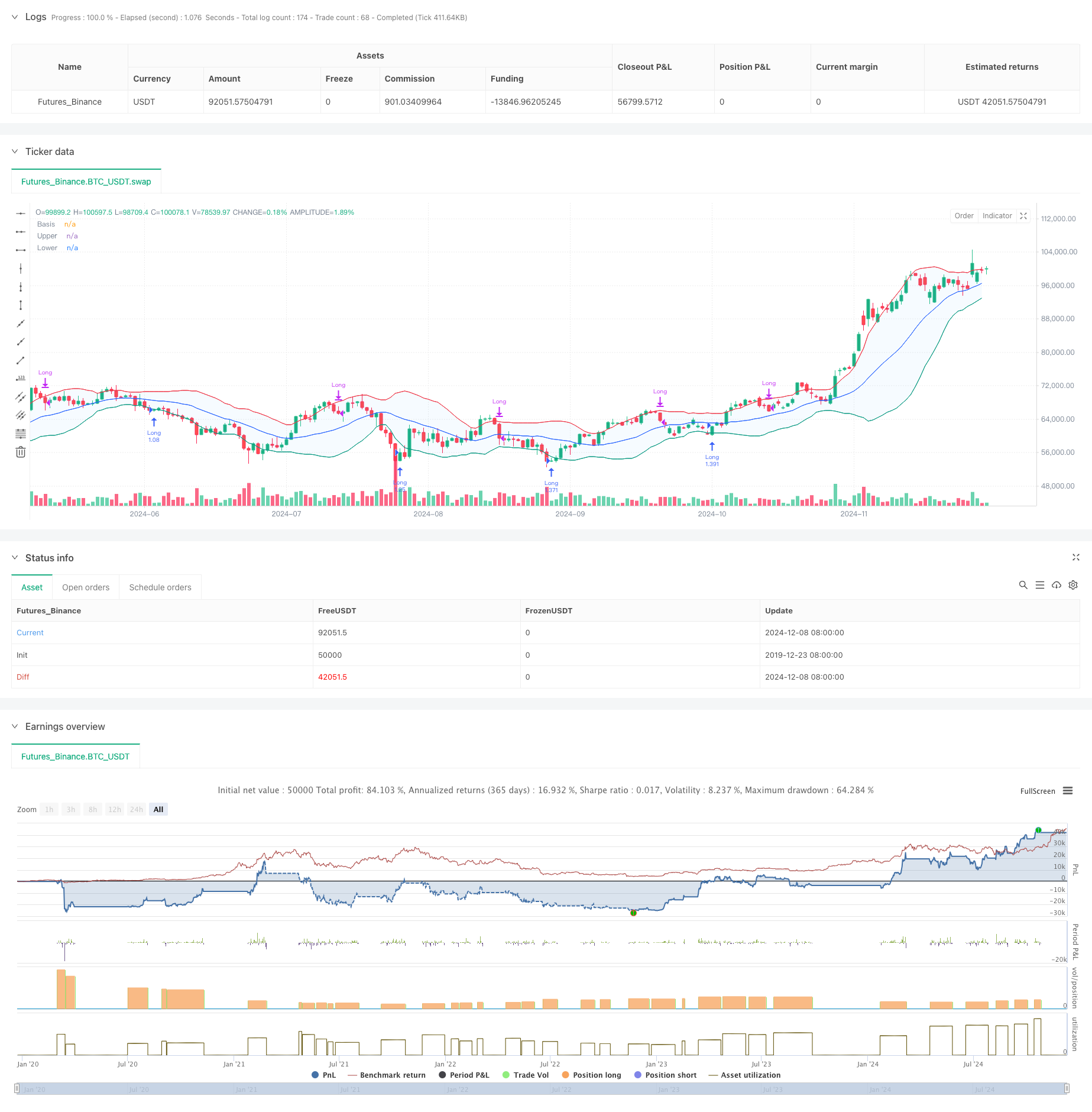

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Demo GPT - Bollinger Bands Strategy with Tightened Trailing Stops", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_value=0.1, slippage=3)

// Input settings

length = input.int(20, minval=1)

maType = input.string("SMA", "Basis MA Type", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

src = input(close, title="Source")

mult = 1.5 // Standard deviation multiplier set to 1.5

offset = input.int(0, "Offset", minval=-500, maxval=500)

atrMultiplier = input.float(1.0, title="ATR Multiplier for Trailing Stop", minval=0.1) // ATR multiplier for trailing stop

// Time range filters

start_date = input(timestamp("2018-01-01 00:00"), title="Start Date")

end_date = input(timestamp("2069-12-31 23:59"), title="End Date")

in_date_range = true

// Moving average function

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

// Calculate Bollinger Bands

basis = ma(src, length, maType)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

// ATR Calculation

atr = ta.atr(length) // Use ATR for trailing stop adjustments

// Plotting

plot(basis, "Basis", color=#2962FF, offset=offset)

p1 = plot(upper, "Upper", color=#F23645, offset=offset)

p2 = plot(lower, "Lower", color=#089981, offset=offset)

fill(p1, p2, title="Background", color=color.rgb(33, 150, 243, 95))

// Candle color detection

isGreen = close > open

isRed = close < open

// Flags for entry and exit conditions

var bool redTouchedLower = false

var float targetPrice = na

var float stopLossPrice = na

var float trailingStopPrice = na

if in_date_range

// Entry Logic: First green candle after a red candle touches the lower band

if close < lower and isRed

redTouchedLower := true

if redTouchedLower and isGreen

strategy.entry("Long", strategy.long)

targetPrice := close * 1.2 // Set the target price to 20% above the entry price

stopLossPrice := close * 0.88 // Set the stop loss to 12% below the entry price

trailingStopPrice := na // Reset trailing stop on entry

redTouchedLower := false

// Exit Logic: Trailing stop after 20% price increase

if strategy.position_size > 0 and not na(targetPrice) and close >= targetPrice

if na(trailingStopPrice)

trailingStopPrice := close - atr * atrMultiplier // Initialize trailing stop using ATR

trailingStopPrice := math.max(trailingStopPrice, close - atr * atrMultiplier) // Tighten dynamically based on ATR

// Exit if the price falls below the trailing stop after 20% increase

if strategy.position_size > 0 and not na(trailingStopPrice) and close < trailingStopPrice

strategy.close("Long", comment="Trailing Stop After 20% Increase")

targetPrice := na // Reset the target price

stopLossPrice := na // Reset the stop loss price

trailingStopPrice := na // Reset trailing stop

// Stop Loss: Exit if the price drops 12% below the entry price

if strategy.position_size > 0 and not na(stopLossPrice) and close <= stopLossPrice

strategy.close("Long", comment="Stop Loss Triggered")

targetPrice := na // Reset the target price

stopLossPrice := na // Reset the stop loss price

trailingStopPrice := na // Reset trailing stop

// Trailing Stop: Activate after touching the upper band

if strategy.position_size > 0 and close >= upper and isGreen

if na(trailingStopPrice)

trailingStopPrice := close - atr * atrMultiplier // Initialize trailing stop using ATR

trailingStopPrice := math.max(trailingStopPrice, close - atr * atrMultiplier) // Tighten dynamically based on ATR

// Exit if the price falls below the trailing stop

if strategy.position_size > 0 and not na(trailingStopPrice) and close < trailingStopPrice

strategy.close("Long", comment="Trailing Stop Triggered")

trailingStopPrice := na // Reset trailing stop

targetPrice := na // Reset the target price

stopLossPrice := na // Reset the stop loss price

- Bollinger Bands dan Moving Average Crossover Strategy

- Strategi Perdagangan Kuantitatif Lanjutan Menggabungkan Divergensi RSI dan Rata-rata Bergerak

- Bollinger Bands Momentum Breakout Adaptive Trend Mengikuti Strategi

- Bollinger Bands Breakout Momentum Strategi Perdagangan

- Strategi Perdagangan Band Volatilitas Multi-Layer

- Adaptive Moving Average Crossover Strategi

- Trend Crossover Rata-rata Multi-Moving Mengikuti Strategi dengan Filter Volatilitas

- Trend Crossover Rata-rata Bergerak Multi-Periode Mengikuti Strategi

- Dual Moving Average Momentum Tracking Strategi Kuantitatif

- RSI Dinamis Smart Timing Swing Trading Strategi

- Tren Heikin Ashi yang Diatasi Berbagai Jangka Waktu Mengikuti Sistem Perdagangan Kuantitatif

- Osilator RSI Dinamis Indikator Kecocokan Polinomial Tren Strategi Perdagangan Kuantitatif

- Strategi Perdagangan Satu Arah Penembusan Jangkauan Harian

- SMA-RSI-MACD Multi-Indicator Dynamic Limit Order Trading Strategy

- EMA/SMA Trend Following dengan Swing Trading Strategy Combined Volume Filter and Percentage Take-Profit/Stop-Loss System

- VWAP Standar Deviasi Rata-rata Reversi Strategi Perdagangan

- Strategi Perdagangan Breakout Zona Harga Dinamis Berdasarkan Sistem Kuantitatif Dukungan dan Resistensi

- Strategi Kuantitatif Crossover Trend Momentum Multi-Indikator

- Perhentian Trailing Dinamis Lanjutan dengan Strategi Penargetan Risiko-Penghargaan

- Strategi Breakout Trendline Dinamis Lang-Only Advanced

- Strategi Crossover EMA Dual Dinamis dengan Kontrol Keuntungan/Hilang yang Adaptif

- Bollinger Bands dan RSI Combined Dynamic Trading Strategy

- RSI-ATR Momentum Volatilitas Strategi Perdagangan Gabungan

- Dual EMA Trend-Following Strategy dengan Limit Buy Entry

- Sistem Perdagangan Analisis Teknis Multi-Strategi

- Strategi perdagangan pengakuan pola candlestick gabungan multi-frame

- Triple Bollinger Bands Mencapai Tren Mengikuti Strategi Perdagangan Kuantitatif

- Sistem Perdagangan Breakout Dinamis Multidimensional Berdasarkan Bollinger Bands dan RSI

- RSI Mean Reverssion Breakout Strategi

- Tren Momentum Dual EMA Crossover Mengikuti Strategi