概述

该策略使用随机指标(Stochastic Oscillator)的交叉信号来识别潜在的买入和卖出机会。当随机指标的%K线从下方穿过%D线,并且%K值低于20时,策略会产生买入信号。当%K线从上方穿过%D线,并且%K值高于80时,策略会产生卖出信号。该策略适用于5分钟的时间框架。

策略原理

随机指标由%K线和%D线组成。%K线衡量了收盘价相对于过去一段时间的最高价和最低价的位置。%D线是%K线的移动平均线,用于平滑%K线并产生更可靠的信号。当%K线穿过%D线时,表明价格动量正在发生变化,这可以被解释为潜在的买入或卖出信号。 该策略使用随机指标的交叉来识别趋势反转或动量变化。当%K线从下方穿过%D线,并且%K值低于20(表明资产处于超卖状态)时,策略会产生买入信号。相反,当%K线从上方穿过%D线,并且%K值高于80(表明资产处于超买状态)时,策略会产生卖出信号。这种方法试图在价格反转之前捕捉到趋势的变化。

策略优势

- 简单易懂:该策略基于一个广泛使用的技术指标,易于理解和实现。

- 趋势识别:通过使用随机指标的交叉,该策略能够识别潜在的趋势反转和动量变化。

- 超买/超卖信号:通过将随机指标的交叉与超买/超卖水平相结合,该策略试图在价格反转之前识别出极端条件。

策略风险

- 错误信号:随机指标可能产生错误信号,导致无利可图的交易。

- 滞后性:作为一个落后指标,随机指标可能在价格已经反转之后才产生信号。

- 缺乏趋势确认:该策略可能在震荡市场中产生频繁的交易信号,导致过度交易和潜在损失。

策略优化方向

- 趋势确认:在产生交易信号之前,可以加入其他技术指标或价格行为分析来确认趋势。这可以帮助过滤掉震荡市场中的错误信号。

- 动态参数:可以根据市场波动性或其他市场条件动态调整随机指标的参数,以优化策略性能。

- 风险管理:在策略中加入适当的止损和头寸规模控制,以限制潜在损失并保护利润。

总结

随机交叉指标动量交易策略使用随机指标的交叉来识别潜在的买入和卖出机会,同时考虑资产的超买/超卖状态。虽然该策略简单易懂,能够识别趋势反转,但它也可能产生错误信号并缺乏趋势确认。通过加入趋势确认指标、动态参数优化和风险管理,可以进一步提高策略的性能。然而,在实施之前,有必要在不同的市场条件下全面测试和评估该策略。

策略源码

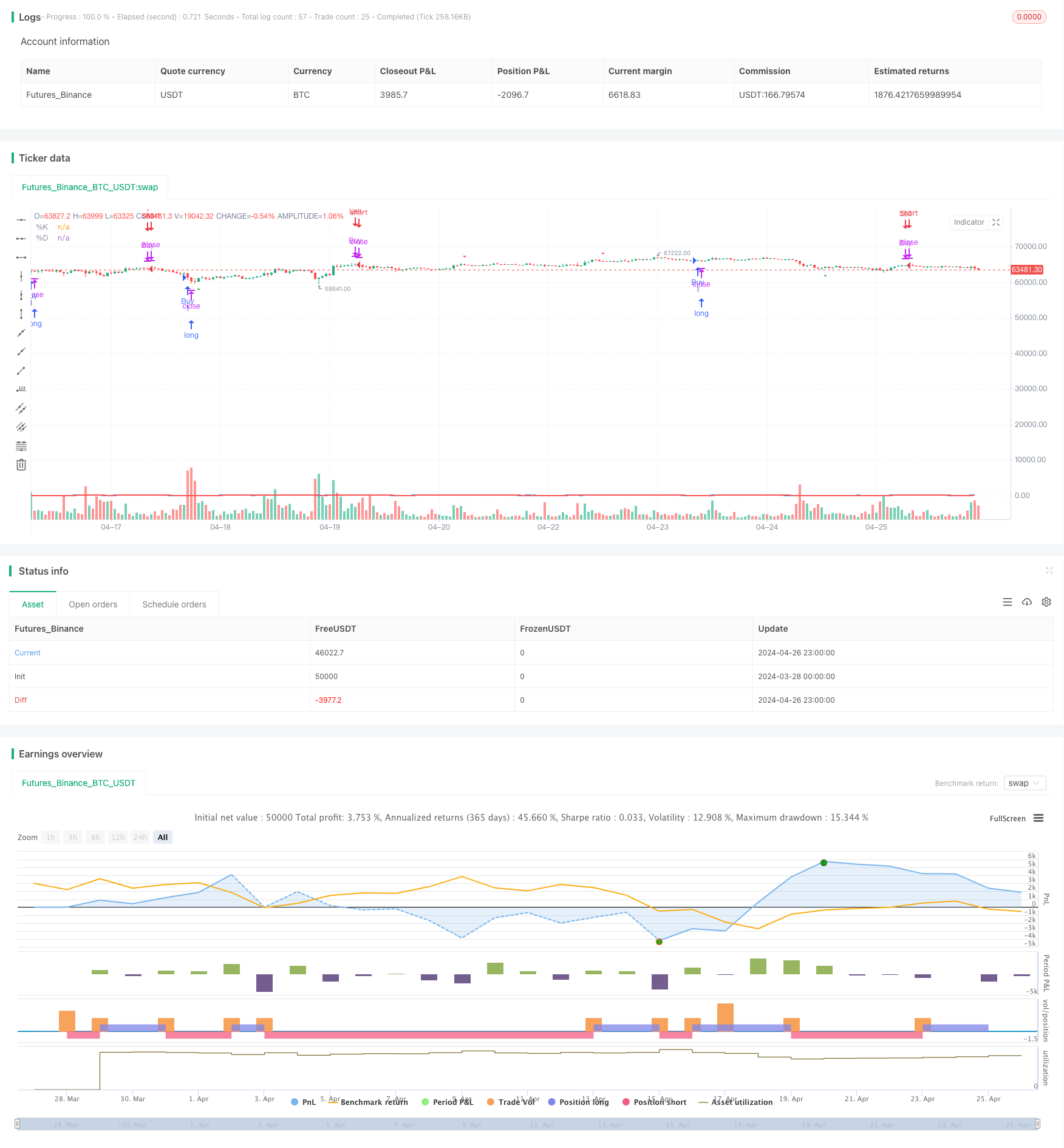

/*backtest

start: 2024-03-28 00:00:00

end: 2024-04-27 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Stochastic Crossover Buy/Sell", shorttitle="Stochastic Crossover", overlay=true)

// Stochastic Oscillator Parameters

length = input(14, title="Stochastic Length")

smoothK = input(3, title="Stochastic %K Smoothing")

smoothD = input(3, title="Stochastic %D Smoothing")

// Calculate %K and %D

stoch = stoch(close, high, low, length)

k = sma(stoch, smoothK)

d = sma(k, smoothD)

// Plot Stochastic Lines

plot(k, color=color.blue, linewidth=2, title="%K")

plot(d, color=color.red, linewidth=2, title="%D")

// Stochastic Crossover Buy/Sell Signals

buySignal = crossover(k, d) and k < 20 // Buy when %K crosses above %D and %K is below 20

sellSignal = crossunder(k, d) and k > 80 // Sell when %K crosses below %D and %K is above 80

// Plot Buy/Sell Arrows

plotshape(series=buySignal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, title="Buy Signal")

plotshape(series=sellSignal, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, title="Sell Signal")

// Entry and Exit Points

strategy.entry("Buy", strategy.long, when=buySignal)

strategy.close("Buy", when=sellSignal)

strategy.entry("Sell", strategy.short, when=sellSignal)

strategy.close("Sell", when=buySignal)

相关推荐