HalfTrend Bullish and Bearish Trend Following Stop-Limit Buy Strategy

Author: ChaoZhang, Date: 2024-05-17 15:45:13Tags: ATR

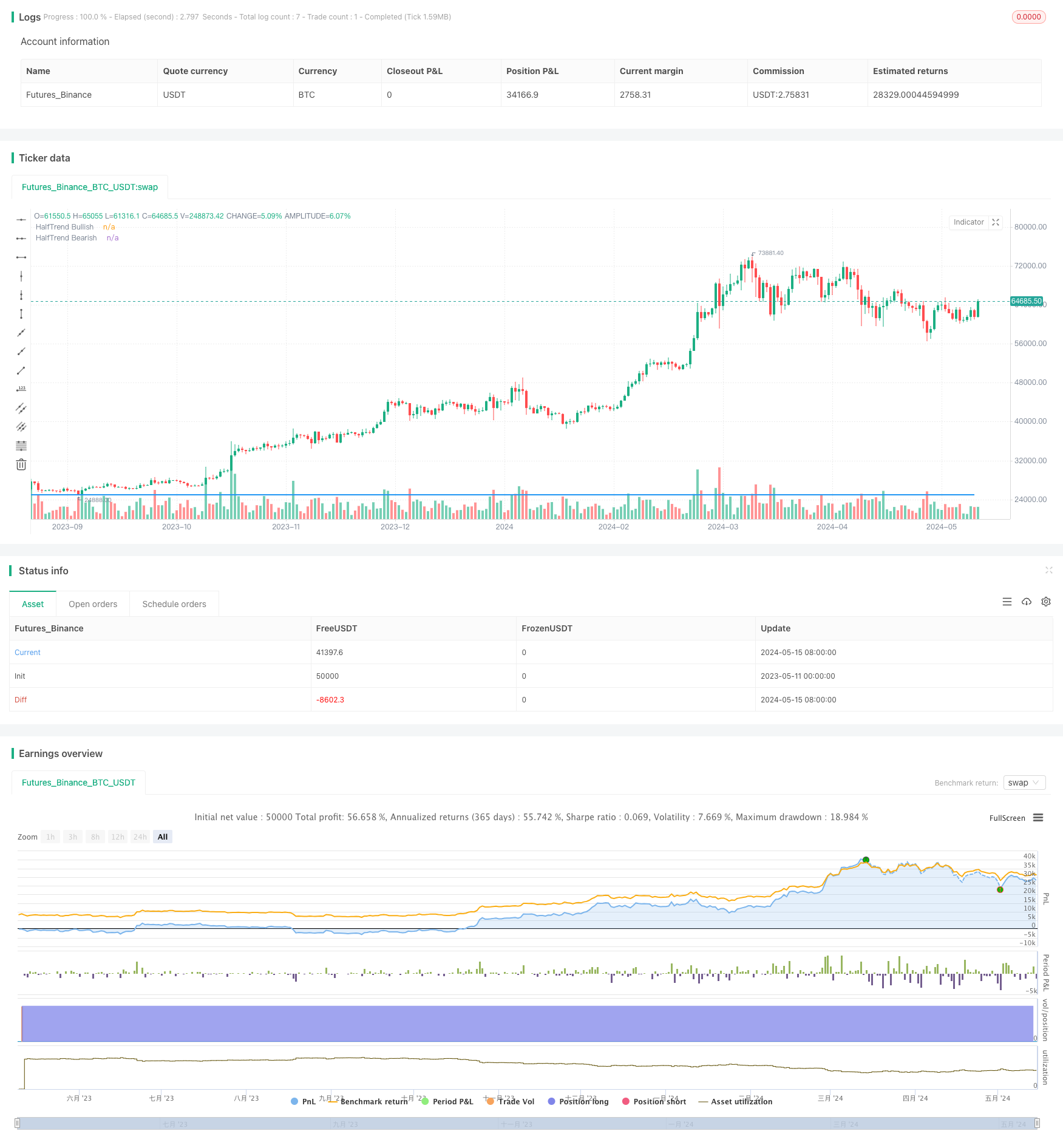

####Overview This strategy is based on the HalfTrend indicator and identifies buy signals by determining bullish and bearish trends. When the HalfTrend indicator switches from bearish to bullish, a stop-limit buy order is placed at the HalfTrend value of the previous bearish trend. The strategy uses the AmplitudeTrend (ATR) indicator to dynamically adjust the amplitude parameter for trend determination.

####Strategy Principle 1. Calculate the HalfTrend indicator value, which requires setting the lookback period length and amplitude parameter. 2. Compare the current closing price with the previous period’s HalfTrend indicator value to determine the bullish or bearish trend. - When the closing price crosses above the HalfTrend indicator value by amplitude points, the trend turns bullish. - When the closing price crosses below the HalfTrend indicator value by amplitude points, the trend turns bearish. 3. Record the HalfTrend indicator value when the trend turns bearish, which serves as a potential future buy position. 4. When the HalfTrend indicator switches from bearish to bullish again, place a stop-limit buy order at the position recorded in step 3.

####Strategy Advantages 1. Based on complete bullish and bearish trends to determine the investment direction, maximally adapting to the current market condition. 2. Using limit orders for buying, which can achieve better execution prices at predetermined positions. 3. The buy position is determined based on the previous bearish HalfTrend trend, ensuring the safety of buying at a low level. 4. The amplitude parameter is used to control the minimum amplitude required to distinguish between bullish and bearish trends, effectively filtering out noise signals.

####Strategy Risks 1. The trend reversal determination relies on the amplitude parameter, and inappropriate parameter values may lead to premature or delayed order placement. 2. Limit orders may fail to execute due to price fluctuations, missing out on upward movements. 3. The stop-loss setting position may be too close to the buy position, potentially incurring significant losses.

####Strategy Optimization Directions 1. Optimize the amplitude parameter to find the best amplitude for trend determination. The AmplitudeTrend (ATR) indicator can be used to dynamically adjust the amplitude. 2. Set a take profit sell order along with the stop-loss buy order to lock in profits in a timely manner. 3. The stop-loss position can be set lower to allow for a larger loss margin while also increasing the profit potential. 4. Incorporate a trailing stop-loss logic to raise the stop-loss position when the price moves in a favorable direction, reducing risk.

####Summary The HalfTrend Bullish and Bearish Trend Following Stop-Limit Buy Strategy determines the timing of buying based on changes in the bullish and bearish trends of the HalfTrend indicator. It uses the low point of the previous bearish trend as the buy position, aiming to enter long positions at relatively safe low levels. This strategy incorporates common strategy elements such as trend determination, limit orders, and stop-loss orders, and it can be further optimized to improve the risk-reward ratio.

/*backtest

start: 2023-05-11 00:00:00

end: 2024-05-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("HalfTrend Stop-Limit Buy", overlay=true)

// HalfTrend indicator parameters

length = 1

amplitude = 2.0

// HalfTrend calculation

float ph = na

float pl = na

var float dir = na

var float trend = na

if na(trend)

trend := close

ph := high

pl := low

dir := na

else

if high > ph

ph := high

if low < pl

pl := low

if close > trend and na(dir)

dir := 1

trend := close

ph := high

pl := low

if close < trend and na(dir)

dir := -1

trend := close

ph := high

pl := low

if dir == 1 and close < trend - amplitude

dir := -1

trend := close

ph := high

pl := low

if dir == -1 and close > trend + amplitude

dir := 1

trend := close

ph := high

pl := low

// Buy signal based on HalfTrend

buySignal = dir == 1 and ta.valuewhen(dir == -1, trend, 0)

// Plot HalfTrend

plot(dir == 1 ? trend : na, color=color.blue, linewidth=2, title="HalfTrend Bullish")

plot(dir == -1 ? trend : na, color=color.red, linewidth=2, title="HalfTrend Bearish")

// Place a stop-limit buy order

if (buySignal)

stopPrice = ta.valuewhen(dir == -1, trend, 0)

strategy.entry("HalfTrend Buy", strategy.long, stop=stopPrice, comment="HalfTrend Buy")

- Dynamic Dual-Indicator Momentum Trend Quantitative Strategy System

- Multi-Dimensional Trend Analysis with ATR-Based Dynamic Stop Management Strategy

- Advanced Multi-Indicator Trend Confirmation Trading Strategy

- SMA-Based Intelligent Trailing Stop Strategy with Intraday Pattern Recognition

- Multi-Factor Regression and Dynamic Price Band Quantitative Trading System

- Multi-Smoothed Moving Average Dynamic Crossover Trend Following Strategy with Multiple Confirmations

- Advanced Dynamic Stop-Loss Strategy Based on Large Candles and RSI Divergence

- Multi-Indicator Synergistic Trend Reversal Quantitative Trading Strategy

- Multi-Channel Dynamic Support Resistance Keltner Channel Strategy

- Machine Learning Adaptive SuperTrend Quantitative Trading Strategy

- Volatility Stop Based EMA Trend Following Trading Strategy

- SMK ULTRA TREND Dual Moving Average Crossover Strategy

- Quintuple Strong Moving Average Strategy

- EMA-SMA Crossover Bull Market Support Band Strategy

- Multi-Timeframe Trend Following Strategy with 200 EMA Filter - Long Only

- SMC Market High-Low Breakout Strategy

- Dynamic Trend Momentum Trading Strategy

- EMA Crossover with Short-term Signals Strategy

- Ichimoku Cloud and ATR Strategy

- BONK Multi-Factor Trading Strategy

- Dual Moving Average Crossover Strategy

- Alligator Long-Term Trend Following Trading Strategy

- Multi-timeframe Trend Tracking Strategy Based on Impulse MACD and Dual Moving Average Crossover

- EMA5 and EMA13 Crossover Strategy

- EMA SAR Medium-to-Long-Term Trend Following Strategy

- Reverse Volatility Breakout Strategy

- Nifty 50 3-Minute Opening Range Breakout Strategy

- Dynamic Stop Loss and Take Profit Bollinger Bands Strategy

- Improved Swing High/Low Breakout Strategy with Bullish and Bearish Engulfing Patterns

- Laguerre RSI with ADX Filtered Trading Signals Strategy

- Price and Volume Breakout Buy Strategy