Pemecahan Struktur dengan Konfirmasi Volume Multi-kondisi Strategi Perdagangan Cerdas

Penulis:ChaoZhang, Tanggal: 2024-12-20 16:15:43Tag:BOSSMAATRTPSL

Gambaran umum

Ini adalah strategi perdagangan cerdas yang didasarkan pada Break of Structure (BOS) dan konfirmasi volume. Strategi ini menghasilkan sinyal perdagangan dengan mendeteksi price breakout dari level tertinggi atau terendah sebelumnya, dikombinasikan dengan konfirmasi ekspansi volume.

Prinsip Strategi

Logika inti mencakup elemen kunci berikut:

- Mengidentifikasi harga tertinggi dan terendah struktural dengan menghitung harga tertinggi dan terendah dalam periode tertentu

- Menggunakan rata-rata bergerak untuk menghitung volume dasar dan menentukan ekspansi volume yang signifikan

- Mengakumulasikan konfirmasi kenaikan ketika harga melanggar di atas sebelumnya tinggi dengan peningkatan volume

- Mengakumulasi konfirmasi penurunan ketika harga melanggar di bawah rendah sebelumnya dengan peningkatan volume

- Sinyal perdagangan hanya dipicu setelah mencapai jumlah konfirmasi yang ditentukan

- Mengatur tingkat profit dan stop loss berdasarkan persentase setelah masuk posisi

Keuntungan Strategi

- Mekanisme verifikasi kondisi ganda meningkatkan keandalan sinyal

- Integrasi indikator volume membantu menghindari sinyal breakout palsu

- Mekanisme konfirmasi berturut-turut mengurangi frekuensi perdagangan dan meningkatkan tingkat kemenangan

- Pengaturan take profit/stop loss dinamis secara otomatis menyesuaikan posisi keluar berdasarkan harga masuk

- Logika strategi yang jelas dengan parameter yang dapat disesuaikan menawarkan kemampuan beradaptasi yang baik

Risiko Strategi

- Pelanggaran palsu yang sering terjadi di berbagai pasar dapat menyebabkan kerugian berturut-turut

- Posisi stop loss mungkin tidak cukup tepat waktu di pasar yang volatile

- Mekanisme konfirmasi dapat menunda entri, kehilangan titik harga optimal

- Kriteria penilaian volume tetap mungkin tidak beradaptasi dengan baik dengan perubahan kondisi pasar Solusi:

- Memperkenalkan indikator volatilitas pasar untuk penyesuaian parameter dinamis

- Tambahkan filter tren untuk mengurangi sinyal palsu di pasar yang berbeda

- Mengoptimalkan logika stop-loss untuk meningkatkan fleksibilitas

- Metode perhitungan ambang volume adaptif

Arah Optimasi Strategi

- Menambahkan indikator identifikasi tren, seperti sistem rata-rata bergerak, untuk hanya berdagang ke arah tren

- Mengintegrasikan indikator ATR untuk penyesuaian jarak stop-loss dinamis

- Merancang mekanisme penilaian ambang volume yang beradaptasi volatilitas

- Sertakan filter waktu untuk menghindari periode berisiko tinggi

- Mengoptimalkan mekanisme konfirmasi untuk meningkatkan waktu masuk sambil mempertahankan keandalan

Ringkasan

Ini adalah sistem strategi yang menggabungkan teori analisis teknis klasik dengan metode perdagangan kuantitatif modern. Melalui verifikasi kondisi ganda dan kontrol risiko yang ketat, strategi menunjukkan stabilitas dan keandalan yang baik. Meskipun ada aspek yang membutuhkan optimasi, desain kerangka keseluruhan masuk akal dan memiliki nilai aplikasi praktis.

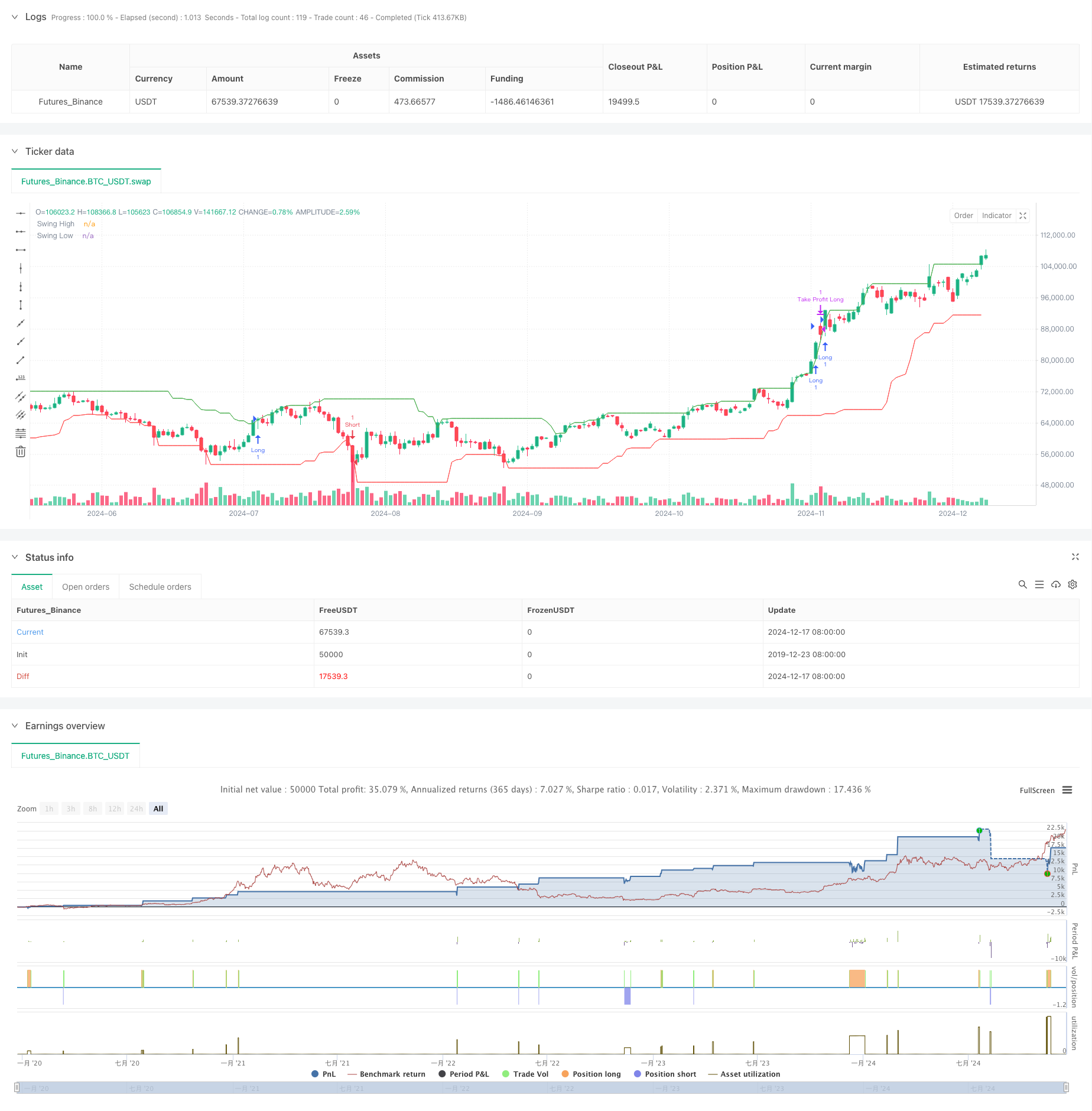

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("BOS and Volume Strategy with Confirmation", overlay=true)

// Parameters

swingLength = input.int(20, title="Swing Length", minval=1)

volumeMultiplier = input.float(1.1, title="Volume Multiplier", step=0.1)

volumeSMA_length = input.int(10, title="Volume SMA Length", minval=1)

takeProfitPercentage = input.float(0.02, title="Take Profit Percentage", step=0.01)

stopLossPercentage = input.float(0.15, title="Stop Loss Percentage", step=0.01) // New parameter for stop loss

atrLength = input.int(14, title="ATR Length")

confirmationBars = input.int(2, title="Confirmation Bars", minval=1)

// Calculate Swing Highs and Lows

swingHigh = ta.highest(high, swingLength)[1]

swingLow = ta.lowest(low, swingLength)[1]

// Calculate Volume Moving Average

volumeSMA = ta.sma(volume, volumeSMA_length)

highVolume = volume > (volumeSMA * volumeMultiplier)

// Break of Structure Detection with Confirmation

var int bullishCount = 0

var int bearishCount = 0

if (close > swingHigh and highVolume)

bullishCount := bullishCount + 1

bearishCount := 0

else if (close < swingLow and highVolume)

bearishCount := bearishCount + 1

bullishCount := 0

else

bullishCount := 0

bearishCount := 0

bullishBOSConfirmed = (bullishCount >= confirmationBars)

bearishBOSConfirmed = (bearishCount >= confirmationBars)

// Entry and Exit Conditions

var float entryPrice = na // Declare entryPrice as a variable

if (bullishBOSConfirmed and strategy.position_size <= 0)

entryPrice := close // Use ':=' for assignment

strategy.entry("Long", strategy.long)

if (strategy.position_size > 0)

// Calculate stop loss price

stopLossPrice = entryPrice * (1 - stopLossPercentage)

strategy.exit("Take Profit Long", from_entry="Long", limit=entryPrice * (1 + takeProfitPercentage), stop=stopLossPrice)

if (bearishBOSConfirmed and strategy.position_size >= 0)

entryPrice := close // Use ':=' for assignment

strategy.entry("Short", strategy.short)

if (strategy.position_size < 0)

// Calculate stop loss price

stopLossPrice = entryPrice * (1 + stopLossPercentage)

strategy.exit("Take Profit Short", from_entry="Short", limit=entryPrice * (1 - takeProfitPercentage), stop=stopLossPrice)

// Plot Swing Highs and Lows for Visualization

plot(swingHigh, title="Swing High", color=color.green, linewidth=1)

plot(swingLow, title="Swing Low", color=color.red, linewidth=1)

Berkaitan

- Strategi crossover rata-rata bergerak ganda dengan manajemen risiko dinamis

- Tren Dual-SMA yang Dinamis Mengikuti Strategi dengan Manajemen Risiko Cerdas

- Strategi kuantitatif rebound over-sold RSI stop-loss ATR dinamis

- Trend Rata-rata Bergerak Ganda Mengikuti Strategi dengan Sistem Manajemen Risiko Berbasis ATR

- Strategi Breakout Trendline Dinamis Lang-Only Advanced

- Adaptive Volatility and Momentum Quantitative Trading System (AVMQTS) (Sistem Perdagangan Kuantitatif Volatilitas dan Momentum Adaptif)

- Strategi Model Optimasi Tren Fusi ATR

- Adaptive Moving Average Crossover dengan Trailing Stop-Loss Strategy

- Strategi perdagangan swing panjang/pendek yang dinamis dengan sistem sinyal crossover rata-rata bergerak

- Tren Tingkat Menang Tinggi Artinya Strategi Perdagangan Reversi

Lebih banyak

- Adaptive Trend Following Strategy dengan Sistem Pengendalian Penarikan Dinamis

- Strategi Golden Cross Multi-EMA dengan tingkat Take-Profit

- Multi-Technical Indicator Cross-Trend Tracking Strategy: RSI dan Stochastic RSI Synergy Trading System

- Strategi Dynamic Buy Entry Menggabungkan EMA Crossing dan Penetrasi Tubuh Lilin

- Strategi Perdagangan Siklik Rata-rata Biaya Dolar

- MACD-RSI Crossover Trend Mengikuti Strategi dengan Sistem Optimasi Bollinger Bands

- Adaptive EMA Dynamic Position Break-out Trading Strategy (Strategi Perdagangan Posisi Dinamis Adaptif EMA)

- Strategi Optimasi Perdagangan Dinamis Multi-Indikator

- Penarikan Zona Multi-SMA dengan Strategi Perdagangan Kuantitatif Gembok Keuntungan Dinamis

- Strategi Pelacakan Tren Gelombang Dinamis

- Strategi Trading Tren Stop-Loss Dinamis Multi-Indicator

- Tren multi-kondisi mengikuti strategi perdagangan kuantitatif berdasarkan tingkat retracement Fibonacci

- Tren Rata-rata Bergerak Berbagai Mengikuti Strategi Perdagangan

- Strategi Trading Rata-rata Bergerak Cerdas Penembusan Tren Multi-Filter

- Strategi Penembusan dan Pembalikan EMA yang Dinamis

- Strategi Optimasi Momentum Tren Dinamis dengan Indikator G-Channel

- Strategi Pelacakan Dinamis ATH Bertingkat Bertiga

- Band VWAP adaptif dengan Strategi Pelacakan Volatilitas Dinamis Kelas Garman

- Tren Multi-Indikator Mengikuti Opsi Trading EMA Cross Strategy

- Strategi Trading Volatilitas Multi-Indikator RSI-EMA-ATR