AlphaTradingBot Trading Strategy

Author: ChaoZhang, Date: 2024-04-28 13:48:51Tags: MAEMAATRRSI

Overview

AlphaTradingBot is a day trading strategy based on the Zigzag indicator and Fibonacci sequence. The strategy identifies the high points (HH) and low points (LL) of the market to determine the trend, and uses Fibonacci retracements and expansions to set entry points, take-profits, and stop-losses. The strategy only runs within a specified date range and can go both long and short, with some ability to grasp trends and control risk-reward ratio.

Strategy Principle

- Use the Zigzag indicator to identify the market’s high points (HH), low points (LL), higher lows (HL), and lower highs (LH).

- When an HH appears, it is regarded as the beginning of an uptrend and the strategy starts looking for long opportunities; when an LL appears, it is regarded as the beginning of a downtrend and the strategy starts looking for short opportunities.

- In an uptrend, if an HL appears, the range formed by the HL and the previous LL is used as the Fibonacci retracement range for longs. If the price breaks the previous high, a long order is placed in the 23.6%-38.2% (adjustable) retracement zone, with the stop-loss set at the 61.8% retracement level and the take-profit calculated based on the RR value (adjustable).

- In a downtrend, if an LH appears, the range formed by the LH and the previous HH is used as the Fibonacci retracement range for shorts. If the price breaks the previous low, a short order is placed in the 61.8%-76.4% (adjustable) retracement zone, with the stop-loss set at the 38.2% retracement level and the take-profit calculated based on the RR value (adjustable).

- Order management: Only one order is placed per signal until that order is closed. If the loss of a single trade reaches X% (adjustable) of the total account balance, the strategy stops running.

Advantage Analysis

- Strong trend-following ability. Effectively identifies trends through Zigzag and can enter at the early stage of a trend.

- Clear retracement logic. Uses Fibonacci retracements to set entry zones and enters during trend retracements, resulting in a relatively high win rate.

- Controllable risk. Controls the risk of each trade by setting a maximum single-trade loss percentage, while a strict stop-loss system also ensures overall risk control.

- Optimizable risk-reward ratio. The RR value can be adjusted according to market characteristics and personal preferences to optimize the strategy’s risk-reward ratio.

Risk Analysis

- Frequent trading. Due to the high sensitivity of Zigzag, it may generate signals frequently, leading to over-trading.

- Imprecise trend identification. The trends determined by Zigzag may still have deviations, resulting in less-than-ideal entry timing.

- Poor performance in range-bound markets. In sideways markets, the strategy may generate more losing trades.

- Limited running period. The strategy only runs within a specified date range and may miss some market moves.

Optimization Direction

- Introduce more technical indicators, such as MA and MACD, to improve the accuracy of trend identification.

- Optimize position management, such as dynamically adjusting position size based on indicators like ATR.

- Optimize take-profit and stop-loss logic, such as dynamically adjusting stop-loss levels based on market volatility.

- Introduce market sentiment indicators to avoid entering during extreme optimism or pessimism.

- Relax the date restriction to increase the strategy’s versatility.

Summary

AlphaTradingBot is a trend-following intraday strategy based on the Zigzag indicator and Fibonacci retracements. It determines trends through high and low points and enters during trend retracements, aiming to pursue a higher win rate and risk-reward ratio. The strategy’s advantages lie in its strong trend-grasping ability, clear retracement logic, and measurable risk, but it also faces risks such as over-trading, trend misjudgment, and poor performance in range-bound markets. In the future, the strategy can be optimized in terms of technical indicators, position management, take-profit and stop-loss, and market sentiment to improve its robustness and profitability.

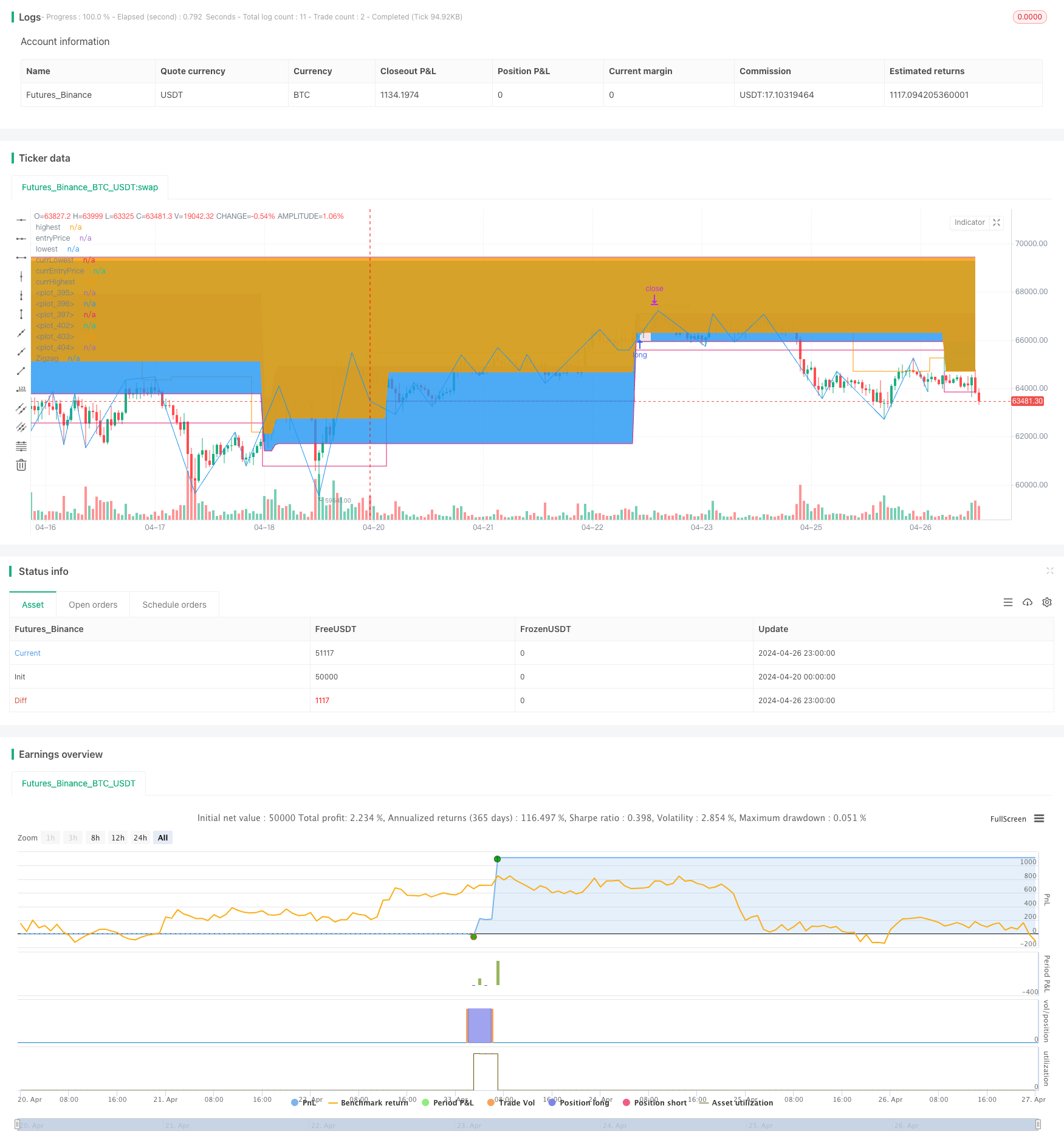

/*backtest

start: 2024-04-20 00:00:00

end: 2024-04-27 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © javierfish

//@version=5

strategy(title = 'Augusto Bot v1.2', shorttitle='🤑 🤖 v1.2', overlay = true, pyramiding=0, initial_capital=100000, default_qty_value=1)

lb = input.int(5, title='Pivot Bars Count', minval=1)

rb = lb

var color supcol = color.lime

var color rescol = color.red

// srlinestyle = line.style_dotted

srlinewidth = 1

changebarcol = true

bcolup = color.blue

bcoldn = color.black

intDesde = input(timestamp('2023-01-01T00:00:00'), 'Desde', group='Rango de fechas')

intHasta = input(timestamp('2023-12-31T23:59:59'), 'Hasta', group='Rango de fechas')

blnFechas = true

blnShorts = input.bool(false, " Shorts", group="Trading", tooltip = 'Checked = Shorts. No Checked = Longs')

blnLongs = not blnShorts

pctRisk = input.float(1, 'Riesgo %', 0.1, 100,step = .1, group='Trading', tooltip = 'Porcentaje del total de su cuenta que está dispuesto a arriesgar en cada trade')

RR = input.float(2, 'Ratio de Ganancia X', 1, 10, .5, tooltip = 'Proporción de Take Profit contra Stop Loss', group='Trading')

retro = input.float(40, 'Retroceso %', 1, 100, 10, tooltip = 'Porcentaje de Fibonacci que debe alcanzar el precio para considerar un retroceso', group='Fibonacci')

fibSL = input.float(72, 'Stop Loss %', 1, 100, 5, tooltip = 'Porcentaje de Fibonacci que debe alcanzar el precio para considerar perdido un trade', group='Fibonacci')

blnDebug = input.bool(false, 'Debug', tooltip = 'Mostrar información de depuración como estatus y línea de tendencia')

showsupres = blnDebug

blnEnLong = strategy.position_size > 0

blnEnShort = strategy.position_size < 0

blnEnTrade = blnEnLong or blnEnShort

ph = ta.pivothigh(lb, rb)

pl = ta.pivotlow(lb, rb)

iff_1 = pl ? -1 : na // Trend direction

hl = ph ? 1 : iff_1

iff_2 = pl ? pl : na // similar to zigzag but may have multiple highs/lows

zz = ph ? ph : iff_2

valuewhen_1 = ta.valuewhen(hl, hl, 1)

valuewhen_2 = ta.valuewhen(zz, zz, 1)

zz := pl and hl == -1 and valuewhen_1 == -1 and pl > valuewhen_2 ? na : zz

valuewhen_3 = ta.valuewhen(hl, hl, 1)

valuewhen_4 = ta.valuewhen(zz, zz, 1)

zz := ph and hl == 1 and valuewhen_3 == 1 and ph < valuewhen_4 ? na : zz

valuewhen_5 = ta.valuewhen(hl, hl, 1)

valuewhen_6 = ta.valuewhen(zz, zz, 1)

hl := hl == -1 and valuewhen_5 == 1 and zz > valuewhen_6 ? na : hl

valuewhen_7 = ta.valuewhen(hl, hl, 1)

valuewhen_8 = ta.valuewhen(zz, zz, 1)

hl := hl == 1 and valuewhen_7 == -1 and zz < valuewhen_8 ? na : hl

zz := na(hl) ? na : zz

findprevious() => // finds previous three points (b, c, d, e)

float loc1 = na

float loc2 = na

float loc3 = na

float loc4 = na

if not na(hl)

ehl = hl == 1 ? -1 : 1

loc1 := 0.0

loc2 := 0.0

loc3 := 0.0

loc4 := 0.0

xx = 0

for x = 1 to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc1 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc2 := zz[x]

xx := x + 1

break

ehl := hl == 1 ? -1 : 1

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc3 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc4 := zz[x]

break

[loc1, loc2, loc3, loc4]

[loc1, loc2, loc3, loc4] = findprevious()

a = fixnan(zz)

b = loc1

c = loc2

d = loc3

e = loc4

_hh = zz and a > b and a > c and c > b and c > d

_ll = zz and a < b and a < c and c < b and c < d

_hl = zz and (a >= c and b > c and b > d and d > c and d > e or a < b and a > c and b < d)

_lh = zz and (a <= c and b < c and b < d and d < c and d < e or a > b and a < c and b > d)

plotshape(blnDebug and _hl, text='HL', title='Higher Low', style=shape.labelup, color=color.lime, textcolor=color.new(color.black, 0), location=location.belowbar, offset=-rb)

plotshape(blnDebug and _hh, text='HH', title='Higher High', style=shape.labeldown, color=color.lime, textcolor=color.new(color.black, 0), location=location.abovebar, offset=-rb)

plotshape(blnDebug and _ll, text='LL', title='Lower Low', style=shape.labelup, color=color.red, textcolor=color.new(color.white, 0), location=location.belowbar, offset=-rb)

plotshape(blnDebug and _lh, text='LH', title='Lower High', style=shape.labeldown, color=color.red, textcolor=color.new(color.white, 0), location=location.abovebar, offset=-rb)

float res = na

float sup = na

res := _lh ? zz : res[1]

sup := _hl ? zz : sup[1]

int trend = na

iff_3 = close < sup ? -1 : nz(trend[1])

trend := close > res ? 1 : iff_3

res := trend == 1 and _hh or trend == -1 and _lh ? zz : res

sup := trend == 1 and _hl or trend == -1 and _ll ? zz : sup

rechange = res != res[1]

suchange = sup != sup[1]

var line resline = na

var line supline = na

if showsupres

if rechange

line.set_x2(resline, bar_index)

line.set_extend(resline, extend=extend.none)

resline := line.new(x1=bar_index - rb, y1=res, x2=bar_index, y2=res, color=rescol, extend=extend.right, width=srlinewidth)

resline

if suchange

line.set_x2(supline, bar_index)

line.set_extend(supline, extend=extend.none)

supline := line.new(x1=bar_index - rb, y1=sup, x2=bar_index, y2=sup, color=supcol, extend=extend.right, width=srlinewidth)

supline

iff_4 = trend == 1 ? bcolup : bcoldn

barcolor(color=changebarcol and blnDebug ? iff_4 : na)

usdCalcRisk = strategy.equity * pctRisk / 100

usdRisk = usdCalcRisk > 0 ? usdCalcRisk : 0

blnOrder = strategy.opentrades > 0

var entryPrice = close

var hhVal = high

var lhVal = high

var hlVal = low

var llVal = low

var longTP = high

var longSL = low

var shortTP = low

var shortSL = high

var lowest = low

var highest = high

var status = 0

var closedTrades = strategy.closedtrades

var currSignal = ''

var prevSignal = currSignal

if _hh

hhVal := a

prevSignal := currSignal

currSignal := 'HH'

else if _lh

lhVal := a

prevSignal := currSignal

currSignal := 'LH'

else if _hl

hlVal := a

prevSignal := currSignal

currSignal := 'HL'

else if _ll

llVal := a

prevSignal := currSignal

currSignal := 'LL'

fibo(fibTop, fibLow) =>

diff = fibTop - fibLow

fib50 = 0.0

if status % 2 == 1 // Estatus pares son longs

fib50 := fibLow + (diff * (1 - (retro / 100))) // Longs

else

fib50 := fibLow + (diff * (retro / 100))

fib70UP = fibLow + (diff * (1 - (fibSL / 100))) // Fibo 61.8% up

fib70DW = fibLow + (diff * (fibSL / 100)) // Fibo 61.8% down

[fib50, fib70UP, fib70DW]

currLowest = ta.lowest(low, lb + 1) // El menor low de las últimas n barras

currHighest = ta.highest(high, lb + 1) // El mayor high de las últimas n barras

// status 0. En espera de un LL para longs o un HH para shorts

if status == 0 and blnFechas

closedTrades := strategy.closedtrades

if _ll and blnLongs

status := 1

else if _hh and blnShorts

status := 2

// -------- LONGS --------

// status 1. Longs. En espera de un nuevo nivel superior (HH o LH)

else if status == 1

closedTrades := strategy.closedtrades

if _hh or _lh

highest := currHighest

else if _hl

lowest := currLowest

if high > highest

status := 5

highest := high

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

if low <= entryPrice and close <= open // Si la vela roja que rebasó el reciente nivel superior también cruzó el precio de entrada se ingresa a un trade inmediatamente

entryPrice := close

longSL := fibUP // Reajuste de SL para long

diff = entryPrice - longSL

longTP := entryPrice + diff * RR // Reajuste de TP para long

lotSize = usdRisk / diff

if entryPrice > longSL

strategy.entry('🚀 1', strategy.long, limit = entryPrice, qty = lotSize, alert_message = 'long ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(longTP) + ' sl=' + str.tostring(longSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('lx', '🚀 1', limit = longTP, stop = longSL, comment_loss = '💥', comment_profit = '✅', alert_message = 'bal')

else

status := 3

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

else if low < llVal

status := 0

// status 3. Longs. En espera de que aparezca un HL

else if status == 3

if _hl

lowest := currLowest

if _lh or _ll or low < hlVal

strategy.cancel_all()

status := _ll ? 1 : 0 // Si fue un nuevo LL comienza a formarse un nuevo setup alcista

else if high > highest

status := 5

highest := high

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

if low <= entryPrice

entryPrice := close

longSL := fibUP // Reajuste de SL para long

diff = entryPrice - longSL

longTP := entryPrice + diff * RR // Reajuste de TP para long

lotSize = usdRisk / diff

if not blnEnLong and entryPrice > longSL

strategy.cancel_all()

strategy.entry('🚀 3', strategy.long, limit = entryPrice, qty = lotSize, alert_message = 'long ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(longTP) + ' sl=' + str.tostring(longSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('lx', '🚀 3', limit = longTP, stop = longSL, comment_loss = '💥', comment_profit = '✅', alert_message = 'bal')

// status 5. Longs. Crecimiento del fibo en espera de que se rebase el nivel superior y se toque el entry price para entrar a un trade

else if status == 5

if strategy.closedtrades > closedTrades // Caso trade abre y cierra en una misma vela

status := 0

else if blnEnLong

status := 7

else if _lh or _ll or low < llVal // Caso invalidación por nuevo bajo nivel

strategy.cancel_all()

status := _ll ? 1 : 0 // Si fue un nuevo LL comienza a formarse un nuevo setup alcista

else if high > highest // Caso de rebase de niveles superiores

highest := high

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

longSL := fibUP // Reajuste de SL para long

diff = entryPrice - longSL

longTP := entryPrice + diff * RR // Reajuste de TP para long

lotSize = usdRisk / diff

if not blnEnLong and entryPrice > longSL // Orden limit de long con su TP y SL

strategy.cancel_all()

strategy.entry('🚀 5', strategy.long, limit = entryPrice, qty = lotSize, alert_message = 'long ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(longTP) + ' sl=' + str.tostring(longSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('lx', '🚀 5', limit = longTP, stop = longSL, comment_loss = '💥', comment_profit = '✅', alert_message = 'bal')

// status 7. Longs. En espera que finalice el trade

else if status == 7

blnOrder := false

if not blnEnLong

strategy.cancel_all()

if currSignal == 'HH' and blnShorts // Si se finaliza un trade e inmediatamente se presenta un HH debe comenzarse la formación de un setup bajista

status := 2

else

status := 0

// -------- SHORTS --------

// status 2. Shorts. En espera de un nuevo nivel inferior (LL o HL)

else if status == 2

closedTrades := strategy.closedtrades

if _ll or _hl

lowest := currLowest

else if _lh

highest := currHighest

if low < lowest

status := 6

lowest := low

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

if high >= entryPrice and close > open // Si la vela verde que rebasó el reciente nivel inferior tambien cruzó el precio de entrada se ingresa a un trade inmediatamente

entryPrice := close

shortSL := fibDW

diff = shortSL - entryPrice

shortTP := entryPrice - diff * RR

lotSize = usdRisk / diff

if entryPrice < shortSL

strategy.entry('🐻 2', strategy.short, limit = entryPrice, qty = lotSize, alert_message = 'short ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(shortTP) + ' sl=' + str.tostring(shortSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('sx', '🐻 2', limit = shortTP, stop = shortSL, comment_loss = '☠️', comment_profit = '❎', alert_message = 'bal')

else

status := 4

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

else if high > hhVal

status := 0

// status 4. Shorts. En espera de que aparezca un LH

else if status == 4

if _lh

highest := currHighest

if _hl or _hh or high > lhVal

strategy.cancel_all()

status := _hh ? 2 : 0 // Si fue un nuevo HH comienza a formarse un nuevo setup bajista

else if low < lowest

status := 6

lowest := low

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

if high >= entryPrice

entryPrice := close

shortSL := fibDW

diff = shortSL - entryPrice

shortTP := entryPrice - diff * RR

lotSize = usdRisk / diff

if not blnEnShort and entryPrice < shortSL

strategy.cancel_all()

strategy.entry('🐻 4', strategy.short, limit = entryPrice, qty = lotSize, alert_message = 'short ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(shortTP) + ' sl=' + str.tostring(shortSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('sx', '🐻 4', limit = shortTP, stop = shortSL, comment_loss = '☠️', comment_profit = '❎', alert_message = 'bal')

// status 6. Shorts. Crecimiento del fibo en espera de que se rebase el nivel inferior y se toque el entry price para entrar a un trade

else if status == 6

if strategy.closedtrades > closedTrades // Caso trade abre y cierra en una misma vela

status := 0

else if blnEnShort

status := 8

else if _hl or _hh or high > hhVal

strategy.cancel_all()

status := _hh ? 2 : 0 // Si fue un nuevo HH comienza a formarse un nuevo setup bajista

else if low < lowest // Caso de rebase de niveles inferiores

lowest := low

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

shortSL := fibDW

diff = shortSL - entryPrice

shortTP := entryPrice - diff * RR

lotSize = usdRisk / diff

if entryPrice < shortSL

strategy.cancel_all()

strategy.entry('🐻 6', strategy.short, limit = entryPrice, qty = lotSize, alert_message = 'short ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(shortTP) + ' sl=' + str.tostring(shortSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('sx', '🐻 6', limit = shortTP, stop = shortSL, comment_loss = '☠️', comment_profit = '❎', alert_message = 'bal')

// status 8. Shorts. En espera que finalice el trade

else if status == 8

blnOrder := false

if not blnEnShort

strategy.cancel_all()

if currSignal == 'LL' and blnLongs // Si inmediatamente después de finalizar un trade existe un LL debe comenzarse un setup alcista

status := 1

else

status := 0

plotchar(blnDebug and status == 0 and blnFechas, '0', '0', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 1 and blnFechas, '1', '1', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 2 and blnFechas, '2', '2', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 3 and blnFechas, '3', '3', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 4 and blnFechas, '4', '4', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 5 and blnFechas, '5', '5', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 6 and blnFechas, '6', '6', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 7 and blnFechas, '7', '7', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 8 and blnFechas, '8', '8', location.abovebar, color.yellow, size = size.tiny)

plot(highest, 'highest', (status == 5 or status[1] == 5) and blnLongs ? color.new(color.orange, 50) : na, 1, plot.style_stepline)

plot(entryPrice, 'entryPrice', (status == 5 or status[1] == 5) and blnLongs ?color.new(color.white, 50) : na, 1, plot.style_stepline)

plot(lowest, 'lowest', (status == 3 or status == 5 or status[1] == 5) and blnLongs ? color.new(color.yellow, 50) : na, 1, plot.style_stepline)

plot(lowest, 'currLowest', (status == 6 or status[1] == 6) and blnShorts ? color.new(color.orange, 50) : na, 1, plot.style_stepline)

plot(entryPrice, 'currEntryPrice', (status == 6 or status[1] == 6) and blnShorts ?color.new(color.white, 50) : na, 1, plot.style_stepline)

plot(highest, 'currHighest', (status == 4 or status == 6 or status[1] == 6) and blnShorts ?color.new(color.yellow, 50) : na, 1, plot.style_stepline)

exitLong = barstate.isconfirmed and blnEnLong and time >= intHasta

exitShort = barstate.isconfirmed and blnEnShort and time >= intHasta

if exitLong

strategy.cancel_all()

strategy.close_all(comment = close > strategy.position_avg_price ? '✅' : '💥')

status := 0

if exitShort

strategy.cancel_all()

strategy.close_all(comment = close < strategy.position_avg_price ? '❎' : '☠️')

status := 0

plot(zz, 'Zigzag', blnDebug ? color.white : na, offset = lb * -1)

rayaTradeLong = strategy.position_size == strategy.position_size[1] and (strategy.position_size > 0) and blnLongs

tpPlLong = plot(longTP, color = rayaTradeLong ? color.teal : na)

epPlLong = plot(entryPrice, color= rayaTradeLong ? color.white : na)

slPlLong = plot(longSL, color = rayaTradeLong ? color.maroon : na)

fill(tpPlLong, epPlLong, color= rayaTradeLong ? color.new(color.teal, 85) : na)

fill(epPlLong, slPlLong, color= rayaTradeLong ? color.new(color.maroon, 85) : na)

rayaTradeShort = strategy.position_size == strategy.position_size[1] and strategy.position_size < 0 and blnShorts

tpPlShort = plot(shortTP, color = rayaTradeShort ? color.teal : na)

epPlShort = plot(entryPrice, color=rayaTradeShort ? color.white : na)

slPlShort = plot(shortSL, color=rayaTradeShort ? color.maroon : na)

fill(tpPlShort, epPlShort, color=rayaTradeShort ? color.new(color.teal, 85) : na)

fill(epPlShort, slPlShort, color=rayaTradeShort ? color.new(color.maroon, 85) : na)

- Dual EMA Trend Momentum Trading Strategy

- No Upper Wick Bullish Candle Breakout Strategy

- Multi-Indicator Composite Trend Following Strategy

- Multi-Smoothed Moving Average Dynamic Crossover Trend Following Strategy with Multiple Confirmations

- Multi-dimensional Gold Friday Anomaly Strategy Analysis System

- Elliott Wave Theory 4-9 Impulse Wave Automatic Detection Trading Strategy

- Magic Channel Price Action Trading Strategy

- Dynamic Trend Following ATR Multi-Period Trading Strategy

- Moving Average and Relative Strength Index Strategy

- Multi-Level Dynamic Trend Following System

- RSI2 Strategy Intraday Reversal Win Rate Backtest

- Hurst Future Lines of Demarcation Strategy

- Trend Following Strategy Based on OBV and MA Crossover Signals

- GBS TOP BOTTOM Confirmed Strategy

- Multi-Indicator Trend Following Strategy

- Squeeze Backtest Transformer v2.0

- Fibonacci Trend Reversal Strategy

- HTF Zigzag Path Strategy

- WaveTrend Cross LazyBear Strategy

- CCI, DMI, and MACD Hybrid Long-Short Strategy

- Vegas SuperTrend Enhanced Strategy

- Quantitative Trading Strategy Based on Modified Hull Moving Average and Ichimoku Kinko Hyo

- RSI Trend Reversal Strategy

- Stochastic Crossover Indicator Momentum Trading Strategy

- RSI and Dual EMA Crossover Signal Quantitative Strategy

- Elliott Wave Theory 4-9 Impulse Wave Automatic Detection Trading Strategy

- Stochastic Oscillator and Moving Average Crossover Strategy with Stop Loss and Stochastic Filter

- Intraday Scalable Volatility Trading Strategy

- KRK aDa Stochastic Slow Mean Reversion Strategy with AI Enhancements

- Real-time Trendline Trading Based on Pivot Points and Slope