Strategi Stop Trailing Dinamik Berbilang Tahap Berbasis Bollinger Bands dan ATR

Penulis:ChaoZhang, Tarikh: 2024-12-11 14:52:24Tag:BBATRMASMAEMASMMAWMAVWMASD

Ringkasan

Strategi ini adalah sistem dagangan pintar berdasarkan Bollinger Bands dan penunjuk ATR, menggabungkan mekanisme mengambil keuntungan dan menghentikan kerugian pelbagai peringkat. Strategi ini terutamanya memasuki kedudukan panjang dengan mengenal pasti isyarat pembalikan berhampiran Bollinger Band bawah dan menguruskan risiko menggunakan berhenti mengikuti dinamik. Sistem ini direka dengan sasaran keuntungan 20% dan tahap berhenti kehilangan 12%, sambil menggabungkan berhenti mengikuti dinamik berasaskan ATR untuk melindungi keuntungan sambil membolehkan trend ruang yang mencukupi untuk berkembang.

Prinsip Strategi

Logik teras merangkumi beberapa komponen utama: Syarat kemasukan: Memerlukan lilin hijau mengikuti lilin merah yang menyentuh Bollinger Band bawah, biasanya menunjukkan isyarat pembalikan yang berpotensi. 2. Pilihan purata bergerak: Sokong pelbagai jenis (SMA, EMA, SMMA, WMA, VWMA), dengan SMA 20 tempoh lalai. 3. Parameter Bollinger Bands: Menggunakan 1.5 penyimpangan standard untuk lebar jalur, lebih konservatif daripada penyimpangan standard 2 tradisional. 4. Mekanisme mengambil keuntungan: Menetapkan sasaran keuntungan awal 20%. 5. Mekanisme Stop-Loss: Melaksanakan 12% Stop-Loss tetap untuk melindungi modal. 6. hentikan pengekoran dinamik: - Mengaktifkan ATR trailing berhenti selepas mencapai sasaran keuntungan - Memulakan hentian trailing dinamik ATR selepas menyentuh Bollinger Band atas - Menggunakan pengganda ATR untuk menyesuaikan jarak berhenti belakang secara dinamik

Kelebihan Strategi

- Kawalan risiko pelbagai peringkat:

- Stop-loss tetap melindungi pokok

- Penguncian berhenti yang dinamik dalam keuntungan

- Stop dinamik yang dicetuskan oleh Bollinger Band atas memberikan perlindungan tambahan

- Pilihan purata bergerak yang fleksibel membolehkan penyesuaian kepada keadaan pasaran yang berbeza

- Hentian pengangkut dinamik berasaskan ATR disesuaikan secara automatik berdasarkan turun naik pasaran, mengelakkan keluar awal

- Isyarat kemasukan menggabungkan corak harga dan penunjuk teknikal, meningkatkan kebolehpercayaan isyarat

- Menyokong pengurusan kedudukan dan tetapan kos urus niaga, lebih dekat dengan keadaan perdagangan sebenar

Risiko Strategi

- Pasaran yang berayun dengan cepat boleh membawa kepada perdagangan yang kerap, meningkatkan kos transaksi

- 12% stop loss tetap mungkin terlalu ketat di pasaran yang sangat tidak menentu

- Isyarat Bollinger Bands boleh menghasilkan isyarat palsu di pasaran trend

- Hentian trailing ATR boleh mengakibatkan pengeluaran yang lebih besar semasa turun naik yang teruk Langkah-langkah pengurangan:

- Penggunaan yang disyorkan pada jangka masa yang lebih panjang (30min-1 jam)

- Penyesuaian peratusan stop-loss berdasarkan ciri-ciri instrumen tertentu

- Pertimbangkan menambah penapis trend untuk mengurangkan isyarat palsu

- Sesuaikan secara dinamik pengganda ATR untuk persekitaran pasaran yang berbeza

Arahan Pengoptimuman Strategi

- Pengoptimuman kemasukan:

- Tambah mekanisme pengesahan jumlah

- Memasukkan penunjuk kekuatan trend untuk penapisan isyarat

- Pertimbangkan untuk menambah penunjuk momentum untuk pengesahan

- Pengoptimuman Stop-Loss:

- Mengubah stop-loss tetap kepada stop dinamik berasaskan ATR

- Membangunkan algoritma stop-loss adaptif

- Sesuaikan jarak henti secara dinamik berdasarkan turun naik

- Pengoptimuman purata bergerak:

- Uji gabungan tempoh yang berbeza

- Kaedah tempoh penyesuaian penyelidikan

- Pertimbangkan untuk menggunakan tindakan harga dan bukannya purata bergerak

- Pengoptimuman pengurusan kedudukan:

- Membangunkan sistem saiz kedudukan berasaskan turun naik

- Melaksanakan mekanisme kemasukan dan keluar berskala

- Tambah kawalan pendedahan risiko

Ringkasan

Strategi ini membina sistem perdagangan pelbagai peringkat menggunakan Bollinger Bands dan penunjuk ATR, menggunakan kaedah pengurusan dinamik untuk kemasukan, berhenti-kerugian, dan mengambil keuntungan. Kekuatannya terletak pada sistem kawalan risiko yang komprehensif dan keupayaan untuk menyesuaikan diri dengan turun naik pasaran. Melalui arah pengoptimuman yang dicadangkan, strategi ini mempunyai ruang yang signifikan untuk peningkatan. Ia sangat sesuai untuk digunakan pada jangka masa yang lebih besar dan dapat membantu pelabur yang memegang aset berkualiti mengoptimumkan masa masuk dan keluar mereka.

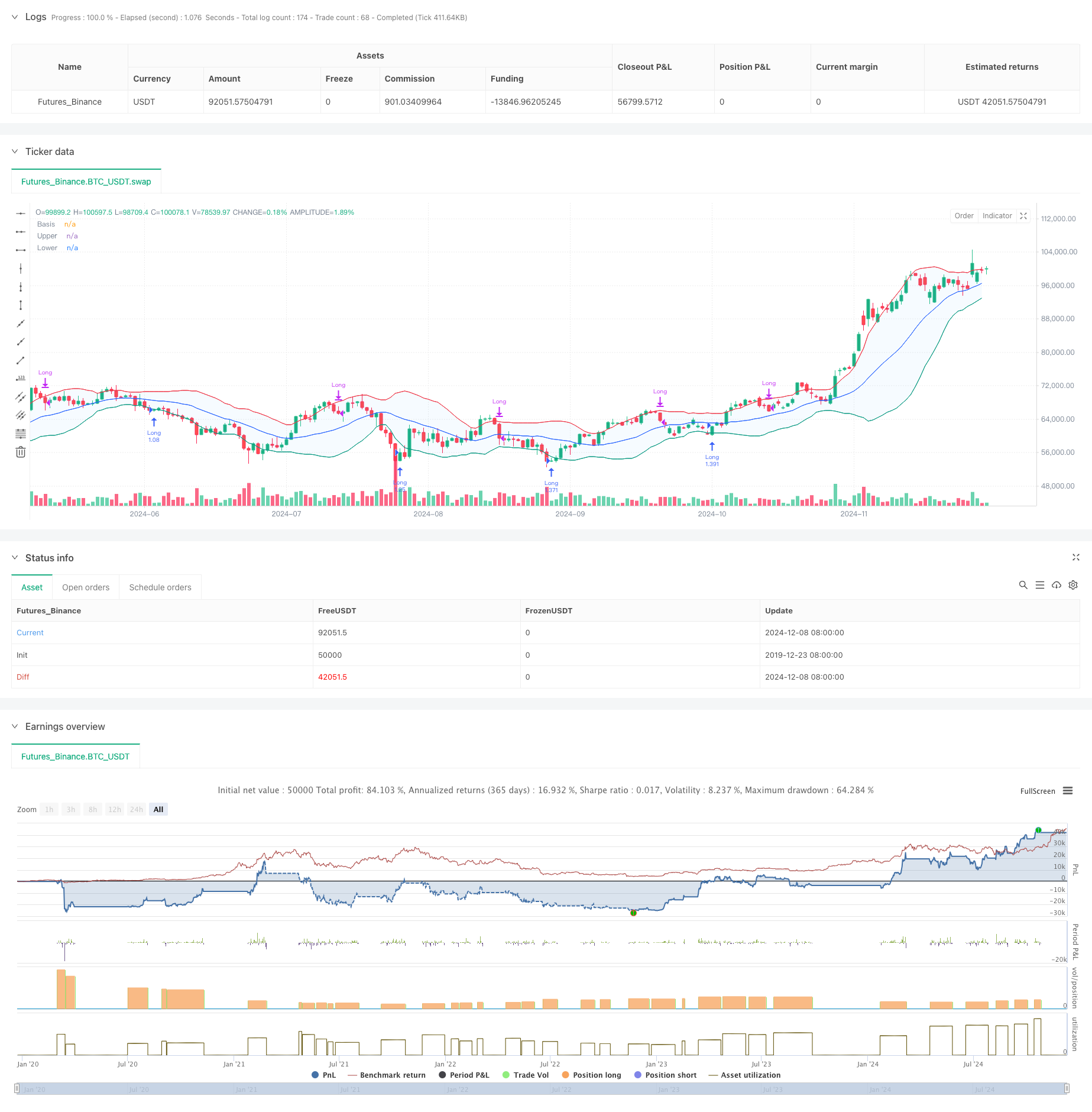

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Demo GPT - Bollinger Bands Strategy with Tightened Trailing Stops", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_value=0.1, slippage=3)

// Input settings

length = input.int(20, minval=1)

maType = input.string("SMA", "Basis MA Type", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

src = input(close, title="Source")

mult = 1.5 // Standard deviation multiplier set to 1.5

offset = input.int(0, "Offset", minval=-500, maxval=500)

atrMultiplier = input.float(1.0, title="ATR Multiplier for Trailing Stop", minval=0.1) // ATR multiplier for trailing stop

// Time range filters

start_date = input(timestamp("2018-01-01 00:00"), title="Start Date")

end_date = input(timestamp("2069-12-31 23:59"), title="End Date")

in_date_range = true

// Moving average function

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

// Calculate Bollinger Bands

basis = ma(src, length, maType)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

// ATR Calculation

atr = ta.atr(length) // Use ATR for trailing stop adjustments

// Plotting

plot(basis, "Basis", color=#2962FF, offset=offset)

p1 = plot(upper, "Upper", color=#F23645, offset=offset)

p2 = plot(lower, "Lower", color=#089981, offset=offset)

fill(p1, p2, title="Background", color=color.rgb(33, 150, 243, 95))

// Candle color detection

isGreen = close > open

isRed = close < open

// Flags for entry and exit conditions

var bool redTouchedLower = false

var float targetPrice = na

var float stopLossPrice = na

var float trailingStopPrice = na

if in_date_range

// Entry Logic: First green candle after a red candle touches the lower band

if close < lower and isRed

redTouchedLower := true

if redTouchedLower and isGreen

strategy.entry("Long", strategy.long)

targetPrice := close * 1.2 // Set the target price to 20% above the entry price

stopLossPrice := close * 0.88 // Set the stop loss to 12% below the entry price

trailingStopPrice := na // Reset trailing stop on entry

redTouchedLower := false

// Exit Logic: Trailing stop after 20% price increase

if strategy.position_size > 0 and not na(targetPrice) and close >= targetPrice

if na(trailingStopPrice)

trailingStopPrice := close - atr * atrMultiplier // Initialize trailing stop using ATR

trailingStopPrice := math.max(trailingStopPrice, close - atr * atrMultiplier) // Tighten dynamically based on ATR

// Exit if the price falls below the trailing stop after 20% increase

if strategy.position_size > 0 and not na(trailingStopPrice) and close < trailingStopPrice

strategy.close("Long", comment="Trailing Stop After 20% Increase")

targetPrice := na // Reset the target price

stopLossPrice := na // Reset the stop loss price

trailingStopPrice := na // Reset trailing stop

// Stop Loss: Exit if the price drops 12% below the entry price

if strategy.position_size > 0 and not na(stopLossPrice) and close <= stopLossPrice

strategy.close("Long", comment="Stop Loss Triggered")

targetPrice := na // Reset the target price

stopLossPrice := na // Reset the stop loss price

trailingStopPrice := na // Reset trailing stop

// Trailing Stop: Activate after touching the upper band

if strategy.position_size > 0 and close >= upper and isGreen

if na(trailingStopPrice)

trailingStopPrice := close - atr * atrMultiplier // Initialize trailing stop using ATR

trailingStopPrice := math.max(trailingStopPrice, close - atr * atrMultiplier) // Tighten dynamically based on ATR

// Exit if the price falls below the trailing stop

if strategy.position_size > 0 and not na(trailingStopPrice) and close < trailingStopPrice

strategy.close("Long", comment="Trailing Stop Triggered")

trailingStopPrice := na // Reset trailing stop

targetPrice := na // Reset the target price

stopLossPrice := na // Reset the stop loss price

- Bollinger Bands dan Strategi Crossover Purata Bergerak

- Strategi Dagangan Kuantitatif Lanjutan Menggabungkan Divergensi RSI dan Purata Bergerak

- Bollinger Bands Momentum Breakout Trend Adaptive Mengikuti Strategi

- Bollinger Bands Breakout Momentum Strategi Dagangan

- Strategi Perdagangan Band Volatiliti Berbilang Lapisan

- Adaptive Moving Average Crossover Strategi

- Trend Crossover Purata Multi-Moving Mengikut Strategi dengan Penapis Volatiliti

- Trend Crossover Purata Bergerak Berbilang Tempoh Mengikut Strategi

- Dual Moving Average Momentum Tracking Strategi Kuantitatif

- RSI Dinamik Strategi Perdagangan Swing Masa Pintar

- Trend Heikin Ashi Berbilang Jangka Masa yang Dihapuskan Mengikut Sistem Dagangan Kuantitatif

- RSI Dinamis Oscillator Polynomial Fitting Indicator Trend Strategi Dagangan Kuantitatif

- Strategi Perdagangan Satu Arah Penembusan Jangkauan Harian

- Strategi Perdagangan Perintah Had Dinamik Multi-Indikator SMA-RSI-MACD

- EMA/SMA Trend Following dengan Swing Trading Strategy Combined Volume Filter dan Peratusan Take-Profit/Stop-Loss System

- VWAP Standard Deviation Mean Reverssion Trading Strategy

- Strategi Dagangan Penembusan Zon Harga Dinamik Berdasarkan Sistem Kuantitatif Sokongan dan Rintangan

- Strategi Kuantitatif Crossover Trend Multi-Indikator Momentum

- Hentikan Pengangkutan Dinamik Lanjutan dengan Strategi Penargetan Risiko-Penghargaan

- Strategi Penembusan Garis Trend Dinamik Yang Lanjutan

- Strategy Crossover EMA Dual Dinamis dengan Kawalan Keuntungan/Kehilangan yang Sesuai

- Bollinger Bands dan RSI Strategy Dagangan Dinamis Gabungan

- RSI-ATR Momentum Volatiliti Strategi Dagangan Gabungan

- Strategi EMA Berganda Mengikuti Trend dengan Pendaftaran Beli Batas

- Sistem Perdagangan Analisis Teknikal Multi-Strategi

- Strategi Dagangan Pengiktirafan Corak Candlestick Gabungan Multi-Timeframe

- Triple Bollinger Bands Mengesan Trend Berikutan Strategi Dagangan Kuantitatif

- Sistem Dagangan Penembusan Dinamik Berbilang Dimensi Berdasarkan Bollinger Bands dan RSI

- RSI Rating Rating Rating

- Trend Momentum Silang EMA Berganda Mengikut Strategi