概述

该策略基于均值回归的原理,利用价格偏离移动平均线的情况来进行交易决策。当价格向上偏离上轨时做空,向下偏离下轨时做多,价格回归到移动平均线时平仓。这个策略的核心是假设价格总是会回归到均值水平。

策略原理

- 计算指定周期(默认20)的简单移动平均线(SMA)作为价格的均值水平。

- 计算价格的标准差(DEV),并以此构建上下轨道。上轨是SMA加上标准差的倍数(默认1.5),下轨是SMA减去标准差的倍数。

- 当价格向上突破上轨时做空,向下突破下轨时做多。

- 当做多的价格向下穿过SMA时平多,做空的价格向上穿过SMA时平空。

- 在图表上标记移动平均线、上轨、下轨以及买卖信号。

优势分析

- 均值回归策略基于价格总是回归均值的统计学原理,长期而言有一定的盈利概率。

- 上下轨的设置提供了明确的入场和出场点位,便于执行和管理。

- 策略逻辑简单清晰,容易理解和实现。

- 适用于存在明显均值回归特征的品种和周期。

风险分析

- 市场趋势发生变化时,价格可能长期偏离均值而不回归,导致策略失效。

- 标准差倍数设置不当会导致交易频率过高或过低,影响收益。

- 极端行情下价格波动剧烈,上下轨可能失去作用。

- 如果品种或周期不存在均值回归的特征,该策略可能无法盈利。

优化方向

- 对SMA的周期和标准差倍数进行优化测试,找到最佳参数。

- 引入趋势判断指标,在趋势明确时避免逆势交易。

- 在标准差之外加入ATR等波动率指标,构建动态轨道。

- 对滑点、手续费等交易成本进行考虑,控制回测的真实性。

- 加入风控模块,如止损止盈、仓位管理等。

总结

均值回归策略是一种基于统计学原理的量化交易策略,通过构建价格均值上下轨来进行交易决策。该策略逻辑简单,执行明确,但要注意品种的选择和参数的优化。在实际应用中,还需要考虑趋势、交易成本、风险控制等因素,以提高策略的稳健性和盈利能力。总之,均值回归策略是量化交易领域一种常见且值得深入研究的策略。

策略源码

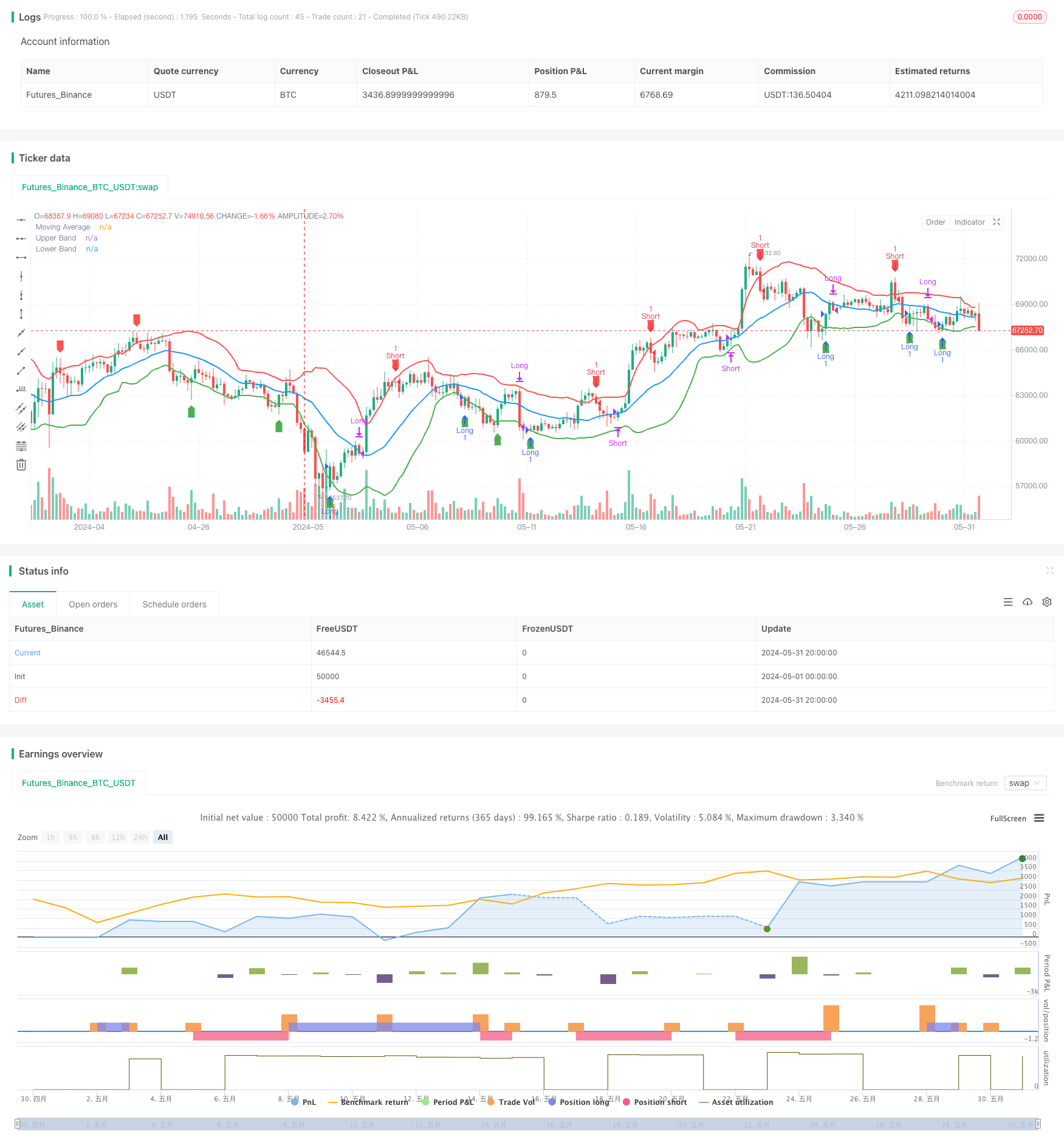

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Mean Regression Strategy", overlay=true)

// Define the lookback period for the moving average

length = input.int(20, title="Moving Average Length")

mult = input.float(1.5, title="Standard Deviation Multiplier")

// Calculate the moving average and standard deviation

ma = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

// Calculate upper and lower bands

upper_band = ma + dev

lower_band = ma - dev

// Plot the moving average and bands

plot(ma, color=color.blue, linewidth=2, title="Moving Average")

plot(upper_band, color=color.red, linewidth=2, title="Upper Band")

plot(lower_band, color=color.green, linewidth=2, title="Lower Band")

// Entry conditions

long_condition = ta.crossover(close, lower_band)

short_condition = ta.crossunder(close, upper_band)

// Exit conditions

exit_long_condition = ta.crossunder(close, ma)

exit_short_condition = ta.crossover(close, ma)

// Strategy orders

if (long_condition)

strategy.entry("Long", strategy.long)

if (short_condition)

strategy.entry("Short", strategy.short)

if (exit_long_condition)

strategy.close("Long")

if (exit_short_condition)

strategy.close("Short")

// Plot signals on the chart

plotshape(series=long_condition, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal")

plotshape(series=short_condition, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal")

相关推荐