Strategi Pengesanan Tren Dinamik ATR Berbilang Jangka Masa

Penulis:ChaoZhang, Tarikh: 2024-12-12 16:24:49Tag:EMARSIMACDATR

Ringkasan

Strategi ini adalah sistem trend berikut adaptif yang menggabungkan beberapa penunjuk teknikal. Ia mengoptimumkan prestasi perdagangan melalui analisis pelbagai jangka masa dan penyesuaian dinamik tahap stop-loss dan mengambil keuntungan. Inti strategi menggunakan sistem purata bergerak untuk mengenal pasti trend, RSI dan MACD untuk mengesahkan kekuatan trend, dan ATR untuk penyesuaian parameter pengurusan risiko dinamik.

Prinsip Strategi

Strategi ini menggunakan mekanisme pengesahan tiga untuk perdagangan: 1) Arah trend ditentukan oleh persilangan EMA cepat / perlahan; 2) Isyarat perdagangan disaring menggunakan tahap overbought / oversold RSI dan pengesahan trend MACD; 3) EMA jangka masa yang lebih tinggi dimasukkan untuk pengesahan trend. Untuk kawalan risiko, strategi secara dinamik menyesuaikan sasaran stop-loss dan keuntungan berdasarkan ATR, mencapai pengurusan kedudukan adaptif. Apabila turun naik pasaran meningkat, sistem secara automatik memperluaskan ruang stop-loss dan keuntungan; apabila pasaran stabil, parameter ini dipersempit untuk meningkatkan kadar kemenangan.

Kelebihan Strategi

- Mekanisme pengesahan isyarat pelbagai dimensi meningkatkan ketepatan perdagangan dengan ketara

- Tetapan stop-loss dan mengambil keuntungan yang disesuaikan lebih sesuai dengan persekitaran pasaran yang berbeza

- Pengesahan trend jangka masa yang lebih tinggi secara berkesan mengurangkan risiko pecah palsu

- Sistem amaran komprehensif membantu menangkap peluang perdagangan dan kawalan risiko tepat pada masanya

- Tetapan arah dagangan yang fleksibel membolehkan penyesuaian strategi kepada pilihan dagangan yang berbeza

Risiko Strategi

- Mekanisme pengesahan berbilang mungkin kehilangan peluang dalam pergerakan pasaran yang cepat

- Stop-loss dinamik mungkin dicetuskan lebih awal di pasaran yang sangat tidak menentu

- Isyarat palsu mungkin sering berlaku di pasaran terhad julat

- Risiko pemasangan berlebihan semasa pengoptimuman parameter

- Analisis pelbagai jangka masa boleh menghasilkan isyarat yang bertentangan dalam jangka masa yang berbeza

Arahan pengoptimuman

- Masukkan penunjuk jumlah sebagai pengesahan tambahan untuk meningkatkan kebolehpercayaan isyarat

- Membangunkan sistem penilaian kekuatan trend kuantitatif untuk mengoptimumkan masa kemasukan

- Melaksanakan mekanisme pengoptimuman parameter adaptif untuk meningkatkan kestabilan strategi

- Tambah sistem klasifikasi persekitaran pasaran untuk menggunakan parameter yang berbeza untuk pasaran yang berbeza

- Membangunkan sistem pengurusan kedudukan dinamik untuk menyesuaikan saiz kedudukan berdasarkan kekuatan isyarat

Ringkasan

Ini adalah sistem trend berikut yang direka dengan ketat yang menyediakan penyelesaian perdagangan yang komprehensif melalui mekanisme pengesahan pelbagai peringkat dan pengurusan risiko dinamik. Kekuatan utama strategi terletak pada kemampuan penyesuaian dan kawalan risiko, tetapi perhatian mesti diberikan kepada pengoptimuman parameter dan pencocokan persekitaran pasaran semasa pelaksanaan. Melalui pengoptimuman dan penyempurnaan berterusan, strategi ini mempunyai potensi untuk mengekalkan prestasi yang stabil di pelbagai persekitaran pasaran.

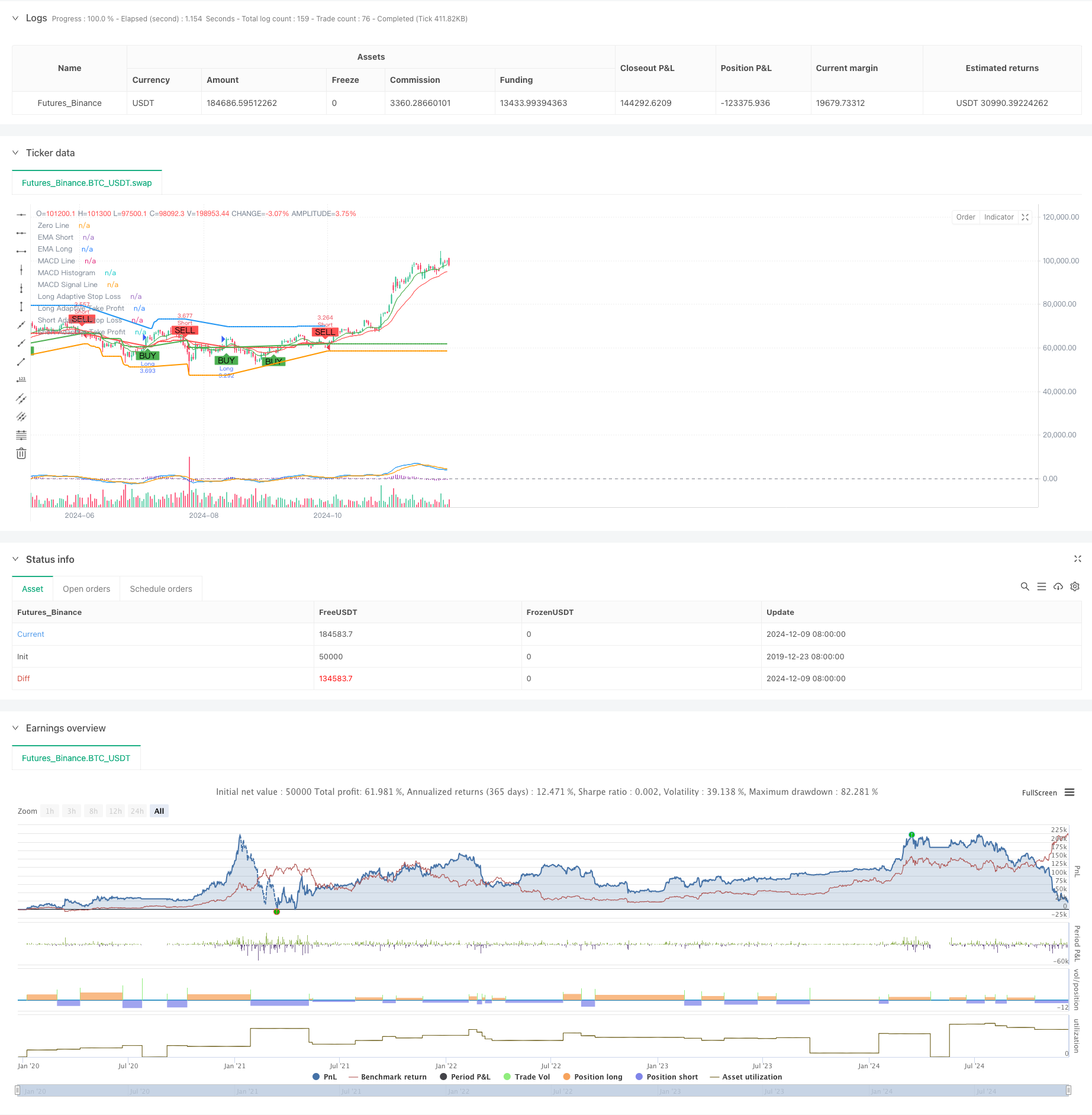

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("TrenGuard Adaptive ATR Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Parameters

emaShortPeriod = input.int(9, title="Short EMA Period", minval=1)

emaLongPeriod = input.int(21, title="Long EMA Period", minval=1)

rsiPeriod = input.int(14, title="RSI Period", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought", minval=50)

rsiOversold = input.int(30, title="RSI Oversold", minval=1)

atrPeriod = input.int(14, title="ATR Period", minval=1)

atrMultiplierSL = input.float(2.0, title="ATR Multiplier for Stop-Loss", minval=0.1)

atrMultiplierTP = input.float(2.0, title="ATR Multiplier for Take-Profit", minval=0.1)

// Multi-timeframe settings

htfEMAEnabled = input.bool(true, title="Use Higher Timeframe EMA Confirmation?", inline="htf")

htfEMATimeframe = input.timeframe("D", title="Higher Timeframe", inline="htf")

// MACD Parameters

macdShortPeriod = input.int(12, title="MACD Short Period", minval=1)

macdLongPeriod = input.int(26, title="MACD Long Period", minval=1)

macdSignalPeriod = input.int(9, title="MACD Signal Period", minval=1)

// Select trade direction

tradeDirection = input.string("Both", title="Trade Direction", options=["Both", "Long", "Short"])

// Calculating indicators

emaShort = ta.ema(close, emaShortPeriod)

emaLong = ta.ema(close, emaLongPeriod)

rsiValue = ta.rsi(close, rsiPeriod)

atrValue = ta.atr(atrPeriod)

[macdLine, macdSignalLine, _] = ta.macd(close, macdShortPeriod, macdLongPeriod, macdSignalPeriod)

// Higher timeframe EMA confirmation

htfEMALong = request.security(syminfo.tickerid, htfEMATimeframe, ta.ema(close, emaLongPeriod))

// Trading conditions

longCondition = ta.crossover(emaShort, emaLong) and rsiValue < rsiOverbought and (not htfEMAEnabled or close > htfEMALong) and macdLine > macdSignalLine

shortCondition = ta.crossunder(emaShort, emaLong) and rsiValue > rsiOversold and (not htfEMAEnabled or close < htfEMALong) and macdLine < macdSignalLine

// Initial Stop-Loss and Take-Profit levels based on ATR

var float adaptiveStopLoss = na

var float adaptiveTakeProfit = na

if (strategy.position_size > 0) // Long Position

if (longCondition) // Trend Confirmation

adaptiveStopLoss := na(adaptiveStopLoss) ? close - atrValue * atrMultiplierSL : math.max(adaptiveStopLoss, close - atrValue * atrMultiplierSL)

adaptiveTakeProfit := na(adaptiveTakeProfit) ? close + atrValue * atrMultiplierTP : math.max(adaptiveTakeProfit, close + atrValue * atrMultiplierTP)

else

adaptiveStopLoss := na(adaptiveStopLoss) ? close - atrValue * atrMultiplierSL : math.max(adaptiveStopLoss, close - atrValue * atrMultiplierSL)

adaptiveTakeProfit := na(adaptiveTakeProfit) ? close + atrValue * atrMultiplierTP : math.max(adaptiveTakeProfit, close + atrValue * atrMultiplierTP)

if (strategy.position_size < 0) // Short Position

if (shortCondition) // Trend Confirmation

adaptiveStopLoss := na(adaptiveStopLoss) ? close + atrValue * atrMultiplierSL : math.min(adaptiveStopLoss, close + atrValue * atrMultiplierSL)

adaptiveTakeProfit := na(adaptiveTakeProfit) ? close - atrValue * atrMultiplierTP : math.min(adaptiveTakeProfit, close - atrValue * atrMultiplierTP)

else

adaptiveStopLoss := na(adaptiveStopLoss) ? close + atrValue * atrMultiplierSL : math.min(adaptiveStopLoss, close + atrValue * atrMultiplierSL)

adaptiveTakeProfit := na(adaptiveTakeProfit) ? close - atrValue * atrMultiplierTP : math.min(adaptiveTakeProfit, close - atrValue * atrMultiplierTP)

// Strategy Entry

if (longCondition and (tradeDirection == "Both" or tradeDirection == "Long"))

strategy.entry("Long", strategy.long)

if (shortCondition and (tradeDirection == "Both" or tradeDirection == "Short"))

strategy.entry("Short", strategy.short)

// Strategy Exit

if (strategy.position_size > 0) // Long Position

strategy.exit("Exit Long", "Long", stop=adaptiveStopLoss, limit=adaptiveTakeProfit, when=shortCondition)

if (strategy.position_size < 0) // Short Position

strategy.exit("Exit Short", "Short", stop=adaptiveStopLoss, limit=adaptiveTakeProfit, when=longCondition)

// Plotting EMAs

plot(emaShort, title="EMA Short", color=color.green)

plot(emaLong, title="EMA Long", color=color.red)

// Plotting MACD

hline(0, "Zero Line", color=color.gray)

plot(macdLine - macdSignalLine, title="MACD Histogram", color=color.purple, style=plot.style_histogram)

plot(macdLine, title="MACD Line", color=color.blue)

plot(macdSignalLine, title="MACD Signal Line", color=color.orange)

// Plotting Buy/Sell signals with distinct colors

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Plotting Trailing Stop-Loss and Take-Profit levels with distinct colors

plot(strategy.position_size > 0 ? adaptiveStopLoss : na, title="Long Adaptive Stop Loss", color=color.red, linewidth=2, style=plot.style_line)

plot(strategy.position_size < 0 ? adaptiveStopLoss : na, title="Short Adaptive Stop Loss", color=color.green, linewidth=2, style=plot.style_line)

plot(strategy.position_size > 0 ? adaptiveTakeProfit : na, title="Long Adaptive Take Profit", color=color.blue, linewidth=2, style=plot.style_line)

plot(strategy.position_size < 0 ? adaptiveTakeProfit : na, title="Short Adaptive Take Profit", color=color.orange, linewidth=2, style=plot.style_line)

// Alert conditions for entry signals

alertcondition(longCondition and (tradeDirection == "Both" or tradeDirection == "Long"), title="Long Signal", message="Long signal triggered: BUY")

alertcondition(shortCondition and (tradeDirection == "Both" or tradeDirection == "Short"), title="Short Signal", message="Short signal triggered: SELL")

// Alert conditions for exit signals

alertcondition(strategy.position_size > 0 and shortCondition, title="Exit Long Signal", message="Exit long position: SELL")

alertcondition(strategy.position_size < 0 and longCondition, title="Exit Short Signal", message="Exit short position: BUY")

// Alert conditions for reaching take-profit levels

alertcondition(strategy.position_size > 0 and close >= adaptiveTakeProfit, title="Take Profit Long Signal", message="Take profit level reached for long position")

alertcondition(strategy.position_size < 0 and close <= adaptiveTakeProfit, title="Take Profit Short Signal", message="Take profit level reached for short position")

- Strategi Dagangan Jangka Pendek dengan Leverage Tinggi Multi-Indikator

- Strategi Dagangan Momentum Komprehensif Berbilang Penunjuk

- Strategi silang EMA yang dipertingkatkan dengan RSI/MACD/ATR

- Strategi Pengesan Lembah MACD

- Strategi Crossover Momentum Pasaran Berbilang Jangka Masa

- Trend Multi-Indikator Berikutan Strategi Pengurusan Risiko Dinamik

- EMA/MACD/RSI Strategy Crossover

- Strategi Dagangan Trend Momentum EMA Berganda

- Strategi Penangkapan Momentum Emas: Sistem Crossover Purata Bergerak Eksponensial Berbilang Jangka Masa

- Trend Multi-EMA Mengikut Strategi dengan Sasaran ATR Dinamik

- Strategi Perdagangan Berpeluang Berpeluang Berpeluang

- Indeks Volatiliti Dinamik (VIDYA) dengan Strategi Pembalikan Trend-Following ATR

- Strategi Dagangan Beradaptasi Berbilang Penunjuk Berdasarkan RSI, MACD dan Volume

- Strategi Dagangan Automatik Berasaskan Pola Harga Berganda dan Atas

- Trend ATR Dinamik Mengikut Strategi Berdasarkan Penembusan Sokongan

- Strategi Kuantitatif Crossover Rata-rata Bergerak Berbilang dan Osilator Stochastic

- Adaptive Trend Following and Reversal Detection Strategy: Sistem Dagangan Kuantitatif Berdasarkan Indikator ZigZag dan Aroon

- Strategi Dagangan Sinergis Multi-Indikator dengan Bollinger Bands, Fibonacci, MACD dan RSI

- Strategi Pelaburan Rata-rata Kos Dolar Bollinger Band

- Sistem Analisis Strategi Anomali Jumaat Emas Berbilang Dimensi

- Perpindahan purata bergerak dengan RSI Trend Momentum Tracking Strategy

- Strategi Dagangan Trailing Stop Berasaskan ATR Dinamis

- Trend Momentum Berikutan Strategi Dagangan Pengesahan Ganda MACD-RSI

- Titik Pivot Dinamik dengan Sistem Pengoptimuman Salib Emas

- Trend Multi-Indikator Mengikut Strategi dengan Bollinger Bands dan ATR Dynamic Stop Loss

- Trend Dinamis Berikutan Strategi Dagangan Multi-Periode ATR

- Trend Multi-Indikator Mengikuti Strategi dengan Saluran Dinamik dan Sistem Dagangan Purata Bergerak

- Multi-EMA Trend Mengikut Strategi dengan Pengesahan SMMA

- Sistem Dagangan Trend Multi-Indikator dengan Strategi Analisis Momentum

- Strategi Divergensi Momentum Awan Mengikut Trend