ドル・コスト平均化投資戦略

作者: リン・ハーンチャオチャン開催日:2024年12月12日 17:17:15タグ:BBDCAエイマSMA

概要

この戦略は,ドルコスト平均 (DCA) とボリンジャーバンド技術指標を組み合わせたインテリジェントな投資アプローチである. 平均逆転原理を活用することで,価格の引き下げ中に体系的にポジションを構築する. 価格がボリンジャーバンドの下位を突破したとき,市場の訂正中により良いエントリー価格を達成することを目的とした,コアメカニズムは固定金額の購入を実行する.

戦略の原則

この戦略は3つの基本的な柱の上に構築されている: 1) 定期的な固定金額投資を通じてタイミングリスクを軽減するドルコスト平均化; 2) 価格が最終的に歴史的な平均に戻ると仮定する平均逆転理論; 3) 過買い・過売区間を特定するためのボリンジャー帯指標. 価格が下帯を下回ると購入信号が起動し,購入量は設定された投資額を現在の価格で割ることで決定される. 戦略は,上位および下位帯を定義するために標準偏差倍数2の中間帯として200期EMAを使用する.

戦略 の 利点

- タイミングリスクが減る - 客観的な判断よりも体系的な購入が人間の誤りを減らす

- 負債の負債の負債の負債の負債の負債の負債

- フレキシブルなパラメータ - 調整可能なボリンジャーバンドパラメータと,異なる市場条件に対する投資金額

- 明確な入国/退出規則 - 技術指標に基づく客観的信号

- 自動実行 - 手動による介入は必要なく,感情取引を避けます

戦略リスク

- 平均逆転失敗リスク - トレンド市場の誤った信号を生む可能性があります.

- 負債・負債・負債・負債・負債・負債・負債・負債・負債・負債・負債・負債・負債・負債

- パラメータ最適化リスク - 過度な最適化は戦略の失敗につながる可能性があります

- 市場環境による依存性 - 高い不安定性のある市場では不良な業績を示す可能性がある 厳格な資本管理規則を導入し,これらのリスクを管理するために戦略の業績を定期的に評価することを推奨する.

戦略の最適化方向

- 強いトレンドで反トレンド操作を避けるためにトレンドフィルターを組み込む

- 複数のタイムフレームの確認メカニズムを追加する

- 波動性に基づくポジションサイズで資本管理システムを最適化

- 価格が平均値に戻ると利益を得るメカニズムを導入する

- 信号の信頼性を向上させるために他の技術指標と組み合わせることを検討する

概要

これは技術分析と体系的な投資方法を組み合わせた堅牢な戦略である.リスクを減らすためにドルコスト平均を導入しながら,過剰販売の機会を特定するためにボリンジャーバンドを使用する.成功の鍵は適切なパラメータ設定と厳格な実行規律にある.リスクが存在する一方で,継続的な最適化とリスク管理は戦略の安定性を向上させることができる.

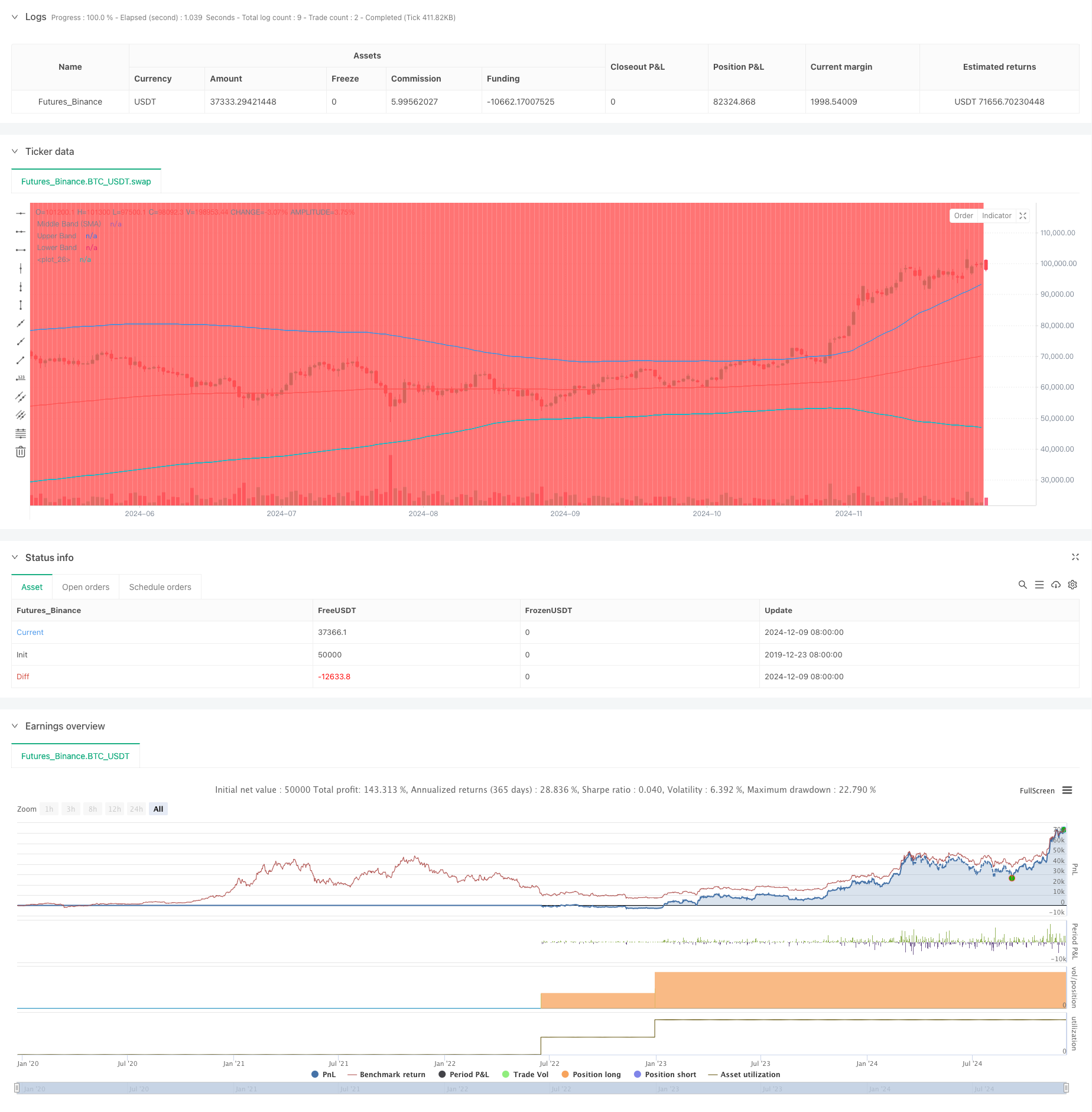

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("DCA Strategy with Mean Reversion and Bollinger Band", overlay=true) // Define the strategy name and set overlay=true to display on the main chart

// Inputs for investment amount and dates

investment_amount = input.float(10000, title="Investment Amount (USD)", tooltip="Amount to be invested in each buy order (in USD)") // Amount to invest in each buy order

open_date = input(timestamp("2024-01-01 00:00:00"), title="Open All Positions On", tooltip="Date when to start opening positions for DCA strategy") // Date to start opening positions

close_date = input(timestamp("2024-08-04 00:00:00"), title="Close All Positions On", tooltip="Date when to close all open positions for DCA strategy") // Date to close all positions

// Bollinger Band parameters

source = input.source(title="Source", defval=close, group="Bollinger Band Parameter", tooltip="The price source to calculate the Bollinger Bands (e.g., closing price)") // Source of price for calculating Bollinger Bands (e.g., closing price)

length = input.int(200, minval=1, title='Period', group="Bollinger Band Parameter", tooltip="Period for the Bollinger Band calculation (e.g., 200-period moving average)") // Period for calculating the Bollinger Bands (e.g., 200-period moving average)

mult = input.float(2, minval=0.1, maxval=50, step=0.1, title='Standard Deviation', group="Bollinger Band Parameter", tooltip="Multiplier for the standard deviation to define the upper and lower bands") // Multiplier for the standard deviation to calculate the upper and lower bands

// Timeframe selection for Bollinger Bands

tf = input.timeframe(title="Bollinger Band Timeframe", defval="240", group="Bollinger Band Parameter", tooltip="The timeframe used to calculate the Bollinger Bands (e.g., 4-hour chart)") // Timeframe for calculating the Bollinger Bands (e.g., 4-hour chart)

// Calculate BB for the chosen timeframe using security

[basis, bb_dev] = request.security(syminfo.tickerid, tf, [ta.ema(source, length), mult * ta.stdev(source, length)]) // Calculate Basis (EMA) and standard deviation for the chosen timeframe

upper = basis + bb_dev // Calculate the Upper Band by adding the standard deviation to the Basis

lower = basis - bb_dev // Calculate the Lower Band by subtracting the standard deviation from the Basis

// Plot Bollinger Bands

plot(basis, color=color.red, title="Middle Band (SMA)") // Plot the middle band (Basis, EMA) in red

plot(upper, color=color.blue, title="Upper Band") // Plot the Upper Band in blue

plot(lower, color=color.blue, title="Lower Band") // Plot the Lower Band in blue

fill(plot(upper), plot(lower), color=color.blue, transp=90) // Fill the area between Upper and Lower Bands with blue color at 90% transparency

// Define buy condition based on Bollinger Band

buy_condition = ta.crossunder(source, lower) // Define the buy condition when the price crosses under the Lower Band (Mean Reversion strategy)

// Execute buy orders on the Bollinger Band Mean Reversion condition

if (buy_condition ) // Check if the buy condition is true and time is within the open and close date range

strategy.order("DCA Buy", strategy.long, qty=investment_amount / close) // Execute the buy order with the specified investment amount

// Close all positions on the specified date

if (time >= close_date) // Check if the current time is after the close date

strategy.close_all() // Close all open positions

// Track the background color state

var color bgColor = na // Initialize a variable to store the background color (set to 'na' initially)

// Update background color based on conditions

if close > upper // If the close price is above the Upper Band

bgColor := color.red // Set the background color to red

else if close < lower // If the close price is below the Lower Band

bgColor := color.green // Set the background color to green

// Apply the background color

bgcolor(bgColor, transp=90, title="Background Color Based on Bollinger Bands") // Set the background color based on the determined condition with 90% transparency

// Postscript:

// 1. Once you have set the "Investment Amount (USD)" in the input box, proceed with additional configuration.

// Go to "Properties" and adjust the "Initial Capital" value by calculating it as "Total Closed Trades" multiplied by "Investment Amount (USD)"

// to ensure the backtest results are aligned correctly with the actual investment values.

//

// Example:

// Investment Amount (USD) = 100 USD

// Total Closed Trades = 10

// Initial Capital = 10 x 100 = 1,000 USD

// Investment Amount (USD) = 200 USD

// Total Closed Trades = 24

// Initial Capital = 24 x 200 = 4,800 USD

関連性

- ボリンジャー帯と指数関数移動平均のクロスオーバー取引戦略

- Wavetrend 大幅のリバウンド・グリッド・トレード戦略

- MACD BB ブレイクストラテジー

- ボリンジャー・バンドとEMA トレンドフォロー戦略

- ボリンジャー帯とRSIに基づく動的コスト平均化戦略システム

- 定量的な勢いと収束-離散に基づいた多期統一戦略

- 多指標の包括的な取引戦略:モメンタム,過剰購入/過剰販売,および不安定性の完璧な組み合わせ

- 強化されたボリンガー平均逆転量的な戦略

- ボリンジャー・バンドの動向傾向は定量戦略に従っている

- 複数の技術指標のシネージスト取引システム

もっと

- 戦略をフォローする多動平均傾向 - EMAとSMA指標に基づく長期投資シグナルシステム

- 戦略をフォローする月間移動平均フィルタートレンドと歴史的な高い突破

- 多均衡価格動向の追跡と逆転取引戦略

- 動的波動性指数 (VIDYA) とATRトレンドフォロディング逆転戦略

- RSI,MACDおよびボリュームに基づく多指標適応型取引戦略

- 価格パターンに基づくダブルボトムとトップ自動取引戦略

- サポートブレイクに基づく戦略をフォローする動的ATR傾向

- 複数の移動平均値とストカスティックオシレータークロスオーバーの定量戦略

- アダプティブ・トレンドフォローと逆転検出戦略:ジグザグとアロン指標に基づく定量取引システム

- 多指標シネージストラテジーはボリンジャーバンド,フィボナッチ,MACD,RSI

- 多次元ゴールド金曜日の異常戦略分析システム

- 多期動的ATRトレンド追跡戦略

- RSI トレンド・モメント・トラッキング・ストラテジーによる移動平均のクロスオーバー

- 動的ATRベースのトレーリングストップ取引戦略

- MACD-RSIの二重確認の取引戦略をフォローするモメンタムトレンド

- 金十字最適化システムを持つダイナミックピボットポイント

- 多指標トレンド ポリンジャーバンドとATRダイナミックストップロスの戦略

- ATRの多期取引戦略に続くダイナミックな傾向

- 動的チャネルと移動平均取引システムによる多指標トレンドフォロー戦略

- SMMAの確認による多EMAトレンドフォロー戦略