Strategi Pelacakan Tren Dinamis ATR Multi-Timeframe

Penulis:ChaoZhang, Tanggal: 2024-12-12 16:24:49Tag:EMARSIMACDATR

Gambaran umum

Strategi ini adalah sistem mengikuti tren adaptif yang menggabungkan beberapa indikator teknis. Ini mengoptimalkan kinerja perdagangan melalui analisis multi-frame waktu dan penyesuaian dinamis tingkat stop-loss dan take-profit. Inti dari strategi ini menggunakan sistem rata-rata bergerak untuk mengidentifikasi tren, RSI dan MACD untuk mengkonfirmasi kekuatan tren, dan ATR untuk penyesuaian parameter manajemen risiko dinamis.

Prinsip Strategi

Strategi ini menggunakan mekanisme verifikasi tiga kali lipat untuk perdagangan: 1) Arah tren ditentukan oleh penyeberangan EMA cepat / lambat; 2) Sinyal perdagangan disaring menggunakan tingkat overbought / oversold RSI dan konfirmasi tren MACD; 3) EMA jangka waktu yang lebih tinggi dimasukkan untuk konfirmasi tren. Untuk pengendalian risiko, strategi secara dinamis menyesuaikan target stop-loss dan profit berdasarkan ATR, mencapai manajemen posisi adaptif. Ketika volatilitas pasar meningkat, sistem secara otomatis memperluas ruang stop-loss dan profit; ketika pasar stabil, parameter ini disempitkan untuk meningkatkan tingkat kemenangan.

Keuntungan Strategi

- Mekanisme verifikasi sinyal multidimensi secara signifikan meningkatkan akurasi perdagangan

- Pengaturan stop loss dan take profit yang dapat disesuaikan lebih baik untuk lingkungan pasar yang berbeda

- Konfirmasi tren jangka waktu yang lebih tinggi secara efektif mengurangi risiko pecah palsu

- Sistem peringatan yang komprehensif membantu menangkap peluang perdagangan dan pengendalian risiko tepat waktu

- Pengaturan arah perdagangan yang fleksibel memungkinkan penyesuaian strategi dengan preferensi perdagangan yang berbeda

Risiko Strategi

- Mekanisme verifikasi ganda dapat kehilangan peluang dalam pergerakan pasar yang cepat

- Stop-loss dinamis dapat memicu prematur di pasar yang sangat volatile

- Sinyal palsu dapat sering terjadi di pasar yang terikat rentang

- Risiko overfit selama optimasi parameter

- Analisis multi-frame waktu dapat menghasilkan sinyal yang bertentangan di berbagai timeframe

Arahan Optimasi

- Masukkan indikator volume sebagai konfirmasi tambahan untuk meningkatkan keandalan sinyal

- Mengembangkan sistem penilaian kekuatan tren kuantitatif untuk mengoptimalkan waktu masuk

- Mengimplementasikan mekanisme optimasi parameter adaptif untuk meningkatkan stabilitas strategi

- Tambahkan sistem klasifikasi lingkungan pasar untuk menerapkan parameter yang berbeda untuk pasar yang berbeda

- Mengembangkan sistem manajemen posisi dinamis untuk menyesuaikan ukuran posisi berdasarkan kekuatan sinyal

Ringkasan

Ini adalah sistem tren yang dirancang dengan ketat yang menyediakan solusi perdagangan yang komprehensif melalui mekanisme verifikasi multi-level dan manajemen risiko dinamis. Kekuatan inti strategi terletak pada kemampuan beradaptasi dan pengendalian risiko, tetapi perhatian harus diberikan pada optimasi parameter dan pencocokan lingkungan pasar selama implementasi. Melalui optimasi dan penyempurnaan terus-menerus, strategi ini memiliki potensi untuk mempertahankan kinerja yang stabil di berbagai lingkungan pasar.

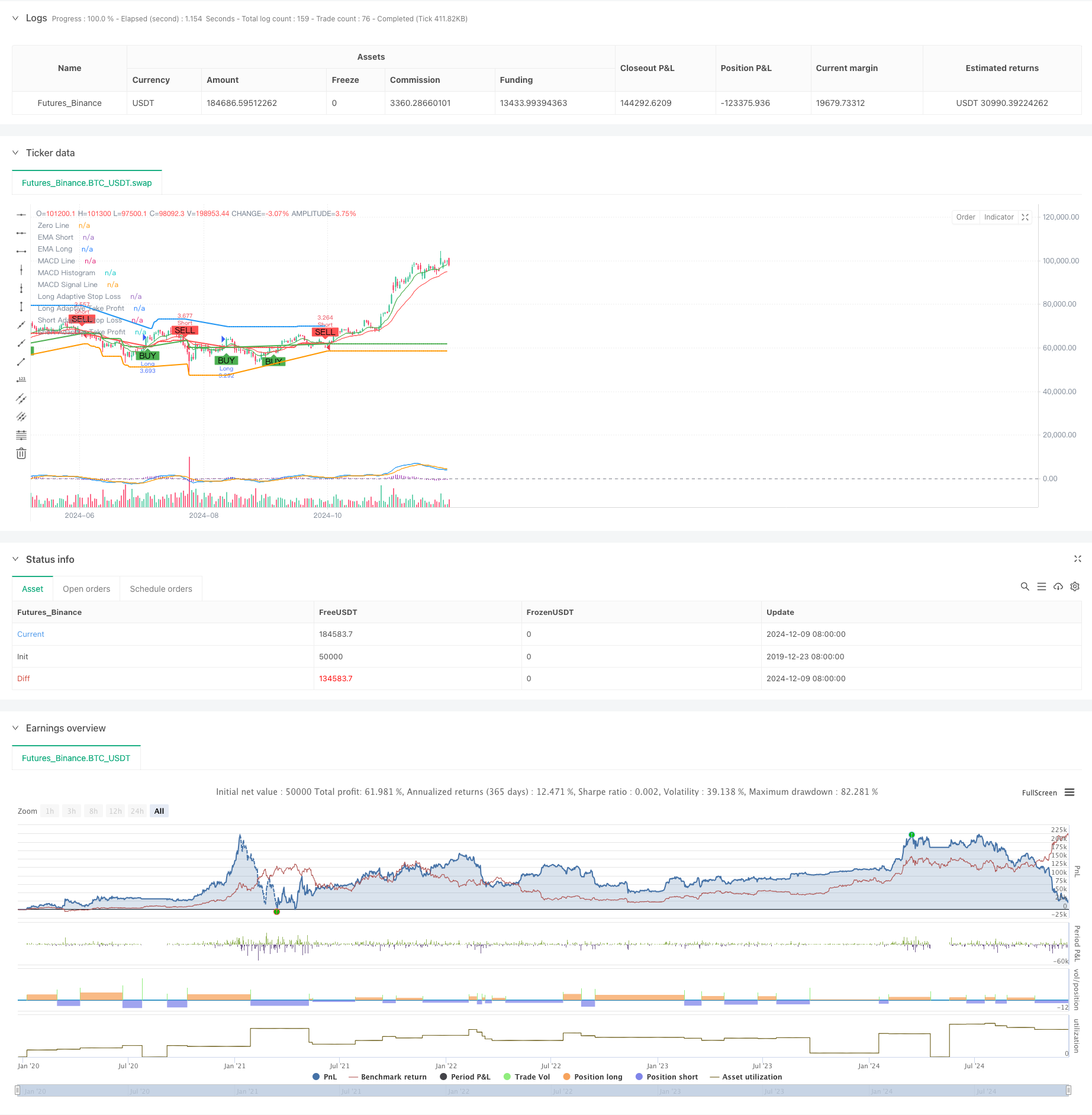

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("TrenGuard Adaptive ATR Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Parameters

emaShortPeriod = input.int(9, title="Short EMA Period", minval=1)

emaLongPeriod = input.int(21, title="Long EMA Period", minval=1)

rsiPeriod = input.int(14, title="RSI Period", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought", minval=50)

rsiOversold = input.int(30, title="RSI Oversold", minval=1)

atrPeriod = input.int(14, title="ATR Period", minval=1)

atrMultiplierSL = input.float(2.0, title="ATR Multiplier for Stop-Loss", minval=0.1)

atrMultiplierTP = input.float(2.0, title="ATR Multiplier for Take-Profit", minval=0.1)

// Multi-timeframe settings

htfEMAEnabled = input.bool(true, title="Use Higher Timeframe EMA Confirmation?", inline="htf")

htfEMATimeframe = input.timeframe("D", title="Higher Timeframe", inline="htf")

// MACD Parameters

macdShortPeriod = input.int(12, title="MACD Short Period", minval=1)

macdLongPeriod = input.int(26, title="MACD Long Period", minval=1)

macdSignalPeriod = input.int(9, title="MACD Signal Period", minval=1)

// Select trade direction

tradeDirection = input.string("Both", title="Trade Direction", options=["Both", "Long", "Short"])

// Calculating indicators

emaShort = ta.ema(close, emaShortPeriod)

emaLong = ta.ema(close, emaLongPeriod)

rsiValue = ta.rsi(close, rsiPeriod)

atrValue = ta.atr(atrPeriod)

[macdLine, macdSignalLine, _] = ta.macd(close, macdShortPeriod, macdLongPeriod, macdSignalPeriod)

// Higher timeframe EMA confirmation

htfEMALong = request.security(syminfo.tickerid, htfEMATimeframe, ta.ema(close, emaLongPeriod))

// Trading conditions

longCondition = ta.crossover(emaShort, emaLong) and rsiValue < rsiOverbought and (not htfEMAEnabled or close > htfEMALong) and macdLine > macdSignalLine

shortCondition = ta.crossunder(emaShort, emaLong) and rsiValue > rsiOversold and (not htfEMAEnabled or close < htfEMALong) and macdLine < macdSignalLine

// Initial Stop-Loss and Take-Profit levels based on ATR

var float adaptiveStopLoss = na

var float adaptiveTakeProfit = na

if (strategy.position_size > 0) // Long Position

if (longCondition) // Trend Confirmation

adaptiveStopLoss := na(adaptiveStopLoss) ? close - atrValue * atrMultiplierSL : math.max(adaptiveStopLoss, close - atrValue * atrMultiplierSL)

adaptiveTakeProfit := na(adaptiveTakeProfit) ? close + atrValue * atrMultiplierTP : math.max(adaptiveTakeProfit, close + atrValue * atrMultiplierTP)

else

adaptiveStopLoss := na(adaptiveStopLoss) ? close - atrValue * atrMultiplierSL : math.max(adaptiveStopLoss, close - atrValue * atrMultiplierSL)

adaptiveTakeProfit := na(adaptiveTakeProfit) ? close + atrValue * atrMultiplierTP : math.max(adaptiveTakeProfit, close + atrValue * atrMultiplierTP)

if (strategy.position_size < 0) // Short Position

if (shortCondition) // Trend Confirmation

adaptiveStopLoss := na(adaptiveStopLoss) ? close + atrValue * atrMultiplierSL : math.min(adaptiveStopLoss, close + atrValue * atrMultiplierSL)

adaptiveTakeProfit := na(adaptiveTakeProfit) ? close - atrValue * atrMultiplierTP : math.min(adaptiveTakeProfit, close - atrValue * atrMultiplierTP)

else

adaptiveStopLoss := na(adaptiveStopLoss) ? close + atrValue * atrMultiplierSL : math.min(adaptiveStopLoss, close + atrValue * atrMultiplierSL)

adaptiveTakeProfit := na(adaptiveTakeProfit) ? close - atrValue * atrMultiplierTP : math.min(adaptiveTakeProfit, close - atrValue * atrMultiplierTP)

// Strategy Entry

if (longCondition and (tradeDirection == "Both" or tradeDirection == "Long"))

strategy.entry("Long", strategy.long)

if (shortCondition and (tradeDirection == "Both" or tradeDirection == "Short"))

strategy.entry("Short", strategy.short)

// Strategy Exit

if (strategy.position_size > 0) // Long Position

strategy.exit("Exit Long", "Long", stop=adaptiveStopLoss, limit=adaptiveTakeProfit, when=shortCondition)

if (strategy.position_size < 0) // Short Position

strategy.exit("Exit Short", "Short", stop=adaptiveStopLoss, limit=adaptiveTakeProfit, when=longCondition)

// Plotting EMAs

plot(emaShort, title="EMA Short", color=color.green)

plot(emaLong, title="EMA Long", color=color.red)

// Plotting MACD

hline(0, "Zero Line", color=color.gray)

plot(macdLine - macdSignalLine, title="MACD Histogram", color=color.purple, style=plot.style_histogram)

plot(macdLine, title="MACD Line", color=color.blue)

plot(macdSignalLine, title="MACD Signal Line", color=color.orange)

// Plotting Buy/Sell signals with distinct colors

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Plotting Trailing Stop-Loss and Take-Profit levels with distinct colors

plot(strategy.position_size > 0 ? adaptiveStopLoss : na, title="Long Adaptive Stop Loss", color=color.red, linewidth=2, style=plot.style_line)

plot(strategy.position_size < 0 ? adaptiveStopLoss : na, title="Short Adaptive Stop Loss", color=color.green, linewidth=2, style=plot.style_line)

plot(strategy.position_size > 0 ? adaptiveTakeProfit : na, title="Long Adaptive Take Profit", color=color.blue, linewidth=2, style=plot.style_line)

plot(strategy.position_size < 0 ? adaptiveTakeProfit : na, title="Short Adaptive Take Profit", color=color.orange, linewidth=2, style=plot.style_line)

// Alert conditions for entry signals

alertcondition(longCondition and (tradeDirection == "Both" or tradeDirection == "Long"), title="Long Signal", message="Long signal triggered: BUY")

alertcondition(shortCondition and (tradeDirection == "Both" or tradeDirection == "Short"), title="Short Signal", message="Short signal triggered: SELL")

// Alert conditions for exit signals

alertcondition(strategy.position_size > 0 and shortCondition, title="Exit Long Signal", message="Exit long position: SELL")

alertcondition(strategy.position_size < 0 and longCondition, title="Exit Short Signal", message="Exit short position: BUY")

// Alert conditions for reaching take-profit levels

alertcondition(strategy.position_size > 0 and close >= adaptiveTakeProfit, title="Take Profit Long Signal", message="Take profit level reached for long position")

alertcondition(strategy.position_size < 0 and close <= adaptiveTakeProfit, title="Take Profit Short Signal", message="Take profit level reached for short position")

- Strategi perdagangan jangka pendek multi-indikator dengan leverage tinggi

- Strategi Perdagangan Momentum Komprehensif Multi-Indikator

- Strategi Crossover EMA yang ditingkatkan dengan RSI/MACD/ATR

- Strategi Detektor Lembah MACD

- Strategi Crossover Momentum Pasar Multi-Timeframe

- Tren Multi-Indikator Mengikuti Strategi Manajemen Risiko Dinamis

- Strategi Crossover EMA/MACD/RSI

- Strategi perdagangan momentum tren EMA ganda

- Golden Momentum Capture Strategy: Sistem Crossover Rata-rata Bergerak Eksponensial Multi-Timeframe

- Tren Multi-EMA Mengikuti Strategi dengan Target ATR Dinamis

- Multi-Equilibrium Price Trend Following dan Reversal Trading Strategy

- Indeks Volatilitas Dinamis (VIDYA) dengan Strategi Pembalikan Trend-Following ATR

- Strategi Trading Adaptif Multi-Indikator Berdasarkan RSI, MACD dan Volume

- Strategi Trading Otomatis Berdasarkan Pola Harga Double Bottom dan Top

- Tren ATR Dinamis Mengikuti Strategi Berdasarkan Support Breakout

- Strategi Kuantitatif Crossover Multiple Moving Average dan Stochastic Oscillator

- Adaptive Trend Following and Reversal Detection Strategy: Sebuah Sistem Perdagangan Kuantitatif Berdasarkan Indikator ZigZag dan Aroon

- Strategi perdagangan sinergis multi-indikator dengan Bollinger Bands, Fibonacci, MACD dan RSI

- Rata-rata Reversi Bollinger Band Dollar-Cost Averaging Strategi Investasi

- Sistem Analisis Strategi Anomali Jumat Emas Multidimensional

- Moving Average Crossover dengan RSI Trend Momentum Tracking Strategy

- Strategi perdagangan trailing stop berbasis ATR yang dinamis

- Tren momentum menyusul strategi perdagangan konfirmasi ganda MACD-RSI

- Titik Pivot Dinamis dengan Sistem Optimasi Golden Cross

- Tren Multi-Indikator Mengikuti Strategi dengan Bollinger Bands dan ATR Dynamic Stop Loss

- Tren Dinamis Mengikuti Strategi Perdagangan Multi-Periode ATR

- Tren Multi-Indikator Mengikuti Strategi dengan Saluran Dinamis dan Sistem Perdagangan Rata-rata Bergerak

- Multi-EMA Trend Mengikuti Strategi dengan Konfirmasi SMMA

- Sistem Perdagangan Tren Multi-Indikator dengan Strategi Analisis Momentum

- Strategi Divergensi Momentum Cloud yang Mengikuti Tren