Sistem Mengikuti Trend Dinamik Berbilang Tahap

Penulis:ChaoZhang, Tarikh: 2024-07-29 17:19:43Tag:ATRMARSI

Ringkasan

Sistem Mengikuti Trend Dinamik Multi-Level adalah strategi yang lebih baik berdasarkan Peraturan Perdagangan Penyu. Strategi ini menggunakan isyarat trend dari beberapa tempoh masa, digabungkan dengan stop-loss dinamik dan pembinaan kedudukan piramid, untuk menangkap trend jangka menengah hingga panjang. Sistem ini menetapkan dua tempoh trend-mengikuti (L1 dan L2) untuk menangkap trend pada kelajuan yang berbeza dan menggunakan penunjuk ATR adaptif untuk menyesuaikan titik kemasukan, pembinaan kedudukan, dan stop-loss secara dinamik. Reka bentuk pelbagai peringkat ini membolehkan strategi untuk mengekalkan kestabilan dalam persekitaran pasaran yang berbeza sambil memaksimumkan potensi keuntungan melalui pembinaan kedudukan piramid.

Prinsip Strategi

-

Pengesanan Trend: Dua tempoh purata bergerak (L1 dan L2) digunakan untuk mengenal pasti trend pada kelajuan yang berbeza. L1 digunakan untuk menangkap trend yang lebih cepat, sementara L2 menangkap trend yang lebih perlahan tetapi lebih boleh dipercayai.

-

Isyarat Masuk: Isyarat panjang dihasilkan apabila harga memecahkan di atas L1 atau L2 tinggi. Jika perdagangan L1 sebelumnya menguntungkan, isyarat L1 seterusnya dilupakan sehingga isyarat L2 muncul.

-

Stop-Loss Dinamik: Ganda ATR (default 3x) digunakan sebagai jarak stop-loss awal, yang secara beransur-ansur bergerak ke atas apabila kedudukan dipegang.

-

Pembinaan Kedudukan Piramid: Semasa kesinambungan trend, kedudukan tambahan ditambahkan setiap kali harga meningkat sebanyak 0.5 ATR, sehingga maksimum 5 kali.

-

Pengendalian Risiko: Setiap perdagangan berisiko tidak lebih daripada 2% daripada ekuiti akaun, yang dicapai melalui ukuran kedudukan dinamik.

-

Mekanisme Keluar: Posisi ditutup apabila harga jatuh di bawah paras terendah 10 hari (L1) atau 20 hari (L2), atau apabila stop-loss terakhir dicetuskan.

Kelebihan Strategi

-

Pengambilan Trend Multi-Level: Tempoh L1 dan L2 membolehkan untuk menangkap kedua-dua trend cepat dan jangka panjang, meningkatkan fleksibiliti dan kestabilan strategi.

-

Pengurusan Risiko Dinamik: Menggunakan ATR sebagai penunjuk turun naik membolehkan penyesuaian dinamik titik kemasukan, hentian kerugian, dan pembinaan kedudukan, menyesuaikan diri dengan perubahan pasaran.

-

Pembinaan Kedudukan Piramid: Meningkatkan kedudukan secara beransur-ansur semasa kesinambungan trend kedua-dua mengawal risiko dan memaksimumkan potensi keuntungan.

-

Tetapan Parameter Fleksibel: Pelbagai parameter yang boleh diselaraskan membolehkan strategi disesuaikan dengan pasaran dan gaya perdagangan yang berbeza.

-

Pelaksanaan automatik: Strategi ini boleh dijalankan secara automatik sepenuhnya, mengurangkan campur tangan manusia dan pengaruh emosi.

Risiko Strategi

-

Risiko Pembalikan Trend: Berprestasi baik di pasaran trend yang kuat tetapi boleh membawa kepada kerugian yang kerap di pasaran yang terhad.

-

Kos Slippage dan Transaksi: Pembentukan kedudukan yang kerap dan pergerakan stop-loss boleh mengakibatkan kos transaksi yang tinggi.

-

Risiko pengoptimuman berlebihan: Banyak parameter boleh menyebabkan data sejarah yang terlalu sesuai.

-

Risiko Pengurusan Modal: Modal awal yang lebih kecil mungkin tidak berkesan melaksanakan pembinaan pelbagai kedudukan.

-

Risiko Kecairan Pasaran: Di pasaran yang kurang cair, mungkin sukar untuk melaksanakan dagangan pada harga yang ideal.

Arahan Pengoptimuman Strategi

-

Menggabungkan Penapisan Persekitaran Pasaran: Tambah penunjuk kekuatan trend (contohnya, ADX) untuk menilai keadaan pasaran dan mengurangkan kekerapan dagangan di pasaran yang terhad.

-

Mengoptimumkan Strategi Pembinaan Kedudukan: Pertimbangkan untuk menyesuaikan secara dinamik selang dan bilangan pembinaan kedudukan berdasarkan kekuatan trend, dan bukannya tetap 0.5 ATR dan 5 kali.

-

Memperkenalkan Mekanisme Mengambil Keuntungan: Dalam trend jangka panjang, tetapkan mengambil keuntungan separa untuk mengunci keuntungan, seperti menutup separuh kedudukan apabila mencapai keuntungan 3x ATR.

-

Analisis korelasi pelbagai instrumen: Apabila memohon untuk portfolio, tambah analisis korelasi antara instrumen untuk mengoptimumkan nisbah risiko-balasan keseluruhan.

-

Tambah Penapisan Volatiliti: Hentikan perdagangan atau sesuaikan parameter risiko semasa tempoh turun naik yang melampau untuk menangani keadaan pasaran yang tidak normal.

-

Mengoptimumkan Mekanisme Keluar: Pertimbangkan untuk menggunakan penunjuk keluar yang lebih fleksibel seperti SAR Parabolik atau Keluar Chandelier.

Ringkasan

Sistem Mengikuti Trend Dinamik Multi-Level adalah strategi komprehensif yang menggabungkan Peraturan Perdagangan Penyu klasik dengan teknik kuantitatif moden. Melalui pengenalan trend pelbagai peringkat, pengurusan risiko dinamik, dan pembinaan kedudukan piramid, strategi ini meningkatkan keupayaan menangkap trend dan potensi keuntungan sambil mengekalkan ketahanan. Walaupun menghadapi cabaran di pasaran terhad, dengan pengoptimuman parameter yang betul dan kawalan risiko, strategi ini mempunyai potensi untuk mengekalkan prestasi yang stabil di pelbagai persekitaran pasaran. Penambahbaikan masa depan boleh memberi tumpuan kepada pengenalan penilaian persekitaran pasaran, mengoptimumkan pembinaan kedudukan dan mekanisme keluar untuk meningkatkan ketahanan dan keuntungan strategi.

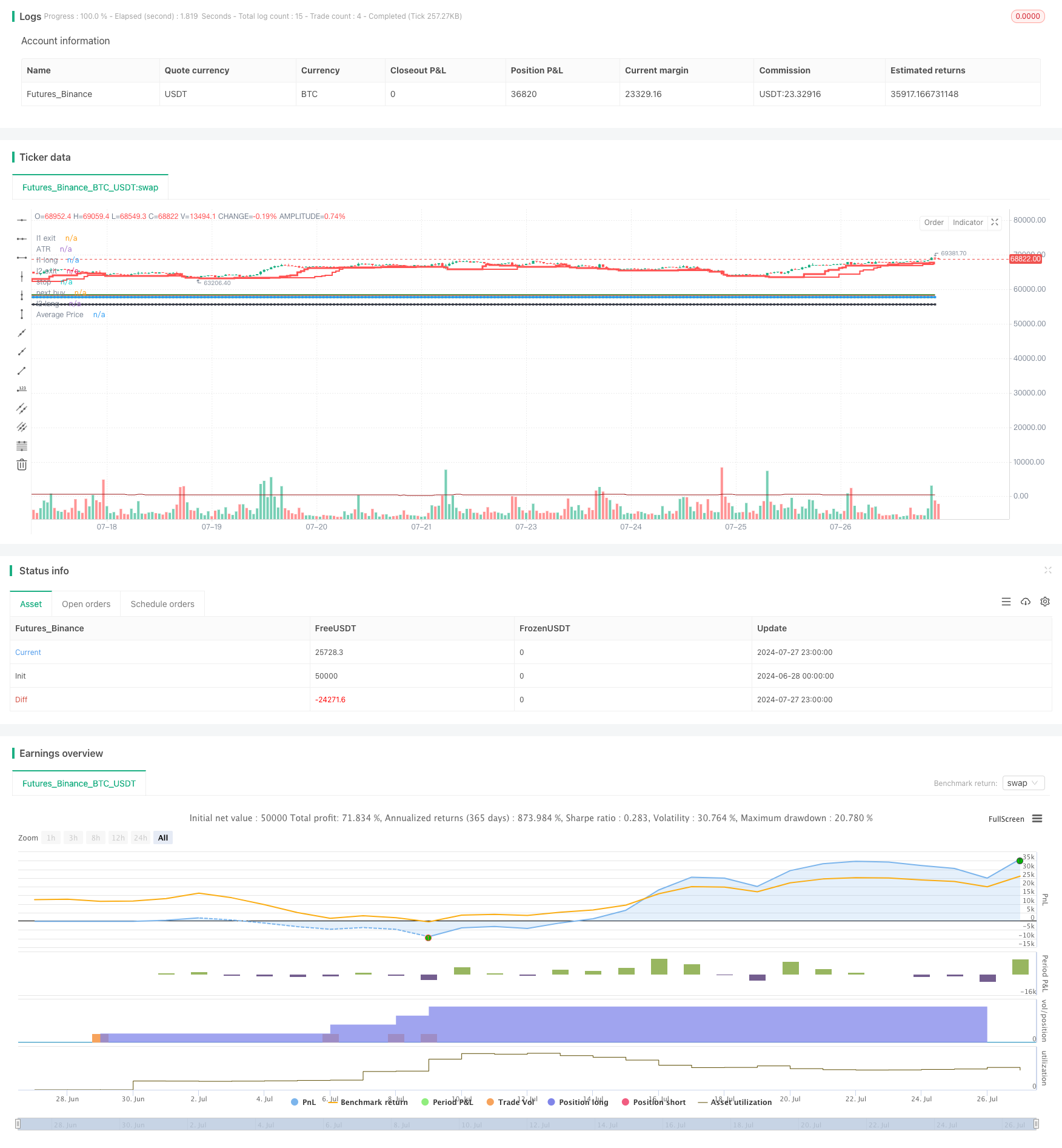

/*backtest

start: 2024-06-28 00:00:00

end: 2024-07-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This is a strategy based on the famous turtle system.

// https://www.tradingblox.com/originalturtles/originalturtlerules.htm

//

// In a nutshell, it a trend trading system where you are buying on strength, selling on weakness.

// positions should be entered when the price crosses over the 20-day high (L1 high) or 55-day high (L2 high).

// positions should be exited when the prices crosses below the 10-day low (L1 low) or 20-day low (L2 low)

// you can add positions at every unit (measured by multiple of n, where n=1 ATR)

// stops should be placed at 2*n below every position entered, when the stop is hit exit your entire position.

// positions should be entered everytime price crosses over L1 or L2, with one exception:

// if the last trade was an L1 trade and it was a winning trade, skip the next trade unless the price crosses

// over L2, if that is the case, you should take it.

// L1 and L2 levels are also configurable for high and lows.

// N multiple for stops and pyramid are also configurable

// To change this from a strategy to a study:

// 1) uncomment the next line and comment out the strategy line.

// 2) at the end of the file comment out the last 2 lines

// study(title="Turtle Study", overlay=true)

strategy(title='kTF-VNI', overlay=true, initial_capital=100000000, commission_type=strategy.commission.percent, commission_value=0.0, pyramiding=100, process_orders_on_close=true, calc_on_every_tick=true)

stopInput = input.float(3, 'Stop N', step=.05)

riskPercent = input.float(.01, 'Risk % of capital', step=.005)

pyramidInput = input.float(0.5, 'Pyramid N', step=.05)

maxUnits = input.int(5, 'Max Pyramid Units', step=1)

atrPeriod = input(20, 'ATR period')

l1LongInput = 10

l2LongInput = 20

l1LongExitInput = 20

l2LongExitInput = 40

l1LongInput := input.int(20, 'L1 Long', minval=2)

l2LongInput := input.int(60, 'L2 Long', minval=2)

l1LongExitInput := input.int(10, 'L1 Long Exit', minval=2)

l2LongExitInput := input.int(20, 'L2 Long Exit', minval=2)

FromYear = input.int(1970, 'From Year', minval=1900)

FromMonth = input.int(1, 'From Month', minval=1, maxval=12)

FromDay = input.int(1, 'From Day', minval=1, maxval=31)

ToYear = input.int(9999, 'To Year', minval=1900)

ToMonth = input.int(1, 'To Month', minval=1, maxval=12)

ToDay = input.int(1, 'To Day', minval=1, maxval=31)

FromDate = timestamp(FromYear, FromMonth, FromDay, 00, 00)

ToDate = timestamp(ToYear, ToMonth, ToDay, 23, 59)

TradeDateIsAllowed() =>

time >= FromDate and time <= ToDate

l1Long = ta.highest(l1LongInput)

l1LongExit = ta.lowest(l1LongExitInput)

l2Long = ta.highest(l2LongInput)

l2LongExit = ta.lowest(l2LongExitInput)

bool win = false // tracks if last trade was winning trade of losing trade.

float buyPrice = 0.0 // tracks the buy price of the last long position.

float nextBuyPrice = 0.0 // tracks the next buy price

float stopPrice = na // tracks the stop price

int totalBuys = 0 // tracks the total # of pyramid buys

bool inBuy = false // tracks if we are in a long position or not.

float l1LongPlot = ta.highest(l1LongInput) // tracks the L1 price to display

float l2LongPlot = ta.highest(l2LongInput) // tracks the L2 price to display

float n = ta.atr(atrPeriod) // tracks the n used to calculate stops and pyramid buys

string mode = 'L1' // tracks whether we are in a L1 position or L2 position.

bool fake = na // tracks if this is a fake trade, see comments below.

string longLevel = na // tracks where long positions, stops, pyramid buys occur.

float capitalLeft = strategy.initial_capital

var shares = 0

float fakeBuyPrice = 0.0

// by default use the last value from the previous bar.

buyPrice := buyPrice[1]

totalBuys := totalBuys[1]

nextBuyPrice := nextBuyPrice[1]

stopPrice := stopPrice[1]

win := win[1]

capitalLeft := capitalLeft[1]

inBuy := inBuy[1]

n := ta.atr(atrPeriod)

fakeBuyPrice := fakeBuyPrice[1]

// State to track if we are in a long positon or not.

if not inBuy[1] and (high > l1Long[1] or high > l2Long[1])

inBuy := true

inBuy

else

inBuy := inBuy[1] and low < stopPrice[1] ? false : inBuy

inBuy := inBuy[1] and mode[1] == 'L1' and low < l1LongExit[1] ? false : inBuy

inBuy := inBuy[1] and mode[1] == 'L2' and low < l2LongExit[1] ? false : inBuy

inBuy

// State to track if we are ia a fake trade. If the last trade was a winning, we need to skip the next trade.

// We still track it though as a fake trade (not counted against us). as the outcome determines if we can

// can take the next trade.

if not inBuy[1] and high > l1Long[1] and win[1]

fake := true

fakeBuyPrice := close

fakeBuyPrice

else

fake := fake[1]

fake

if fake[1] and inBuy[1] and not inBuy

fake := false

win := close >= fakeBuyPrice

win

fake := high > l2Long[1] ? false : fake

// Series representing the l1 and l2 levels. If we break out above the l1 or l2 level, we want the

// line to stay at the breakout level, not follow it up.

l1LongPlot := not inBuy[1] or inBuy[1] and mode == 'L1' and fake[1] ? l1Long[1] : l1LongPlot[1]

l2LongPlot := not inBuy[1] or inBuy[1] and mode == 'L1' and fake[1] ? l2Long[1] : l2LongPlot[1]

// Variable in the series is only set when it happens. Possible values is L1, L2, SR

// (stopped out with a loss), SG (exited with a gain), and 'P' for pyramid buy.

longLevel := not inBuy[1] and high > l1Long[1] ? 'L1' : na

longLevel := (not inBuy[1] or inBuy[1] and fake[1]) and high > l2Long[1] ? 'L2' : longLevel

// Either 'L1' or 'L2' depending on what breakout level we are in.

mode := longLevel == na ? mode[1] : longLevel

// Variables to track calculating nextBuyPrice for pyramiding.

if longLevel == 'L1' or longLevel == 'L2'

buyPrice := close

totalBuys := 1

stopPrice := close - stopInput * n

nextBuyPrice := close + pyramidInput * n

nextBuyPrice

// Marks if we hit our next buy price, if so mark it with a 'P'

longLevel := longLevel == na and inBuy[1] and high > nextBuyPrice and TradeDateIsAllowed() and totalBuys < maxUnits ? 'P' : longLevel

if longLevel == 'P'

buyPrice := close

totalBuys := totalBuys[1] + 1

stopPrice := close - stopInput * n

nextBuyPrice := close + pyramidInput * n

nextBuyPrice

// Tracks stops and exits, marking them with SG or SR

longLevel := longLevel == na and inBuy[1] and low < stopPrice and close >= strategy.position_avg_price ? 'SG' : longLevel

longLevel := longLevel == na and inBuy[1] and low < stopPrice and close < strategy.position_avg_price ? 'SR' : longLevel

longLevel := longLevel == na and mode[1] == 'L1' and inBuy[1] and low < l1LongExit[1] and close >= strategy.position_avg_price ? 'SG' : longLevel

longLevel := longLevel == na and mode[1] == 'L2' and inBuy[1] and low < l2LongExit[1] and close >= strategy.position_avg_price ? 'SG' : longLevel

longLevel := longLevel == na and mode[1] == 'L1' and inBuy[1] and low < l1LongExit[1] and close < strategy.position_avg_price ? 'SR' : longLevel

longLevel := longLevel == na and mode[1] == 'L2' and inBuy[1] and low < l2LongExit[1] and close < strategy.position_avg_price ? 'SR' : longLevel

// Tracks if the trade was a win or loss.

win := longLevel == 'SG' ? true : win

win := longLevel == 'SR' ? false : win

// Variables used to tell strategy when to enter/exit trade.

//plotarrow(fake ? 1 : 0, colordown=color.red, colorup=color.purple, transp=40) // down arrow for winning trade

enterLong = (longLevel == 'L1' or longLevel == 'L2' or longLevel == 'P') and not fake and TradeDateIsAllowed()

exitLong = (longLevel == 'SG' or longLevel == 'SR') and not fake and TradeDateIsAllowed()

p1 = plot(l1LongPlot, title='l1 long', linewidth=3, style=plot.style_stepline, color=color.new(color.green, 0))

p2 = plot(l1LongExit[1], title='l1 exit', linewidth=3, style=plot.style_stepline, color=color.new(color.red, 0))

p3 = plot(l2LongPlot, title='l2 long', linewidth=2, style=plot.style_stepline, color=color.new(color.green, 0))

p4 = plot(l2LongExit[1], title='l2 exit', linewidth=2, style=plot.style_stepline, color=color.new(color.red, 0))

color1 = color.new(color.black, 0)

color2 = color.new(color.black, 100)

col = inBuy ? color1 : color2

p5 = plot(stopPrice, title='stop', linewidth=2, style=plot.style_circles, join=true, color=color.new(color.black, 0))

p6 = plot(nextBuyPrice, title='next buy', linewidth=2, style=plot.style_circles, join=true, color=color.new(color.blue, 0))

fill(p1, p3, color=color.new(color.green, 90))

fill(p2, p4, color=color.new(color.red, 90))

risk = (strategy.initial_capital + strategy.netprofit) * riskPercent

shares := math.floor(risk / (stopInput * n))

capitalLeft := strategy.initial_capital + strategy.netprofit - strategy.position_size * strategy.position_avg_price

if shares * close > capitalLeft

shares := math.max(0, math.floor(capitalLeft / close))

shares

shares := math.max(0, shares)

plotshape(longLevel == 'L1' and not fake and strategy.position_size == 0 ? true : false, color=color.new(color.green, 40), style=shape.triangleup, text='L1 ') // up arrow for entering L1 trade

plotshape(not fake[1] and fake and longLevel == 'L1' and strategy.position_size == 0 ? true : false, color=color.new(color.gray, 40), style=shape.triangleup, text='L1') // up arrow for entering L1 trade

plotshape(longLevel == 'L2' and strategy.position_size == 0 ? true : false, color=color.new(color.green, 40), style=shape.triangleup, text='L2') // up arrow for entering L2 trade

plotshape((mode == 'L1' or mode == 'L2') and shares > 0 and enterLong and strategy.position_size > 0 ? true : false, color=color.new(color.green, 40), style=shape.triangleup, text='P')

plotarrow(strategy.position_size == 0 and longLevel == 'L1' and enterLong ? 1 : 0, colordown=color.new(color.black, 40), colorup=color.new(color.green, 40)) // up arrow for entering L1 trade

plotarrow(strategy.position_size == 0 and longLevel == 'L2' and enterLong ? 1 : 0, colordown=color.new(color.black, 40), colorup=color.new(color.green, 40)) // up arrow for entering L2 trade

plotarrow(strategy.position_size > 0 and longLevel == 'SR' and exitLong ? -1 : 0, colordown=color.new(color.red, 40), colorup=color.new(color.purple, 40)) // down arrow for losing trade

plotarrow(strategy.position_size > 0 and longLevel == 'SG' and exitLong ? -1 : 0, colordown=color.new(color.green, 40), colorup=color.new(color.purple, 40)) // down arrow for winning trade

plotshape(longLevel == na and inBuy[1] and not inBuy, color=color.new(color.gray, 40), style=shape.triangleup, text='Exit') // up arrow for entering L1 trade

plot(ta.atr(atrPeriod), title='ATR', color=color.new(#991515, 0))

plot(strategy.position_avg_price, title='Average Price', color=color.new(#991515, 0))

alertcondition(low < stopPrice, title='crosses under stop price', message='price crossed under stop price')

alertcondition(high > l1Long, title='crosses over L1 price', message='price crossed over L1 price')

alertcondition(high > l2Long, title='crosses over L2 price', message='price crossed over L2 price')

alertcondition(low < l1LongExit, title='crosses under L1 exit price', message='price crossed under L1 exit price')

alertcondition(low < l2LongExit, title='crosses under L2 exit price', message='price crossed under L2 exit price')

strategy.entry('long', strategy.long, qty=shares, comment='long', when=enterLong)

strategy.close('long', when=exitLong)

// simulate_amount = 100000

// simulate_risk = simulate_amount*0.005

// simulate_shares = floor(simulate_risk/(n*stopInput))

// plot(simulate_shares, "Shares", color=#991515, transp=0)

// if (enterLong)

// label.new(bar_index, high, text=tostring(simulate), style=label.style_none)

- RSI-ATR Momentum Volatiliti Strategi Dagangan Gabungan

- Strategi Kembalikan Selasa (Filter hujung minggu)

- Strategi Piramida Pintar Berbilang Penunjuk

- Strategi Penembusan yang dipertingkatkan dengan sasaran dan pengoptimuman Stop Loss

- Strategi Perdagangan AlphaTradingBot

- Trend Multi-Indikator Mengikut Strategi

- MORNING CANDLE BREAKOUT AND REVERSION STRATEGI

- Strategi Dagangan Mengikut Trend dengan Penapisan Momentum

- Sistem Dagangan Stop-Loss Beradaptasi yang dioptimumkan AI dengan integrasi pelbagai penunjuk teknikal

- Strategi Dagangan Berimbang Berasaskan Masa Berputar Pendek dan Lama

- Strategi Crossover Purata Bergerak Eksponensial Berbilang Jangka Masa

- Strategy Crossover Saluran Dinamik Berbilang Tempoh

- Strategi Pengambilan Trend Jurang Harga Jangka Pendek yang Komprehensif

- Sistem Analisis Osilasi dan Momentum Multi-Stochastic

- Strategi Dagangan Trend RSI dan Purata Bergerak Berbilang Jangka Masa

- Trend Crossover Purata Bergerak Berbilang Tempoh Mengikut Strategi

- Strategi Dagangan Tempoh Tinggi-Rendah Tiga Minggu

- Adaptive Moving Average Crossover Strategi

- Strategi Petunjuk Teknikal, Strategi Pengurusan Risiko, Trend Penyesuaian Mengikut Strategi

- Bollinger Bands Momentum Optimization Strategi

- Strategi Dagangan Pembalikan Purata Lanjutan: Sistem Penembusan Julat Dinamik Berdasarkan Penyimpangan Standard

- EMA Crossover dengan Bollinger Bands Double Entry Strategy: Sistem Dagangan Kuantitatif yang menggabungkan trend berikut dan volatility breakout

- Adaptive Trend-Following Trading Strategy: 200 EMA Breakout dengan Sistem Pengurusan Risiko Dinamik

- Strategi Crossover Momentum Pasaran Berbilang Jangka Masa

- Trend Multi-Indikator Mengikut Strategi

- ChandelierExit-EMA Strategi Stop-Loss Dinamik Mengikuti Trend

- Strategi Dagangan Divergensi Multi-Indikator dengan Amalan Ambil Keuntungan dan Hentikan Kerugian

- Strategi Perdagangan Semangat Zon Pecah

- Strategi Dagangan dan Sistem Pengurusan Risiko yang Tepat Berdasarkan Penunjuk SuperTrend

- EMA, RSI, Trend Harga Volume, corak meluap