EMA Crossover Trading Strategy with Dynamic Take Profit and Stop Loss

Author: ChaoZhang, Date: 2024-05-29 16:55:22Tags: EMATPSL

Overview

This strategy utilizes the crossover of Exponential Moving Averages (EMAs) to generate trading signals while dynamically setting take profit and stop loss levels. When the shorter-term EMA (EMA 12) crosses above the longer-term EMA (EMA 26), a buy signal is generated; conversely, when the EMA 12 crosses below the EMA 26, a sell signal is generated. The strategy sets different dynamic take profit and stop loss levels for long and short positions. For long positions, the take profit is set at 8% above the entry price, and the stop loss is set at 2.5% below the entry price; for short positions, the take profit is set at 8% below the entry price, and the stop loss is set at 2.5% above the entry price.

Strategy Principle

The core of this strategy is to use the crossover of two EMAs with different periods to generate trading signals. EMA is a trend-following indicator that smooths price data and reduces noise interference. When the shorter-term EMA crosses above the longer-term EMA, it indicates a strengthening price trend and generates a buy signal; conversely, when the shorter-term EMA crosses below the longer-term EMA, it indicates a weakening price trend and generates a sell signal.

At the same time, the strategy employs a dynamic take profit and stop loss method, setting different take profit and stop loss levels based on the direction of the current position (long or short). This method of dynamically adjusting take profit and stop loss levels allows profits to fully expand when the trend is strong while timely cutting losses when prices reverse, thereby better controlling risks.

Strategy Advantages

Simple and easy to use: The strategy only uses the crossover of two EMA lines to generate trading signals, with clear logic and easy to understand and implement.

Trend following: The EMA indicator has good trend-following capabilities and can effectively capture the main trends of prices.

Dynamic take profit and stop loss: By dynamically adjusting take profit and stop loss levels based on the position direction, it allows profits to fully expand when the trend is strong while timely cutting losses when prices reverse, better controlling risks.

Strong adaptability: The strategy is applicable to different market environments and trading instruments, with strong adaptability and flexibility.

Strategy Risks

Parameter optimization risk: The selection of EMA periods and the setting of take profit and stop loss ratios need to be optimized according to specific market environments and trading instruments. Inappropriate parameter settings may lead to poor strategy performance.

Frequent trading risk: When the market is in a volatile state, EMA crossovers may occur frequently, causing the strategy to generate more trading signals and increase trading costs and risks.

Trend reversal risk: When the market trend reverses suddenly, the strategy may generate incorrect trading signals, leading to losses.

Strategy Optimization Directions

Introduce other technical indicators: Consider introducing other technical indicators, such as RSI and MACD, to assist in confirming EMA crossover signals and improve the reliability of trading signals.

Optimize parameter settings: Find the best parameter combination suitable for specific market environments and trading instruments by optimizing and testing EMA periods and take profit and stop loss ratios.

Introduce risk control measures: Consider introducing risk control measures, such as position management and capital management, to better control trading risks.

Combine with fundamental analysis: Combine technical analysis with fundamental analysis, comprehensively considering market environment, economic data, and other factors to improve the accuracy of trading decisions.

Summary

This strategy uses EMA crossovers to generate trading signals and employs a dynamic take profit and stop loss method to control risks. It has advantages such as simplicity, trend-following, and strong adaptability, but also faces challenges such as parameter optimization risk, frequent trading risk, and trend reversal risk. By introducing other technical indicators, optimizing parameter settings, introducing risk control measures, and combining with fundamental analysis, the performance of this strategy can be further optimized to improve its applicability and profitability in actual trading.

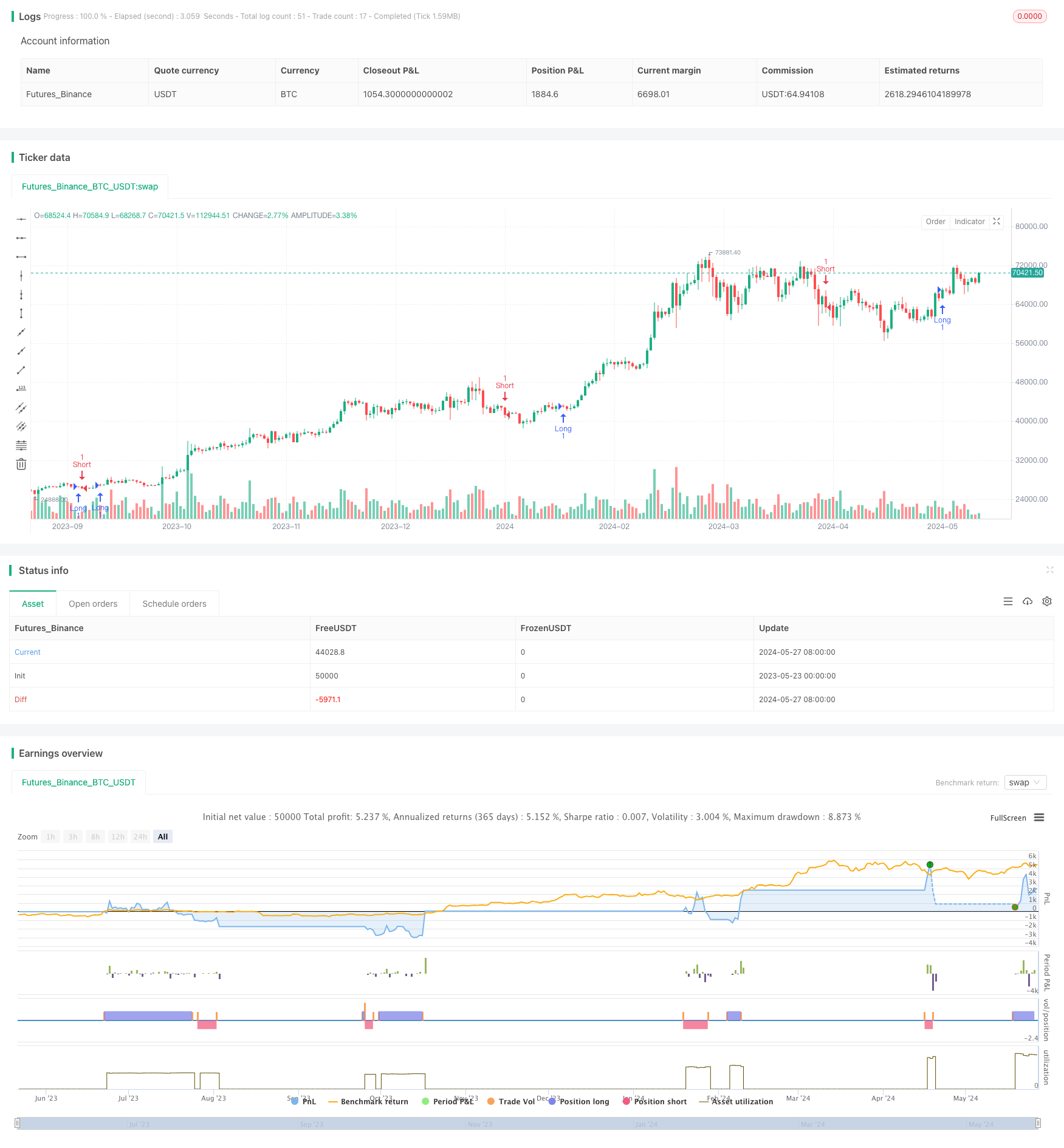

/*backtest

start: 2023-05-23 00:00:00

end: 2024-05-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("CDC Action Zone Trading Bot with Dynamic TP/SL", overlay=true)

// ดึงข้อมูลราคาปัจจุบัน

current_price = close

// คำนวณเส้น EMA 12 และ EMA 26

ema12 = ta.ema(current_price, 12)

ema26 = ta.ema(current_price, 26)

// กำหนดเปอร์เซ็นต์ Take Profit และ Stop Loss

takeProfitPercent = 0.080

stopLossPercent = 0.025

// คำนวณระดับ Take Profit และ Stop Loss

longTakeProfit = strategy.position_avg_price * (1 + takeProfitPercent)

longStopLoss = strategy.position_avg_price * (1 - stopLossPercent)

shortTakeProfit = strategy.position_avg_price * (1 - takeProfitPercent)

shortStopLoss = strategy.position_avg_price * (1 + stopLossPercent)

// สัญญาณ Buy

buySignal = (ema12 > ema26) and (ema12[1] <= ema26[1])

// สัญญาณ Sell

sellSignal = (ema12 < ema26) and (ema12[1] >= ema26[1])

// เปิด Position Long

if (buySignal)

strategy.entry("Long", strategy.long)

// เปิด Position Short

if (sellSignal)

strategy.entry("Short", strategy.short)

// ปิด Position Long เมื่อถึง Take Profit หรือ Stop Loss

if (strategy.position_size > 0)

strategy.exit("Long TP/SL", from_entry="Long", limit=longTakeProfit, stop=longStopLoss, comment="TP/SL")

// ปิด Position Short เมื่อถึง Take Profit หรือ Stop Loss

if (strategy.position_size < 0)

strategy.exit("Short TP/SL", from_entry="Short", limit=shortTakeProfit, stop=shortStopLoss, comment="TP/SL")

// ปิด Position Long เมื่อเกิดสัญญาณขาย

if (strategy.position_size > 0 and sellSignal)

strategy.close("Long", comment="Sell Signal")

// ปิด Position Short เมื่อเกิดสัญญาณซื้อ

if (strategy.position_size < 0 and buySignal)

strategy.close("Short", comment="Buy Signal")

// Debugging messages to plot the calculated levels for visual verification

//plot(longTakeProfit, title="Long Take Profit", color=color.green, linewidth=1, style=plot.style_line)

//plot(longStopLoss, title="Long Stop Loss", color=color.red, linewidth=1, style=plot.style_line)

//plot(shortTakeProfit, title="Short Take Profit", color=color.green, linewidth=1, style=plot.style_line)

//plot(shortStopLoss, title="Short Stop Loss", color=color.red, linewidth=1, style=plot.style_line)

- Adaptive Trend-Following Trading Strategy: 200 EMA Breakout with Dynamic Risk Management System

- Williams %R Dynamic TP/SL Adjustment Strategy

- EMA Crossover with Dual Take Profit and Stop Loss Strategy

- Automated Quantitative Trading System with Dual EMA Crossover and Risk Management

- Advanced EMA Crossover Strategy: Adaptive Trading System with Dynamic Stop-Loss and Take-Profit Targets

- Multi-Timeframe Exponential Moving Average Crossover Strategy

- Dual EMA Crossover with RSI Momentum Enhanced Trading Strategy

- Long Entry on EMA Cross with Risk Management Strategy

- Dynamic Trend Following Strategy Combining Supertrend and EMA

- Multi-RSI-EMA Momentum Hedging Strategy with Position Scaling

- VWAP and Super Trend Buy/Sell Strategy

- Advanced MACD Strategy with Limited Martingale

- Keltner Channels EMA ATR Strategy

- MA MACD BB Multi-Indicator Trading Strategy Backtesting Tool

- RSI+Supertrend Trend-Following Trading Strategy

- Ichimoku Kumo Trading Strategy

- Dynamic ATR Stop Loss and Take Profit Moving Average Crossover Strategy

- EMA Trend Momentum Candlestick Pattern Strategy

- G-Channel Trend Detection Strategy

- Moving Average Crossover with Trailing Stop Loss Strategy

- Bollinger Bands and EMA Trend Following Strategy

- WaveTrend Oscillator Divergence Strategy

- Volatility and Linear Regression-based Long-Short Market Regime Optimization Strategy

- Hybrid Binomial Z-Score Quantitative Strategy

- RSI and MA Combination Strategy

- EMA Momentum Trading Strategy

- FVG Momentum Scalping Strategy

- ATR and EMA-based Dynamic Take Profit and Stop Loss Adaptive Strategy

- Trend Following with Breakout and Frequency Filter (Long Only)

- Fibonacci Golden Harmony Breakout Strategy