Strategi Dagangan Kuantitatif Piramiding Martingale Gabungan MACD-KDJ

Penulis:ChaoZhang, Tarikh: 2024-12-05 16:35:26Tag:MACDKDJSMA

Ringkasan

Strategi ini adalah sistem perdagangan Martingale berdasarkan penunjuk MACD dan KDJ, menggabungkan ukuran kedudukan piramid dan pengurusan keuntungan / kerugian dinamik. Strategi ini menentukan masa kemasukan melalui persilangan penunjuk, menggunakan teori Martingale untuk pengurusan kedudukan, dan meningkatkan pulangan melalui piramid dalam pasaran tren.

Prinsip Strategi

Logik teras terdiri daripada empat elemen utama: isyarat kemasukan, mekanisme penambahan kedudukan, pengurusan keuntungan / kerugian, dan kawalan risiko. Isyarat kemasukan adalah berdasarkan konvergensi garis MACD yang melintasi garis isyarat dan KDJs %K melintasi garis %D; mekanisme penambahan kedudukan mengamalkan teori Martingale, menyesuaikan saiz kedudukan secara dinamik melalui faktor pengganda, menyokong sehingga 10 kedudukan tambahan; mengambil keuntungan menggunakan berhenti menyusul untuk menyesuaikan tahap mengambil keuntungan secara dinamik; menghentikan kerugian merangkumi kedua-dua mekanisme tetap dan menyusul. Strategi ini menyokong penyesuaian parameter penunjuk, parameter kawalan kedudukan, dan parameter kawalan risiko yang fleksibel.

Kelebihan Strategi

- Kebolehpercayaan sistem isyarat yang tinggi: Menggabungkan penunjuk trend MACD dan osilator KDJ untuk menapis isyarat palsu dengan berkesan

- Pengurusan kedudukan saintifik: Sistem Martingale boleh mengurangkan kos pegangan melalui penambahan kedudukan dalam arah yang bertentangan

- Kawalan risiko yang komprehensif: Mekanisme stop-loss dan had kedudukan yang berbilang mengawal risiko dengan berkesan

- Struktur pulangan yang dioptimumkan: Pyramiding boleh mencapai pulangan yang lebih baik di pasaran trend

- Parameter fleksibel: Menyokong pengoptimuman parameter strategi untuk ciri pasaran yang berbeza

Risiko Strategi

- Risiko pasaran: Penambahan kedudukan yang kerap di pasaran yang berbeza boleh membawa kepada kerugian yang lebih besar

- Risiko kedudukan: Sistem Martingale boleh menyebabkan saiz kedudukan yang berlebihan

- Risiko kecairan: Penempatan modal yang besar mungkin menghadapi isu kecairan yang tidak mencukupi

- Risiko sistem: Pengoptimuman parameter yang berlebihan boleh membawa kepada overfit strategi

Arahan Pengoptimuman Strategi

- Pengoptimuman sistem isyarat: Masukkan penunjuk turun naik untuk menyesuaikan kepekaan isyarat dalam persekitaran turun naik yang tinggi

- Pengoptimuman pengurusan kedudukan: Reka bentuk faktor pengganda dinamik untuk pelarasan adaptif berdasarkan keadaan pasaran

- Pengoptimuman kawalan risiko: Tambah modul kawalan pengeluaran untuk mengurangkan kedudukan semasa pengeluaran yang signifikan

- Pengoptimuman parameter: Memperkenalkan kaedah pembelajaran mesin untuk pelarasan parameter adaptif

Ringkasan

Strategi ini membina sistem perdagangan kuantitatif yang lengkap dengan menggabungkan penunjuk teknikal klasik dengan kaedah pengurusan kedudukan maju. Kelebihan utamanya terletak pada kebolehpercayaan isyarat dan kawalan risiko yang komprehensif, sambil mengekalkan daya adaptasi yang kuat melalui parameterisasi. Walaupun terdapat risiko yang melekat, pengoptimuman dan peningkatan berterusan membolehkan strategi untuk mengekalkan prestasi yang stabil di pelbagai persekitaran pasaran.

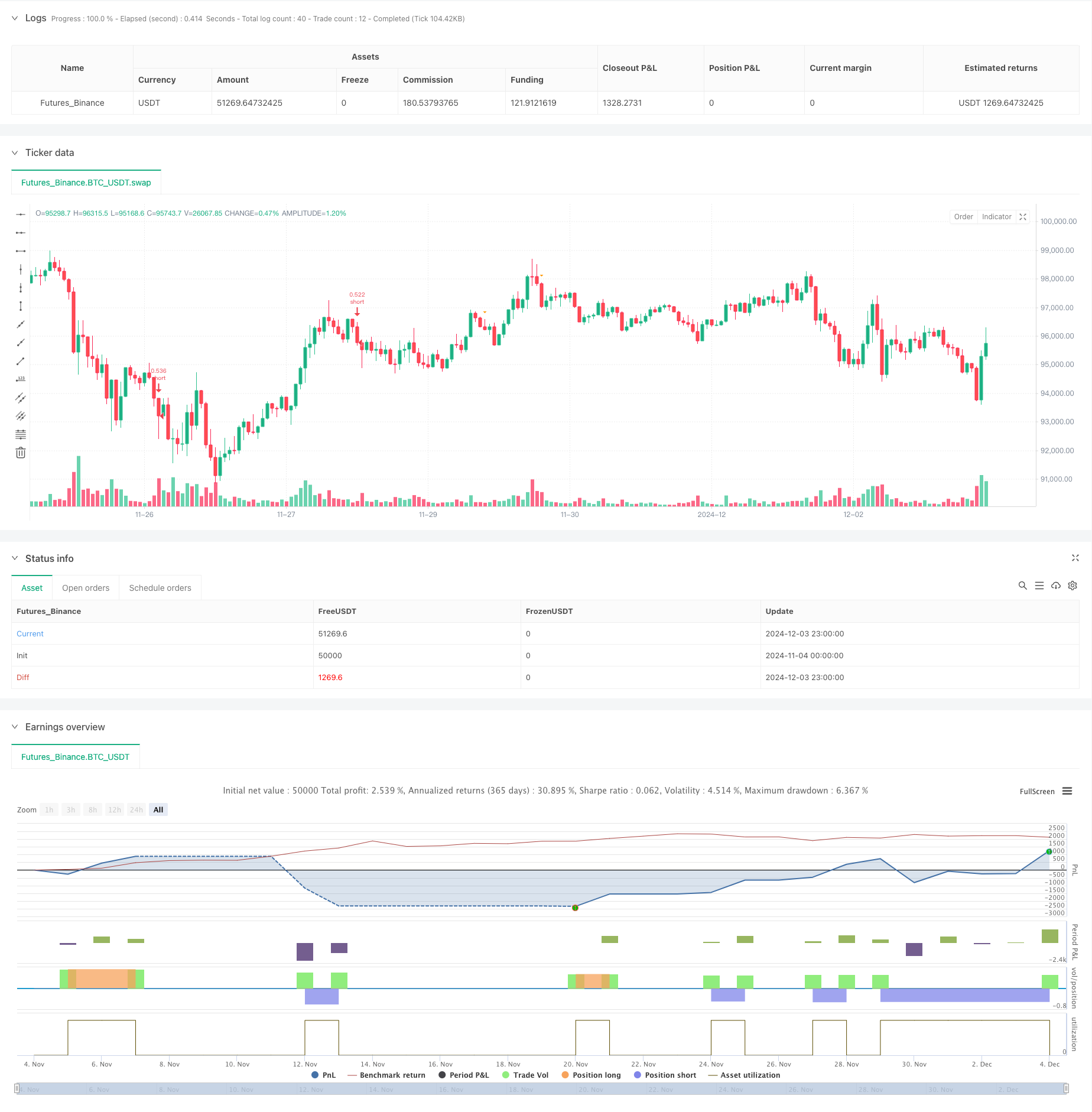

/*backtest

start: 2024-11-04 00:00:00

end: 2024-12-04 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © aaronxu567

//@version=5

strategy("MACD and KDJ Opening Conditions with Pyramiding and Exit", overlay=true) // pyramiding

// Setting

initialOrder = input.float(50000.0, title="Initial Order")

initialOrderSize = initialOrder/close

//initialOrderSize = input.float(1.0, title="Initial Order Size") // Initial Order Size

macdFastLength = input.int(9, title="MACD Fast Length") // MACD Setting

macdSlowLength = input.int(26, title="MACD Slow Length")

macdSignalSmoothing = input.int(9, title="MACD Signal Smoothing")

kdjLength = input.int(14, title="KDJ Length")

kdjSmoothK = input.int(3, title="KDJ Smooth K")

kdjSmoothD = input.int(3, title="KDJ Smooth D")

enableLong = input.bool(true, title="Enable Long Trades")

enableShort = input.bool(true, title="Enable Short Trades")

// Additions Setting

maxAdditions = input.int(5, title="Max Additions", minval=1, maxval=10) // Max Additions

addPositionPercent = input.float(1.0, title="Add Position Percent", minval=0.1, maxval=10) // Add Conditions

reboundPercent = input.float(0.5, title="Rebound Percent (%)", minval=0.1, maxval=10) // Rebound

addMultiplier = input.float(1.0, title="Add Multiplier", minval=0.1, maxval=10) //

// Stop Setting

takeProfitTrigger = input.float(2.0, title="Take Profit Trigger (%)", minval=0.1, maxval=10) //

trailingStopPercent = input.float(0.3, title="Trailing Stop (%)", minval=0.1, maxval=10) //

stopLossPercent = input.float(6.0, title="Stop Loss Percent", minval=0.1, maxval=10) //

// MACD Calculation

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalSmoothing)

// KDJ Calculation

k = ta.sma(ta.stoch(close, high, low, kdjLength), kdjSmoothK)

d = ta.sma(k, kdjSmoothD)

j = 3 * k - 2 * d

// Long Conditions

enterLongCondition = enableLong and ta.crossover(macdLine, signalLine) and ta.crossover(k, d)

// Short Conditions

enterShortCondition = enableShort and ta.crossunder(macdLine, signalLine) and ta.crossunder(k, d)

// Records

var float entryPriceLong = na

var int additionsLong = 0 // 记录多仓加仓次数

var float nextAddPriceLong = na // 多仓下次加仓触发价格

var float lowestPriceLong = na // 多头的最低价格

var bool longPending = false // 多头加仓待定标记

var float entryPriceShort = na

var int additionsShort = 0 // 记录空仓加仓次数

var float nextAddPriceShort = na // 空仓下次加仓触发价格

var float highestPriceShort = na // 空头的最高价格

var bool shortPending = false // 空头加仓待定标记

var bool plotEntryLong = false

var bool plotAddLong = false

var bool plotEntryShort = false

var bool plotAddShort = false

// Open Long

if (enterLongCondition and strategy.opentrades == 0)

strategy.entry("long", strategy.long, qty=initialOrderSize,comment = 'Long')

entryPriceLong := close

nextAddPriceLong := close * (1 - addPositionPercent / 100)

additionsLong := 0

lowestPriceLong := na

longPending := false

plotEntryLong := true

// Add Long

if (strategy.position_size > 0 and additionsLong < maxAdditions)

// Conditions Checking

if (close < nextAddPriceLong) and not longPending

lowestPriceLong := close

longPending := true

if (longPending)

// Rebound Checking

if (close > lowestPriceLong * (1 + reboundPercent / 100))

// Record Price

float addQty = initialOrderSize*math.pow(addMultiplier,additionsLong+1)

strategy.entry("long", strategy.long, qty=addQty,comment = 'Add Long')

additionsLong += 1

longPending := false

nextAddPriceLong := math.min(nextAddPriceLong, close) * (1 - addPositionPercent / 100) // Price Updates

plotAddLong := true

else

lowestPriceLong := math.min(lowestPriceLong, close)

// Open Short

if (enterShortCondition and strategy.opentrades == 0)

strategy.entry("short", strategy.short, qty=initialOrderSize,comment = 'Short')

entryPriceShort := close

nextAddPriceShort := close * (1 + addPositionPercent / 100)

additionsShort := 0

highestPriceShort := na

shortPending := false

plotEntryShort := true

// add Short

if (strategy.position_size < 0 and additionsShort < maxAdditions)

// Conditions Checking

if (close > nextAddPriceShort) and not shortPending

highestPriceShort := close

shortPending := true

if (shortPending)

// rebound Checking

if (close < highestPriceShort * (1 - reboundPercent / 100))

// Record Price

float addQty = initialOrderSize*math.pow(addMultiplier,additionsShort+1)

strategy.entry("short", strategy.short, qty=addQty,comment = "Add Short")

additionsShort += 1

shortPending := false

nextAddPriceShort := math.max(nextAddPriceShort, close) * (1 + addPositionPercent / 100) // Price Updates

plotAddShort := true

else

highestPriceShort := math.max(highestPriceShort, close)

// Take Profit or Stop Loss

if (strategy.position_size != 0)

float stopLossLevel = strategy.position_avg_price * (strategy.position_size > 0 ? (1 - stopLossPercent / 100) : (1 + stopLossPercent / 100))

float trailOffset = strategy.position_avg_price * (trailingStopPercent / 100) / syminfo.mintick

if (strategy.position_size > 0)

strategy.exit("Take Profit/Stop Loss", from_entry="long", stop=stopLossLevel, trail_price=strategy.position_avg_price * (1 + takeProfitTrigger / 100), trail_offset=trailOffset)

else

strategy.exit("Take Profit/Stop Loss", from_entry="short", stop=stopLossLevel, trail_price=strategy.position_avg_price * (1 - takeProfitTrigger / 100), trail_offset=trailOffset)

// Plot

plotshape(series=plotEntryLong, location=location.belowbar, color=color.blue, style=shape.triangleup, size=size.small, title="Long Signal")

plotshape(series=plotAddLong, location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small, title="Add Long Signal")

plotshape(series=plotEntryShort, location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small, title="Short Signal")

plotshape(series=plotAddShort, location=location.abovebar, color=color.orange, style=shape.triangledown, size=size.small, title="Add Short Signal")

// Plot Clear

plotEntryLong := false

plotAddLong := false

plotEntryShort := false

plotAddShort := false

// // table

// var infoTable = table.new(position=position.top_right,columns = 2,rows = 6,bgcolor=color.yellow,frame_color = color.white,frame_width = 1,border_width = 1,border_color = color.black)

// if barstate.isfirst

// t1="Open Price"

// t2="Avg Price"

// t3="Additions"

// t4='Next Add Price'

// t5="Take Profit"

// t6="Stop Loss"

// table.cell(infoTable, column = 0, row = 0,text=t1 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 1,text=t2 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 2,text=t3 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 3,text=t4 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 4,text=t5 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 5,text=t6 ,text_size=size.auto)

// if barstate.isconfirmed and strategy.position_size!=0

// ps=strategy.position_size

// pos_avg=strategy.position_avg_price

// opt=strategy.opentrades

// t1=str.tostring(strategy.opentrades.entry_price(0),format.mintick)

// t2=str.tostring(pos_avg,format.mintick)

// t3=str.tostring(opt>1?(opt-1):0)

// t4=str.tostring(ps>0?nextAddPriceLong:nextAddPriceShort,format.mintick)

// t5=str.tostring(pos_avg*(1+(ps>0?1:-1)*takeProfitTrigger*0.01),format.mintick)

// t6=str.tostring(pos_avg*(1+(ps>0?-1:1)*stopLossPercent*0.01),format.mintick)

// table.cell(infoTable, column = 1, row = 0,text=t1 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 1,text=t2 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 2,text=t3 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 3,text=t4 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 4,text=t5 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 5,text=t6 ,text_size=size.auto)

- Trend gabungan Multi-SMA dan Stochastic Berikutan Strategi Dagangan

- Nifty 50 3-Minute Pembukaan Julat Breakout Strategi

- Teori Gelombang Elliott 4-9 Impulse Wave Automatic Detection Strategi Dagangan

- Starlight Moving Average Crossover Strategi

- 10SMA dan MACD Dual Trend Berikutan Strategi Dagangan

- Midas Mk. II - Ultimate Crypto Swing

- Strategi Dagangan Intraday Multi-Filter MACD dan RSI

- Sistem Dagangan Pengesahan Trend MACD Berganda

- Strategi Perdagangan Trend Trend Pelbagai Indikator Kemungkinan Sempadan

- MACD-Supertrend Trend Pengesahan Ganda Berikutan Strategi Dagangan

- Strategi Dagangan Pengiktirafan Corak Candlestick Gabungan Multi-Timeframe

- Triple Bollinger Bands Mengesan Trend Berikutan Strategi Dagangan Kuantitatif

- Sistem Dagangan Penembusan Dinamik Berbilang Dimensi Berdasarkan Bollinger Bands dan RSI

- RSI Rating Rating Rating

- Trend Momentum Silang EMA Berganda Mengikut Strategi

- Strategi Dagangan ATR Berbilang Langkah dengan Mengambil Keuntungan Dinamik

- Sistem Dagangan Sokongan Dinamik Jangka Masa Berganda

- Trend silang Purata Bergerak Berbilang Tempoh dan Momentum RSI Mengikut Strategi

- Sistem Peratuskan Aset Kewangan MFI-Based Oversold Zone Exit and Signal

- Strategi Perdagangan Crossover Multi-EMA dengan Penunjuk Momentum

- Pengiktirafan Multi-Pattern dan Strategi Dagangan SR

- G-Channel dan EMA Trend Filter Trading System

- Trend RSI Berbilang Tempoh Stop-Loss Dinamik Mengikut Strategi

- Sistem Dagangan Penembusan Rata-rata Bergerak Ganda Dinamik

- Trend Momentum Crossover Multi-Indikator Mengikuti Strategi dengan Sistem Amalan Keuntungan dan Hentian Kerugian yang Dioptimumkan

- Triangle Breakout dengan RSI Momentum Strategy

- Lima EMA RSI Sistem Dagangan Saluran Dinamik Mengikuti Trend

- Adaptive Trend Weighted Following Strategy (Sistem Multi-Indikator Vidya)

- Strategi Dagangan Pembalikan Titik Pivot Dual yang Dipertingkatkan

- Strategi Peningkatan Trend Kuantitatif Multi-Layer AO