RSI50_EMA Long Only Strategy

Author: ChaoZhang, Date: 2024-05-11 11:49:29Tags: EMARSIATR

Overview

The strategy named “RSI50_EMA Long Only Strategy” mainly uses the crossover signals of two technical indicators, Relative Strength Index (RSI) and Exponential Moving Average (EMA), to make trading decisions. It opens a long position when the price breaks above the upper band of EMA from below and RSI is above 50, and closes all long positions when the price breaks below the lower band of EMA from above or RSI falls below 50. This strategy only takes long positions and does not short, it is a trend-following strategy.

Strategy Principle

- Calculate EMA and ATR to get the upper and lower bands of EMA.

- Calculate RSI.

- When the closing price crosses above the upper band of EMA and RSI is above 50, open a long position.

- When the closing price crosses below the lower band of EMA or RSI falls below 50, close all long positions.

- Only long, no short.

Strategy Advantages

- Suitable for use in a strong market, can effectively capture the upward trend of strong stocks.

- Uses both EMA and RSI indicators to better confirm trend signals and improve signal reliability.

- Position management uses percentage stop loss, risk is controllable.

- The code logic is clear and simple, easy to understand and implement.

Strategy Risks

- Prone to frequent trading and large drawdowns in volatile markets.

- Improper parameter selection can lead to signal failure. For example, improper selection of EMA length will lead to lagging trend judgment; improper selection of RSI upper and lower limits will lead to undesirable entry and exit points.

- The strategy can only capture unilateral upward trends, and cannot grasp downward and oscillating trends, easy to miss opportunities.

Strategy Optimization Directions

- Introduce trend confirmation indicators, such as MACD, to improve the accuracy of trend judgment.

- Optimize parameters for RSI, or introduce RSI divergence and other improvements to signals.

- Consider adding trailing stop loss or volatility stop loss to improve risk control.

- Consider adding reversal entry logic in oscillating markets and downward trends.

Summary

The RSI50_EMA Long Only Strategy is a simple and easy-to-use trend-following strategy based on RSI and EMA, suitable for use in unilateral upward trends. The strategy has clear logic and obvious advantages, but also has some shortcomings and risks. By introducing more auxiliary indicators, optimizing parameters, improving risk control and other measures, the stability and profitability of the strategy can be further improved. However, in actual application, it is necessary to flexibly adjust and improve according to market characteristics, personal risk preferences and other factors.

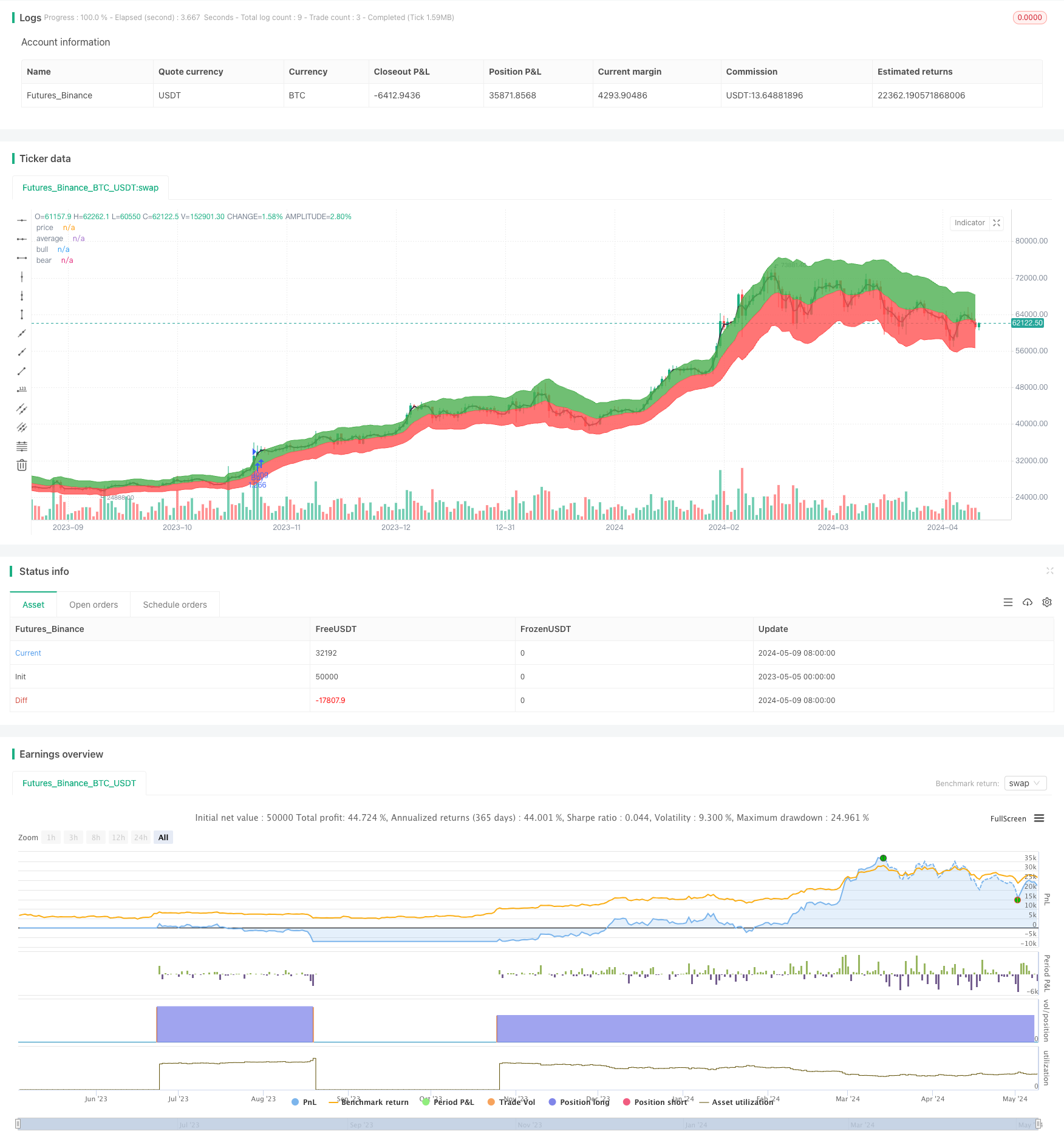

/*backtest

start: 2023-05-05 00:00:00

end: 2024-05-10 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("RSI50_EMA Long Only Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

len = input(11, type=input.integer, minval=1, title="Length")

mul = input(2, type=input.float, minval=0, title="Multiplier")

rsicap = input(50, type=input.integer, minval=1, title="rsicap")

rsi_1 = rsi(close,20)

price = sma(close, 2)

average = ema(close, len)

diff = atr(len) * mul

bull_level = average + diff

bear_level = average - diff

bull_cross = crossover(price, bull_level)

RENTRY = crossover(rsi_1,rsicap)

bear_cross = crossover(bear_level, price)

EXIT = crossunder(rsi_1,50)

strategy.entry("Buy", strategy.long, when=bull_cross)

strategy.close("Buy", when=bear_cross) //strategy.entry("Sell", strategy.short, when=bear_cross)

if (RENTRY)

strategy.entry("RSI", strategy.long, when=bull_cross)

if (EXIT)

strategy.close("RSICLose", when=bull_cross) //strategy.entry("Sell", strategy.short, when=bear_cross)

plot(price, title="price", color=color.black, transp=50, linewidth=2)

a0 = plot(average, title="average", color=color.red, transp=50, linewidth=1)

a1 = plot(bull_level, title="bull", color=color.green, transp=50, linewidth=1)

a2 = plot(bear_level, title="bear", color=color.red, transp=50, linewidth=1)

fill(a0, a1, color=color.green, transp=97)

fill(a0, a2, color=color.red, transp=97)

- Han Yue - Trend Following Trading Strategy Based on Multiple EMAs, ATR and RSI

- Multi-Indicator Intelligent Pyramiding Strategy

- ATR-RSI Enhanced Trend Following Trading System

- Gold Trend Channel Reversal Momentum Strategy

- EMA RSI Crossover Strategy

- 4-Hour Timeframe Engulfing Pattern Trading Strategy with Dynamic Take Profit and Stop Loss Optimization

- Dynamic Stop-Loss Multi-Period RSI Trend Following Strategy

- Multi-Timeframe Quantitative Trading Strategy Based on EMA-Smoothed RSI and ATR Dynamic Stop-Loss/Take-Profit

- AlphaTradingBot Trading Strategy

- Multi-Timeframe Exponential Moving Average Crossover Strategy with Risk-Reward Optimization

- EMA, MACD, and RSI Triple Indicator Momentum Strategy

- Multi-Timeframe Reversal Confirmation Trading Strategy

- Larry Williams' Three-Period Dynamic Moving Average Trading Strategy

- Multi-Moving Average Trend Trading Strategy

- Advanced MACD Strategy with Limited Martingale

- H1 Trend Bias + M15 MACD Signal + M5 Fast Volatility Gap Strategy

- Short-Medium-Long Term Triple Moving Average Trend Following Strategy

- MACD Dual Moving Average Crossover Strategy

- Automated Trading Strategy Based on RSI Overbought and Oversold Levels

- Trading Strategy Based on Support and Resistance Levels Using Technical Analysis

- KDJ Trending View with Signals and MA Strategy

- VWAP and RSI Crossover Strategy

- Moving Average and Relative Strength Index Strategy

- EMA Dynamic Trend Following Trading Strategy

- Dynamic Take Profit and Stop Loss Trading Strategy Based on Three Consecutive Bearish Candles and Moving Averages

- MOST and Dual Moving Average Crossover Strategy

- Bollinger Bands Stochastic Oscillator Strategy

- MACD RSI Ichimoku Momentum Trend Following Long Strategy

- Dual Moving Average Crossover Entry Strategy

- Moving Average Crossover Strategy