Pengukuran Posisi Adaptif Dinamik Multi-Indikator dengan Strategi Volatiliti ATR

Penulis:ChaoZhang, Tarikh: 2024-11-12 11:41:30Tag:ATREMARSISMA

Ringkasan

Strategi ini adalah sistem perdagangan kuantitatif yang menggabungkan beberapa penunjuk teknikal dengan pengurusan risiko dinamik. Ia mengintegrasikan trend EMA berikut, turun naik ATR, keadaan overbought / oversold RSI, dan pengenalan corak candlestick, mencapai pulangan yang seimbang melalui ukuran kedudukan adaptif dan mekanisme stop-loss dinamik.

Prinsip Strategi

Strategi ini melaksanakan perdagangan melalui:

- Menggunakan persimpangan EMA 5 tempoh dan 10 tempoh untuk arah trend

- Indikator RSI untuk zon overbought/oversold

- Indikator ATR untuk stop-loss dinamik dan saiz kedudukan

- Corak lilin (menelan, tukul, bintang jatuh) sebagai isyarat masuk

- Pembalasan pelepasan dinamik berasaskan ATR

- Pengesahan jumlah untuk penapisan isyarat

Kelebihan Strategi

- Penanda silang isyarat berbilang meningkatkan kebolehpercayaan

- Pengurusan risiko dinamik menyesuaikan diri dengan turun naik pasaran

- Strategi mengambil keuntungan separa mengunci keuntungan

- Stop-loss berturut-turut melindungi keuntungan terkumpul

- Had kerugian harian mengawal pendedahan risiko

- Pembalasan slippage dinamik meningkatkan pelaksanaan pesanan

Risiko Strategi

- Pelbagai penunjuk boleh menyebabkan kelewatan isyarat

- Perdagangan yang kerap boleh menimbulkan kos yang tinggi

- Stop-loss boleh mencetuskan kerap di pasaran pelbagai

- Faktor subjektif dalam pengenalan corak candlestick

- Pengoptimuman parameter risiko terlalu sesuai

Arahan pengoptimuman

- Memperkenalkan pengesanan kitaran pasaran untuk pelarasan parameter dinamik

- Tambah penapis kekuatan trend untuk mengurangkan isyarat palsu

- Mengoptimumkan algoritma saiz kedudukan untuk kecekapan modal yang lebih baik

- Memasukkan penunjuk sentimen pasaran tambahan

- Membangunkan sistem pengoptimuman parameter adaptif

Ringkasan

Ini adalah sistem strategi yang canggih yang menggabungkan pelbagai penunjuk teknikal, meningkatkan kestabilan perdagangan melalui pengurusan risiko dinamik dan pengesahan isyarat berbilang.

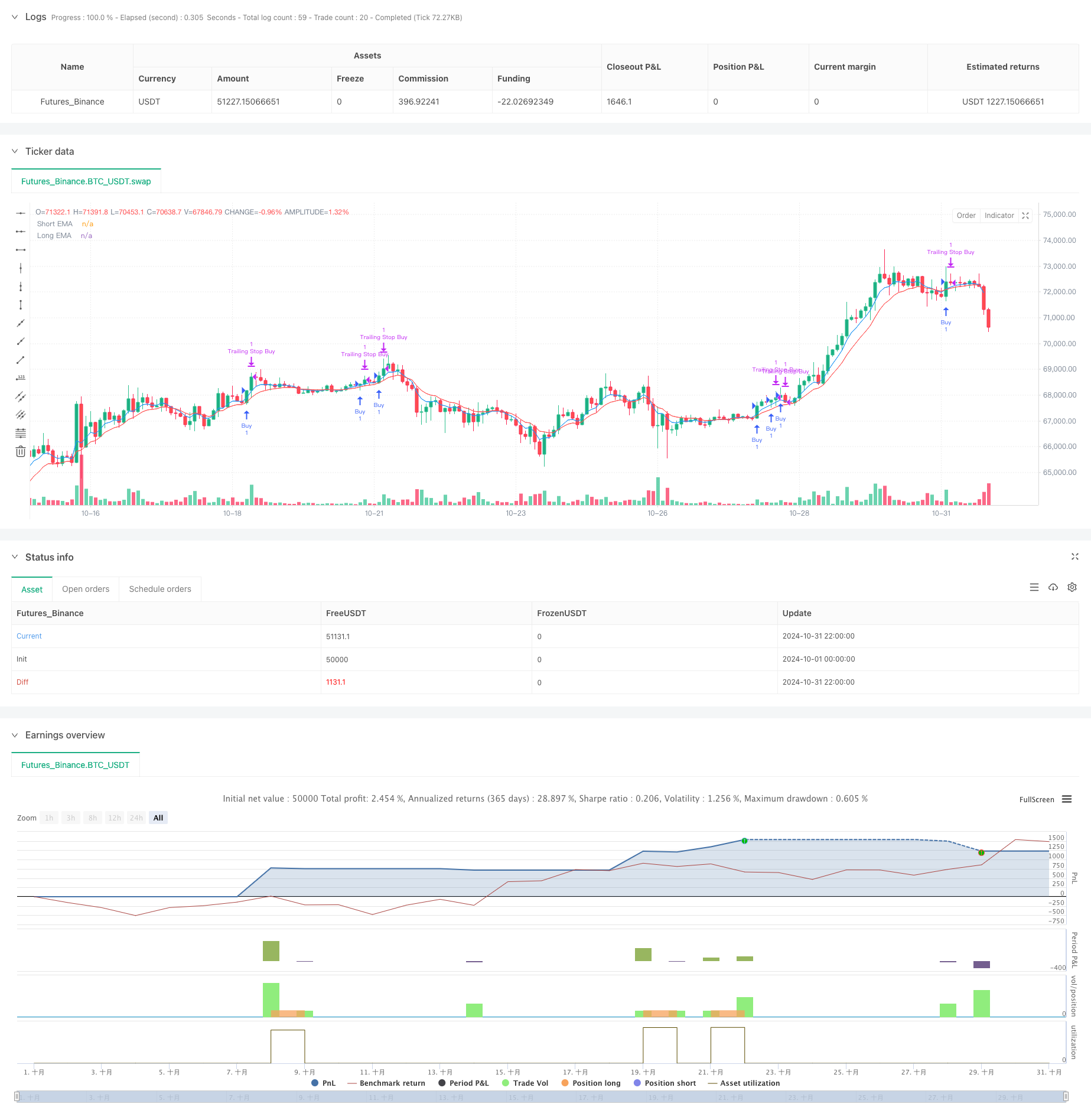

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Optimized Scalping with High Risk-Reward", overlay=true)

// Input for EMA periods

shortEMA_length = input(5, title="Short EMA Length")

longEMA_length = input(10, title="Long EMA Length")

// ATR for dynamic stop-loss

atrPeriod = input(14, title="ATR Period")

atrMultiplier = input(1.5, title="ATR Multiplier for Stop Loss")

// Calculate EMAs

shortEMA = ta.ema(close, shortEMA_length)

longEMA = ta.ema(close, longEMA_length)

// ATR calculation for dynamic stop loss

atr = ta.atr(atrPeriod)

// RSI for overbought/oversold conditions

rsi = ta.rsi(close, 14)

// Plot EMAs

plot(shortEMA, color=color.blue, title="Short EMA")

plot(longEMA, color=color.red, title="Long EMA")

// Dynamic Slippage based on ATR

dynamic_slippage = math.max(5, atr * 0.5)

// Candlestick pattern recognition

bullish_engulfing = close[1] < open[1] and close > open and close > open[1] and close > close[1]

hammer = close > open and (high - close) / (high - low) > 0.6 and (open - low) / (high - low) < 0.2

bearish_engulfing = open[1] > close[1] and open > close and open > open[1] and close < close[1]

shooting_star = close < open and (high - open) / (high - low) > 0.6 and (close - low) / (high - low) < 0.2

// Enhanced conditions with volume and RSI check

buy_condition = (bullish_engulfing or hammer) and close > shortEMA and shortEMA > longEMA and volume > ta.sma(volume, 20) and rsi < 70

sell_condition = (bearish_engulfing or shooting_star) and close < shortEMA and shortEMA < longEMA and volume > ta.sma(volume, 20) and rsi > 30

// Dynamic ATR multiplier based on recent volatility

volatility = atr

adaptiveMultiplier = atrMultiplier + (volatility - ta.sma(volatility, 50)) / ta.sma(volatility, 50) * 0.5

// Execute buy trades with slippage consideration

if (buy_condition)

strategy.entry("Buy", strategy.long)

stop_loss_buy = strategy.position_avg_price - atr * adaptiveMultiplier - dynamic_slippage

take_profit_buy = strategy.position_avg_price + atr * adaptiveMultiplier * 3 + dynamic_slippage

strategy.exit("Exit Buy", "Buy", stop=stop_loss_buy, limit=take_profit_buy)

// Execute sell trades with slippage consideration

if (sell_condition)

strategy.entry("Sell", strategy.short)

stop_loss_sell = strategy.position_avg_price + atr * adaptiveMultiplier + dynamic_slippage

take_profit_sell = strategy.position_avg_price - atr * adaptiveMultiplier * 3 - dynamic_slippage

strategy.exit("Exit Sell", "Sell", stop=stop_loss_sell, limit=take_profit_sell)

// Risk Management

maxLossPerTrade = input.float(0.01, title="Max Loss Per Trade (%)", minval=0.01, maxval=1, step=0.01) // 1% max loss per trade

dailyLossLimit = input.float(0.03, title="Daily Loss Limit (%)", minval=0.01, maxval=1, step=0.01) // 3% daily loss limit

maxLossAmount_buy = strategy.position_avg_price * maxLossPerTrade

maxLossAmount_sell = strategy.position_avg_price * maxLossPerTrade

if (strategy.position_size > 0)

strategy.exit("Max Loss Buy", "Buy", stop=strategy.position_avg_price - maxLossAmount_buy - dynamic_slippage)

if (strategy.position_size < 0)

strategy.exit("Max Loss Sell", "Sell", stop=strategy.position_avg_price + maxLossAmount_sell + dynamic_slippage)

// Daily loss limit logic

var float dailyLoss = 0.0

if (dayofweek != dayofweek[1])

dailyLoss := 0.0 // Reset daily loss tracker at the start of a new day

if (strategy.closedtrades > 0)

dailyLoss := dailyLoss + strategy.closedtrades.profit(strategy.closedtrades - 1)

if (dailyLoss < -strategy.initial_capital * dailyLossLimit)

strategy.close_all("Daily Loss Limit Hit")

// Breakeven stop after a certain profit with a delay

if (strategy.position_size > 0 and close > strategy.position_avg_price + atr * 1.5 and bar_index > strategy.opentrades.entry_bar_index(0) + 5)

strategy.exit("Breakeven Buy", from_entry="Buy", stop=strategy.position_avg_price)

if (strategy.position_size < 0 and close < strategy.position_avg_price - atr * 1.5 and bar_index > strategy.opentrades.entry_bar_index(0) + 5)

strategy.exit("Breakeven Sell", from_entry="Sell", stop=strategy.position_avg_price)

// Partial Profit Taking

if (strategy.position_size > 0 and close > strategy.position_avg_price + atr * 1.5)

strategy.close("Partial Close Buy", qty_percent=50) // Use strategy.close for partial closure at market price

if (strategy.position_size < 0 and close < strategy.position_avg_price - atr * 1.5)

strategy.close("Partial Close Sell", qty_percent=50) // Use strategy.close for partial closure at market price

// Trailing Stop with ATR type

if (strategy.position_size > 0)

strategy.exit("Trailing Stop Buy", from_entry="Buy", trail_offset=atr * 1.5, trail_price=strategy.position_avg_price)

if (strategy.position_size < 0)

strategy.exit("Trailing Stop Sell", from_entry="Sell", trail_offset=atr * 1.5, trail_price=strategy.position_avg_price)

Berkaitan

- Strategi Kuantitatif Crossover Trend Multi-Indikator Momentum

- Strategi Dagangan Trend RSI dan Purata Bergerak Berbilang Jangka Masa

- Strategi Jualan Pendek Jangka Pendek untuk Pasangan Mata Wang Likuiditi Tinggi

- Trend Multi-EMA Mengikut Strategi dengan Sasaran ATR Dinamik

- Strategi crossover purata bergerak pelbagai penunjuk dinamik frekuensi tinggi

- Strategi Penangkapan Momentum Emas: Sistem Crossover Purata Bergerak Eksponensial Berbilang Jangka Masa

- Strategi Crossover Purata Bergerak Eksponensial Berbilang Tempoh dengan Sistem Cadangan Perdagangan Pilihan

- Strategi Dagangan Multi-EMA Trend Momentum dengan Sistem Pengurusan Risiko

- Strategi Dagangan Swing Panjang/Pendek Dinamik dengan Sistem Isyarat Crossover Purata Bergerak

- Super Scalper - 5 minit 15 minit

Lebih lanjut

- Strategi silang Momentum SMA yang digabungkan dengan Sentimen Pasaran dan Sistem Pengoptimuman Tahap Rintangan

- RSI Multi-Periode Momentum dan Tren EMA Tiga Berikutan Strategi Komposit

- Trend Momentum Purata Multi-Moving Mengikut Strategi

- E9 Shark-32 Pattern Strategi Penembusan Harga Kuantitatif

- Eksposur Pasaran Terbuka Penyesuaian Posisi Dinamik Strategi Dagangan Kuantitatif

- Trend Kadar Menang Tinggi Bermakna Strategi Perdagangan Pembalikan

- Strategi Momentum Trend RSI Purata Bergerak Berganda

- Trend pembalikan purata penggabungan pelbagai penunjuk mengikut strategi

- Strategi Dagangan Pasca-Terbuka Breakout dengan Pengurusan Posisi Berasaskan ATR Dinamis

- Integrasi Multi-Indikator dan Kawalan Risiko Cerdas Sistem Dagangan Kuantitatif

- RSI Strategi Perdagangan Pintar Stop-Loss Dinamik

- Pembaharuan purata RSI yang disahkan tiga kali dengan strategi penapis purata bergerak

- Strategi Dagangan Trend Osilasi Beradaptasi dengan Bollinger Bands dan Integrasi RSI

- ADX (Indeks Arah Purata) dan Strategi Pengesanan Trend Volume Dinamik

- Strategi Dagangan Gabungan Multi-Volume Momentum

- Fibonacci Retracement dan Peluasan Multi-Indikator Strategi Dagangan Kuantitatif

- Strategi Posisi Sepanjang Malam Pasar dengan Penapis EMA

- Strategi Pembalikan Purata dan Pengikut Trend Berasaskan Penunjuk Multi-Teknik

- Pengendali WebSocket Kecepatan

- pelbagai benang mendapatkan simbol pembiayaan