RSI ダイナミック・トラッキング・ストップ・ロスの量的な取引戦略

作者: リン・ハーンチャオチャン,日付: 2024-11-29 16:10:35タグ:マルチRSISMASLTS

概要

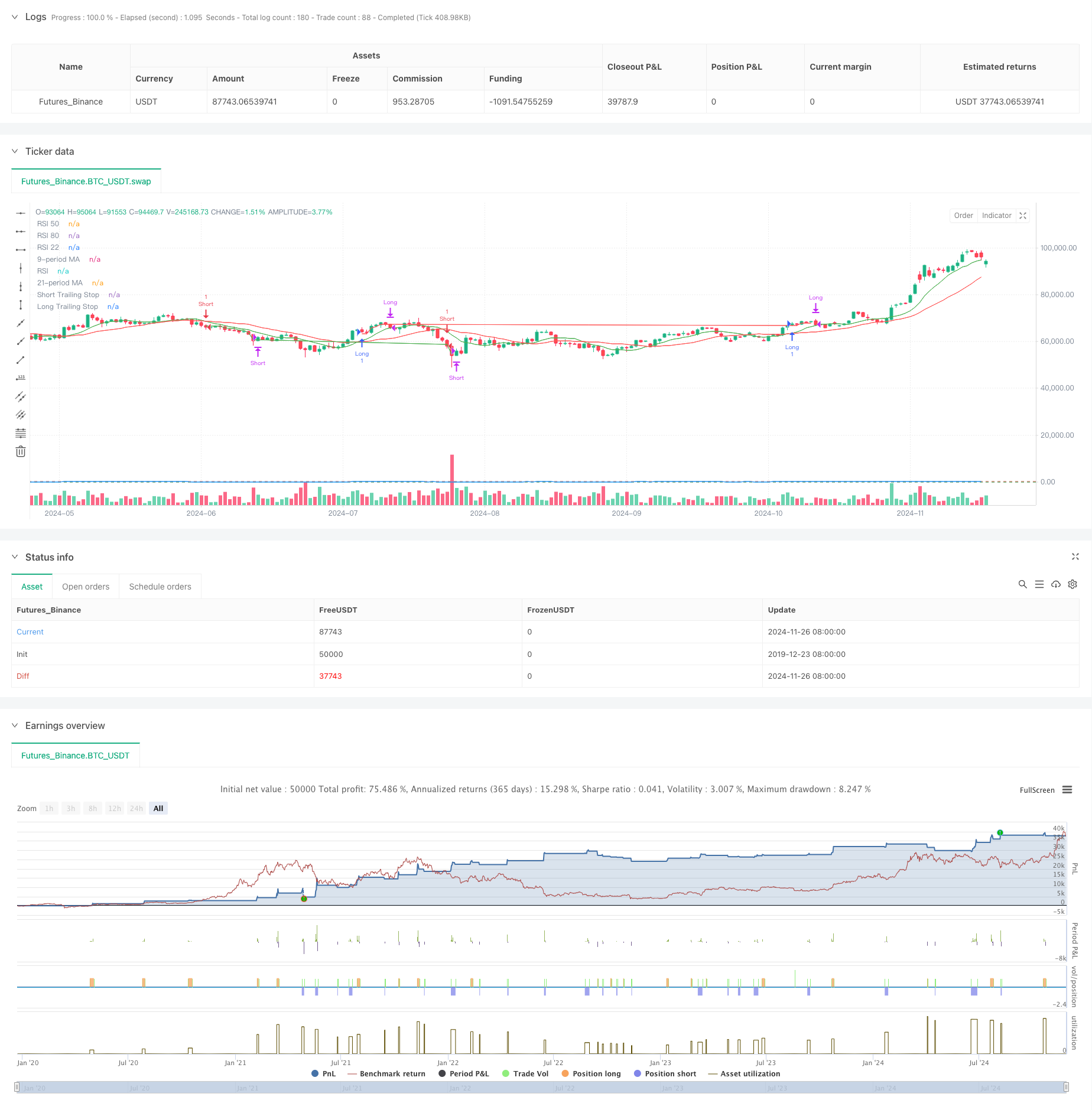

この戦略は,移動平均を相対強度指数 (RSI) とクロスオーバーを組み合わせ,トライリングストップ損失関数と統合した定量的な取引システムである.この戦略は,主要トレンドインジケーターとして9期と21期の移動平均を2つ利用し,貿易信号の確認のためにRSIと組み合わせ,利益保護とリスク管理のために動的トライリングストップを実装する.戦略設計は,完全な取引システムを形成するために,市場のトレンド,モメンタム,リスク管理の次元を包括的に考慮する.

戦略の原則

戦略の基本論理は次の主要な要素に基づいています

- トレンド識別:高速 (9期) と遅い (21期) 移動平均のクロスオーバーを通じて市場のトレンド変化を認識する.高速MAがRSIが55を超える遅いMAの上に横断したとき,長い信号が生成され,高速MAがRSIが45以下の低値に横断したとき,ショート信号が発生する.

- シグナル確認: RSIをシグナルフィルターとして使用し,RSIの

値設定を通じて取引シグナル信頼性を向上させる. - リスクコントロール: 1%のストップロスを採用し,利益を保護するためにストップポジションを動的に調整する.また,RSIベースの利益取りの条件を含み,RSIが80を超えるとロングポジションを閉じて,RSIが22を下回るとショートポジションを閉じる.

- ストップ・ロスのメカニズム:固定ストップとトライリング・ストップを組み合わせ,価格違反がエントリーポイントから前もって設定された割合レベルに達するかトライリング・ストップレベルに達すると自動的にポジションを閉じる.

戦略 の 利点

- 多次元信号検証: MAクロスオーバーとRSIの二重確認によって取引信号の精度を向上させる.

- 総合的なリスク管理: 利益保護とリスク管理の両方のために動的なトラッキングストップを実装する.

- 柔軟な入場メカニズム: トレンドとモメント指標を組み合わせて市場の転換点を効果的に把握する.

- 高自動化レベル: 明確な戦略論理は自動化取引の実施を容易にする.

- 高い適応性:パラメータ調整によって異なる市場環境に適応できます.

戦略リスク

- 横向市場リスク: 範囲限定の市場で頻繁に誤ったブレイクシグナルを生む可能性があります.

- 滑り込みリスク: 遅延停止実行中の潜在的な滑り込み損失.

- パラメータ敏感性: MA 期間と RSI 限界設定によって戦略のパフォーマンスが著しく影響を受ける.

- システムリスク: ストップ損失は,極端な市場条件では,間に合わない可能性があります.

戦略の最適化方向

- 信号強化: 追加的な確認条件として音量指標を組み込むことを検討する.

- ストップ・ロスの調整: 変動性に基づく動的ストップ・ロスの調整メカニズムを実施する.

- ポジション管理:リスク評価に基づく動的ポジションサイズシステムを追加する.

- 市場適応性: 市場環境の認識メカニズムを含めて,さまざまな市場状態における異なるパラメータ設定をします.

- シグナルフィルタリング: 変動性の高い市場開閉期間の取引を避けるために時間フィルタを追加します.

概要

この戦略は,従来の技術分析指標を通じてトレンドフォローとモメンタム特性を組み合わせた取引システムを構築する.その核心強みは多次元信号確認メカニズムと包括的なリスク管理システムにある.継続的な最適化と改善を通じて,この戦略は異なる市場環境で安定したパフォーマンスを維持するための約束を示している.トレーダーはライブ実装前に徹底的なバックテストを行い,特定の取引機器の特徴に応じてパラメータを調整することをお勧めする.

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("ojha's Intraday MA Crossover + RSI Strategy with Trailing Stop", overlay=true)

// Define Moving Averages

fastLength = 9

slowLength = 21

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

// Define RSI

rsiPeriod = 14

rsiValue = ta.rsi(close, rsiPeriod)

// Define Conditions for Long and Short

longCondition = ta.crossover(fastMA, slowMA) and rsiValue > 55

shortCondition = ta.crossunder(fastMA, slowMA) and rsiValue < 45

// Define the trailing stop distance (e.g., 1% trailing stop)

trailingStopPercent = 1.0

// Variables to store the entry candle high and low

var float longEntryLow = na

var float shortEntryHigh = na

// Variables for trailing stop levels

var float longTrailingStop = na

var float shortTrailingStop = na

// Exit conditions

exitLongCondition = rsiValue > 80

exitShortCondition = rsiValue < 22

// Stop-loss conditions (price drops below long entry candle low * 1% or exceeds short entry candle high * 1%)

longStopLoss = longEntryLow > 0 and close < longEntryLow * 0.99

shortStopLoss = shortEntryHigh > 0 and close > shortEntryHigh * 1.01

// Execute Buy Order and store the entry candle low for long stop-loss

if (longCondition)

strategy.entry("Long", strategy.long)

longEntryLow := low // Store the low of the candle where long entry happened

longTrailingStop := close * (1 - trailingStopPercent / 100) // Initialize trailing stop at entry

// Execute Sell Order and store the entry candle high for short stop-loss

if (shortCondition)

strategy.entry("Short", strategy.short)

shortEntryHigh := high // Store the high of the candle where short entry happened

shortTrailingStop := close * (1 + trailingStopPercent / 100) // Initialize trailing stop at entry

// Update trailing stop for long position

if (strategy.opentrades > 0 and strategy.position_size > 0)

longTrailingStop := math.max(longTrailingStop, close * (1 - trailingStopPercent / 100)) // Update trailing stop as price moves up

// Update trailing stop for short position

if (strategy.opentrades > 0 and strategy.position_size < 0)

shortTrailingStop := math.min(shortTrailingStop, close * (1 + trailingStopPercent / 100)) // Update trailing stop as price moves down

// Exit Buy Position when RSI is above 80, Stop-Loss triggers, or trailing stop is hit

if (exitLongCondition or longStopLoss or close < longTrailingStop)

strategy.close("Long")

longEntryLow := na // Reset the entry low after the long position is closed

longTrailingStop := na // Reset the trailing stop

// Exit Sell Position when RSI is below 22, Stop-Loss triggers, or trailing stop is hit

if (exitShortCondition or shortStopLoss or close > shortTrailingStop)

strategy.close("Short")

shortEntryHigh := na // Reset the entry high after the short position is closed

shortTrailingStop := na // Reset the trailing stop

// Plot Moving Averages on the Chart

plot(fastMA, color=color.green, title="9-period MA")

plot(slowMA, color=color.red, title="21-period MA")

// Plot RSI on a separate panel

rsiPlot = plot(rsiValue, color=color.blue, title="RSI")

hline(50, "RSI 50", color=color.gray)

hline(80, "RSI 80", color=color.red)

hline(22, "RSI 22", color=color.green)

// Plot Trailing Stop for Visualization

plot(longTrailingStop, title="Long Trailing Stop", color=color.red, linewidth=1, style=plot.style_line)

plot(shortTrailingStop, title="Short Trailing Stop", color=color.green, linewidth=1, style=plot.style_line)

関連性

- アダプティブ・トレンド・モメンタム・RSI戦略 移動平均フィルターシステム

- RSI トレンド・モメント・トラッキング・ストラテジーによる移動平均のクロスオーバー

- トレンドフィルターと例外出口のスムーズな移動平均ストップ・ロスト&テイク・プロフィート戦略

- 動的動向を追求する戦略 - 多指標統合動力分析システム

- 取引戦略をフォローするマルチテクニカル指標傾向

- MA,SMA,MA傾斜,ストップ損失を後押しし,再入力

- 複数のタイムフレームのビットコイン,バイナンスコイン,およびイーサリアムのプルバック・トレード戦略

- ストップ・ロスの最適化モデルによるダイナミックRSIオーバーセール リバウンド・トレーディング戦略

- 戦略をフォローする多動平均勢力の傾向

- 多期移動平均値とRSIモメントの交差トレンド 戦略に従う

もっと

- SMAのクロスオーバートレンドと戦略を順守するハイキン・アシのスムーズ化

- Hull移動平均値に基づく EMAの傾向決定戦略を反映した

- ダイナミックストップ・ロストとテイク・プロフィート戦略を持つダブル・EMAインジケーター・スマート・クロシング・トレーディング・システム

- RSIフィルターと OBV-SMAクロスオーバー 多次元モメンタム取引戦略

- ボリンジャー帯とキャンドルスティックパターンに基づく動的変動取引戦略

- ダイナミックなリスクマネジメントと固定得益を備えた高度なフェアバリューギャップ検出戦略

- ストップ・ロスの最適化モデルによるダイナミックRSIオーバーセール リバウンド・トレーディング戦略

- ダイナミックATRストップ・ロスのRSI 過売度リバウンド量的な戦略

- ATR波動性フィルターシステムによる高度な二重EMA戦略

- 双 EMA ダイナミックゾーン トレンド フォローする戦略

- 双 EMA トレンド モメンタム 取引戦略

- 多トレンドモメンタムクロスオーバー戦略と波動性最適化システム

- 多指標トレンドブレイク量的な取引戦略

- モメント インディケーター オシレーション

値 強化 トレーディング 戦略 - 複数のゾーンSMC理論に基づいた 戦略をフォローするインテリジェントトレンド

- RSIとEMAを組み合わせた多期量的なダイナミック取引戦略

- 多次元技術指標の動向は定量的な戦略に従った

- 2つの移動平均交差調整パラメータ取引戦略

- 複数のトレンドをフォローし,構造を突破する戦略

- TRAMA 双動平均 クロスオーバー インテリジェント量的な取引戦略