Overview

This strategy is a volume-based dynamic DCA strategy that uses price breakouts. It identifies the most recent price low and starts building positions when the price breaks below that low and the trading volume increases. As the price continues to fall, the strategy dynamically adjusts the quantity of each position based on the size of the floating loss until it reaches the set total number of positions. At the same time, the strategy sets the take-profit price based on the median of the historical price drop percentages.

Strategy Principles

- Use the ta.pivotlow() function to identify the most recent price low and treat it as a support level.

- Calculate the historical price drop percentages after breaking the support level and take the median as a reference for the safe distance and take-profit percentage.

- Trigger the position-building signal when the price breaks below the support level and the relative trading volume is greater than the set multiple.

- Based on the set total number of positions, divide the total funds into equal proportions. Each time a position is built, dynamically adjust the position size based on the current number of positions, achieving exponential growth in position size.

- During the position-building process, if the floating loss reaches the set threshold, continue to add positions until the total number of positions is reached.

- When the price rises to the take-profit price, close all positions.

Strategy Advantages

- Dynamic position size adjustment: By dynamically adjusting the size of each position based on the floating loss during the price decline, the strategy controls risk while also allowing for greater profits when the price rebounds.

- Parameter setting based on historical data: By calculating the median of the historical price drop percentages after breaking the support level and using it as a reference for the safe distance and take-profit percentage, the strategy parameters are more closely aligned with actual market conditions.

- Limiting the total number of positions: By setting a total number of positions, the strategy controls its overall risk exposure and avoids excessive losses due to over-positioning.

Strategy Risks

- Support level failure risk: If the market experiences extreme conditions and the price continues to fall sharply after breaking the support level, the strategy’s position-adding mechanism may lead to significant losses.

- Parameter setting risk: The strategy’s performance largely depends on the parameter settings. If the parameters are set improperly, it may lead to poor strategy performance.

- Take-profit price setting risk: If the take-profit price is set too high, potential profits may be missed. If it is set too low, positions may be closed too early, missing opportunities to fully capitalize on price rebounds.

Strategy Optimization Directions

- Introduce more indicators: In determining the position-building signal, more technical indicators such as RSI and MACD can be introduced to improve signal accuracy.

- Optimize money management: Based on factors such as market volatility and account risk tolerance, dynamically adjust the proportion of funds for each position to better control risk.

- Adaptive take-profit and stop-loss: Dynamically adjust the take-profit and stop-loss percentages based on changes in market volatility to better adapt to market changes.

Summary

By dynamically adjusting position sizes and setting parameters based on historical data, this strategy aims to control risk while seeking greater profits during price rebounds. However, the strategy’s performance largely depends on parameter settings and market conditions, and risks still exist. By introducing more indicators, optimizing money management, and using adaptive take-profit and stop-loss, the strategy’s performance can be further improved.

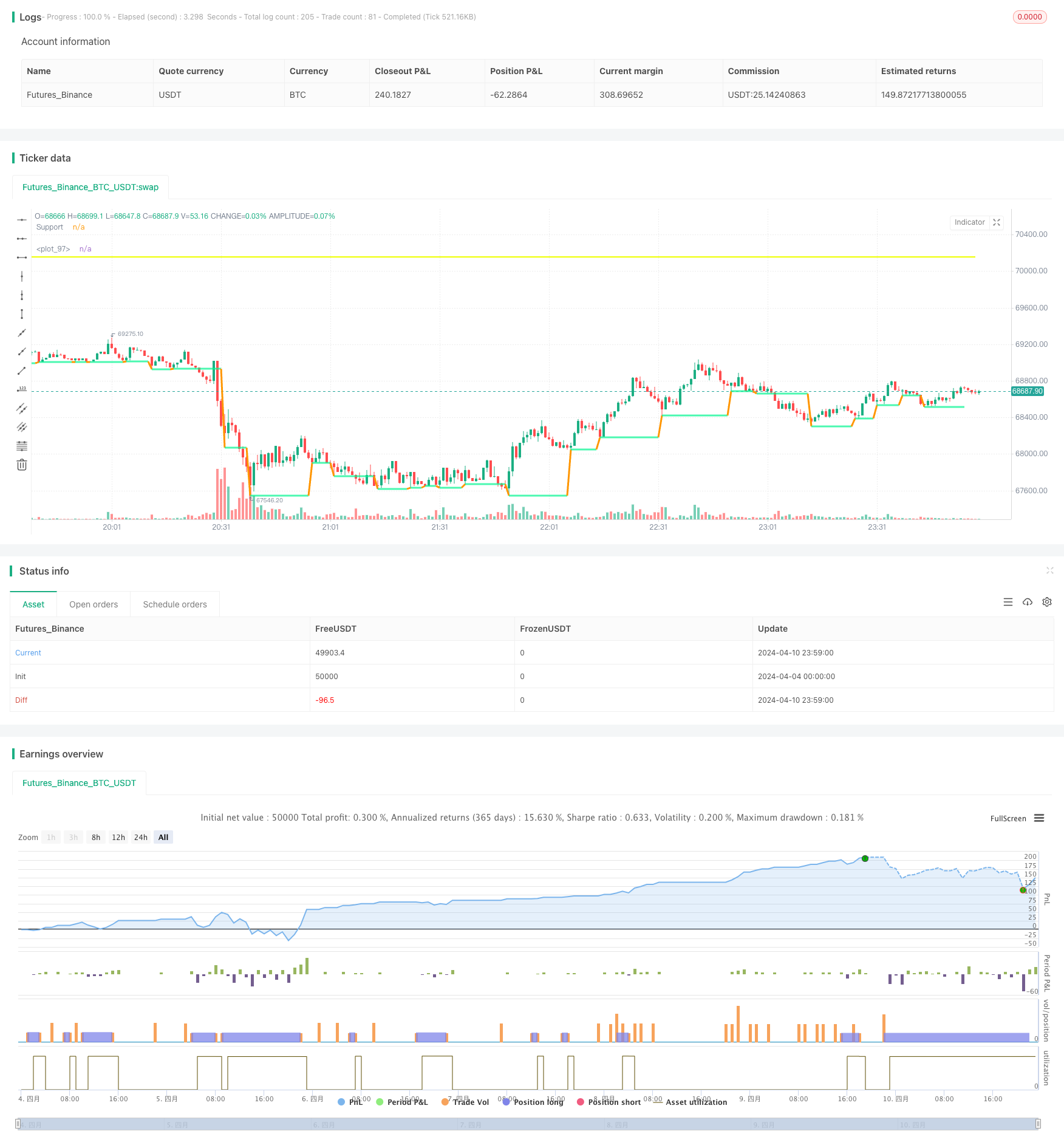

/*backtest

start: 2024-04-04 00:00:00

end: 2024-04-11 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © AHMEDABDELAZIZZIZO

//@version=5

strategy("Qfl Dca strategy", overlay=true)

// Parameters

swing = input(3 , title = "Swing Points")

mediandropmult = input.float(1.1, "Median drop Mult", step=0.1 , tooltip = "The script Calculate The Median Drop for all last Bases That Was cracked you can Increase or decrease it")

floatinglossvalue = input(-5 , "Floating Loss" , tooltip = "Position Floating Loss to start firs DCA order")

num_orders = input(5 , "Number of all orders" , tooltip = " The number of orders is including the base order and the DCA orders the script will alculate every order qty based on the orders number So that the position size doubles with every order")

length = input(20, title="Length of relative volume" ,tooltip = " the length of relative volume indicator")

mult = input(2.0, title="Volume Multiplier" , tooltip = "you can adjust the relative volume multiplier to find best parameter")

tpmult = input.float(1, step=0.1 ,title = "Take Profit Multiplier" ,tooltip = " By default, the script is set to take profits based on the same median drop percent you can adjust it as you like")

// Pivot Calculation

p = ta.pivotlow(low, swing, swing)

v = ta.valuewhen(p, low[swing], 0)

// Variables

var float[] lows = array.new_float()

var float chn = na

// Calculate drops

if v < v[1]

chn := (v[1] - v) / v[1] * 100

if array.size(lows) < 4000

array.push(lows, chn)

else

array.shift(lows)

array.push(lows, chn)

mediandrop = array.avg(lows)

maxdrop = array.max(lows)

mindrop = array.min(lows)

// Table display

textcolor = color.white

// tabl = table.new(position=position.top_right, columns=4, rows=4)

// table.cell(table_id=tabl, column=1, row=1, text="Avg Drop %", width=15, text_color=textcolor)

// table.cell(table_id=tabl, column=2, row=1, text="Min Drop %", width=15, text_color=textcolor)

// table.cell(table_id=tabl, column=3, row=1, text="Max Drop %", width=15, text_color=textcolor)

// table.cell(table_id=tabl, column=1, row=2, text=str.tostring(mediandrop), width=10, text_color=textcolor)

// table.cell(table_id=tabl, column=2, row=2, text=str.tostring(mindrop), width=10, text_color=textcolor)

// table.cell(table_id=tabl, column=3, row=2, text=str.tostring(maxdrop), width=10, text_color=textcolor)

// Plot support

t = fixnan(ta.pivotlow(low, swing, swing))

plot(t, color=ta.change(t) ? na : #03f590b6, linewidth=3, offset=-(swing), title="Support")

// Calculate relative volume

avgVolume = ta.sma(volume, length)

relVolume = volume / avgVolume

// Base Activation

var bool baseisactive = na

if not na(p)

baseisactive := true

// Buy Signal Calculation

buyprice = v * (1 - (mediandrop / 100) * mediandropmult)

signal = close <= buyprice and relVolume > mult and baseisactive

// Take Profit Calculation

tpsl = (mediandrop / 100)

tp = (strategy.position_avg_price * (1 + (tpsl * tpmult)))

// Position Sizing

capital_per_order(num_orders, equity) =>

equity / math.pow(2, (num_orders - 1))

equity_per_order = capital_per_order(num_orders, strategy.equity)

qty_per_order(equity_per_order, order_number) =>

equity_per_order * order_number / close

// Calculate floating loss

floatingLoss = ((close - strategy.position_avg_price) / strategy.position_avg_price) * 100

// Strategy Entries

if signal and strategy.opentrades == 0

strategy.entry("Buy", strategy.long, qty=qty_per_order(equity_per_order, 1))

baseisactive := false

for i = 1 to num_orders -1

if signal and strategy.opentrades == i and floatingLoss <= floatinglossvalue

strategy.entry("Buy", strategy.long, qty=qty_per_order(equity_per_order, i), comment="DCA Order" + str.tostring(i))

baseisactive := false

// Strategy Exit

strategy.exit("exit", "Buy", limit=tp)

// Plot

plot(strategy.position_avg_price, color=color.rgb(238, 255, 0), style=plot.style_linebr, linewidth=2)