Strategi perdagangan kontra-tren multi-faktor

Penulis:ChaoZhang, Tanggal: 2024-12-11 17:36:41Tag:BBVOLATREMA

Gambaran umum

Multi-Factor Counter-Trend Trading Strategy adalah sistem perdagangan algoritmik yang canggih yang dirancang untuk mengidentifikasi titik pembalikan potensial setelah kenaikan atau penurunan harga berturut-turut di pasar. Strategi menganalisis pergerakan harga bersama dengan konfirmasi volume dan saluran band (Bollinger Bands atau Keltner Channels) untuk menangkap peluang pembalikan dalam kondisi overbought atau oversold. Kekuatan inti terletak pada pendekatan multi-faktor untuk meningkatkan keandalan dan akurasi sinyal.

Prinsip Strategi

Strategi menghasilkan sinyal perdagangan berdasarkan tiga elemen inti:

- Deteksi Gerakan Harga Berturut-turut - Mengidentifikasi tren yang kuat melalui pengaturan ambang untuk bar naik atau turun berturut-turut

- Mekanisme Konfirmasi Volume - Analisis volume opsional yang membutuhkan peningkatan volume selama pergerakan harga berturut-turut

- Verifikasi Penembusan Saluran - Mendukung kedua Bollinger Band dan Saluran Keltner untuk mengkonfirmasi kondisi overbought/oversold

Sinyal perdagangan dipicu ketika kondisi yang ditetapkan terpenuhi. Sistem memetakan penanda segitiga dan mengeksekusi posisi panjang / pendek yang sesuai setelah konfirmasi bar. Strategi ini menggunakan 80% ekuitas akun untuk ukuran posisi dan faktor dalam komisi perdagangan 0,01%

Keuntungan Strategi

- Konfirmasi Sinyal Multidimensional - Mengurangi sinyal palsu melalui analisis komprehensif harga, volume, dan saluran

- Konfigurasi Parameter Fleksibel - Jumlah bar yang dapat disesuaikan, volume opsional dan konfirmasi saluran untuk kondisi pasar yang berbeda

- Clear Visual Feedback - Visualisasi titik masuk yang intuitif melalui penanda segitiga untuk pemantauan dan backtesting

- Manajemen uang rasional - Dimensi posisi dinamis berdasarkan proporsi akun untuk pengendalian risiko yang efektif

Risiko Strategi

- Risiko pembalikan gagal - Sinyal kontra-trend dapat menyebabkan kerugian dalam tren yang kuat

- Masalah Efisiensi Modal - Penggunaan ekuitas tetap 80% mungkin terlalu agresif dalam kondisi pasar tertentu

- Time Lag Risk - Menunggu konfirmasi bar dapat mengakibatkan titik masuk yang tidak optimal

- Sensitivitas parameter - Kinerja bervariasi secara signifikan dengan kombinasi parameter yang berbeda

Arah Optimasi Strategi

- Implementasikan Stop-Loss Dinamis - Pertimbangkan stop-loss adaptif berdasarkan ATR atau volatilitas

- Mengoptimalkan Manajemen Posisi - Mempertimbangkan ukuran posisi dinamis berdasarkan volatilitas pasar

- Tambahkan Filter Tren - Masukkan indikator tren seperti rata-rata bergerak untuk menghindari perdagangan kontra-tren dalam tren yang kuat

- Memperkuat Mekanisme Keluar - Merancang aturan pengambilan keuntungan berdasarkan indikator teknis

- Adaptasi Lingkungan Pasar - Sesuaikan secara dinamis parameter strategi berdasarkan kondisi pasar

Ringkasan

Multi-Factor Counter-Trend Trading Strategy menyediakan pendekatan sistematis untuk reversal trading melalui analisis komprehensif pola harga, perubahan volume, dan breakout saluran. Sementara strategi ini unggul dalam konfigurasi yang fleksibel dan konfirmasi sinyal multi-dimensi, perhatian harus diberikan pada adaptasi lingkungan pasar dan pengendalian risiko. Arahan optimasi yang disarankan menawarkan peningkatan potensial untuk kinerja perdagangan langsung.

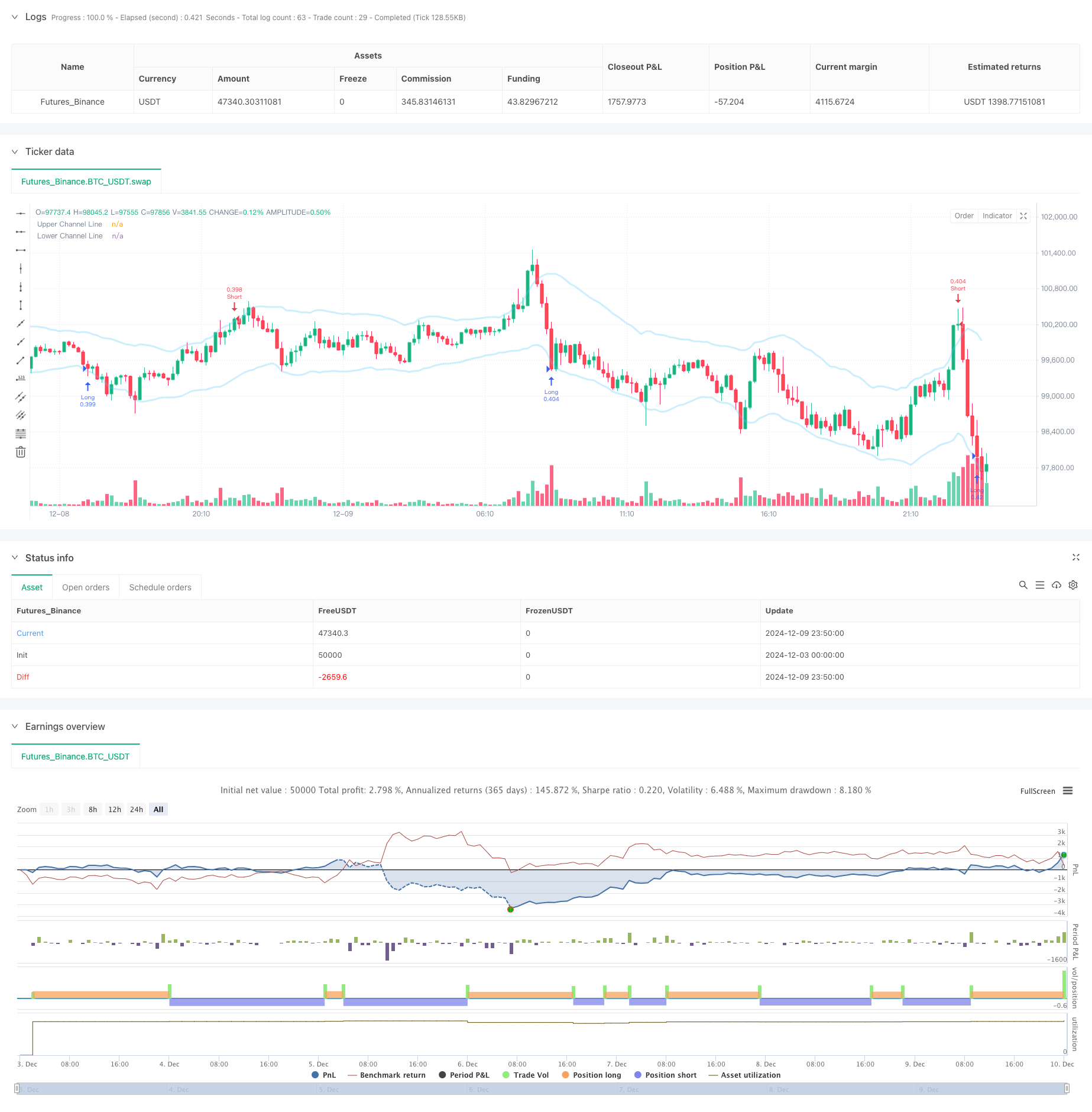

/*backtest

start: 2024-12-03 00:00:00

end: 2024-12-10 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="The Bar Counter Trend Reversal Strategy [TradeDots]", overlay=true, initial_capital = 10000, default_qty_type = strategy.percent_of_equity, default_qty_value = 80, commission_type = strategy.commission.percent, commission_value = 0.01)

// Initialize variables

var bool rise_triangle_ready = false

var bool fall_triangle_ready = false

var bool rise_triangle_plotted = false

var bool fall_triangle_plotted = false

//Strategy condition setup

noOfRises = input.int(3, "No. of Rises", minval=1, group="STRATEGY")

noOfFalls = input.int(3, "No. of Falls", minval=1, group="STRATEGY")

volume_confirm = input.bool(false, "Volume Confirmation", group="STRATEGY")

channel_confirm = input.bool(true, "", inline="CHANNEL", group="STRATEGY")

channel_type = input.string("KC", "", inline="CHANNEL", options=["BB", "KC"],group="STRATEGY")

channel_source = input(close, "", inline="CHANNEL", group="STRATEGY")

channel_length = input.int(20, "", inline="CHANNEL", minval=1,group="STRATEGY")

channel_mult = input.int(2, "", inline="CHANNEL", minval=1,group="STRATEGY")

//Get channel line information

[_, upper, lower] = if channel_type == "KC"

ta.kc(channel_source, channel_length,channel_mult)

else

ta.bb(channel_source, channel_length,channel_mult)

//Entry Condition Check

if channel_confirm and volume_confirm

rise_triangle_ready := ta.falling(close, noOfFalls) and ta.rising(volume, noOfFalls) and high > upper

fall_triangle_ready := ta.rising(close, noOfRises) and ta.rising(volume, noOfRises) and low < lower

else if channel_confirm

rise_triangle_ready := ta.falling(close, noOfFalls) and low < lower

fall_triangle_ready := ta.rising(close, noOfRises) and high > upper

else if volume_confirm

rise_triangle_ready := ta.falling(close, noOfFalls) and ta.rising(volume, noOfFalls)

fall_triangle_ready := ta.rising(close, noOfRises) and ta.rising(volume, noOfRises)

else

rise_triangle_ready := ta.falling(close, noOfFalls)

fall_triangle_ready := ta.rising(close, noOfRises)

// Check if trend is reversed

if close > close[1]

rise_triangle_plotted := false // Reset triangle plotted flag

if close < close[1]

fall_triangle_plotted := false

//Wait for bar close and enter trades

if barstate.isconfirmed

// Plot triangle when ready and counts exceed threshold

if rise_triangle_ready and not rise_triangle_plotted

label.new(bar_index, low, yloc = yloc.belowbar, style=label.style_triangleup, color=color.new(#9CFF87,10))

strategy.entry("Long", strategy.long)

rise_triangle_plotted := true

rise_triangle_ready := false // Prevent plotting again until reset

if fall_triangle_ready and not fall_triangle_plotted

label.new(bar_index, low, yloc = yloc.abovebar, style=label.style_triangledown, color=color.new(#F9396A,10))

strategy.entry("Short", strategy.short)

fall_triangle_plotted := true

fall_triangle_ready := false

// plot channel bands

plot(upper, color = color.new(#56CBF9, 70), linewidth = 3, title = "Upper Channel Line")

plot(lower, color = color.new(#56CBF9, 70), linewidth = 3, title = "Lower Channel Line")

- Strategi Crossover Momentum Multi-Trend dengan Sistem Optimasi Volatilitas

- EMA Crossover dengan Bollinger Bands Double Entry Strategy: Sistem Trading Kuantitatif Menggabungkan Trend Following dan Volatility Breakout

- Tren Penembusan Multi-Order Mengikuti Strategi

- Strategi Kuantitatif Breakout Bollinger yang ditingkatkan dengan Sistem Integrasi Filter Momentum

- Strategi perdagangan setelah pembukaan dengan manajemen posisi berbasis ATR yang dinamis

- Strategi Kuantitatif Reversi Rata-rata Bollinger yang Ditingkatkan

- Tidak ada Upper Wick Bullish Candle Breakout Strategi

- Strategi Trading Tren Stop-Loss Dinamis Multi-Indicator

- Strategi pembalikan rata-rata yang ditingkatkan dengan pelaksanaan MACD-ATR

- Tren Komposit Multi-Indikator Mengikuti Strategi

- Bollinger Breakout dengan Reversi Rata-rata 4H Strategi Perdagangan Kuantitatif

- Tren Mengikuti Strategi Pengukuran Posisi Garis Dinamis

- Dual BBI (Bulls and Bears Index) Strategi Crossover

- Strategi perdagangan swing panjang/pendek yang dinamis dengan sistem sinyal crossover rata-rata bergerak

- Trend Indikator Multi-Teknis Mengikuti Strategi Perdagangan

- Strategi Trading Revolusi Volatilitas Mean Advanced: Sistem Trading Kuantitatif Multidimensional Berdasarkan VIX dan Moving Average

- Strategi Momentum Pembalikan Saluran Tren Emas

- Strategi Perdagangan Tren Momentum EMA Lanjutan

- Strategi Trading Intensitas Tren Multi-MA - Sistem Trading Pintar Fleksibel Berdasarkan Penyimpangan MA

- Sistem Deteksi Tren Dual Volume-Weighted

- Strategi Perdagangan Kuantitatif Osilator Momentum dan Divergensi Stochastic yang Ditingkatkan

- Retracement Fibonacci Multi-Timeframe dengan Strategi Trading Trend Breakout

- Tren Multi-Indikator Mengikuti Strategi dengan Optimasi Keuntungan

- Strategi Perdagangan Momentum Breakout Fraktal dengan Optimasi Keuntungan

- Adaptive Mean-Reversion Trading Strategy Berdasarkan Chande Momentum Oscillator

- MACD-Supertrend Tren Konfirmasi Ganda Mengikuti Strategi Perdagangan

- Strategi Perdagangan Dinamis SuperTrend Multi-Periode

- Multi-Timeframe EMA dengan Fibonacci Retracement dan Pivot Points Trading Strategy

- Strategi perdagangan EMA-Squeeze Stop-Loss Dinamis Multi-Timeframe

- MACD dan Strategi Perdagangan Cerdas Sinyal Ganda Regresi Linear