Moving Average Crossover Strategy

Author: ChaoZhang, Date: 2024-06-14 15:48:32Tags: SMAMA

Overview

This strategy is a quantitative trading strategy based on moving average crossovers. It generates buy signals when the fast moving average (shorter period) crosses above the slow moving average (longer period) from below, and generates sell signals when the fast moving average crosses below the slow moving average from above. Additionally, the strategy introduces the concept of dynamic position sizing by adjusting the size of each trade based on the account’s profit and loss, in order to control risk.

Strategy Principle

- Calculate two simple moving averages (SMA) with different periods, namely 9 and 21.

- Generate a buy signal when the fast moving average (9-period) crosses above the slow moving average (21-period) from below, and generate a sell signal when the fast moving average crosses below the slow moving average from above.

- Calculate the risk amount for each trade based on 1% of the account balance, then determine the number of shares to buy based on the risk amount and the current price range (high - low).

- If the strategy is currently profitable, increase the position size of the next trade by 10%; if it is in a loss, decrease the position size of the next trade by 10%.

- Execute a buy order when a buy signal appears, and execute a sell order when a sell signal appears.

Strategy Advantages

- Simplicity: The strategy is based on the classic moving average crossover principle, which is straightforward, easy to understand, and implement.

- Trend following: By using two moving averages with different periods, the strategy can effectively capture medium to long-term price trends, making it suitable for trend-following trading.

- Dynamic position sizing: By adjusting the position size based on the profit and loss, the strategy appropriately increases the position size when profitable and decreases it when in a loss, which helps control risk and improve returns.

- Wide applicability: The strategy can be applied to various financial markets and trading instruments, such as stocks, futures, forex, etc.

Strategy Risks

- Frequent trading: Since the strategy relies on short-term moving average crossover signals, it may lead to frequent trading, increasing transaction costs and slippage risk.

- Poor performance in choppy markets: In choppy, non-trending markets, the strategy may generate more false signals, resulting in losses.

- Parameter optimization risk: The performance of the strategy depends on the choice of moving average periods, and different parameters may lead to different results, posing the risk of overfitting during parameter optimization.

Strategy Optimization Directions

- Introduce trend confirmation indicators: In addition to the moving average crossover signals, introduce other trend confirmation indicators such as MACD, ADX, etc., to filter out some false signals and improve signal quality.

- Optimize position sizing rules: The current position sizing rules are relatively simple. Consider introducing more complex position sizing algorithms, such as the Kelly Criterion or fixed fraction money management, to further improve risk-adjusted returns.

- Incorporate stop-loss and take-profit mechanisms: Add stop-loss and take-profit rules to the strategy to control the maximum loss and maximum profit for each trade, improving the strategy’s risk-reward ratio.

- Adaptive parameter optimization: Introduce an adaptive parameter optimization mechanism to automatically adjust strategy parameters based on changes in market conditions, enhancing the strategy’s robustness and adaptability.

Summary

The moving average crossover strategy is a simple and practical quantitative trading strategy that captures price trends using crossover signals from two moving averages with different periods while introducing dynamic position sizing rules to control risk. The strategy has a clear logic, is easy to implement, and has a wide range of applications. However, in practical application, one needs to be aware of potential risks such as frequent trading, poor performance in choppy markets, and parameter optimization. The strategy should be optimized and improved as needed, such as introducing trend confirmation indicators, optimizing position sizing rules, incorporating stop-loss and take-profit mechanisms, and implementing adaptive parameter optimization. Through continuous optimization and refinement, the strategy’s robustness and profitability can be further enhanced.

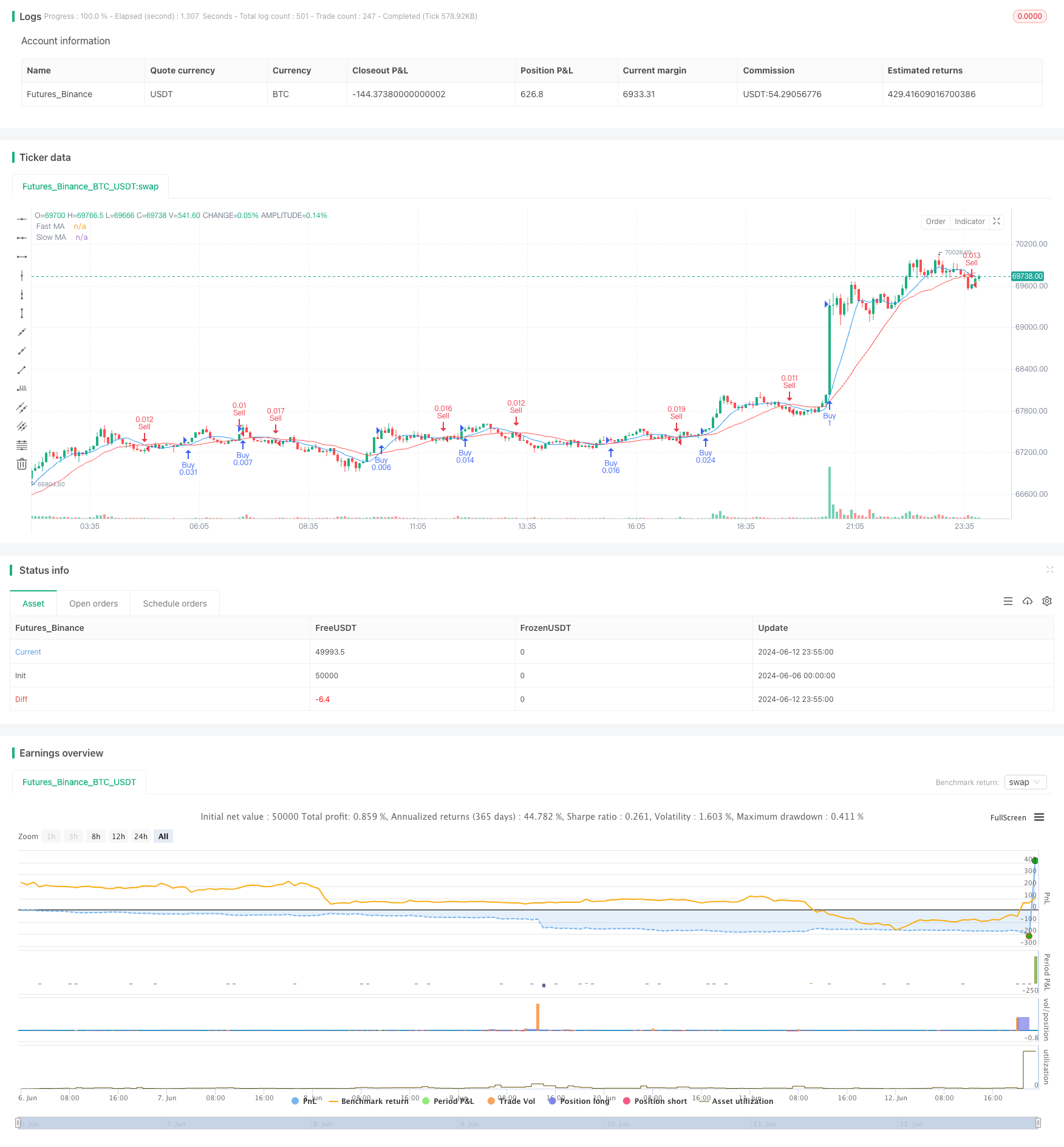

/*backtest

start: 2024-06-06 00:00:00

end: 2024-06-13 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © okolienicholas

//@version=5

strategy("Moving Average Crossover Strategy", overlay=true)

// Input parameters

fast_length = input(9, title="Fast MA Length")

slow_length = input(21, title="Slow MA Length")

source = close

account_balance = input(100, title="Account Balance") // Add your account balance here

// Calculate moving averages

fast_ma = ta.sma(source, fast_length)

slow_ma = ta.sma(source, slow_length)

// Plot moving averages

plot(fast_ma, color=color.blue, title="Fast MA")

plot(slow_ma, color=color.red, title="Slow MA")

// Generate buy/sell signals

buy_signal = ta.crossover(fast_ma, slow_ma)

sell_signal = ta.crossunder(fast_ma, slow_ma)

// Plot buy/sell signals

plotshape(buy_signal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, title="Buy Signal")

plotshape(sell_signal, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, title="Sell Signal")

// Calculate the risk per trade

risk_per_trade = account_balance * 0.01

// Calculate the number of shares to buy

shares_to_buy = risk_per_trade / (high - low)

// Calculate the profit or loss

profit_or_loss = strategy.netprofit

// Adjust the position size based on the profit or loss

if (profit_or_loss > 0)

shares_to_buy = shares_to_buy * 1.1 // Increase the position size by 10% when in profit

else

shares_to_buy = shares_to_buy * 0.9 // Decrease the position size by 10% when in loss

// Execute orders

if (buy_signal)

strategy.entry("Buy", strategy.long, qty=shares_to_buy)

if (sell_signal)

strategy.entry("Sell", strategy.short, qty=shares_to_buy)

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- Adaptive Risk Management Strategy Based on Dual Moving Average Golden Cross

- Dual Moving Average Crossover Adaptive Parameter Trading Strategy

- MA Cross Strategy

- Moving Average Crossover Strategy Based on Dual Moving Averages

- MA,SMA Dual Moving Average Crossover Strategy

- Moving Average Crossover with Multiple Take Profits Strategy

- SMA Dual Moving Average Trading Strategy

- Dual Moving Average Crossover Strategy

- Cloud Momentum Crossover Strategy with Moving Averages and Volume Confirmation

- RSI, MACD, Bollinger Bands and Volume-Based Hybrid Trading Strategy

- ZLSMA-Enhanced Chandelier Exit Strategy with Volume Spike Detection

- Short-term Quantitative Trading Strategy Based on Dual Moving Average Crossover, RSI, and Stochastic Indicators

- RSI Low Point Reversal Strategy

- Fisher Transform Dynamic Threshold Trend Following Strategy

- Mean Reversion Strategy

- EMA100 and NUPL Relative Unrealized Profit Quantitative Trading Strategy

- Volatility Range Trading Strategy Based on Stochastic Oscillator

- Simple Combined Strategy: Pivot Point SuperTrend and DEMA

- EMA Trend Filter Strategy

- Intraday Breakout Strategy Based on 3-Minute Candle High Low Points

- Advanced Entry Strategy based on Moving Average, Support/Resistance, and Volume

- EMA RSI MACD Dynamic Take Profit and Stop Loss Trading Strategy

- G-Trend EMA ATR Intelligent Trading Strategy

- Trend Following Strategy Based on 200-Day Moving Average and Stochastic Oscillator

- RSI Trend Strategy

- EMA Crossover Momentum Scalping Strategy

- BB Breakout Strategy

- VWAP and RSI Dynamic Bollinger Bands Take Profit and Stop Loss Strategy

- Chande-Kroll Stop Dynamic ATR Trend Following Strategy