概述

“Vegas SuperTrend Enhanced 策略”是一种创新的交易策略,它结合了Vegas通道和SuperTrend指标,通过动态调整SuperTrend指标的灵敏度来适应不同的市场波动情况。该策略利用Vegas通道衡量市场波动性,并基于此调整SuperTrend指标的参数,以在趋势追踪的同时,更好地适应市场的变化。策略会根据价格与SuperTrend指标的相对位置,产生买入和卖出信号,同时提供灵活的交易方向选择,可以进行多头、空头或双向交易。该策略视觉化效果出色,使用简洁的绿色和红色来标识多头和空头趋势,便于traders快速把握市场趋势。

策略原理

该策略的核心是Vegas通道和SuperTrend指标的结合。Vegas通道使用简单移动平均线(SMA)和标准差(STDEV)来确定价格的上下波动区间。通道的宽度反映了市场的波动程度。而SuperTrend指标则是一个趋势跟踪指标,通过比较当前价格与指标值的相对位置来判断趋势方向。

策略通过动态调整SuperTrend指标的乘数来适应Vegas通道的宽度变化。当Vegas通道较宽时(即市场波动性较大),SuperTrend指标的乘数会相应增大,使其对趋势变化更为敏感;反之,当Vegas通道较窄时(即市场波动性较小),乘数会减小,使指标更为稳健。这种动态调整使得SuperTrend指标能够适应不同的市场节奏。

交易信号的产生基于当前收盘价与SuperTrend指标值的比较。当价格从下向上穿越SuperTrend指标线时,产生做多信号;反之,当价格从上向下穿越指标线时,产生做空信号。这种简单而直观的信号判断方式,使得该策略易于理解和应用。

策略优势

动态适应市场波动:通过Vegas通道动态调整SuperTrend指标的参数,使其能够适应不同的市场波动情况,在趋势性市场中及时捕捉趋势,在震荡市场中保持稳健。

简明直观的交易信号:策略基于价格与SuperTrend指标的相对位置产生明确的买卖信号,简单易懂,有利于交易者快速做出决策。

灵活的交易方向选择:策略提供多头、空头和双向交易三种选择,满足不同交易者的需求和市场观点。

出色的视觉辅助:策略在图表上以绿色和红色标识多头和空头趋势,并用箭头标记买卖点,直观明了,便于掌握市场脉搏。

策略风险

趋势识别滞后:像所有趋势跟踪策略一样,该策略在趋势转折初期可能出现信号滞后,导致错失最佳入场时机或承担额外风险。

参数设置敏感:策略的表现在一定程度上取决于参数的选择,如ATR周期、Vegas通道长度等,不同参数可能带来不同结果。

频繁交易:策略对趋势变化较为敏感,在震荡市中可能产生频繁的交易信号,增加交易成本和回撤风险。

策略优化方向

引入更多指标:考虑引入其他技术指标如RSI、MACD等,以多维度验证趋势信号,提高信号可靠性。

优化入场和出场规则:在当前入场信号基础上,可以引入更多过滤条件,如要求连续多根K线收盘价维持在趋势方向等,以减少虚假信号;同时可以设置移动止损或波动率止损等来优化出场。

动态调整仓位:根据市场趋势强度、波动率等指标,动态调整每笔交易的仓位,在趋势强劲时加大仓位,趋势转弱时减仓,以更好地控制风险和优化收益。

总结

“Vegas SuperTrend Enhanced策略”是一个创新的趋势跟踪交易策略,通过Vegas通道动态调节SuperTrend指标,实现了趋势识别与市场适应性的有机结合。策略交易信号明确,适应性强,视觉辅助效果出色,但同时也面临趋势识别滞后、参数敏感等固有风险。未来可从信号验证、优化入场出场规则、动态仓位调整等方面对策略进行优化。总的来说,该策略为捕捉市场趋势、把握交易机会提供了一个灵活有效的思路。

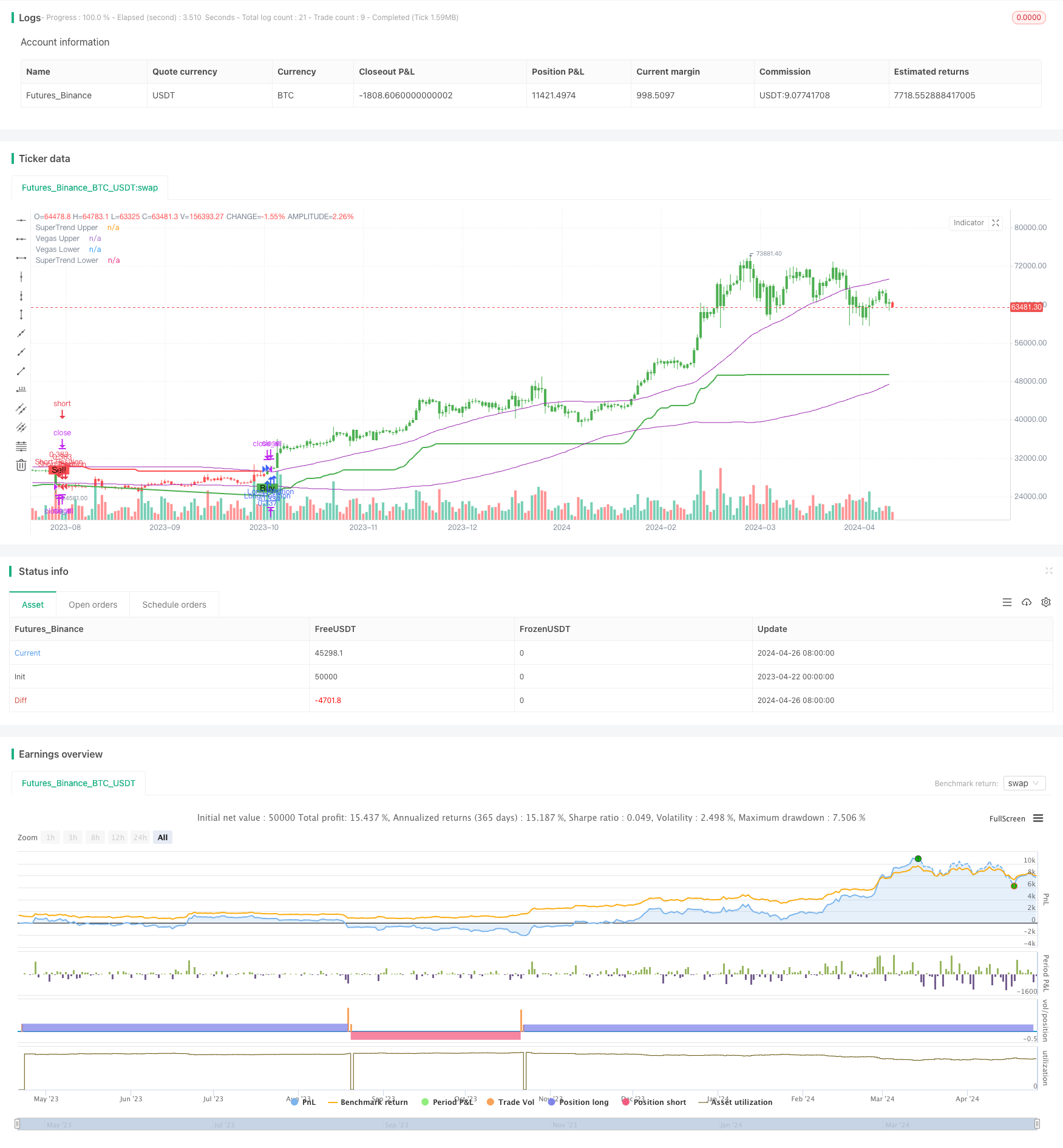

/*backtest

start: 2023-04-22 00:00:00

end: 2024-04-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PresentTrading

// The "Vegas SuperTrend Strategy" uses Vegas Channel and SuperTrend indicators on trading charts, allowing for adjustable settings like ATR length and channel size.

// It modifies the SuperTrend's sensitivity to market volatility, generating buy (green) or sell (red) signals upon trend shifts.

// Entry and exit points are visually marked, with the strategy automating trades based on these trend changes to adapt to different market conditions.

//@version=5

strategy("Vegas SuperTrend Enhanced - strategy [presentTrading]", shorttitle="Vegas SuperTrend Enhanced - strategy [presentTrading]", overlay=true, precision=3, default_qty_type=strategy.cash,

commission_value=0.1, commission_type=strategy.commission.percent, slippage=1, currency=currency.USD, default_qty_value=10000, initial_capital=10000)

// Input settings allow the user to customize the strategy's parameters.

tradeDirectionChoice = input.string(title="Trade Direction", defval="Both", options=["Long", "Short", "Both"]) // Option to select the trading direction

atrPeriod = input(10, "ATR Period for SuperTrend") // Length of the ATR for volatility measurement

vegasWindow = input(100, "Vegas Window Length") // Length of the moving average for the Vegas Channel

superTrendMultiplier = input(5, "SuperTrend Multiplier Base") // Base multiplier for the SuperTrend calculation

volatilityAdjustment = input.float(5, "Volatility Adjustment Factor") // Factor to adjust the SuperTrend sensitivity to the Vegas Channel width

// Calculate the Vegas Channel using a simple moving average and standard deviation.

vegasMovingAverage = ta.sma(close, vegasWindow)

vegasChannelStdDev = ta.stdev(close, vegasWindow)

vegasChannelUpper = vegasMovingAverage + vegasChannelStdDev

vegasChannelLower = vegasMovingAverage - vegasChannelStdDev

// Adjust the SuperTrend multiplier based on the width of the Vegas Channel.

channelVolatilityWidth = vegasChannelUpper - vegasChannelLower

adjustedMultiplier = superTrendMultiplier + volatilityAdjustment * (channelVolatilityWidth / vegasMovingAverage)

// Calculate the SuperTrend indicator values.

averageTrueRange = ta.atr(atrPeriod)

superTrendUpper = hlc3 - (adjustedMultiplier * averageTrueRange)

superTrendLower = hlc3 + (adjustedMultiplier * averageTrueRange)

var float superTrendPrevUpper = na

var float superTrendPrevLower = na

var int marketTrend = 1

// Update SuperTrend values and determine the current trend direction.

superTrendPrevUpper := nz(superTrendPrevUpper[1], superTrendUpper)

superTrendPrevLower := nz(superTrendPrevLower[1], superTrendLower)

marketTrend := close > superTrendPrevLower ? 1 : close < superTrendPrevUpper ? -1 : nz(marketTrend[1], 1)

superTrendUpper := marketTrend == 1 ? math.max(superTrendUpper, superTrendPrevUpper) : superTrendUpper

superTrendLower := marketTrend == -1 ? math.min(superTrendLower, superTrendPrevLower) : superTrendLower

superTrendPrevUpper := superTrendUpper

superTrendPrevLower := superTrendLower

// Enhanced Visualization

// Plot the SuperTrend and Vegas Channel for visual analysis.

plot(marketTrend == 1 ? superTrendUpper : na, "SuperTrend Upper", color=color.green, linewidth=2)

plot(marketTrend == -1 ? superTrendLower : na, "SuperTrend Lower", color=color.red, linewidth=2)

plot(vegasChannelUpper, "Vegas Upper", color=color.purple, linewidth=1)

plot(vegasChannelLower, "Vegas Lower", color=color.purple, linewidth=1)

// Apply a color to the price bars based on the current market trend.

barcolor(marketTrend == 1 ? color.green : marketTrend == -1 ? color.red : na)

// Detect trend direction changes and plot entry/exit signals.

trendShiftToBullish = marketTrend == 1 and marketTrend[1] == -1

trendShiftToBearish = marketTrend == -1 and marketTrend[1] == 1

plotshape(series=trendShiftToBullish, title="Enter Long", location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

plotshape(series=trendShiftToBearish, title="Enter Short", location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")

// Define conditions for entering long or short positions, and execute trades based on these conditions.

enterLongCondition = marketTrend == 1

enterShortCondition = marketTrend == -1

// Check trade direction choice before executing trade entries.

if enterLongCondition and (tradeDirectionChoice == "Long" or tradeDirectionChoice == "Both")

strategy.entry("Long Position", strategy.long)

if enterShortCondition and (tradeDirectionChoice == "Short" or tradeDirectionChoice == "Both")

strategy.entry("Short Position", strategy.short)

// Close all positions when the market trend changes.

if marketTrend != marketTrend[1]

strategy.close_all()