概述

基于双均线交叉的移动平均线策略是一种简单而有效的日内交易方法,旨在通过分析两条不同周期的移动平均线之间的关系,识别市场潜在的买入和卖出机会。该策略使用一条短期简单移动平均线(SMA)和一条长期简单移动平均线,当短期均线上穿长期均线时,表明看涨信号,提示潜在的买入机会;反之,当短期均线下穿长期均线时,则表明看跌信号,提示潜在的卖出机会。这种交叉法有助于交易者捕捉市场趋势行情,同时最小化市场噪音干扰。

策略原理

该策略的核心原理是利用不同周期移动平均线的趋势特性和滞后性,通过比较短期均线和长期均线的相对位置关系,判断当前市场的趋势方向,从而作出相应的交易决策。当市场出现上涨趋势时,价格会先突破长期均线,短期均线随后上穿长期均线形成金叉,产生买入信号;当市场出现下跌趋势时,价格会先跌破长期均线,短期均线随后下穿长期均线形成死叉,产生卖出信号。该策略的参数设置中,短期均线的周期为9,长期均线的周期为21,这两个参数可以根据市场特征和个人偏好进行调整。同时,该策略还引入了资金管理的概念,通过设置初始资金和单笔交易风险比例,利用仓位调整来控制每笔交易的风险敞口。

策略优势

- 简单易懂:该策略基于经典的移动平均线理论,逻辑清晰,容易理解和实现。

- 适应性强:该策略可以适用于多个市场和不同的交易品种,通过调整参数设置,可以灵活应对不同的市场特征。

- 捕捉趋势:通过双均线交叉来判断趋势方向,有助于交易者及时跟进主流趋势,提高盈利机会。

- 风险控制:该策略引入了风险管理的概念,通过仓位调整来控制每笔交易的风险敞口,有效地管理潜在损失。

- 减少噪音:利用均线的滞后性特点,有效地过滤掉市场中的随机噪音,提高交易信号的可靠性。

策略风险

- 参数选择:不同的参数设置会对策略表现产生重要影响,选择不当可能导致策略失效或表现不佳。

- 市场趋势:在震荡市或趋势转折点,该策略可能会出现连续亏损的情况。

- 滑点成本:频繁交易可能会产生较高的滑点成本,影响策略的整体收益。

- 黑天鹅事件:该策略对于极端行情的适应性较差,黑天鹅事件可能会给策略带来巨大损失。

- 过拟合风险:如果参数优化过于依赖历史数据,可能会导致策略在实际交易中表现不佳。

策略优化方向

- 动态参数优化:根据市场状态的变化,动态调整策略参数,提高适应性。

- 趋势确认:在产生交易信号后,引入其他指标或价格行为模式来确认趋势,提高信号可靠性。

- 止损止盈:引入合理的止损止盈机制,进一步控制单笔交易的风险敞口。

- 仓位管理:优化仓位调整的方法,例如引入波动率指标,根据市场波动水平动态调整仓位。

- 多空力度评估:评估多头和空头力量的对比关系,在趋势初期介入,提高趋势把握的准确性。

总结

基于双均线交叉的移动平均线策略是一种简单实用的日内交易方法,通过比较不同周期均线的位置关系,判断市场趋势方向,产生交易信号。该策略逻辑清晰,适应性强,可以有效捕捉市场趋势,同时引入风险管理措施,控制潜在损失。但是,该策略也存在参数选择、趋势转折、频繁交易等潜在风险,需要通过动态优化、信号确认、仓位管理等方式进一步提升策略的稳健性和盈利能力。总的来说,移动平均线作为一种经典的技术分析指标,其基本原理和实际应用价值已经得到市场的广泛验证,是值得深入研究和不断优化的交易策略。

Overview

The Moving Average Crossover Strategy based on dual moving averages is a straightforward and effective intraday trading approach designed to identify potential buy and sell opportunities in the market by analyzing the relationship between two moving averages of different periods. This strategy utilizes a short-term simple moving average (SMA) and a long-term simple moving average. When the short-term moving average crosses above the long-term moving average, it indicates a bullish signal, suggesting a potential buying opportunity. Conversely, when the short-term moving average crosses below the long-term moving average, it indicates a bearish signal, suggesting a potential selling opportunity. This crossover method helps traders capture trending moves in the market while minimizing market noise interference.

Strategy Principle

The core principle of this strategy is to utilize the trend characteristics and lag of moving averages with different periods. By comparing the relative position relationship between the short-term moving average and the long-term moving average, it determines the current market trend direction and makes corresponding trading decisions. When an upward trend emerges in the market, the price will first break through the long-term moving average, and the short-term moving average will subsequently cross above the long-term moving average, forming a golden cross and generating a buy signal. When a downward trend emerges in the market, the price will first break below the long-term moving average, and the short-term moving average will subsequently cross below the long-term moving average, forming a death cross and generating a sell signal. In the parameter settings of this strategy, the period of the short-term moving average is set to 9, and the period of the long-term moving average is set to 21. These two parameters can be adjusted based on market characteristics and personal preferences. Additionally, this strategy introduces the concept of money management by setting the initial capital and risk percentage per trade, using position sizing to control the risk exposure of each trade.

Strategy Advantages

- Simplicity: This strategy is based on the classic moving average theory, with clear logic and easy to understand and implement.

- Adaptability: This strategy can be applied to multiple markets and different trading instruments. By adjusting parameter settings, it can flexibly adapt to different market characteristics.

- Trend Capture: By using the dual moving average crossover to determine the trend direction, it helps traders timely follow the mainstream trend and increase profit opportunities.

- Risk Control: This strategy introduces the concept of risk management, using position sizing to control the risk exposure of each trade, effectively managing potential losses.

- Noise Reduction: By utilizing the lag characteristic of moving averages, it effectively filters out random noise in the market, improving the reliability of trading signals.

Strategy Risks

- Parameter Selection: Different parameter settings can have a significant impact on strategy performance. Improper selection may lead to strategy failure or poor performance.

- Market Trend: In ranging markets or trend turning points, this strategy may experience consecutive losses.

- Slippage Costs: Frequent trading may result in higher slippage costs, affecting the overall profitability of the strategy.

- Black Swan Events: This strategy has poor adaptability to extreme market conditions, and black swan events may cause significant losses to the strategy.

- Overfitting Risk: If parameter optimization relies too heavily on historical data, it may lead to poor performance of the strategy in actual trading.

Strategy Optimization Directions

- Dynamic Parameter Optimization: Dynamically adjust strategy parameters based on changes in market conditions to improve adaptability.

- Trend Confirmation: After generating trading signals, introduce other indicators or price behavior patterns to confirm the trend, improving signal reliability.

- Stop-Loss and Take-Profit: Introduce reasonable stop-loss and take-profit mechanisms to further control the risk exposure of each trade.

- Position Management: Optimize the position sizing method, such as introducing volatility indicators to dynamically adjust positions based on market volatility levels.

- Long-Short Strength Assessment: Assess the comparative relationship between bullish and bearish strengths, entering at the early stage of a trend to improve the accuracy of trend capture.

Summary

The Moving Average Crossover Strategy based on dual moving averages is a simple and practical intraday trading method. By comparing the position relationship of moving averages with different periods, it determines the market trend direction and generates trading signals. This strategy has clear logic, strong adaptability, and can effectively capture market trends while introducing risk management measures to control potential losses. However, this strategy also has potential risks such as parameter selection, trend reversal, frequent trading, etc. It needs to be further improved through dynamic optimization, signal confirmation, position management, and other methods to enhance the robustness and profitability of the strategy. In general, as a classic technical analysis indicator, the basic principles and practical application value of moving averages have been widely verified by the market. It is a trading strategy worthy of in-depth research and continuous optimization.

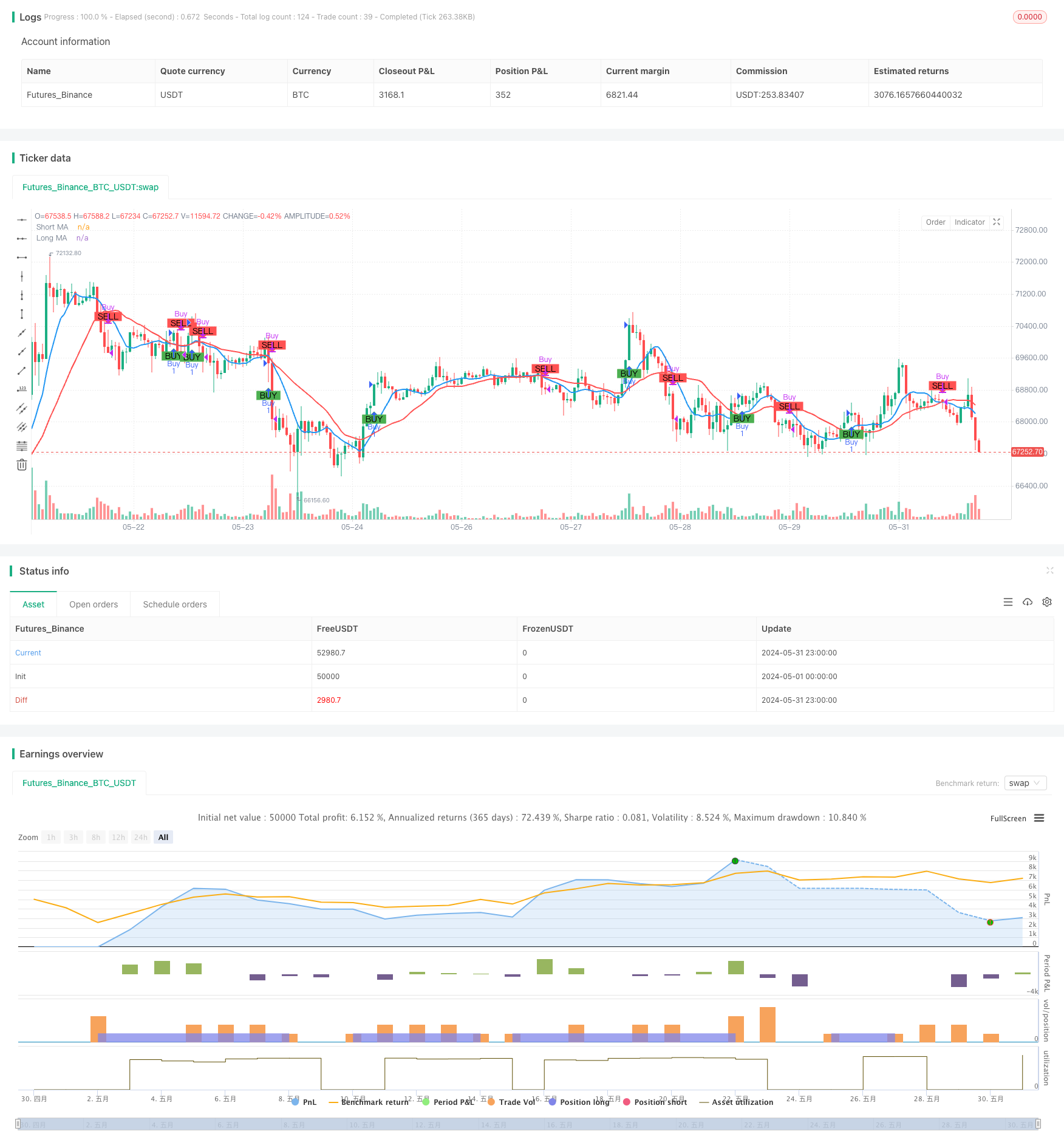

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Moving Average Crossover Strategy", overlay=true)

// Input parameters

shortLength = input.int(9, title="Short Moving Average Length")

longLength = input.int(21, title="Long Moving Average Length")

capital = input.float(100000, title="Initial Capital")

risk_per_trade = input.float(1.0, title="Risk Per Trade (%)")

// Calculate Moving Averages

shortMA = ta.sma(close, shortLength)

longMA = ta.sma(close, longLength)

// Plot Moving Averages

plot(shortMA, title="Short MA", color=color.blue, linewidth=2)

plot(longMA, title="Long MA", color=color.red, linewidth=2)

// Generate Buy/Sell signals

longCondition = ta.crossover(shortMA, longMA)

shortCondition = ta.crossunder(shortMA, longMA)

// Plot Buy/Sell signals

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Risk management: calculate position size

risk_amount = capital * (risk_per_trade / 100)

position_size = risk_amount / close

// Execute Buy/Sell orders with position size

if (longCondition)

strategy.entry("Buy", strategy.long, qty=1, comment="Buy")

if (shortCondition)

strategy.close("Buy", comment="Sell")

// Display the initial capital and risk per trade on the chart

var label initialLabel = na

if (na(initialLabel))

initialLabel := label.new(x=bar_index, y=high, text="Initial Capital: " + str.tostring(capital) + "\nRisk Per Trade: " + str.tostring(risk_per_trade) + "%", style=label.style_label_down, color=color.white, textcolor=color.black)

else

label.set_xy(initialLabel, x=bar_index, y=high)